The blockchain landscape today consists of specialized networks, each optimized for its own trade-offs but isolated in practice. Ethereum, for example, offers strong decentralization but can become congested under heavy use. Optimistic rollups reduce transaction costs, but they tend to partition liquidity into separate pools. ZK rollups improve privacy guarantees but often require complex tooling and setup. As a result, assets and users frequently find themselves confined to individual walled gardens, and any attempt to move value between chains involves navigating a complex sequence of bridges, approvals, and network switches.

-

Siloed Liquidity & User Bases

At any moment, significant portions of capital and user activity are trapped within single chains or rollups. Transferring tokens from one environment to another typically involves bridge contracts, which introduce additional parties and potential vulnerabilities. The outcome is often fragmented liquidity and unpredictable slippage for users.

-

Developer Overhead & Duplication

Creating a cross-chain dApp usually entails replicating smart-contract deployments and front-end code for each target network. Engineers must integrate with a variety of bridges or SDKs, keep separate CI/CD pipelines, and maintain multiple versions of documentation. This duplication increases maintenance burdens and slows down the development cycle.

-

Complex & Error-Prone UX

End users face a multi-step process whenever they wish to move assets: approving tokens on the source chain, initiating the bridge transfer, waiting for confirmations, switching wallets or networks, and then unwrapping or swapping on the destination chain. Each individual step carries its own risks (failed transactions, stuck funds, or unexpected fees) that can erode confidence in the technology.

-

Trust Assumptions & Security Trade-Offs

Many existing bridge solutions depend on trust models such as multi-sig guardians, federated custodians, or optimistic fraud proofs. None fully replicate the assurances provided by native full-node verification. Users who opt out of running their own nodes must place implicit trust in off-chain infrastructure, introducing centralization concerns.

What Needs to Be Achieved

-

Truly unified asset flows must allow users to move value seamlessly between any chains directly within a dApp’s interface, without requiring manual bridge interactions.

-

A single-deployment paradigm should enable developers to write and deploy an application once and unlock access to all supported networks through configuration rather than maintaining separate codebases.

-

Full-node guarantees (including execution correctness, transaction ordering, and data availability) need to be preserved without obligating every user or application to run a local node.

-

The developer experience ought to be simplified by abstracting cross-chain plumbing behind standardized interfaces and SDKs, so that teams can focus on building features instead of integration complexities.

Avail Nexus

Avail Nexus is designed to turn interoperability from an afterthought into a core blockchain primitive. Rather than relying on external bridges or bespoke integrations, Nexus embeds cross-chain capabilities directly into the underlying protocol and exposes them through a simple developer SDK.

At its heart, Nexus consists of two complementary layers:

