Introduction

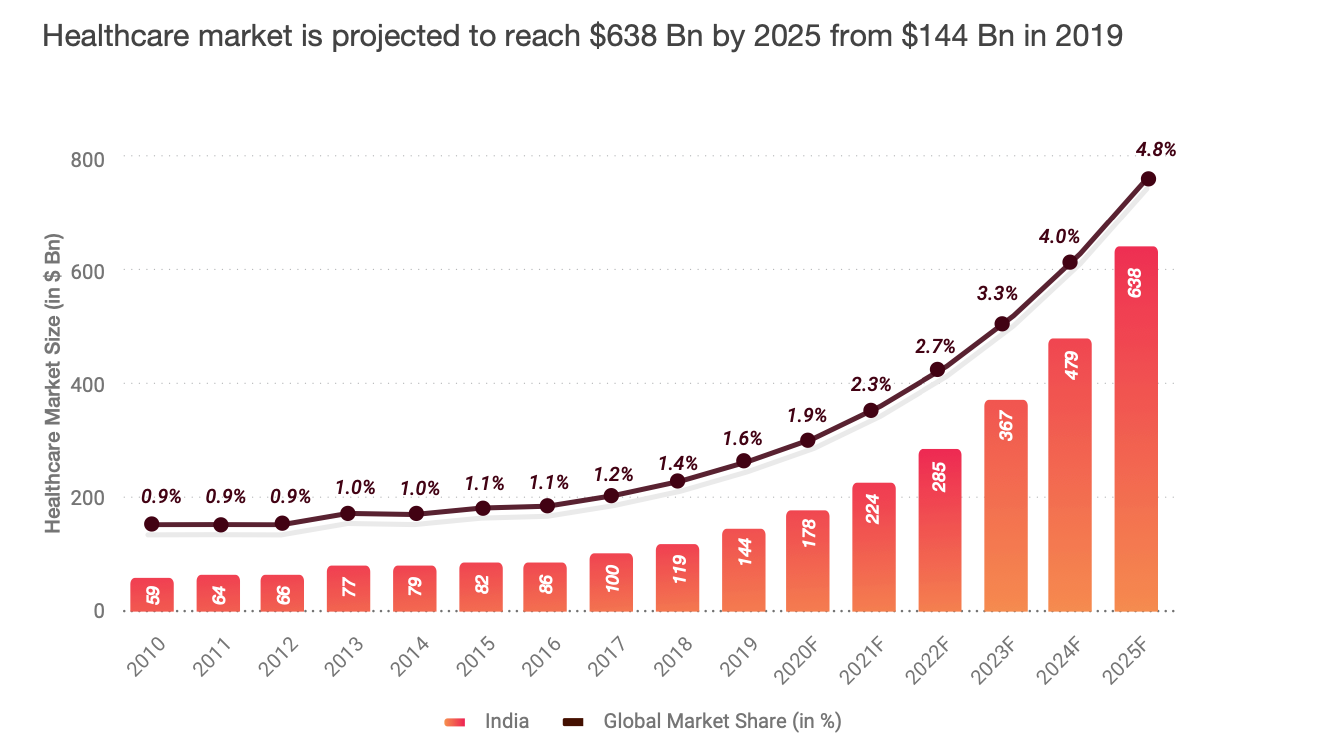

The Indian healthcare market is on a robust growth trajectory, driven by a confluence of factors including demographic shifts, rising incomes, and increasing awareness about health and wellness.

As the world’s second-most populous country, India is expected to surpass China in population by 2025. This demographic shift, coupled with rising incomes and a burgeoning middle class, is putting unprecedented pressure on the country’s healthcare infrastructure.

As of 2024, the market size is expected to reach an impressive USD 638 billion, expanding at a compound annual growth rate (CAGR) of 29% from 2020 to 2025. This growth is essential to meet the healthcare needs of over 1.4 billion people, particularly in the face of increasing incidences of chronic diseases and an aging population.

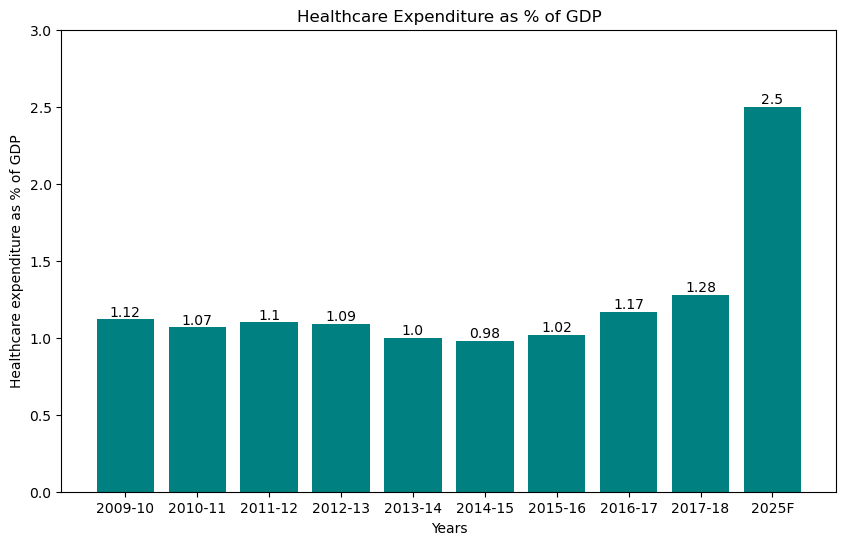

This growth is underpinned by a significant increase in healthcare expenditure, which is projected to rise from 1.28% of GDP in 2017–18 to 2.5% by 2025.

