Decentralized Exchanges (DEXs)

Before we delve into DEX, let’s briefly discuss Cryptocurrency exchanges and the types we have.

Similar to the traditional financial exchange, cryptocurrency exchanges are platforms that provide the tools needed to trade cryptocurrencies.

Currently there are three types of cryptocurrency exchanges -

i) Centralized exchanges (CEXs)

ii) Hybrid exchanges (HEXs)

iii) Decentralized exchanges (DEXs)

Centralized exchanges (CEXs)

A centralized cryptocurrency exchange is a platform operated by a single organization, facilitating the exchange of digital currencies between buyers and sellers. It acts as an intermediary, ensuring reliability by managing any assets involved in a trade. Typically, centralized exchanges require users to undergo a Know Your Customer (KYC) process to comply with legal requirements. This procedure verifies user identities and helps prevent illicit activities.

Hybrid exchanges (HEXs)

Despite being in its early stages of development, hybrid exchanges were designed to address the limitations of both centralized exchanges (CEXs) and decentralized exchanges (DEXs). By merging the strengths of both models, hybrid exchanges provide the high liquidity and quick transaction capabilities of centralized exchanges, along with the anonymity and security features found in decentralized exchanges. One of the primary objectives of hybrid exchanges is to tackle the scalability challenges faced by DEXs.

Decentralized exchanges (DEXs)

A DEX is a peer-to-peer marketplace where users can trade cryptocurrencies without the need for a custodial middleman. Transactions on a DEX are facilitated by smart contracts, which are self-executing programs that activate when predetermined conditions are fulfilled.

DEXs emerged with the aim of removing intermediaries or third parties from cryptocurrency transfers. By doing so, DEXs embody one of the fundamental promises of cryptocurrencies: enabling financial transactions that are not dependent on banks, brokers, payment processors, or any other form of intermediary.

Advantages of Decentralized Exchanges:

-

Enhanced Custody: Users of decentralized exchanges (DEX) enjoy a higher level of security against hacking and theft. They retain sole control over their wallet keys and are not required to transfer their assets to a third-party custodian.

-

Reduced Censorship: Unlike centralized exchanges (CEX), DEX users are not compelled to complete Know-Your-Customer (KYC) forms, ensuring greater anonymity and privacy.

-

Diverse Asset Selection: DEX platforms offer easy access to a broader range of assets compared to CEX, as they are not bound by the regulatory constraints that govern centralized exchanges. They provide opportunities to trade new assets that may not be listed on centralized platforms.

-

Accessibility: The advent of DEX has facilitated access to the cryptocurrency market for crypto enthusiasts residing in countries with strict crypto regulations or unfavorable crypto environments. DEX operates independently from traditional financial systems, offering a viable alternative for these individuals.

- Decentralized Exchange or Centralized Exchange: A comparison.

