In the past year, analysts have noted a significant retreat in venture capital investments in cryptocurrency projects, returning to levels reminiscent of 2017. However, there are positive developments: some initiatives are rekindling a spirit of freedom from venture capitalists — at least at the declarative level.

Not So Distant Past

The investment landscape in 2024 has not differed greatly from the previous year, except for the last three months when venture activity surged dramatically. Starting in October, the situation changed qualitatively, although the amounts raised from the VC segment still lag far behind the levels seen in 2021–2022.

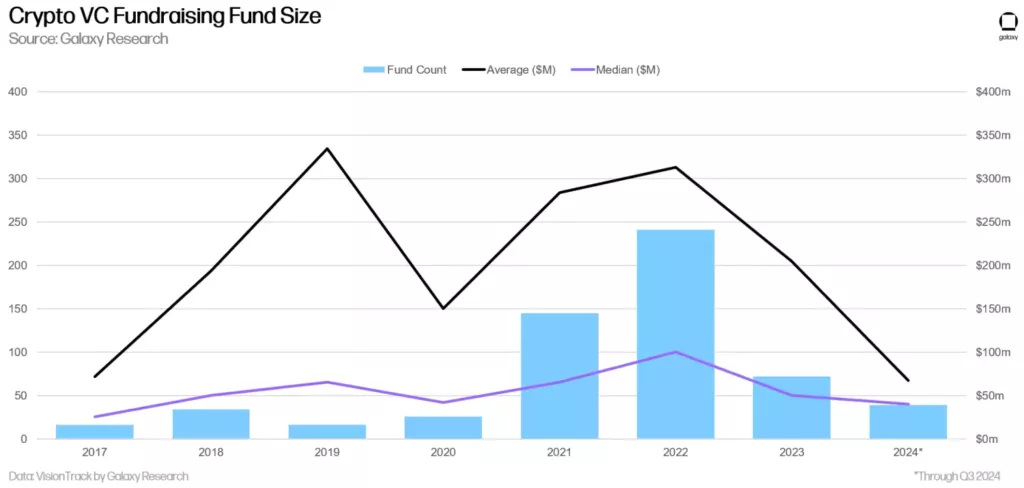

A report from Galaxy clearly shows a reduced participation of venture firms, with the median capital in new cryptocurrency funds hitting its lowest point since 2017—around $40 million.

As 2024 draws to a close, it promises to be the weakest year for fundraising since 2020. Only about 40 new funds raised $1.95 billion, significantly lower than the frenzy of 2021–2022. Notably, the largest share of capital went to companies and projects founded in 2021 and 2022. For comparison, such figures were achieved in just one quarter during the weak year of 2023.

In previous bull cycles, a consistent correlation was observed between venture investment volumes and cryptocurrency growth. However, over the past two years, this trend has reversed—the growth of the crypto market has not translated into success for the VC segment as it had in earlier cycles. Several factors likely contribute to this shift.

As the U.S. remains an undeniable leader in capital investment, regulatory uncertainty following the FTX collapse may have created a bottleneck, along with expanded access to exchange products.

Now, many find it safer to enter the crypto market by purchasing shares of public blockchain companies and crypto funds or ETFs; there are plenty of highly liquid instruments available.

It seems that private projects and startups have become a thing of the past for large capital. The "Wild West of ICOs" has likely shifted to respectable offices of specialized funds and divisions within major crypto companies.