-

Protocol Layer

-

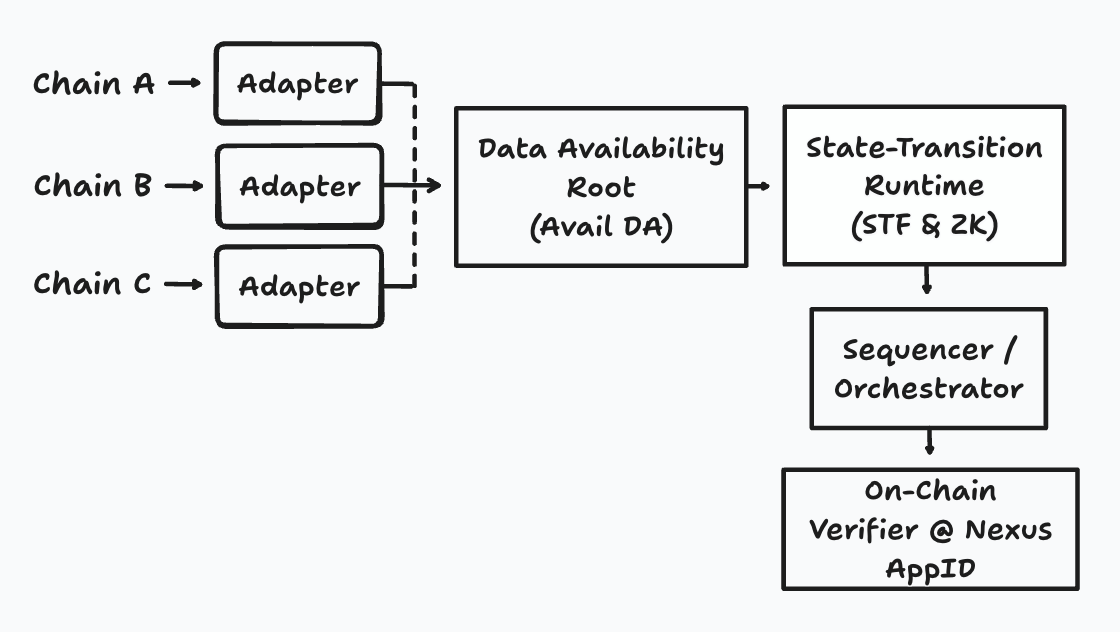

Data Availability Root: Nexus builds on Avail’s modular data availability chain, which provides high-throughput, horizontally scalable storage for any rollup or sidechain.

-

State-Transition Runtime (STF): A lightweight execution engine orders and verifies state updates from connected chains. Validity proofs, generated by ZK engines like SP1 or RISC0, are aggregated into succinct proofs that attest to correct execution and ordering.

-

Sequencer/Orchestrator: Running alongside Avail nodes, the sequencer ingests each Avail block header, collects submitted proofs or intents from rollups, and produces Nexus blocks that update the global interop state.

-

On-Chain Verifier: A smart-contract module at the Nexus AppID confirms proofs against each chain’s registered verification key before committing new state roots.

