This article will be especially valuable for TON coin holders. If you’ve invested in TON, you’re likely anticipating a bright future. As TON gains momentum, you’re probably looking for ways to earn more from holding your TON. At the same time, this article might be helpful for those considering buying TON, as we’ll revisit the core concepts of DeFi.

DeFi: Farming, Staking — What Is It All About?

What’s the idea behind decentralized finance (DeFi)? It’s simple: DeFi empowers users who own their personal wallets (with sole access to their assets). By connecting these wallets to various protocols, users can generate additional yield. Every interaction is transparent, and you can track your funds through the appropriate blockchain explorer, such as TonScan for the TON blockchain.

If you own an asset like TON, you can stake it to earn additional yield. Simply put, staking is akin to a deposit. You deposit your TON into a protocol, and it accrues interest. However, there are two main challenges:

-

The annual yield is relatively low, around 2–3%.

-

This yield is not fixed and can fluctuate over time, either increasing or decreasing.

When you stake TON (i.e., connect your wallet to a staking protocol), you receive a derivative token (essentially a receipt from the protocol acknowledging your deposited funds). You can then deposit this derivative token into another protocol to engage in what’s known as “restaking.”

In this way, you’ve bought TON, staked it (put it on deposit), received a derivative token (staked token), and then transferred it into another protocol (restaking) to boost your yield by another 1–2%. However, this yield is also annualized and unstable.

As for farming, it is a kind of "reward" for performing specific actions within a protocol. For instance, if you have TON and USDT, you can combine them and deposit them into a liquidity pool of a particular protocol. In return, you will receive rewards in the form of that protocol's token. However, it is important to note that the price stability of this token depends on various factors and requires separate analysis.

This is the standard DeFi loop that emerged in 2021. You might wonder, where do these 2–3–4% yields actually come from? Every blockchain has two key elements: validators and its economic model. Validators are participants who maintain the functionality of the blockchain itself. If you think of a blockchain as an Excel spreadsheet, validators (for PoS blockchains like TON, ETH, SOL, or miners for PoW blockchains like Bitcoin) are those who ensure that the entries in the file are accurate and irreversible. For their work, validators are rewarded in the native coin of the blockchain.

The economic model of a blockchain assumes that the number of new tokens (which are generated through the work of validators or miners) must be lower than the demand for them from new holders. Holders, in turn, are incentivized not only by the potential growth of the token’s value but also by additional benefits of holding it. As a result, part of the yield from validation is redistributed to staking.

Thus, the yield from staking or farming is largely constrained by the economic model of the blockchain itself.

How Does YieldFort Redefine Yield in DeFi?

In the previous section, we established that the current logic of decentralized finance revolves around users managing their funds through wallets to generate additional yield. All transactions are transparent and can be tracked through a blockchain explorer.

For example, you deposit your funds (staking) and see them sitting there for a year or two, earning 2–3% annually (which isn’t guaranteed). Essentially, you’re left relying solely on the potential price growth of your asset.

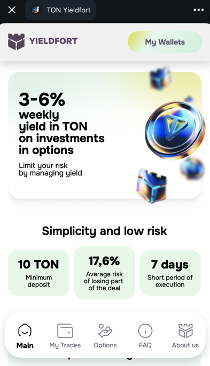

We believe that in the volatile world of crypto, such returns do not adequately reflect the risk/reward ratio or the “risk premium.” Alternative ways of generating yield are needed. This is why we launched the YieldFort protocol on the TON blockchain.

First and foremost, we adopted the best elements of DeFi: user funds remain on-chain and visible via the explorer. At the same time, the yield is generated from traditional finance (TradFi). The paradox lies in the fact that TradFi operates within a paradigm of much higher yields — primarily due to elevated interest rates and a more accurate assessment of “risk premiums” in traditional markets.

How does it work?

When a user launches the YieldFort Mini App on Telegram, the YieldFort smart contract connects to Deribit (the world’s leading crypto options exchange) and assembles a structured product for the user. If the product’s terms meet the user’s needs, they purchase it and wait for the product to expire (1–2 weeks).

Since the launch, there have already been cases where users earned 8% in less than a week — that’s over 400% annualized.

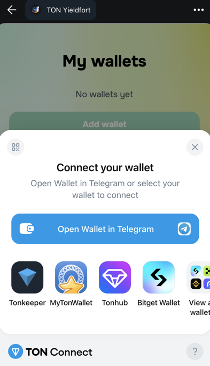

To use the YieldFort application, you first need to have your own cryptocurrency wallet, such as Telegram Wallet (@wallet). Next, launch the YieldFort Mini App on Telegram → https://t.me/ton_yieldfortbot/ton.

Now you need to connect your wallet to the Mini App.

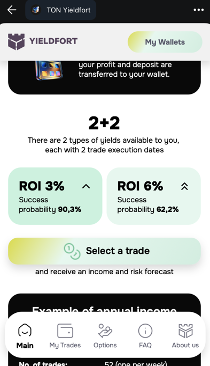

Then the most exciting part begins. You interact with the smart contract to select strategies for you.

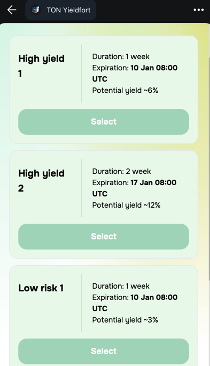

You have a choice between a higher-risk and a lower-risk option. The risk criterion is probability. We’ll explain further.

