Underlooked Components of Stablecoin

Stablecoins are advancing into the core of digital finance. In May 2025, the combined market capitalization climbed to approximately 246 billion dollars, marking the twentieth consecutive month of expansion. Earlier that month, Tether alone surpassed 150 billion dollars in circulating supply. Circle, the issuer of USDC, is preparing to list on the New York Stock Exchange, which signals that traditional capital markets now see stablecoins as a mainstream asset class.

Most commentary still evaluates stablecoins through two familiar lenses: the credibility of the issuer’s reserves and the transaction throughput of the underlying blockchain. Some also consider regulatory clarity. While important, these angles often miss the operational infrastructure that determines whether stablecoins can function as real money in global finance. This article focuses on three foundational but underappreciated components that enable that transformation:

-

Clearing layer: Establishes a common settlement framework that allows stablecoins to be freely tradable and accepted across issuers. We explore M^0 and Ubyx.

-

Compliance layer: Ensures that travel rule, sanctions screening, and KYC are embedded into every transaction. We examine Notabene’s TAP and Coinbase’s TRUST.

-

Last mile liquidity layer: Converts digital dollars into usable local currency where and when it is needed. We look at Stable Sea and OpenFX.

Clearing Layer and the Singleness of Money

In traditional banking, one dollar at any commercial bank is functionally equivalent to one dollar at any other bank. That equivalence is guaranteed by settlement through central bank reserves. Economists call this property the singleness of money.

Stablecoins do not have this structure. Each token is issued by a different entity and represents a separate promise. That means converting between two stablecoins can involve price spreads, counterparty risk, and slippage, making it feel more like a currency exchange than a simple payment.

A clearing layer addresses this by creating a common settlement asset and enforcing a shared set of rules. This infrastructure gives stablecoins the same kind of par value fungibility that central bank money has. It allows stablecoins to achieve full moneyness, where value can flow freely and predictably across systems.

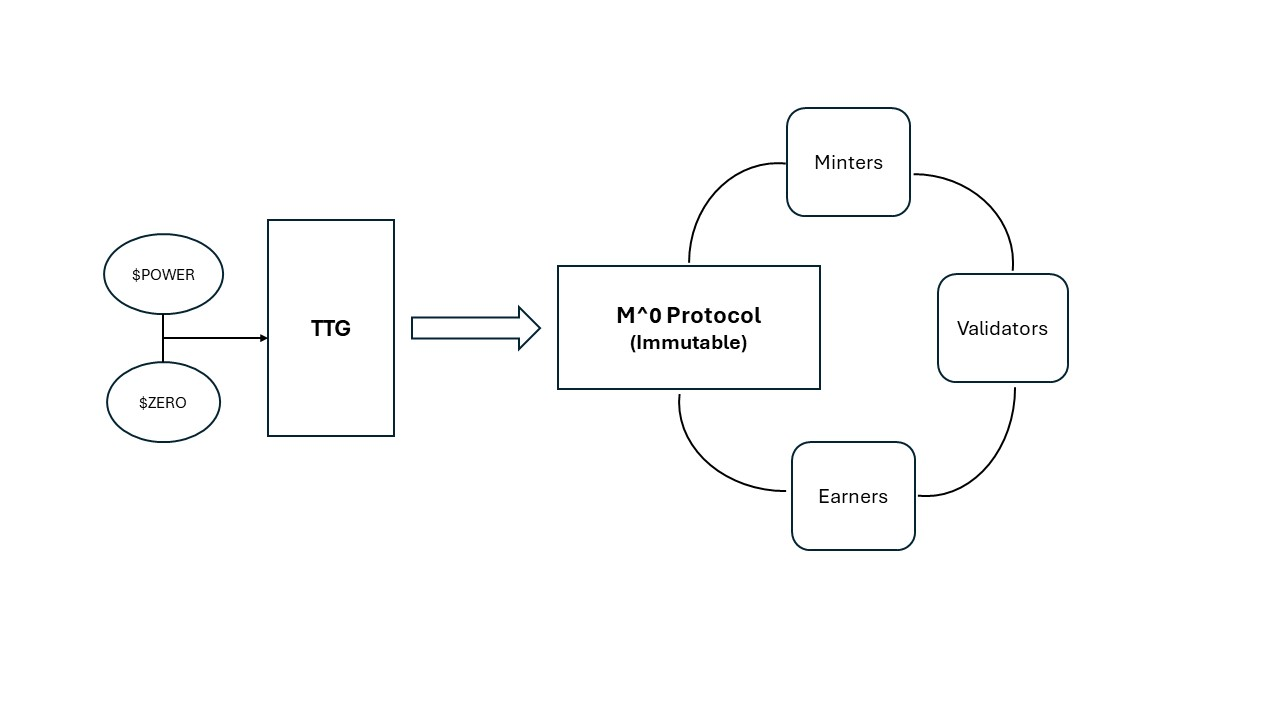

M0

M0 introduces a reserve-backed base token called M. There are three primary actors in its system:

-

Minters are approved institutions that deposit short-dated United States Treasury bills into a legally isolated structure and mint an equivalent amount of M.

