The Fed has been sending strong signals lately, suggesting another 50 basis point interest rate cut could be coming this November. This news is creating buzz across the crypto world.

How Rate Cuts Impact the Crypto Market

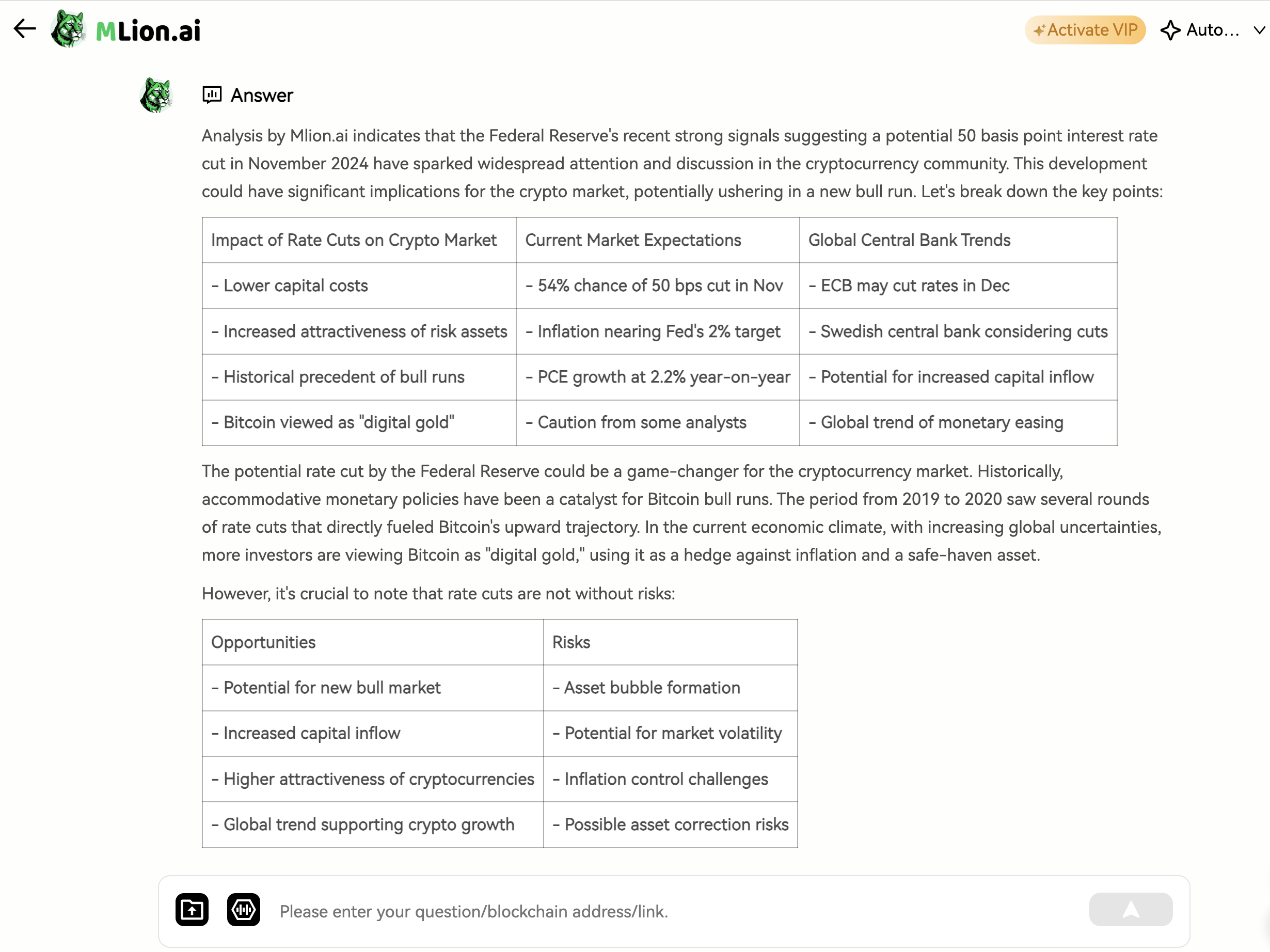

When the Fed lowers interest rates, it adopts a looser monetary policy, reducing borrowing costs. In traditional markets, this often pushes investors to seek higher returns, making riskier assets like Bitcoin more attractive.

Looking back, the Fed's rate cuts and easing policies from 2019 to 2020 played a key role in fueling Bitcoin's bull market. With global economic uncertainty rising, more investors now view Bitcoin as "digital gold" to hedge against inflation and market volatility. If the Fed cuts rates again, we could see another surge in Bitcoin and other cryptocurrencies.

Current Market Expectations

Right now, the market estimates a 54% chance that the Fed will cut rates by 50 basis points in November. This is largely due to the ongoing decline in U.S. inflation. In August, the personal consumption expenditure price index (PCE) rose by 2.2% year-on-year, nearing the Fed's 2% target. This slowdown in inflation gives the Fed more flexibility to ease policy further, increasing the odds of a faster rate cut.

However, not everyone is on board with an aggressive cut. Analyst John Choong cautions that while the overall PCE data looks promising, it's masking underlying inflation pressures from energy costs and commodity deflation. Unless inflation continues to cool, the Fed may not rush into such a drastic cut.

Is the European Central Bank Following Suit?

The European Central Bank (ECB) might also be preparing for a major rate cut. Deutsche Bank predicts the ECB could cut rates by 50 basis points in December and continue until deposit rates fall below 2.5%. Other central banks, like Sweden's, are also considering sharp rate cuts. This global trend could drive more capital into the crypto market.

The Risks of a Rate Cut

While rate cuts can boost economic growth, they also carry risks, including asset bubbles. If monetary policy becomes too loose, it could fail to control inflation, leading to potential market pullbacks. Investors should focus not only on short-term gains but also be mindful of future market volatility.

Bottom Line: Opportunities and Challenges in the Crypto Market

The Fed’s potential rate cuts could create a positive backdrop for the crypto market, but uncertainty remains. Investors should proceed cautiously, given the global economic challenges. Historically, looser monetary policies have sparked growth in the crypto market, but they often come with volatility.

In the coming months, the crypto space may offer new opportunities—but be prepared for both the risks and rewards.

For real-time analysis and market updates, visit: mlion.ai

Disclaimer: The above content is for informational purposes only and does not constitute investment advice. Investing is risky, so enter the market with caution! Follow me for daily market insights.

评论 (0)