Tl;dr:

🔥 Bubbleswap CLMM explanation

BubbleeSwap CLMM Introduction

Today, BubbleSwap has transformed into a Concentrated Liquidity Market Maker (CLMM), opening the next chapter of #1 Native and Most Trusted DEX on Bitlayer.

CLMM is a feature introduced in Uniswap V3, now available on BubbleSwap. CLMM enables liquidity providers (LP) to concentrate their funds within specific price ranges in the liquidity pool, providing more capital efficiency and control over their liquidity provision.

For users who don't want to dive into the technical details of CLMM or AMM, here's a simple example:

-

Let's consider Alice and Bob, both having $1000 each in the ETH-USDC pair. The current ETH price is $2000.

-

Alice provides liquidity to the old version of BubblSwap (AMM) with $500 in ETH and $500 in USDC. Bob, on the other hand, utilizes BubbleSwap CLMM and also provides $500 in ETH and $500 in USDC. However, Bob forecasts that the ETH price will stay between $1700 and $2300 throughout the year. So, Bob sets his liquidity price range accordingly.

-

At the end of the year, the ETH price is now $2100. Alice earns a liquidity fee of $50 (5% apr), while Bob earns $300 in liquidity fees (30% apr). This is because the ETH price remained within Bob's specified price range for liquidity provision, making Bob's liquidity utilization more efficient compared to Alice's approach in the old version of BubbleSwap.

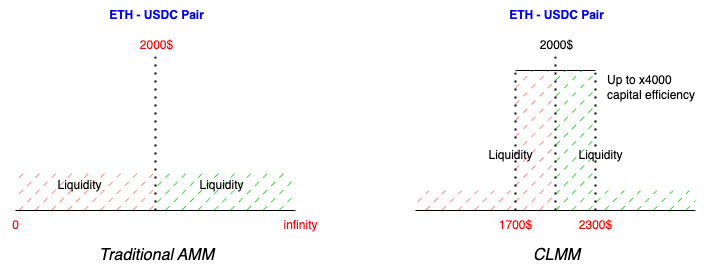

For technical guys, the image below provides a simple explanation of the difference between CLMM and AMM (Automated Market Maker) in liquidity providing.

As you can see, in the AMM model, liquidity is spread out from 0 to infinity, which can lead to inefficiencies in capital utilization. On the other hand, CLMM allows users to provide liquidity in a more concentrated manner, resulting in improved capital efficiency. The benefits of CLMM include:

-

Concentrated Liquidity: allowing LP to concentrate their funds within specific price ranges. This enables them to optimize capital efficiency and reduce exposure to impermanent loss.

-

Customizable Fee Tiers: the old version of AMM fixed a 0.3% fee for all trades, BubbleSwap CLMM allows LP to set different fee tiers for different price ranges. This provides greater flexibility in fee structures and can attract LP with diverse strategies.

-

Range Orders: enable traders to specify the price range they want to execute their trades. This feature allows for more precise and efficient trading, especially in volatile markets.

-

Capital Efficiency: With the ability to concentrate liquidity within specific price ranges, BubbleSwap CLMM offers improved capital efficiency compared to the old version. LP can effectively deploy their assets and maximize returns in the areas they deem most profitable.

Conclusion

BubbleSwap CLMM offers our users the best rates, with low slippage, enhanced capital efficiency, and an exceptional user experience. At DackieLabs, our goal is to provide the utmost benefits to our Dackity community.

Enjoy the #1 Native and Most Trusted DEX on Bitlayer

评论 (0)