import matplotlib.pyplot as plt

# Data from the chart, (Data Source: Inc42)

years = ['2009-10', '2010-11', '2011-12', '2012-13', '2013-14', '2014-15', '2015-16', '2016-17', '2017-18', '2025F']

values = [1.12, 1.07, 1.1, 1.09, 1, 0.98, 1.02, 1.17, 1.28, 2.5]

# Create a bar chart with a different color scheme

plt.figure(figsize=(10, 6))

bars = plt.bar(years, values, color='teal')

# Adding value labels on top of the bars

for bar in bars:

yval = bar.get_height()

plt.text(bar.get_x() + bar.get_width()/2, yval, round(yval, 2), ha='center', va='bottom')

# Adding titles and labels

plt.title('Healthcare Expenditure as % of GDP')

plt.xlabel('Years')

plt.ylabel('Healthcare expenditure as % of GDP')

plt.ylim(0, 3)

# Show the plot

plt.show()

Despite these efforts, the healthcare system remains highly fragmented, with a significant urban-rural divide and low levels of medical awareness, particularly in rural areas. This disparity is exacerbated by a shortage of healthcare professionals, with India having only 0.82 doctors per 1,000 people, well below the World Health Organization’s recommended ratio of 1 doctor per 1,000 people.

Government programs like Ayushman Bharat are key drivers, providing health coverage to over 500 million people and boosting demand for telemedicine, digital health records, and online pharmacies. The rising prevalence of chronic diseases and the COVID-19 pandemic have accelerated the adoption of preventive healthcare and telehealth services, with platforms reporting up to a 500% increase in usage.

India’s rapid digital adoption, with over 560 million internet users as of 2020, supports the growth of healthtech solutions leveraging AI, ML, data analytics, and blockchain. The sector includes diverse startups offering integrated healthcare services, specialized SaaS solutions, e-commerce platforms for healthcare products, and personalized healthcare plans. This vibrant ecosystem presents substantial opportunities for investors, healthcare providers, and technology companies to collaborate in creating a more efficient, accessible, and patient-centric healthcare landscape in India.

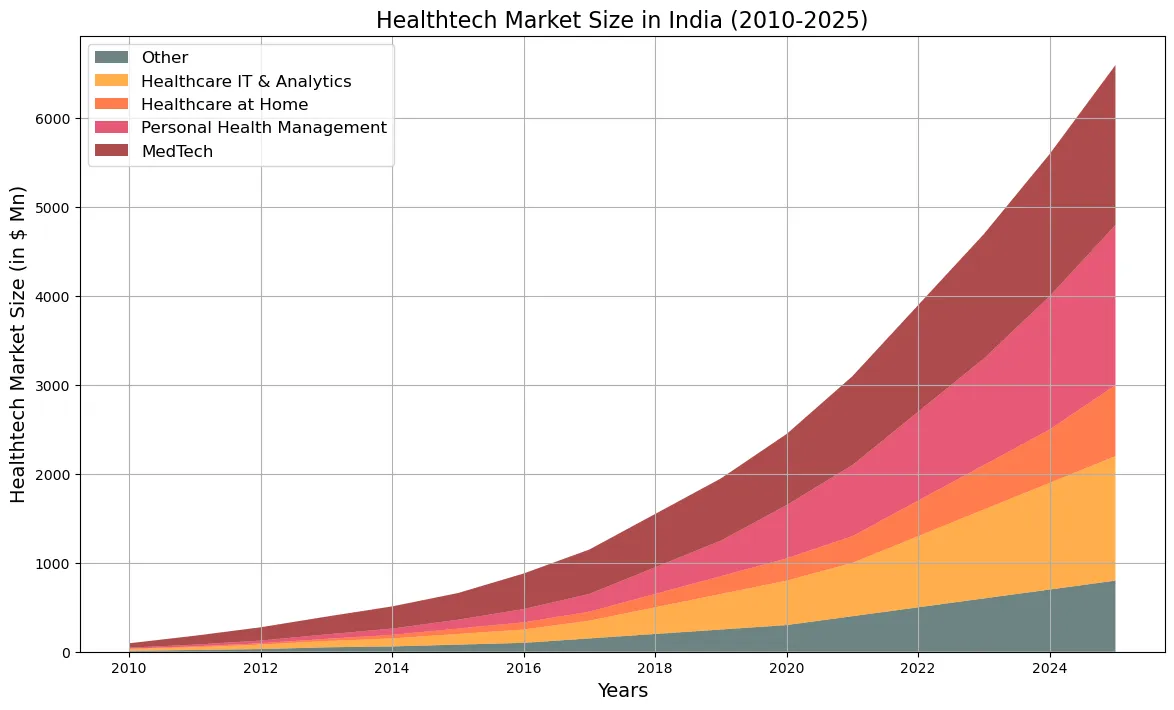

The Indian healthtech market is projected to reach $21.3 Bn by 2025 acquiring 3.2% of global healthtech market pie. The market is expected to grow at a CAGR of 27% during 2020–2025.

