The crypto world has been rocked by a wave of aggressive US regulatory actions. But what's driving this crackdown, and what does it mean for the industry and investors?

Key Settlements and Numbers

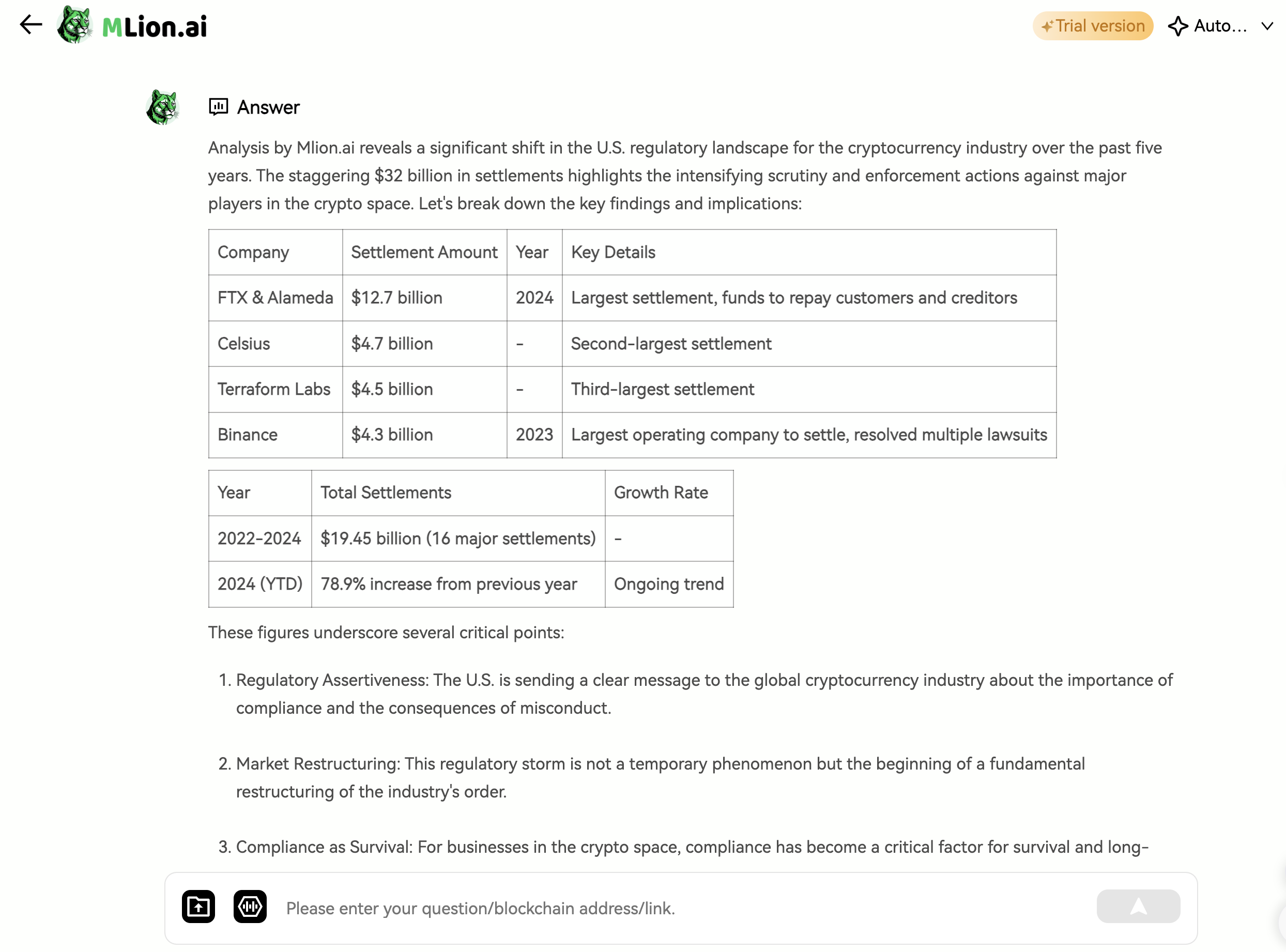

Since the collapse of FTX in 2022, US regulators have significantly ramped up their scrutiny of the crypto industry. The past two years have seen 16 major settlements, totaling a staggering $19.45 billion. And 2024 isn’t over yet—settlements this year are already up 78.9% from 2023.

Here are some of the key settlements:

-

FTX & Alameda: $12.7 billion settlement, aimed at repaying customers and creditors after the shocking collapse.

-

Celsius: $4.7 billion settlement.

-

Terraform Labs: $4.5 billion settlement.

-

Binance: $4.3 billion settlement, the only company among the top fined entities that remains operational, highlighting the importance of compliance for survival.

Why the Crackdown?

So, why have US regulators been so aggressive towards the crypto industry in recent years? The answer lies in the desire to instill accountability and prevent future collapses like that of FTX. The wave of fines sends a clear message to the global crypto industry: compliance is no longer optional—it's crucial for survival.

This regulatory sweep represents a shift in the US government's approach to the crypto space, aiming to reshape the industry and protect investors. For companies operating in the crypto ecosystem, there is now a stronger push for transparency, accountability, and regulatory adherence.

Impact on the Crypto Industry

-

Compliance as Key to Survival: The regulatory environment is becoming more stringent, making compliance essential for survival.

-

Reshaping the Order: The actions taken by regulators are not just reactive; they are reshaping the very order of the crypto industry.

-

Balancing Innovation and Regulation: The challenge ahead is finding the right balance between fostering innovation and ensuring regulatory compliance.

What It Means for Investors

For investors, the key takeaway is to stay informed about the evolving regulatory landscape. Prioritize platforms with strong compliance records and understand that this regulatory crackdown is not a passing storm—it's here to stay, and it's reshaping the market.

The Future of Crypto

The crypto industry is at a crossroads, forced to evolve under the growing weight of regulation. The path forward involves finding a new equilibrium between decentralization and regulatory compliance. While the regulatory storm may seem harsh, it could ultimately lead to a more resilient and mature crypto ecosystem.

For more real-time analysis, news interpretation, and market insights, visit mlion.ai.

Disclaimer: This information is for educational purposes only. Always conduct your own research before making investment decisions. Investment is risky; proceed with caution.

Follow me for daily updates and insights into the crypto market!

评论 (0)