Recent reports indicate that El Salvador is reconsidering its cryptocurrency policy, which may not favor Bitcoin holders. This shift is likely driven by pressure from the International Monetary Fund (IMF).

Oleg Cash Coin delves into why the country, once a symbol of Bitcoin's rise to state-level recognition, is now making compromises.

Expectations vs. Reality

El Salvador, dubbed the "land of rising Bitcoin," is set to ease its cryptocurrency policies in exchange for a loan from the IMF. According to the Financial Times, the government plans to eliminate mandatory acceptance of Bitcoin as a means of payment, likely leaving it at the discretion of businesses.

By making this compromise, El Salvador aims to secure a $3.3 billion loan from the IMF, the Inter-American Development Bank, and the World Bank. An agreement is expected to be reached within the next two to three weeks.

While this news sounds significant and suggests that El Salvador is abandoning Bitcoin, negotiations have been ongoing for quite some time, and cryptocurrency policy is just a small part of the broader demands imposed by global banks.

El Salvador is often presented in the media as the first country in the world to adopt Bitcoin as legal tender. However, Japan has had similar legislation since 2017, which has not raised concerns among anyone, including the IMF.

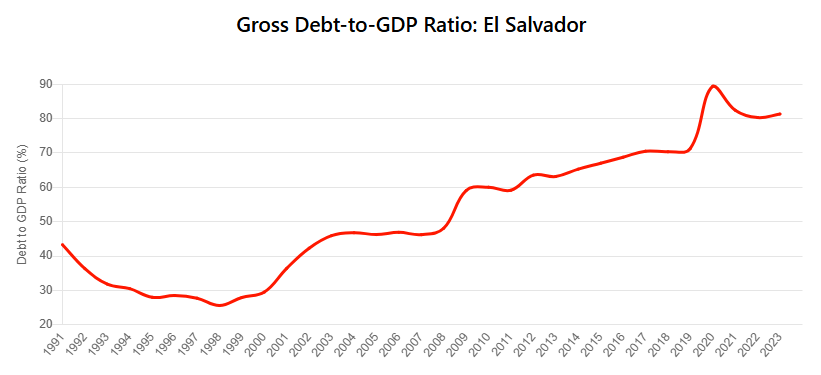

The difference lies in Japan being a highly developed nation with a robust regulatory framework, while El Salvador is socially, politically, and financially unstable, with an external debt estimated at 80% of its GDP.

Doubts about the republic's creditworthiness led the IMF and other international organizations to initiate discussions with President Nayib Bukele regarding a rollback of his Bitcoin strategy.

Moreover, given that El Salvador uses the U.S. dollar as its national currency, it is unlikely that it can pursue an independent cryptocurrency policy if circumstances demand otherwise. The country lacks conditions for issuing its own currency, which imposes significant limitations.

Bukele finds himself in a vastly different situation compared to Argentina's President Javier Milei, who leads with a "people's cryptocurrency policy" that allows for more maneuverability.

Biden and Trump

Discussions about El Salvador's debts and their restructuring resumed in late summer 2024, shortly after Joe Biden exited the presidential race. Around that time, Bukele gave a significant interview to Time magazine in which he gently acknowledged that Bitcoin had not lived up to expectations as a "currency for all," although it had found followers within the country. It was then that an agreement was reached between Bukele and the IMF regarding concessions.

"Progress has been made in negotiations on a Fund-supported program aimed at strengthening public finances and reducing risks associated with Bitcoin," stated an IMF announcement on August 6, 2024.

It appears that Donald Trump's figure played a crucial role in negotiations between the IMF and El Salvador. The issue at hand is not truly about Bitcoin but rather about managing an increasing national debt that needs financing without any possibility of offsetting it through the state budget. The smallest country in Central America simply cannot tackle this problem alone.

Even considering Bitcoin's colossal growth, there are no grounds to believe that digital gold reserves can be used to repay old debts. A week after Trump's victory, news emerged that El Salvador had submitted an offer to buy back $2.5 billion in debt maturing by 2034.

Not long before this, Bukele met with Elon Musk. The billionaire welcomed the Salvadoran president amid Trump's election campaign to discuss artificial intelligence and robotics development (what else?).

El Salvador and New Debts

On economic macro indicators, El Salvador's situation may not be as dire as it seems at first glance.

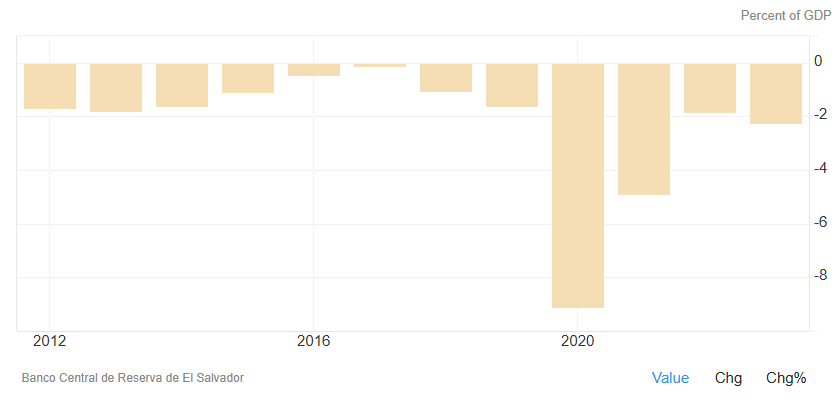

However, there are no significant improvements in sight. Even with GDP growth over many years, a persistent budget deficit continues to affect national debt levels. Bukele lacks a "printing press" capable of patching financial gaps without issues.

In 2021, the country's GDP was $29 billion compared to $25.5 billion in debt. By 2023, these figures rose to $34 billion against $28.8 billion in debt. Despite seemingly positive dynamics in GDP growth rates and debt levels, the budget deficit remains above 2.2%.

According to Arkham, Bukele's Bitcoin strategy has allowed the government to accumulate nearly 6,000 BTC valued at approximately $580 million as of December 10, 2024. Relative to national debt levels, this amount represents about 2%, which falls far short of covering any substantial portion.

Indeed, since 2021 El Salvador has become something of a symbol for applying HODL strategies not just for individual citizens but also for entire nations. However, this does not imply that Bukele's approach has brought noticeable economic improvements.

Bitcoin bonds discussed for several years have yet to be issued, and the mining business remains intangible at best. Perhaps this process is slower than many anticipated.

As Tether CEO Paolo Ardoino noted back in early 2023, judging El Salvador's success after such a short period is shortsighted given the rapidly changing global landscape that could completely collapse within just a few years.

It’s likely that things could have been much worse for the republic without adopting Bitcoin; however, it cannot be said that they have dramatically improved from an economic standpoint so far.

评论 (0)