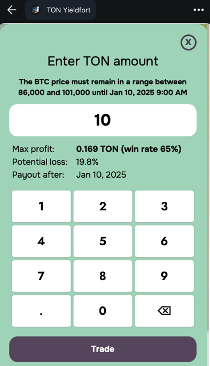

So, the smart contract has assembled a strategy on Deribit. What does the information below indicate? It means that if a user deposits 10 TON into the smart contract and by January 10 the price of Bitcoin remains between 86,000 USDT and 101,000 USDT, they will earn 0.169 TON or 1.7% over 10 days. However, their maximum potential loss could amount to 2 TON if the price significantly moves outside the range, falling below 80,000 USDT or exceeding around 110,000 USDT.

Generally, if we look at the market, its movement typically consists of around 60 days of growth (or decline) and 300 days of consolidation within a range. In YieldFort, users are not restricted in their decision-making and can check in periodically. (In the future, a push notification system will be introduced, alerting users when the smart contract identifies something noteworthy.) Based on practice, the most interesting days for such structured products are usually Wednesday, Thursday, and weekends.

What are the alternatives in the TON ecosystem?

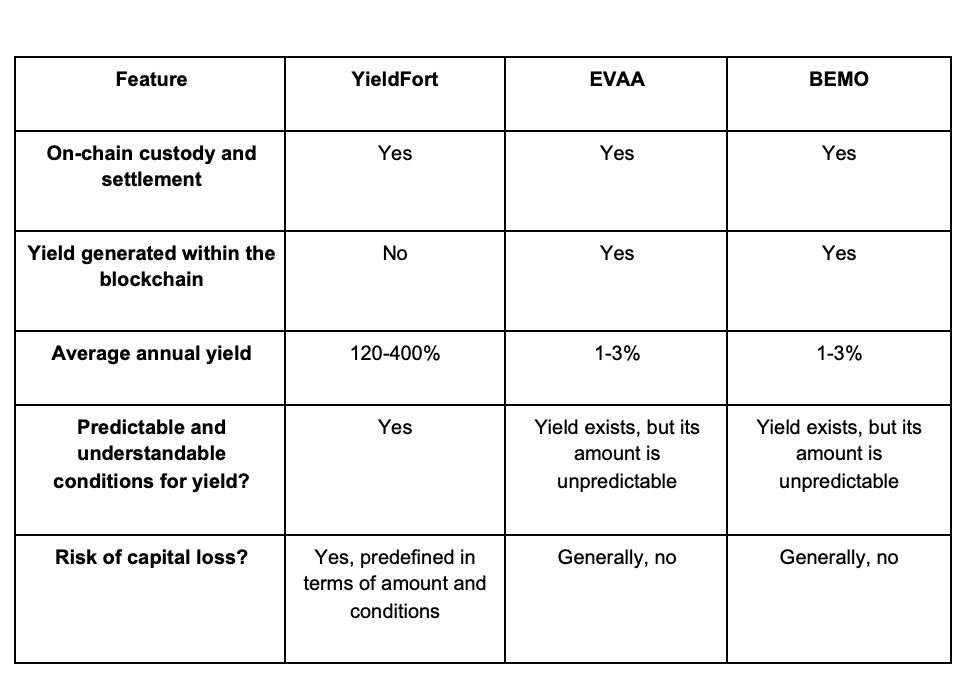

When considering the TON ecosystem, two staking protocols stand out: EVAA and BEMO. However, due to their business models, they are unable to offer returns beyond the limits of the blockchain’s intrinsic yield. Let’s compare not only the returns but also the overall business logic:

As we can see, YieldFort does not differ significantly from “classic” DeFi protocols in terms of its core principles. However, we believe that a “risk premium” of 2–3% for holding a token does not accurately reflect the actual risk-to-reward ratio of owning it. Users undeniably want higher compensation for risk, and, most importantly, they need the risk’s magnitude and the conditions for its occurrence to be explicitly clear. This is the philosophy behind YieldFort: you can earn up to 100x more from your holdings, but you need to understand the risks involved.

What is YieldFort?

The YieldFort team has been active in DeFi since 2021. Initially, we developed a protocol on EVM networks that functions as a decentralized order book for trading options. It might sound complex, but deltatheta is still operational, enabling users to trade cryptocurrency options on EVM-compatible networks.

In 2023, we launched a centralized solution, YieldFort, to assess the value of structured financial products presented in a user-friendly way. We introduced two products:

-

Crypto price protection: Users can safeguard their BTC/ETH/TON. If the price drops between the 2nd and 4th week of the month, the number of their assets increases. If the price rises, their assets remain unchanged.

-

Fixed deposit for BTC and ETH: Tied to the Federal Reserve’s interest rate.

Over 1.5 years, we have gained 1,200 users, insuring around $10M in assets monthly, obtained a VASP license in the EU, and became an official partner of Deribit. In 2024, we started preparing to launch a decentralized application and chose the TON blockchain as the foundation for this expansion.

The First Strategy on TON: YieldFort Mini App

The first strategy we implemented in the YieldFort Mini App is the classic condor options strategy. This allows users to earn as long as the price remains within a predefined range and limits losses if the price moves outside that range. In the near future, we will release additional strategies, followed by continuous updates and enhancements.

👉 Buy Protection: https://yieldfort.com/

👉 Launch YieldFort Mini App: https://t.me/ton_yieldfortbot/ton

👉 Twitter: https://x.com/yieldfort

评论 (0)