It's All Users' Fault

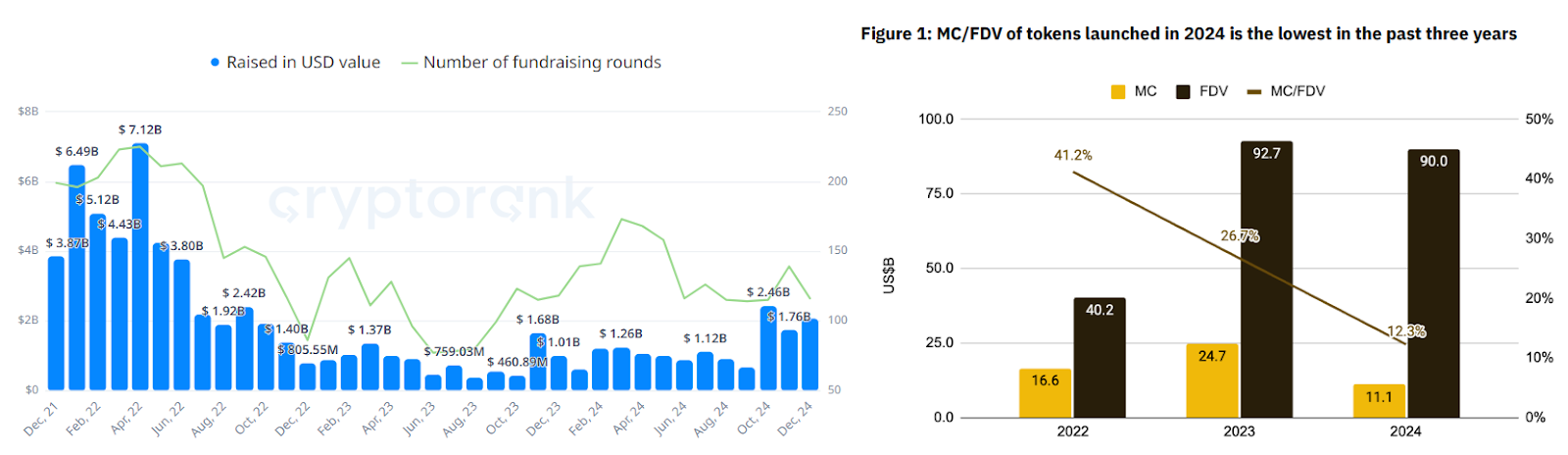

The trend toward declining funding amounts coincided with a rise in popularity for tokens with high FDV (Fully Diluted Valuation) but low circulating supply.

According to a report from Binance Research, the trend toward "adequate" tokenomics began to decline right after the FTX collapse. This may be attributed to decreased competition in the token issuance market from 2022 to 2024 compared to the previous bull cycle.

It is evident that in most cases, tokenomics structures where 95% or more of a project's tokens will be unlocked on the market in subsequent years negatively impact asset prices.

Investors quickly concluded that such projects lack fundamental long-term prospects. It appears that in recent years they prefer projects with maximum MC/FDV ratios.

In this regard, meme coins traditionally lead among all instruments. Their MC/FDV is almost always equal to 1, completely eliminating the risk of sell pressure after unlocking tokens for early investors who entered at prices tens of times lower than market rates. Meme coins have returned ordinary users to a level playing field with modest financial means.

This trend has also been supported by venture investors and entire companies that created specialized divisions for investing in meme coins in 2024. Binance, Avalanche, TRON, and TON have all launched corresponding initiatives—just like traditional organizations.

For instance, Matt Hougan, Chief Investment Officer at Bitwise, openly expressed support for such products:

"I would prefer investing in meme coins through ETFs rather than through FTX."

Indeed: why buy high-risk assets with multi-year profit timelines when you can enter the meme coin market and see returns within a month or even a week?

Where Investments Are Going

A notable development in 2024 is the Bitcoin ecosystem beginning to experiment with new DeFi implementations. According to DeFi Llama, around 30 such startups raised approximately $650 million—accounting for over 60% of total investments received from investors during 2022 and 2023.

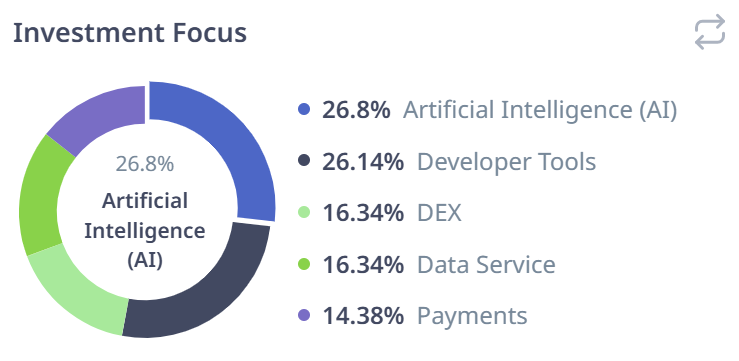

Outside of Bitcoin, venture capital is most actively present in the AI sector as well as development tools; collectively they accounted for over 50% of investments during the second half of 2024.

Data from CryptoRank confirms Galaxy's analysts who observed a fivefold increase in AI investments during Q3 2024.

It seems no major companies remain that do not incorporate AI-based applications into their investment plans. Some—like Coinbase Ventures—focus on infrastructure projects while others—such as VanEck and a16z—forecast developments involving AI agents transforming into economic entities naturally generating millions in profits for beneficiaries.

Yet it is essential to note that in 2024, there has been a resurgence of community-driven projects within crypto markets aiming to operate without VC assistance. Aside from memes, an important event occurred at year's end: Hyperliquid (HYPE) launched its token—the largest airdrop in cryptocurrency history.

It’s worth mentioning that no venture firm was publicly involved in this project. Its team states:

"Hyperliquid Labs is self-funded and does not seek external capital."

The project took an unconventional route for 2024 by releasing around 30% of its tokens at TGE (Token Generation Event) from its maximum supply.

Thus, recently—and especially throughout 2024—a noticeable trend towards high-liquidity regulated investment options has emerged within cryptocurrency markets. The success of tokens increasingly correlates with reduced public involvement from venture firms in early-stage projects.

评论 (0)