Funding Overview:

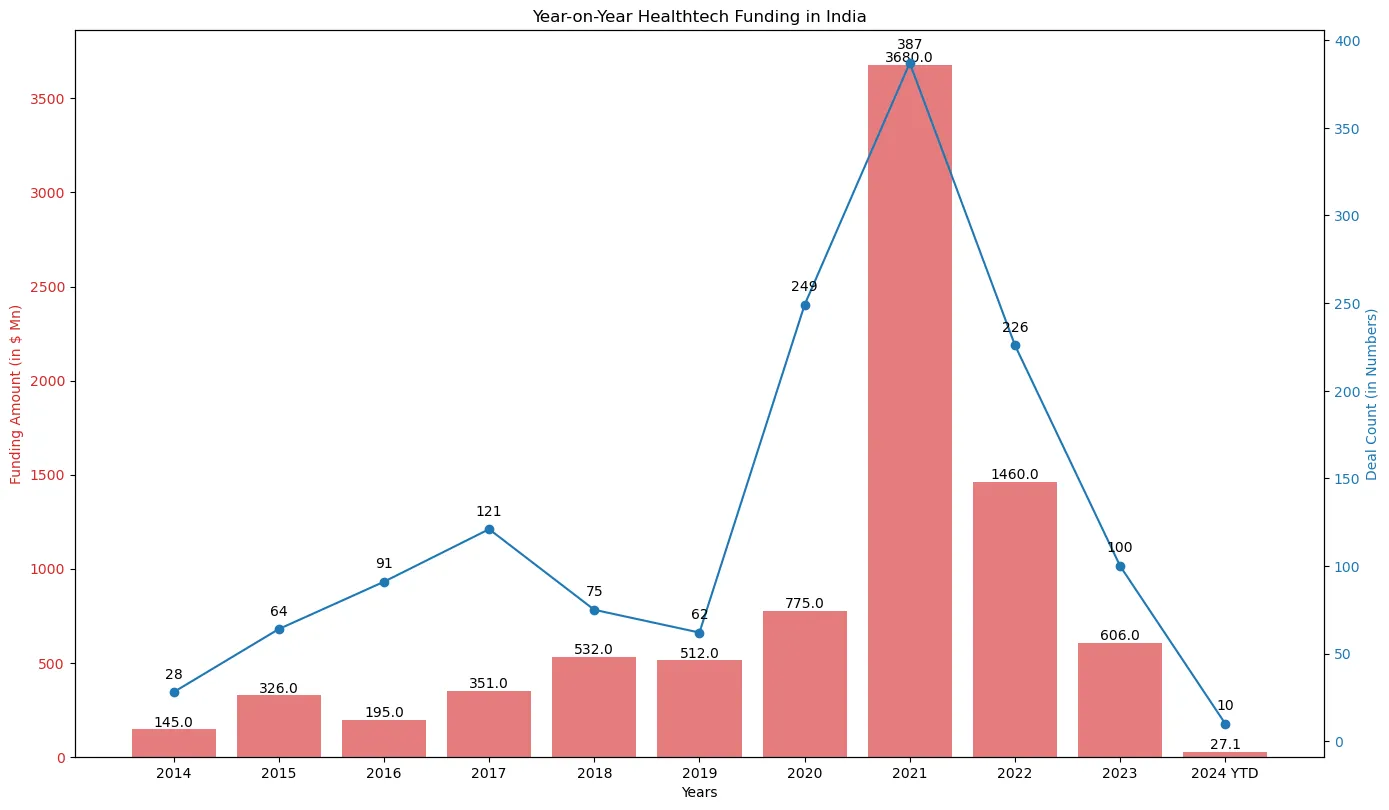

The Indian healthtech sector has experienced a dynamic funding landscape over the past decade, reflecting both the potential and the challenges inherent in this rapidly evolving market. From 2014 to 2021, the sector saw substantial growth in funding, peaking in 2021 with an impressive USD 3.68 billion across 387 rounds. This surge was driven by increased investor confidence and the accelerated adoption of digital health solutions due to the COVID-19 pandemic. However, post-2021, the funding landscape faced a downturn, with 2022 seeing a decline to USD 1.46 billion across 226 rounds, and further contraction in 2023 to USD 606 million over 100 rounds. The trend in 2024, with only USD 27.1 million raised year-to-date, indicates a cautious approach by investors amid economic uncertainties. Despite this fluctuation, the cumulative funding of USD 10.5 billion highlights the substantial capital inflow and the enduring interest in the healthtech sector, underpinned by the ongoing need for innovative healthcare solutions in India.