-

Validators monitor the system and sign off on collateral updates. They also have the authority to freeze a Minter if the rules are violated.

-

Earners are entities like exchanges that hold M and receive yield from the underlying collateral.

Governance is handled through a two-token model, where POWER and ZERO tokens influence monetary parameters such as minting limits and penalty schedules.

Any project can create a branded stablecoin by wrapping M. Since all wrappers ultimately redeem back to the same pool of collateral, any two tokens based on M can be exchanged at one to one value. Users can unwrap one brand and rewrap another without loss. M functions like reserves at a central bank, offering a common basis for transfer and settlement across the ecosystem.

Ubyx

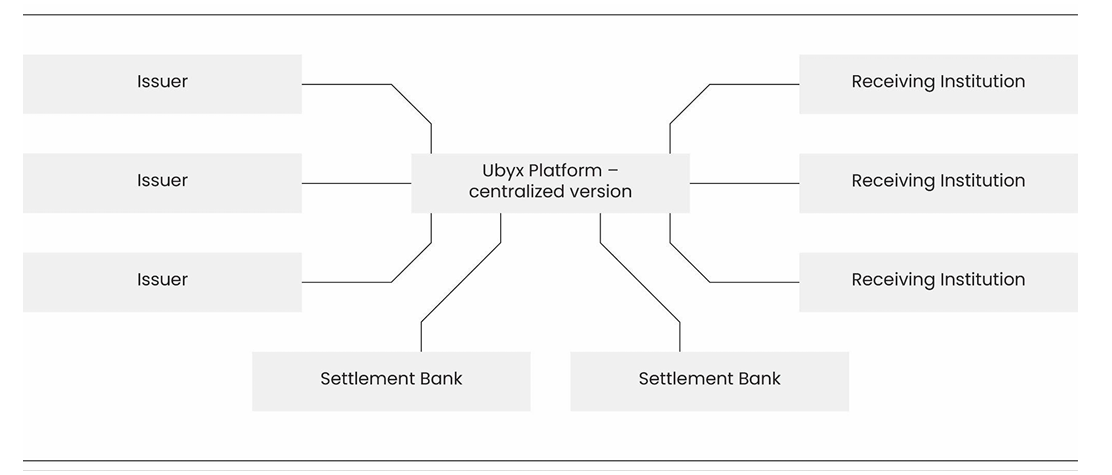

Ubyx takes a very different route. It models stablecoins as digital cheques. Regulated banks and financial service providers issue tokens that are backed by cash held in prefunded accounts at settlement banks. Ubyx coordinates the end-to-end lifecycle of these tokens, including redemption, message routing, and compliance data exchange.

The platform uses a formal rulebook to handle conditional credits, resolve disputes, and run either net or gross settlement cycles. This structure closely mirrors how traditional cheque clearinghouses work.

When a Ubyx token is transferred, the receiving institution gives a provisional credit, pending final clearing. Since the cash is already prefunded, settlement risk is minimized. Once clearing is confirmed, the value is treated as final and redeemable at face value. Every participant agrees to honor tokens issued by others. The system also supports multiple chains and currencies, meaning a user can send or receive funds across borders while retaining legal and monetary equivalence.

Comparison Between the Two Approaches

-

M^0 creates a neutral reserve token that everyone wraps and unwraps, while Ubyx clears institution-specific tokens through interbank agreements.

-

M^0 uses on-chain governance with token voting, whereas Ubyx uses an off-chain rulebook and plans to decentralize governance later.

-

M^0 is built for DeFi applications, fintech companies, and crypto-native firms. Ubyx is tailored to traditional banks, payment processors, and corporate treasuries.

-

M^0 focuses on one shared collateral asset. Ubyx allows multiple issuers to maintain their own balance sheets but still achieve par-value settlement through a shared protocol.