-

-

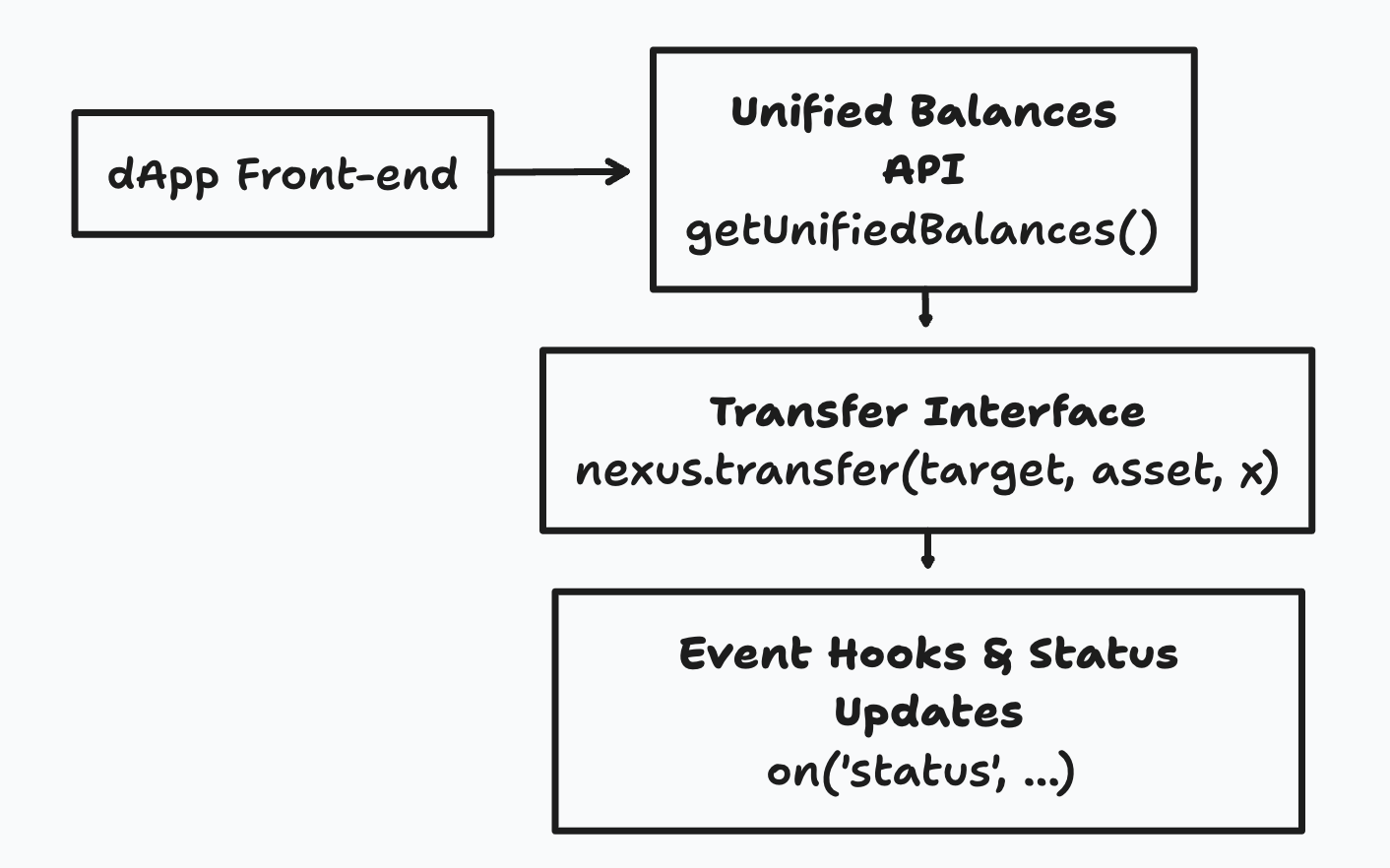

Developer-Facing SDK

-

Unified Balances API: Retrieves and aggregates a user’s token balances across all enabled networks, presenting them as a single in-app portfolio.

-

Transfer Interface: A single call -

nexus.transfer(targetChain, asset, amount)- handles approvals, intent creation, proof routing, and final settlement, abstracting all cross-chain plumbing. -

Event Hooks and Status Updates: Front-end listeners notify applications of transfer progress, proof verification, or failure reasons, enabling responsive UI flows.

-

Together, these layers allow dApps to offer:

-

In-App Cross-Chain Transfers: Users never leave the interface to bridge assets; they select the destination chain, specify an amount, and confirm a single transaction.

-

Choice of Security vs. Speed: Developers configure which settlement path to use: ZK proofs for maximal trust minimization, TEEs for hardware-backed attestations, or ERC-7683 intents for low-latency transfers.

-

One-Click Integration: Installing the Nexus SDK and importing its React/Vue components takes only minutes; all back-end orchestration is handled by the Nexus network.

Nexus Architecture

The core of Avail Nexus is a purpose-built architecture that securely connects multiple chains, preserves full-node guarantees, and offers flexible settlement models.

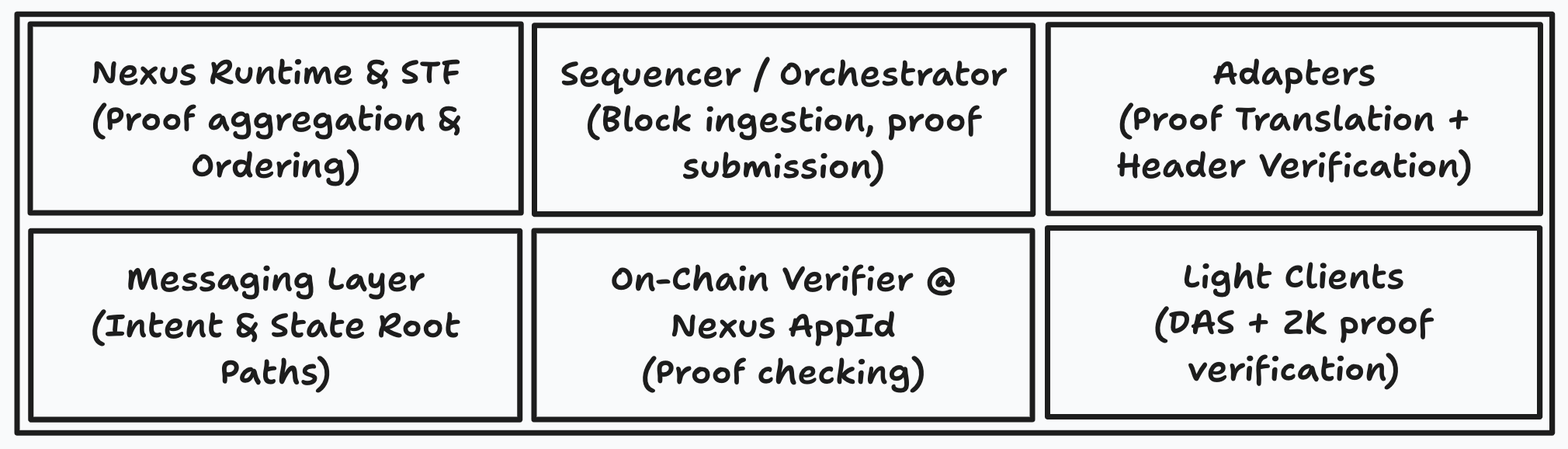

1. Core Components

1.1 Nexus Runtime & State-Transition Function (STF)

The Nexus Runtime implements a simple but powerful state-transition function (STF) that tracks the latest state root of each connected chain. Every time a chain submits a proof of its new state, the STF:

-

Validates the Proof

-

For ZK-based chains, it verifies a succinct proof (SP1 or RISC0) that the chain’s ledger execution from its previous state root to the new one was correct.

