Mitosis: A New Model for Liquidity Allocation

Mitosis offers a new way to manage on-chain liquidity through a marketplace built into each blockchain. The Mitosis Chain serves as a hub, matching liquidity supply and demand, while Mitosis Vaults on individual chains allocate liquidity to dApps based on market needs. This system ensures liquidity flows efficiently where it's needed most, optimizing DeFi resources.

Onboarding Liquidity Providers to Mitosis

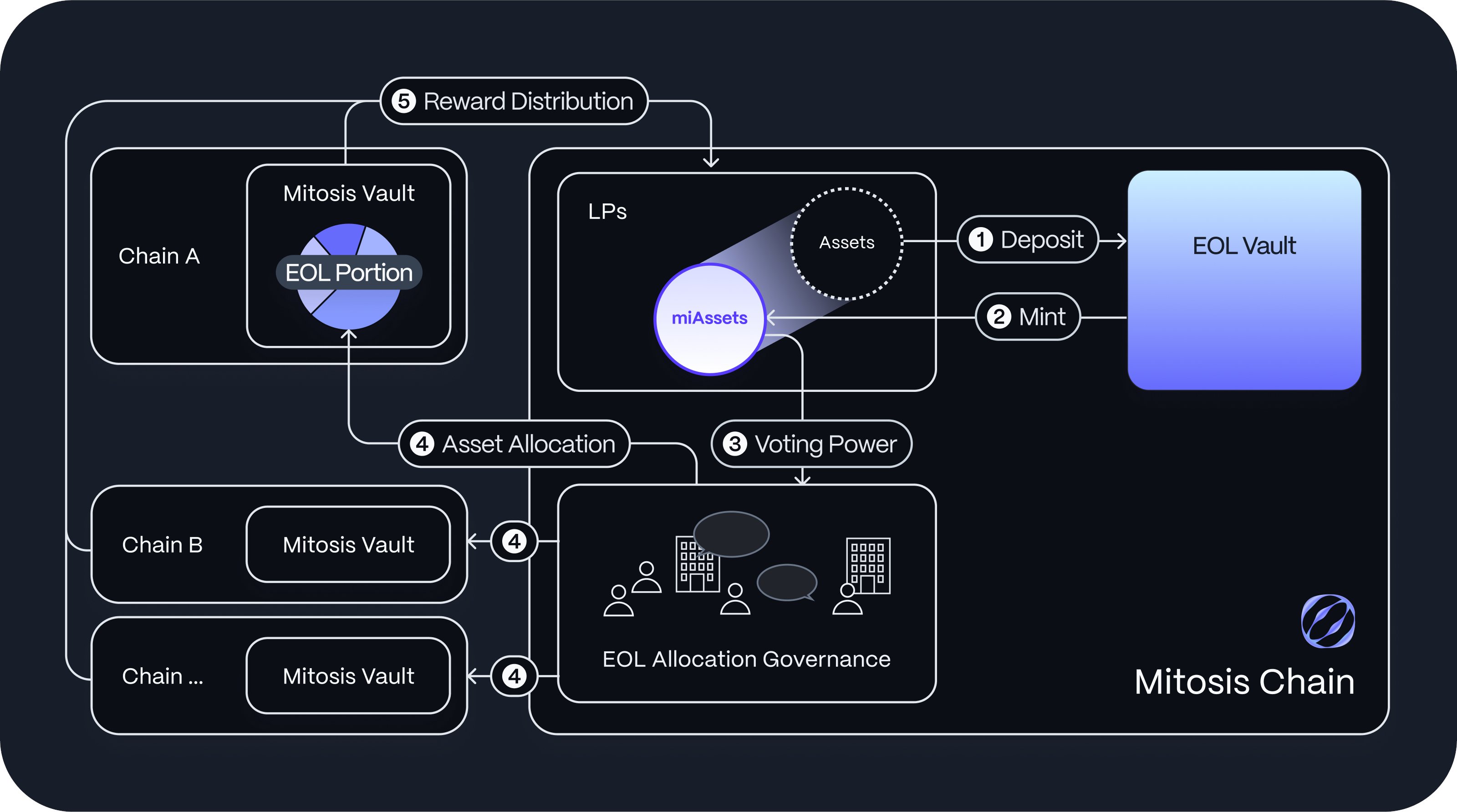

Liquidity providers (LPs) are essential to the Mitosis ecosystem. They deposit assets into Mitosis Vaults across various chains and receive equivalent assets on the Mitosis Chain. For instance, LPs depositing ETH into a Vault on Arbitrum get ETH on the Mitosis Chain as a representation of their deposit.