import matplotlib.pyplot as plt

# Data from the charts, (Data Source: Inc42)

years = ['2014', '2015', '2016', '2017', '2018', '2019', '2020', '2021', '2022', '2023', '2024 YTD']

funding = [145, 326, 195, 351, 532, 512, 775, 3680, 1460, 606, 27.1]

deal_counts = [28, 64, 91, 121, 75, 62, 249, 387, 226, 100, 10]

# Create a consolidated bar and line chart

fig, ax1 = plt.subplots(figsize=(14, 8))

color = 'tab:red'

ax1.set_xlabel('Years')

ax1.set_ylabel('Funding Amount (in $ Mn)', color=color)

bars = ax1.bar(years, funding, color=color, alpha=0.6, label='Funding Amount')

ax1.tick_params(axis='y', labelcolor=color)

# Adding value labels on top of the bars

for bar in bars:

yval = bar.get_height()

ax1.text(bar.get_x() + bar.get_width()/2, yval, round(yval, 1), ha='center', va='bottom')

ax2 = ax1.twinx()

color = 'tab:blue'

ax2.set_ylabel('Deal Count (in Numbers)', color=color)

line = ax2.plot(years, deal_counts, color=color, marker='o', label='Deal Count')

ax2.tick_params(axis='y', labelcolor=color)

# Adding value labels on top of the line points

for i, txt in enumerate(deal_counts):

ax2.annotate(txt, (years[i], deal_counts[i]), textcoords="offset points", xytext=(0,10), ha='center')

fig.tight_layout()

plt.title('Year-on-Year Healthtech Funding in India')

plt.show()