-

For optimistic chains, it recognizes intent-based proofs (ERC-7683) and enforces challenge/slashing rules.

-

For TEE-based chains, it checks a hardware attestation signature.

-

-

Updates the Global State Tree

-

Stores each chain’s new state root in a Jellyfish Merkle Tree keyed by the chain’s AppID.

-

Records the Avail block height at which the proof was accepted, preventing reorg or replay attacks.

-

-

Generates a Succinct Validity Proof

-

Aggregates all individual proofs submitted in a single Avail block into one ZK proof of global correctness.

-

This aggregated proof can be verified by light clients with minimal computation.

-

1.2 Sequencer / Orchestrator

A long-running process co-located with Avail nodes, the Orchestrator:

-

Listens for each new Avail block header.

-

Collects all

StateUpdateandIntenttransactions directed to the Nexus AppID in that block. -

Invokes the Nexus STF to validate and record each update.

-

Submits the aggregated proof back to Nexus as an on-chain transaction, producing a new Nexus Block.

This design ensures the Nexus state stays perfectly synchronized with Avail’s base layer.

1.3 Adapters

Every connected chain or rollup integrates via an Adapter, which performs two roles:

-

Proof Translation

Converts native chain proofs (ZK proofs, optimistic intents, or TEE attestations) into Nexus-standard transactions.

-

Header Verification

Maintains a light-client instance of the source chain, confirming that any submitted header hashes genuinely originate from the chain’s consensus.

Adapters may run as side-car services or be embedded directly within a rollup’s infrastructure.

1.4 Messaging Layer

The Nexus Messaging Layer carries cross-chain messages and asset-transfer requests:

-

Intent Path (Fast)

Uses ERC-7683 intents to transmit desired actions immediately, relying on solver networks to fill and settle them optimistically.

-

State-Root Path (Safe)

Bundles messages into the next ZK aggregation. Users may experience higher latency, but gain full cryptographic finality once the proof is available.

1.5 On-Chain Verifier & Light Clients

-

On-Chain Verifier: A smart-contract at the Nexus AppID checks every aggregated proof or intent settlement against registered validation keys before updating the global state.

-

Light Clients: Running in wallets, browsers, or mobile apps, Avail light clients perform Data Availability Sampling (DAS) on Avail DA and verify succinct proofs from Nexus, providing full-node security guarantees without running a full node.