Compliance Layer and the Travel Rule

Stablecoins move through a mix of wallets, exchanges, banks, and even smart contracts. Regulators care less about the technology and more about whether transfers comply with global anti-money laundering standards. The most important of these is the Travel Rule, which requires that identifying information about the sender and recipient is exchanged before a transfer is finalized.

According to a 2025 industry survey, one hundred percent of virtual asset service providers plan to be Travel Rule compliant by the end of the year. Eighty-nine percent are targeting the first half. In the European Union, a new regulation called the Transfer of Funds Regulation led to a two hundred times increase in Travel Rule messaging volume.

Despite that growth, implementation is still uneven. Some providers use peer-to-peer messaging channels, others rely on centralized gateways, and many face problems with identity verification. Two initiatives now define the leading models for compliance infrastructure: Notabene’s TAP and Coinbase’s TRUST.

Notabene’s Transaction Authorization Protocol (TAP)

TAP is an open protocol that supports pre-transaction compliance messaging. It allows any wallet, exchange, or smart contract system to attach identity and compliance data to a transfer request.

Its architecture includes:

-

Peer-to-peer encrypted messaging using DID-Comm, which avoids central storage of sensitive information.

-

Use of IVMS-101 identity formats and pre-screened sanctions data within the request object.

-

A three-phase flow where the recipient approves the request before any transaction is sent.

-

Support for custom policy layers like selective disclosure and chain-agnostic asset identifiers.

TAP treats compliance as a part of the transaction itself. Whether the final movement happens on a banking rail, Ethereum, or Solana, the protocol preserves a unified audit trail. This structure is already in use for billions of dollars in value transfers that require legal and reputational assurance.

Coinbase’s TRUST Network

Coinbase’s TRUST network was launched in 2022 and now includes over 120 members across 20 countries. Participants include major exchanges and custodians such as Coinbase, OKX, BitGo, Kraken, PayPal, Circle, Gemini, Revolut, Anchorage, and Fidelity.

TRUST works by:

-

Hosting a public directory where members list their endpoints and the addresses they control.

-

Letting senders verify that a recipient address belongs to another TRUST member before transferring funds.

-

Delivering encrypted customer data directly to the receiving institution, without relying on a central database.

The network offers a fast and privacy-safe way to meet Travel Rule obligations without forcing major changes in the user experience. Smaller firms can also join under subsidized tiers, which lowers the barrier to adoption.

Comparison Between the Two Approaches

-

TAP is open source and protocol-level, while TRUST is a gated industry alliance.

-

TAP includes a pre-transfer authorization step; TRUST sends compliance data after the transaction is constructed.

-

TAP supports self-custody and smart contract flows. TRUST is optimized for custodial exchanges and brokers.

-

TAP keeps no shared metadata. TRUST centralizes address discovery but avoids storing personal data.

Last Mile Liquidity Layer

Stablecoins enable cross-border value transfer, but they are not fully usable until they can be exchanged for local fiat. Most people and businesses still rely on local currency for payments, payroll, and tax compliance. In 2024, stablecoins settled 28 trillion dollars in value, but many companies paid up to five percent in hidden fees to convert those balances into cash.

A last mile liquidity layer solves this problem. It aggregates stablecoin liquidity, connects to local banking infrastructure, and allows businesses to receive or send local currency within hours or even minutes. Two emerging platforms, Stable Sea and OpenFX, show how this conversion layer is evolving.

Stable Sea

Stable Sea launched in May 2025 to serve enterprise users who need to off-ramp large stablecoin balances quickly and transparently. The platform supports trades up to 50 million dollars per transaction and aggregates pricing across regulated asset managers.

Its features include:

-

A unified API and dashboard to manage wallets, bank accounts, and conversions.

-

Compliance tools that handle KYC and AML automatically.

-

Transparent FX quotes with breakdowns of fees and time to settlement.

By replacing ad hoc OTC desks with deterministic pricing and audited partners, Stable Sea reduces both the cost and time of large stablecoin conversions.

OpenFX

OpenFX is built for companies that need constant fiat access across multiple corridors. It offers a 24/7 API-based conversion rail with predictive routing and low-latency settlement.

Key features include:

-

A smart routing engine that selects the best currency corridor in real time.

-

Webhook updates and execution tracking for operational transparency.

-

Predictive liquidity analytics that help businesses manage prefunding.

OpenFX integrates directly into platforms like neobrokers and remittance apps, allowing users to convert stablecoins into local currency in minutes instead of days.

评论 (0)