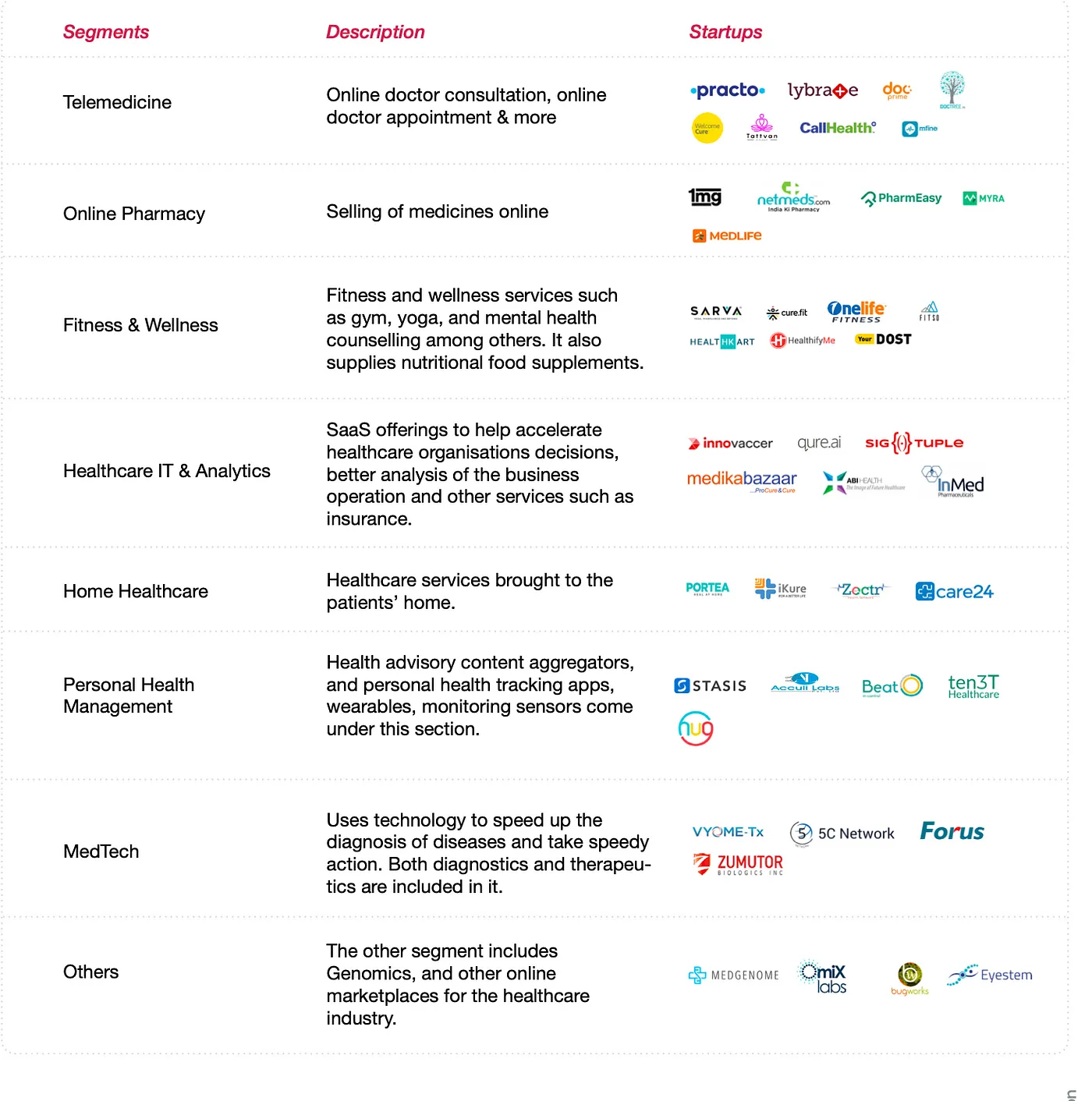

Segmentation/Categorisation of the Indian Healthtech Sector

To comprehensively understand the Indian healthtech landscape, we have broadly segmented the sector into seven distinct categories based on their business models, target demographics, and technological applications. These segments include Integrated Healthcare Providers (IHPs), Healthcare Software-as-a-Service (SaaS), Supply Chain and Logistics, E-Commerce, Personalized Healthcare, Wearables, and Fitness & Wellness. Each category addresses specific aspects of the healthcare continuum, from broad, integrated service offerings to specialized, technology-driven solutions targeting niche markets. This classification enables a nuanced analysis of the market, highlighting the diverse approaches and innovations that are driving the healthtech revolution in India.

Integrated Healthcare Providers (IHPs):

Description

Integrated Healthcare Providers (IHPs) offer a broad spectrum of healthcare services under one umbrella. These services typically include e-pharmacy, teleconsultation, diagnostics, and more. The goal is to provide a one-stop solution that addresses various healthcare needs, making it convenient for patients to access comprehensive care through a single platform.

Key Players:

Pharmeasy: A leading e-pharmacy and teleconsultation service provider.

Practo: Offers both B2B and B2C teleconsultation, along with an online appointment booking platform.

Tata 1mg: Provides e-pharmacy, diagnostics, and teleconsultation services.

Medibuddy: Focuses on teleconsultation and corporate health benefits.

Funding and Market overview:

Approximately $2 billion in cumulative funding, reflecting substantial investor confidence in the growth potential of IHPs. The telemedicine market will reach $5.4 Bn by 2025 with maintaining more than 25% market share in the India healthtech market. Online pharmacy market is expected to reach $4.2 Bn by 2025 with a CAGR of 36%.

Sub-segments:

-

E-Pharmacy: Online platforms for purchasing medications and health products.

-

Example: Pharmeasy has raised $1.1 billion, although it faces challenges with capital efficiency and competition.

-

Teleconsultation: Services connecting patients with healthcare providers remotely.

-

Example: Practo, an early mover, offers both B2B and B2C services but has struggled with competition and product utility.

-

Diagnostics: Online booking of diagnostic tests and home sample collection.

-

Example: Medibuddy derives 60% of its revenue from corporate clients, facing issues with timely payments and service delivery.

Challenges

The IHP segment faces several challenges, including low capital efficiency, heavy competition from both large conglomerates and specialized vertical players, and operational difficulties in ensuring timely service delivery and payment collections. The fragmented healthcare system and varying levels of digital literacy across urban and rural areas also pose significant hurdles.

What Gives a Startup the Right to Win in this category?

Startups that offer comprehensive and integrated healthcare services, maintain operational efficiency, leverage advanced technologies like AI and data analytics, form strategic partnerships, and deliver excellent user experiences are well-positioned to succeed. The ability to scale operations efficiently and address both urban and rural healthcare needs is crucial for gaining a competitive edge in the IHP segment.

Healthcare SaaS:

Description

Healthcare Software-as-a-Service (SaaS) includes companies providing software solutions specifically designed for the healthcare industry. These solutions often target specific medical verticals such as oncology, cardiology, radiology, and diabetes, offering advanced analytics, electronic health records, and population health management tools.

Key Players

• Innovaccer: Offers unified healthcare data and analytics for patient-centric care.

• Indegene: Provides commercialization services to biotech and medical device companies.

• Tricog: Specializes in cardiovascular diagnostics, leveraging real-time data.

• Karkinos: Focuses on oncology care, using data-driven approaches for cancer treatment.

• Qure.ai: Develops AI-powered radiology solutions.

• Deeptek: Provides radiology imaging solutions using AI and machine learning.

Funding

Approximately $770 million in cumulative funding, demonstrating significant investor interest in the potential of healthcare SaaS solutions.

Sub-segments

-

Unified Healthcare Data and Analytics: Platforms offering comprehensive data solutions for patient-centric care.

-

Example: Innovaccer provides a range of analytics tools to improve healthcare outcomes.

-

Commercialization Services: Digital solutions for biotech and medical device companies.

-

Example: Indegene offers technology-driven services to support commercialization efforts.

-

Specialized Medical Vertical Solutions: Targeted SaaS products for specific medical fields.

-

Example: Tricog specializes in cardiovascular diagnostics, leveraging real-life data.

Challenges

The Healthcare SaaS segment faces challenges such as low domestic adoption due to the traditionally slow uptake of technology by healthcare providers in India. Additionally, the high cost of implementation and the need for extensive training and support can be barriers. Ensuring data privacy and security is another significant challenge, given the sensitive nature of healthcare information.