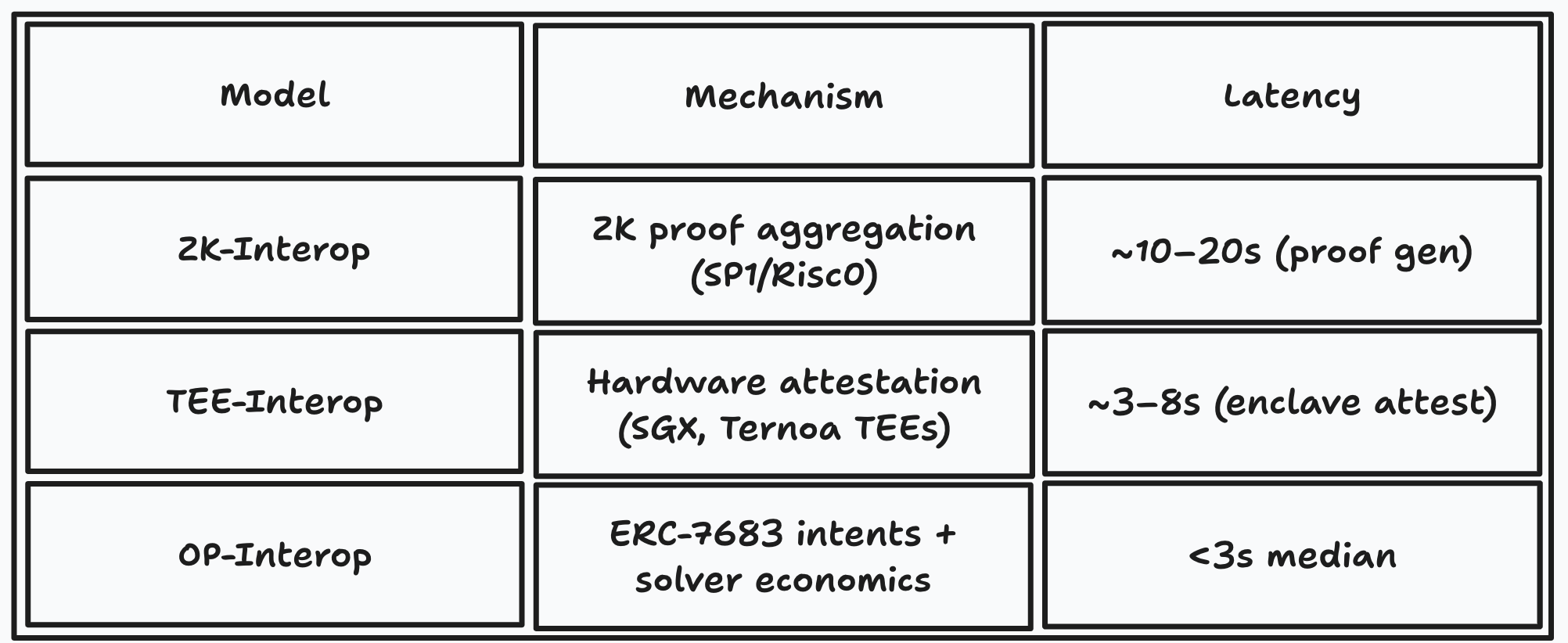

2. Settlement Models in Detail

2.1 ZK-Interop (Maximal Trust Minimization)

-

Workflow:

-

A connected ZK rollup issues a

StateUpdateTxcontaining a proof that its ledger execution fromstateRootₙtostateRootₙ₊₁is correct. -

The Adapter translates this into a Nexus transaction.

-

The Nexus Runtime validates the proof and updates the Merkle state tree.

-

The Runtime aggregates all proofs from that block into a single ZK proof submitted on-chain.

-

-

Guarantees: Execution correctness, transaction ordering, and data availability fully verifiable by any Avail light client.

-

Latency: Proof generation currently takes 10–20 seconds but is expected to improve with optimized zkVMs.

2.2 TEE-Interop (Hardware-Backed Attestations)

-

Workflow:

-

A rollup runs its state aggregation inside a Trusted Execution Environment (e.g., Intel SGX).

-

The enclave produces a cryptographic attestation that the state transition was executed faithfully.

-

An

AttestationTxis sent to Nexus containing the enclave’s signature and the new state root. -

Nexus Verifier checks the attestation signature and records the update.

-

-

Guarantees: Hardware-enforced execution integrity; faster than ZK proofs.

-

Latency: Typically 3–8 seconds per update, depending on enclave setup.

2.3 OP-Interop (ERC-7683 Intents & Solver Economics)

-

Workflow:

-

The dApp front-end creates an ERC-7683 intent on Avail, specifying the desired cross-chain action (e.g., “transfer 50 USDC from Chain A to Chain B”).

-

Solvers, off-chain participants, monitor

IntentCreatedevents, post economic bonds, and compete to fulfill the action by submitting the necessary bridging transactions. -

The winning solver calls

fillIntent(intentId, proofData)on the Nexus AppID, including proof of execution. -

Nexus Verifier checks the proof, slashes misbehaving solvers if needed, and finalizes the transfer.

-

-

Guarantees: Rapid settlement (sub-3 seconds), secured by bonded economic incentives.

-

Trade-Offs: Relies on off-chain actors; slashing mechanisms mitigate dishonesty.

By combining these components and settlement models, Avail Nexus creates a unified, trust-minimized fabric for cross-chain interactions allowing developers to choose the right balance between security and speed for each use case, and enabling users to move value without leaving their favorite dApp.

The Avail Stack and Its Role in the Interoperable Future

https://x.com/AvailProject/status/1937888574692786231

Beyond cross-chain messaging with Nexus, the Avail Stack provides a set of modular components that together address data availability, execution verification, client lightness, and economic security. These components underpin the interoperability fabric and shape a path toward a more connected blockchain landscape.

