Level: Onchain Banking That Expands the Crypto Economy

From Stablecoin to Monetary Infrastructure

Since its launch in late 2024, Level has gained recognition as a yield-bearing stablecoin offering competitive returns with low risk—anchored in blue-chip lending protocols.

But that was just the beginning.

To understand Level’s broader mission, we must move beyond stablecoins and look at what it's truly building: a full-stack, onchain banking protocol designed to expand the crypto economy.

Rethinking Money: From M0 to Onchain M1

Traditional financial systems break down money supply into categories:

-

M0: Physical cash and central bank reserves

-

M1: M0 + demand deposits (e.g., checking accounts)

This system allows economies to grow, but introduces complexity and risk. Most stablecoins today—like USDC or USDT—mimic narrow banking, backed 1:1 by treasuries. They’re safe, but not scalable.

DeFi, however, opens the door to programmable money. With smart contracts, transparency, and composability, we can build fractional reserve systems onchain, without the systemic opacity.

Lending Protocols: The Foundation of Onchain Credit

In DeFi:

-

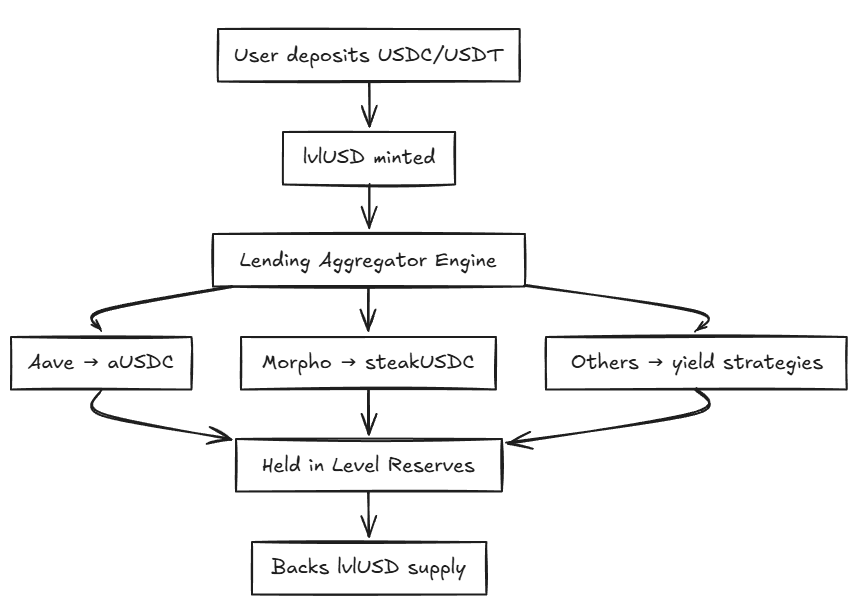

Deposit USDC into Aave → Get aUSDC

-

Deposit USDC into Morpho → Get steakUSDC

These are receipt tokens, proofs of capital being lent out. Functionally, they’re onchain M1. But aUSDC ≠ steakUSDC. None of these tokens are interchangeable.

This leads to fragmentation. Users must manually choose where to lend. There’s no abstraction layer—until now.

Enter Level: The Onchain Bank

Level simplifies and composes the entire flow:

-

lvlUSD becomes a unified stablecoin backed by receipt tokens from multiple protocols.

-

Users don’t need to choose lending strategies; Level does it programmatically.

-

The reserves are fully onchain, auditable, and verifiable in real-time.

This structure brings fractional reserve dynamics to crypto — but without the centralization.

Why It Matters

Level is not just a high-yield stablecoin. It’s:

-

A programmable savings layer

-

A composable monetary base

-

A bridge between DeFi-native innovation and tradfi-grade efficiency

Unlike wrapped tokens or siloed protocols, lvlUSD works across the DeFi stack — usable as collateral, in LPs, or treasury strategies.

This is onchain banking infrastructure: a system that lets capital grow, transparently and efficiently, while staying liquid and secure.

Programmable Money Deserves Programmable Banking.

Level is building it. Block by block.

评论 (0)