Notable Mention:

Qure.ai stands out for its innovative use of artificial intelligence in radiology. By developing AI-powered solutions that assist radiologists in interpreting medical images, Qure.ai improves diagnostic accuracy and efficiency. Their AI algorithms are trained on extensive datasets, enabling them to provide high-quality, consistent interpretations. This focus on leveraging AI for better diagnostics makes Qure.ai a unique and valuable player in the healthcare SaaS space.

What Gives a Startup the Right to Win in this Category?

Startups that offer specialized, technology-driven solutions that address specific healthcare needs, ensure robust data privacy and security, and provide strong support and training to healthcare providers are well-positioned to succeed. The ability to integrate seamlessly with existing healthcare systems and demonstrate clear value through improved patient outcomes and operational efficiencies will be key factors in gaining a competitive edge in the Healthcare SaaS segment.

Supply Chain and Logistics:

Description

Companies in the Supply Chain and Logistics segment focus on improving the efficiency and reliability of the medical supply chain. They provide solutions for the aggregation, digitization, and distribution of medical supplies, pharmaceuticals, and equipment.

Key Players

• Ascent Wellness and Pharma Solutions: Specializes in medical supply aggregation and distribution.

• Aknamed: Focuses on B2B medical supply chain solutions.

• Medikabazaar: Offers a marketplace for medical supplies and equipment.

Funding

Approximately $510 million in cumulative funding, highlighting the importance of efficient supply chain solutions in the healthcare sector.

Sub-segments

-

Medical Supply Aggregation: Platforms that consolidate medical supplies and equipment under one roof.

-

Example: Medikabazaar offers an extensive catalog of medical supplies catering to various specialties.

-

Logistics and Distribution: Solutions aimed at improving the distribution efficiency of medical products.

-

Example: Ascent Wellness and Pharma Solutions have been acquired by Pharmeasy to enhance its B2B distribution network.

Challenges

The Supply Chain and Logistics segment faces challenges such as maintaining the quality and integrity of medical supplies during transportation, especially for temperature-sensitive products like vaccines. The fragmented nature of the supply chain and the lack of standardized processes can lead to inefficiencies and higher costs. Ensuring timely delivery and managing inventory effectively are also critical issues.

Notable Mention:

Medikabazaar is unique due to its comprehensive marketplace approach, offering a wide range of medical supplies and equipment. By providing an extensive catalog that caters to diverse medical specialties, Medikabazaar simplifies the procurement process for healthcare providers. Its focus on digitizing the supply chain and providing real-time inventory management solutions makes it a standout player in this segment.

What Gives a Startup the Right to Win?

Startups that offer comprehensive and digitized supply chain solutions, ensure the quality and integrity of medical supplies, and provide efficient logistics and distribution services are likely to succeed. The ability to manage inventory effectively, ensure timely deliveries, and maintain cost efficiency are key factors for gaining a competitive edge in the Supply Chain and Logistics segment.

E-Commerce:

Description

The E-Commerce segment encompasses online marketplaces dedicated to healthcare consumables, including over-the-counter medications, wellness products, and medical equipment.

Key Players

• Healthkart: Specializes in health supplements and wellness products.

• Netmeds: Provides a comprehensive range of pharmaceutical products.

• Sasta Sundar: Offers a wide range of healthcare consumables and has been acquired by Flipkart and rebranded as Flipkart Healthplus.

Funding

Approximately $490 million in cumulative funding, reflecting the growing consumer demand for online healthcare products.

Sub-segments:

-

Health and Wellness Products: Platforms selling supplements, personal care items, and fitness products.

-

Example: Healthkart focuses on health supplements and wellness products.

-

Pharmacy and Medical Supplies: Online stores for medications and medical supplies.

-

Example: Netmeds, owned by Reliance, offers a comprehensive range of pharmaceutical products.

-

Niche Marketplaces: Specialized platforms targeting specific health needs.

-

Example: Sasta Sundar, acquired by Flipkart and rebranded as Flipkart Healthplus, focuses on a wide range of healthcare consumables.

Challenges

The E-Commerce segment faces challenges such as ensuring the authenticity and quality of healthcare products, managing logistics for timely delivery, and dealing with regulatory compliance issues. Building consumer trust and providing a seamless online shopping experience are also critical hurdles.

Notable Mention:

Sasta Sundar is unique due to its focus on a wide range of healthcare consumables and its acquisition by Flipkart, which has rebranded it as Flipkart Healthplus. This acquisition provides Sasta Sundar with significant resources and expertise in e-commerce, enabling it to expand its reach and improve its service offerings.

What Gives a Startup the Right to Win?

Startups that offer a wide range of authentic and high-quality healthcare products, ensure efficient logistics and timely delivery, and provide a seamless online shopping experience are well-positioned to succeed. Building strong brand recognition and consumer trust, along with navigating regulatory compliance effectively, are crucial factors for gaining a competitive edge in the E-Commerce segment.