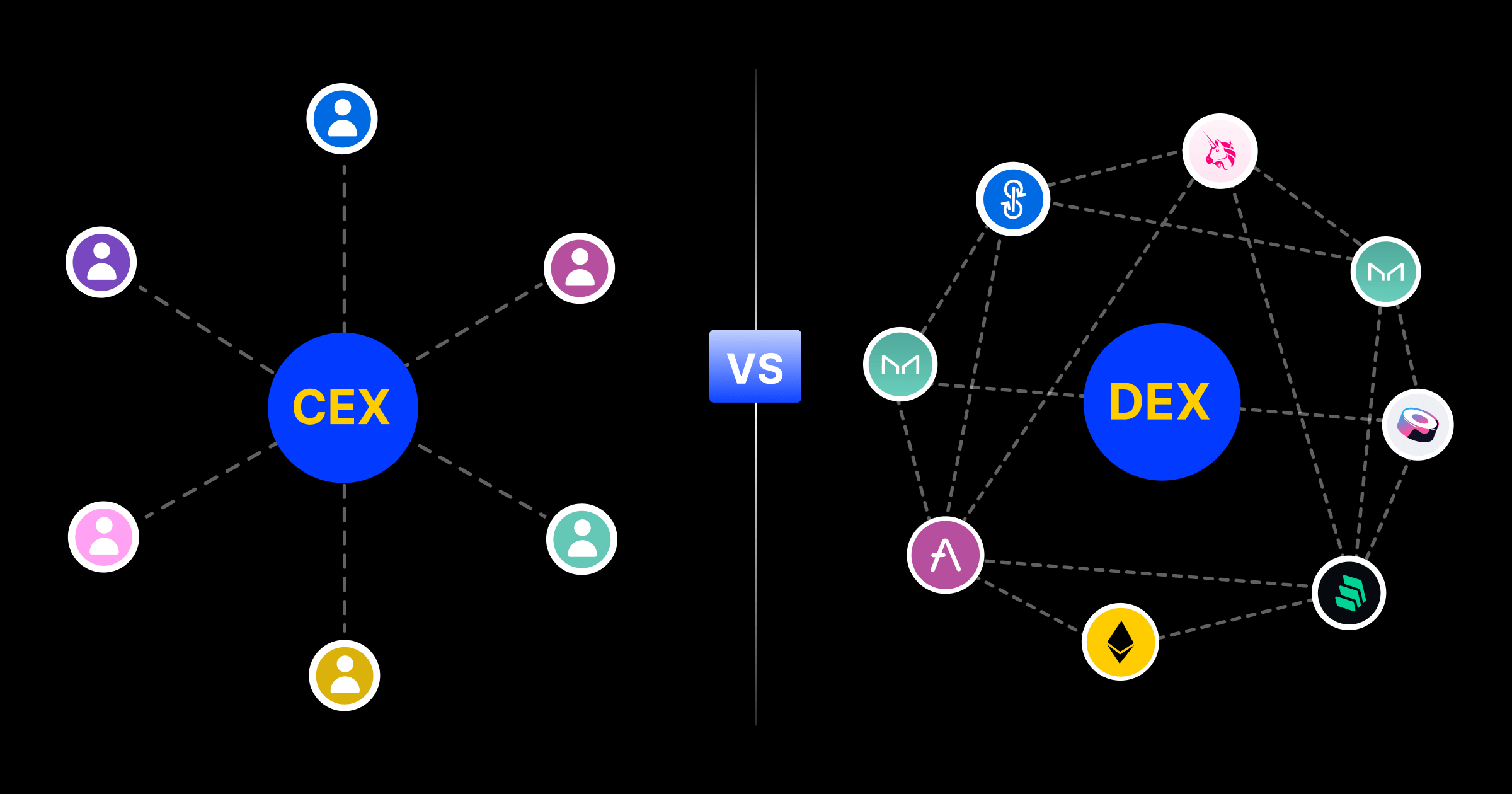

Choosing the right exchange platform can be confusing, especially for new cryptocurrency users. While CEXs have been around for a long time and are more well-known, DEXs have been gaining popularity in recent years due to their advantages over CEXs.

Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs) offer various approaches to cryptocurrency trading. Let's explore their distinguishing features.

Custodial vs. Non-Custodial: One aspect that sets DEXs and CEXs apart is the decision between directly holding one's cryptocurrencies or entrusting them to the exchange. CEXs usually mandate users to deposit their assets under the exchange's custody before engaging in trades. Opting to maintain control over your assets aligns with the principle of self-reliance prevalent in the crypto realm, granting you complete and exclusive ownership. However, there is a risk of losing or obliterating private keys, which could render associated assets irretrievable.

Regulations: The increasing popularity of DEXs can partly be attributed to their adeptness at maneuvering through certain regulatory challenges. Unlike CEXs, DEXs operate autonomously and steer clear of acting as financial intermediaries or counterparts, thus circumventing the need to adhere to know-your-customer (KYC) and anti-money laundering (AML) standards.

Liquidity: DEXs may encounter difficulties when dealing with larger investors. They presently cannot rival the scale and liquidity provided by the largest CEXs. Inadequate liquidity can result in "slippage," leading to unforeseen additional costs for substantial orders. Moreover, institutional investors face their own set of AML and regulatory hurdles and may encounter challenges when dealing with exchanges that do not conform to similar requirements.

Impermanent Loss: A Significant Concern for DEXs: While the DEX system is appealing, it introduces a risk known as impermanent loss for liquidity providers participating in the liquidity pool. Liquidity providers can only withdraw the portion of the pool's value they contributed, rather than the precise number of tokens they initially provided. As trades occur, the ratio of different tokens in the pool fluctuates, making it impossible to guarantee each provider their specific tokens. Consequently, the pool gradually contains a higher proportion of the token experiencing value depreciation and a lower proportion of the token appreciating in value. As a result, liquidity providers tend to withdraw more of the devalued token and less of the appreciating one, leading to a loss compared to privately holding their assets. In practice, DEXs generally compensate liquidity providers through transaction fees, necessitating higher fees than they would otherwise require.

Drawbacks of Decentralized Exchanges

While decentralized exchanges introduce groundbreaking changes, they come with their own set of disadvantages. It is essential to carefully assess these downsides before selecting an exchange platform.

Transaction Speed: The processing speed of orders on DEXs can be comparatively sluggish. This is because trading requests must first be disseminated across the network and validated by miners before they are executed. Consequently, transactions on DEXs are more prone to encountering "price slippage," where trades fail to execute due to fluctuations in the values of the cryptocurrencies involved.

Another concern is "front-running" in relation to public order books. In this scenario, users initiate trades with higher gas fees to prioritize their execution over pending transactions.

Liquidity Challenges: Centralized exchanges achieve liquidity through significant capital reserves. In contrast, DEXs often face hurdles in this aspect as their liquidity predominantly relies on the number of active traders on the platform. Moreover, DEXs generally lack access to centralized funds that can be utilized to facilitate trades.

1Fortunately, the decentralized finance (DeFi) sector has introduced a solution to address this concern through liquidity pools that DEXs can leverage.

-

References

Are you confused on the DEX to use?

Jump in and create account with our partner bybit exchange to get started Click here . Create account and verify it

What do you want us to cover in our next article? Why don't you Join our communities and tell us

You can join our communities below for more updates:

You can join our communities below for more updates:

https://twitter.com/FlendCryptoClub?t=inxX2B1U66ottpijD1Mj1w&s=09

评论 (0)