LPs can then become Ecosystem-Owned Liquidity (EOL) LPs by depositing these assets into the EOL Vault on the Mitosis Chain, receiving miAssets in return. miAssets offer exposure to the yield and risk managed by the liquidity marketplace, with the ecosystem-owned liquidity allocated to dApps for generating yield.

Capturing Market Sentiment: The Role of miAssets

Mitosis Vaults distribute Ecosystem-Owned Liquidity (EOL) based on periodic gauge votes, where miAsset holders decide the allocation of EOL to each dApp. These votes occur for each chain and asset combination, with voting power proportional to the amount of miAssets held by participants.

While direct voting by LPs reflects market sentiment, full participation from all LPs is unlikely. To address this, Mitosis translates the broader ecosystem activity involving miAssets into EOL allocation ratios, effectively crowdsourcing liquidity decisions.

Direct Voting and Delegation Mechanisms

LPs holding miAssets can directly vote on liquidity allocation across supported chains. For instance, an LP holding 3% of all miweETH can determine how to allocate 3% of the ecosystem-owned weETH in Mitosis Vaults on different chains, regardless of where they initially deposited their assets. If there are 10M ecosystem-owned weETH in the Scroll Mitosis Vault and 20M in Arbitrum, the LP can choose to allocate 0.3M (3% of 10M) from Scroll and 0.6M (3% of 20M) from Arbitrum.

LPs can delegate their voting power to dApps when depositing miAssets, allowing dApps to use that voting power. However, LPs can reclaim their voting rights anytime without withdrawing their deposit. This delegation gives dApps significant influence over liquidity allocation, especially with large miAsset deposits.

Facilitating Network Expansion with miAssets

In the multi-chain era, dApp developers often expand across multiple blockchains to capture more market share, but securing liquidity for new networks can be challenging. Mitosis addresses this by enabling builders to use miAssets to obtain the liquidity needed for expansion.

For example, if a dApp like Aave holds 20% of all miweETH, it can use this voting power to allocate ecosystem-owned weETH to its new deployments on different chains. This initial liquidity enables Aave to offer competitive weETH borrowing rates from day one on a new network. The voting power of miAssets not only reduces the resources needed for liquidity bootstrapping but also gives dApp builders an early advantage, making it crucial for scaling across multiple networks.

Mitosis Ecosystem: A Marketplace for Liquidity

The Mitosis ecosystem functions as a transparent on-chain marketplace where multi-chain dApp builders compete for miAsset deposits, while LPs allocate their miAssets based on factors like yield, security, reputation, and user experience. For instance, Aave might offer a share of the yield from its new launch on Scroll to those who delegate voting power to Aave on the Mitosis Chain. This market-driven approach ensures liquidity allocation aligns with the collective sentiment of ecosystem participants.

Diverse LP Profiles in Mitosis

The Mitosis ecosystem accommodates different types of LPs:

-

Active LPs: These LPs vote directly to participate in the ecosystem’s EOL allocation decisions.

-

Delegating LPs: These LPs delegate their voting power to dApps, allowing the dApps to reflect the LPs’ intentions.

-

Passive LPs: These LPs simply hold miAssets, gaining exposure to the EOL’s risk and reward profile without influencing allocation decisions.

Through active and delegating LPs, the ecosystem captures the market sentiment in a decentralized manner while minimizing the impact of voter apathy. Mitosis also allows passive participants to benefit from an ecosystem-driven liquidity strategy.

Implications for the Broader Blockchain Landscape

Mitosis allows even passive participants to keep their liquidity dynamic and responsive to market sentiment. This inclusivity enhances the growth and resilience of chains integrating the Mitosis liquidity marketplace, invigorating the DeFi market within these ecosystems. Ultimately, Mitosis seeks to establish a fair market value for liquidity, leading to greater maturity and efficiency in the DeFi landscape through fair pricing.

P.s Article written by Dollin

评论 (0)