Personalized Healthcare:

Description

Companies in the Personalized Healthcare segment provide customized healthcare solutions tailored to individual needs. These solutions often combine products and services to deliver holistic healthcare experiences, ranging from mental health support to chronic disease management.

Key Players

• Wysa: Offers an AI-based chatbot for managing mental health.

• Cureskin: Provides personalized skincare and haircare treatments using AI.

• Healthifyme: Offers personalized diet and workout plans based on individual health data.

• Portea: Provides home healthcare services for chronic and post-hospitalization care.

• MakeO: Specializes in dental and orthodontic care.

• BeatO: Provides comprehensive diabetes management tools.

Funding

Approximately $474 million in cumulative funding, indicating strong investor interest in tailored healthcare solutions.

Sub-segments:

-

Mental Health: AI-driven platforms providing mental health support and therapy.

-

Example: Wysa offers an AI-based chatbot for managing mental health.

-

Dermatology and Hair Care: Personalized solutions for skin and hair care.

-

Example: Cureskin uses AI to provide customized skincare and haircare treatments.

-

Nutrition and Fitness: Platforms offering personalized diet and exercise plans.

-

Example: Healthifyme provides tailored meal and workout plans based on individual health data.

-

Home Healthcare: Services providing medical care at home, including nursing and physiotherapy.

-

Example: Portea offers home healthcare services for chronic and post-hospitalization care.

-

Chronic Disease Management: Solutions for managing long-term health conditions like diabetes.

-

Example: BeatO provides comprehensive diabetes management tools.

Challenges

The Personalized Healthcare segment faces challenges such as ensuring the accuracy and efficacy of personalized treatments, managing data privacy and security, and providing consistent and high-quality services. The need for continuous innovation and staying updated with the latest medical research are also critical hurdles.

Notable Mention

Wysa stands out for its innovative use of AI in mental health support. By offering an AI-based chatbot that provides therapy and mental health support, Wysa makes mental healthcare accessible and affordable. Its ability to provide personalized support based on user interactions makes it a unique and valuable player in the personalized healthcare space.

What Gives a Startup the Right to Win?

Startups that offer highly accurate and effective personalized treatments, ensure robust data privacy and security, and continuously innovate to stay ahead in medical research are well-positioned to succeed. Providing consistent and high-quality services, building strong user engagement, and leveraging advanced technologies like AI and machine learning are key factors for gaining a competitive edge in the Personalized Healthcare segment.

Healthtech Wearables

Description

The Healthtech Wearables segment focuses on devices designed to monitor and improve health through technology. These devices, primarily wristbands and watches, offer health tracking features such as ECG sensors, heart rate monitoring, activity tracking, and sleep pattern analysis. The market aims to provide personalized care, early identification of health risks, and promote positive lifestyle and behavioral changes.

Key Players:

Apple Watch: Features an ECG sensor, heart rhythm monitoring, and heart fall detection system.

Fitbit Versa: Measures sleep, breathing, heart rate, and activity.

GOQii Vital 2.0: Equipped with BP and ECG sensors.

Xiaomi Mi Bands: Tracks activity and heart rate, including Titan’s fast track reflex.

ten3T Healthcare: Provides a wearable patch for real-time monitoring of cardiac signals and body vitals.

ReTiSense: Smart shoe insoles integrated with a smartphone app to monitor running patterns and provide real-time foot and knee stress monitoring.

Terrablue XT: Wearable for stress management, mental health, and epilepsy alerts.

Funding and Market Overview

The Healthtech Wearables market in India is relatively small, valued at approximately USD 10 million, but it is estimated to grow at a CAGR of 40% from FY18–21. The market is projected to grow at over 60% CAGR over the next five years due to increasing consumer awareness about preventive health, smartphone and internet penetration.

Sub-segments

Wrist Bands and Watches: Devices focusing on health tracking features like ECG sensors, heart rate, activity, and sleep patterns.

• Example: Apple Watch, Fitbit Versa.

Wearable Patches: Devices providing real-time monitoring of specific health parameters.

• Example: ten3T Healthcare.

Smart Insoles: Footwear integrated with technology for health monitoring.

• Example: ReTiSense.

Challenges

The Healthtech Wearables segment faces challenges related to data privacy, affordability, and ensuring the accuracy and reliability of health monitoring features. There is also the challenge of integrating these devices seamlessly into users’ daily lives and maintaining user engagement over time.

What Gives a Startup the Right to Win in this Category?

Startups that offer reliable, accurate, and user-friendly wearable devices, ensure robust data privacy and security, and effectively educate consumers about the benefits of these technologies are well-positioned to succeed. The ability to innovate continuously, integrate seamlessly with other health tech ecosystems, and provide clear, actionable health insights will be crucial for gaining a competitive edge in the Healthtech Wearables segment.

Fitness and Wellness

Description: The Fitness and Wellness segment provides standardized models for fitness and wellness, addressing an unmet need in the country. This segment offers both digital and offline experiences across fitness, nutrition, and mental well-being. Business models can be asset-light or asset-heavy, offering a range of services from therapy sessions to Ayurveda, along with related products.