1. Modular Data Availability (DA) Layer

At its foundation, Avail offers a purpose-built data availability blockchain that offloads transaction data from execution networks. This DA layer:

-

Horizontally Scales by sharding and by increasing block sizes on demand, removing the throughput bottlenecks of first-generation monolithic chains.

-

TurboDA provides a high-performance API for posting and retrieving data with sub-250 ms pre-confirmation and built-in retry logic.

-

Enigma DA supports encrypted data availability, enabling private rollups to submit confidential payloads publicly without revealing sensitive information.

By decoupling data availability from execution, Avail ensures that any number of chains (rollups, app-chains, validiums) can post transaction data without overloading the network.

2. ZK Execution Runtime

Beyond data storage, the Avail Stack includes a native zero-knowledge execution layer, allowing arbitrary computation (EVM, MoveVM, custom logic) to run off-chain and prove its correctness succinctly on the base layer:

-

Turing-complete support means developers can choose familiar VMs or specialized zkVMs.

-

Succinct proofs prevent on-chain bloat: only a compact verification key and proof need to be stored on the DA chain.

-

Performance remains decoupled from consensus throughput, since execution happens off-chain.

This arrangement empowers high-throughput dApps without sacrificing the trust-minimized guarantees of on-chain verification.

3. Verifiable Light Clients

Mobile-first light client technology does:

-

Data Availability Sampling (DAS) allows lightweight clients, whether in wallets, browsers, or even smartwatches, to confirm that transaction data is available and unaltered.

-

Aggregated ZK Proofs from the Nexus Runtime deliver full-node assurances (correctness, ordering, availability) in a few hundred kilobytes of data.

-

Consumer-Grade Security extends to non-technical users, broadening participation and decentralization.

With these light clients, every user can verify network state without a full node or reliance on third-party providers.

4. Multi-Asset Security (Fusion)

To support economic security, Avail introduces Fusion which is a multi-asset staking framework:

-

Validators and service providers can stake BTC, ETH, SOL, AVAIL, and other tokens to secure not only the DA layer but also connected rollups and apps.

-

This creates a shared security, aligning incentives across ecosystems and allowing smaller rollups to inherit the aggregate stake of the entire network.

Fusion will transform security from a per-chain silo into a communal resource.

5. AVAIL Token & Economic Coordination

The AVAIL token underpins all activity in the stack:

-

DA Payments: Applications pay for data availability in AVAIL or other accepted tokens.

-

Cross-Chain Transfers: Nexus settlement fees and solver-bonds use AVAIL incentives to ensure prompt execution and honest behavior.

-

Network Security: Validators and stakers earn rewards in AVAIL, reinforcing decentralization.

-

Community Incentives: Bounties, hackathons, and governance proposals use AVAIL to align contributors around shared goals.

Avail’s End-Game Vision

Combining these capabilities allows for a blockchain ecosystem in which:

-

Composable Networks

Rollups, sidechains, and application-specific chains interoperate through standard protocols and proofs, functioning as interchangeable modules rather than isolated silos.

-

Faster Integrations

Adding support for a new chain or enabling cross-chain transfers can be completed in hours rather than weeks, thanks to shared DA and reusable SDK components.

-

Unified User Experience

End users interact with a single interface for balances and transactions, moving assets across chains without leaving the dApp or manually invoking bridges.

-

Decentralized Verification

Light clients on phones, browsers, or edge devices perform data availability sampling and proof checks, providing full-node guarantees without the need to run a local node.

In such an environment, the distinctions between L1s, L2s, and app-chains become less pronounced. Applications can be deployed once and immediately access liquidity and services across multiple networks, forming a cohesive and efficient multi-chain fabric.

Nexus Beta is Live: Ready for Developer Testing

https://x.com/AvailProject/status/1940425290884546916

The Avail Nexus Beta SDK is now available on testnet, offering early-access to its full suite of interoperability features. It can be experimented with:

-

Supported Assets: USDC, USDT, and ETH

-

Supported Networks: Ethereum, Optimism, Arbitrum, Base, Polygon, Scroll, Linea, and Avalanche

-

Quickstart Integration:

npm install @avail/nexus-sdkimport { Nexus } from "@avail/nexus-sdk"; const nexus = new Nexus({ network: "testnet" }); await nexus.connect(); const balances = await nexus.getUnifiedBalances(); await nexus.transfer("Arbitrum", "USDC", "100");

You can get started with Nexus Beta SDK now and join their dedicated developer community on Discord.

评论 (0)