Funding and Market Overview:

The Fitness and Wellness market in India is valued at approximately USD 80 million and is growing at a CAGR of 50% from FY18–21. The market is driven by the increasing demand for standardized fitness and wellness solutions, and the ability to offer comprehensive health and wellness services.

Key Players

• Cult.fit: Offers digital and offline experiences in fitness, nutrition, and mental well-being. Provides meals, mental well-being therapy, Ayurveda, and co-branded products. • FITTR: Pune-based community fitness model, funded by Sequoia. • Sattva Medtech: Chennai-based fitness studios with 200 employees and 40 studios, raised USD 10 million from Fireside Ventures.

Sub-segments

-

Online Platforms: Provide online fitness training and wellness programs. • Example: FITTR.

-

Fitness Studios: Physical locations offering fitness training, wellness programs, and mental well-being therapy. • Example: Sattva Medtech.

-

Offline-cum-Online Platforms: Combine digital and offline services, offering a holistic approach to health and wellness. • Example: Cult.fit.

Challenges

The Fitness and Wellness segment faces challenges such as sourcing and retaining skilled trainers, ensuring the quality and consistency of services, and managing the high initial capital costs for setting up facilities. Additionally, customer acquisition and retention, especially in a competitive market, pose significant hurdles.

What Gives a Startup the Right to Win in this Category?

Startups that can provide high-quality, consistent, and comprehensive fitness and wellness services, maintain a strong and engaged customer base, and effectively manage operational efficiencies are well-positioned to succeed. The ability to leverage technology to enhance service delivery, create a strong brand identity, and form strategic partnerships will be crucial for gaining a competitive edge in the Fitness and Wellness segment.

import matplotlib.pyplot as plt

import numpy as np

# Data from the chart, source

years = np.arange(2010, 2026)

market_size_medtech = [50, 100, 150, 200, 250, 300, 400, 500, 600, 700, 800, 1000, 1200, 1400, 1600, 1800]

market_size_personal_health = [10, 20, 30, 50, 70, 100, 150, 200, 300, 400, 600, 800, 1000, 1200, 1500, 1800]

market_size_healthcare_home = [5, 10, 15, 25, 40, 60, 80, 100, 150, 200, 250, 300, 400, 500, 600, 800]

market_size_healthcare_it = [20, 30, 50, 70, 90, 120, 150, 200, 300, 400, 500, 600, 800, 1000, 1200, 1400]

market_size_other = [10, 20, 30, 50, 60, 80, 100, 150, 200, 250, 300, 400, 500, 600, 700, 800]

# Stack the data

market_sizes = np.vstack([market_size_other, market_size_healthcare_it, market_size_healthcare_home, market_size_personal_health, market_size_medtech])

# Plotting the stacked bar chart

fig, ax = plt.subplots(figsize=(14, 8))

labels = ['Other', 'Healthcare IT & Analytics', 'Healthcare at Home', 'Personal Health Management', 'MedTech']

colors = ['#2F4F4F', '#FF8C00', '#FF4500', '#DC143C', '#8B0000']

# Create stacked bar chart

ax.stackplot(years, market_sizes, labels=labels, colors=colors, alpha=0.7)

# Add titles and labels

ax.set_title('Healthtech Market Size in India (2010-2025)', fontsize=16)

ax.set_xlabel('Years', fontsize=14)

ax.set_ylabel('Healthtech Market Size (in $ Mn)', fontsize=14)

ax.legend(loc='upper left', fontsize=12)

ax.grid(True)

# Show the plot

plt.show()

Conclusion

The Indian healthtech sector is poised for transformative growth, driven by an increasing demand for accessible, efficient, and technology-enabled healthcare solutions. The sector’s evolution is propelled by a diverse array of startups, from Integrated Healthcare Providers (IHPs) offering comprehensive service suites, to Healthcare SaaS companies specializing in advanced data analytics and vertical-specific solutions.

The healthtech landscape in India offers diverse opportunities across various segments. Investors should focus on companies that:

-

Target large, niche markets.

-

Specialize in clinical aspects of the market.

-

Leverage technology to scale and improve outcomes.

By applying this structured evaluation framework, investors can make informed decisions and identify companies with the potential to lead in India’s evolving healthtech sector.

Challenges persist, including the need for capital efficiency, operational scalability, data privacy, and the seamless integration of technology into traditional healthcare practices. However, the startups that can navigate these challenges successfully are those that leverage advanced technologies, form strategic partnerships, and maintain a relentless focus on user experience and service quality.

Ultimately, the healthtech landscape in India presents a vibrant and dynamic ecosystem filled with opportunities for growth, innovation, and collaboration. By addressing both urban and rural healthcare needs, fostering preventive care, and enhancing the overall patient experience, healthtech startups are not only transforming healthcare delivery but also contributing to the broader goal of creating a healthier and more inclusive society. The future of Indian healthcare is undeniably digital, and the companies that adapt and evolve with this paradigm shift are the ones that will lead the charge in shaping the future of healthtech.

评论 (0)