From $1,000 to Total Freedom — This Is My Real Crypto Story.

🔹 Chapter 1: The Beginning — Junk, Bills, and Google Searches for Freedom

In 2016, I was 29 years old, living in a neighborhood called Taisho in Osaka, Japan. I had a license to operate as a secondhand dealer and made a living through a small recycling business — collecting and reselling old furniture, electronics, and junk that people no longer needed.

It wasn’t glamorous. It wasn’t stable. Some months I made around ¥200,000 (~$1,800), and on better months maybe ¥600,000 (~$5,400) depending on the number of pickup requests. But the income was never predictable, and the bills kept coming like clockwork.

No matter how hard I worked, nothing really changed. It was like I was stuck on a treadmill — busy every day, but going nowhere.

Eventually, I started searching online for something more. Not luxury or comfort — just a way out of this endless cycle.

I typed it into Google one night: “How to make money.”

That’s when I first stumbled across the word “investment.” Up until that point, investing had sounded like a dangerous game for rich people. Gambling. Stocks. Scams .No one had ever taught me about money — not in school, not at home, not in society. To me, saving was the only "safe" path, and everything else was a risk.

I started reading about different types of investments. Real estate. Mutual funds. Forex. Stocks. But honestly? They all seemed complicated. Boring. And worst of all — they didn’t excite me.

Then one day, buried deep in a random blog post, I saw it: “Cryptocurrency.”

And that, my friends, was the spark that changed everything.

🔹 Chapter 2: What Drew Me In — And Why I Couldn't Stop

Back then, in 2016, crypto wasn’t exciting. It was suspicious. Everywhere I looked online, I saw the same words: “Crypto is dangerous.” “It’s a scam.” “Stay away.”

But for some reason, I couldn’t. Somewhere deep inside, I felt something. Curiosity. A pull. I had no idea why, but I had to learn more. So I started digging — obsessively.

That’s when I realized: Only Japanese people call it “virtual currency.” The world calls it what it really is — cryptocurrency. Not imaginary money. Not fake money. But encrypted, decentralized, borderless value.

That realization changed everything. It was my first real encounter with Bitcoin.

Then I saw the numbers — and my jaw dropped.

-

In 2009, 1 BTC = ¥0.07 (about $0.0006)

-

When I first found it in 2016, 1 BTC = ¥45,000 (about $400)

That’s a 640,000x increase. Let me say that again:640,000 times.

I did the math:

“If I had just invested ¥10,000 ($90) in Bitcoin back in 2009…I'd have ¥6.4 billion now. That’s $64 million. WHAT!?”

I’ll never forget that moment. The excitement. The disbelief. No other asset class could come close. Not stocks, not bonds, not real estate. Nothing.

At that point, I didn’t hesitate. I studied like my life depended on it. Sometimes 20 hours a day — I ate, slept, and breathed crypto. I read everything I could find about:

-

Satoshi Nakamoto’s philosophy

-

The whitepaper and Bitcoin's original purpose

-

The emergence of altcoins solving Bitcoin’s limitations

The more I learned, the deeper I fell into the rabbit hole.

To this day, I still believe in Bitcoin. Not because I’m a fanboy. Not because it’s trendy.

But because I understand it — at a fundamental level. Because I earned my conviction through relentless learning.

And the deeper my knowledge got, the more I realized:

The real risk isn’t owning Bitcoin. It’s trusting fiat money as your only option.

🔹 Chapter 3: My First Bitcoin — and the Search for Hidden Gems

**The Click That Changed Everything.**I bought my very first Bitcoin on a Japanese exchange called Coincheck. Back then, the price was around ¥50,000 per BTC (~$450).I started with ¥100,000 worth — about $900.

That was my entry point.

Soon after, I noticed there were other coins too: **Ethereum, Ethereum Classic, Lisk, Ripple, NEM...**It felt like a new world full of strange names and wild promises.

But I didn’t know what made one coin better than another. I kept wondering:

“Which one will go up the most?” “Which one will change everything?”

So I did what any curious person would do —I bought a little bit of everything. Another ¥100,000 (~$900) into various altcoins.

I had no strategy. I didn’t fully understand how exchanges worked. There were barely any tutorials in Japanese at the time. Even setting up a wallet was confusing.

But curiosity won. And more than that — it was fun. Comparing price charts, reading about different whitepapers, studying each project's mission... I loved it.

And because I didn’t have much money to invest, I wasn’t looking for 10% gains. That wouldn’t move the needle.

I was looking for coins that could grow 100x, 1000x.

That became my filter. Only projects with real potential for exponential growth made it onto my radar.

One day in the summer of 2016, while diving deep through forums and whitepapers, I came across something that felt different.

It wasn’t flashy. It wasn’t hyped.

It was called: Cardano (ADA).

🔹 Chapter 4: My Encounter with Cardano — Vision Over Hype

While most cryptocurrencies in 2016 were busy shouting about quick profits and "moon shots," Cardano (ADA) was doing something very different.

Their mission was clear from the start:

"To build a third-generation blockchain that would surpass Bitcoin."

It wasn't about fast money. It was about long-term innovation. Cardano was being engineered from the ground up to fix the limitations of both Bitcoin and Ethereum.

The man behind it? Charles Hoskinson — co-founder of Ethereum. He had already helped launch one of the biggest projects in crypto. But instead of cashing out and disappearing, he chose a harder path:

To fix the very flaws he saw inside Ethereum — and build something better.

What made Cardano stand out to me wasn’t just the tech or the founder. It was the approach. They weren’t selling hype — they were publishing peer-reviewed research. Academic papers. Real science.

They were already working with top universities like:

-

The University of Edinburgh

-

Tokyo Institute of Technology

-

Lancaster University

They weren’t just “talking” about innovation — they were proving it.

But of course, the outside world didn’t see that.

Back then, people said:

“Crypto is a scam.” “ADA is a pyramid scheme.” “It’s all multi-level marketing.”

Why? Because ADA was being sold through a referral system. Some shady promoters brought it to Japan and bundled it with scammy info products. So naturally, people assumed ADA = scam.

But I saw through it.

I wasn’t interested in who was selling it. I cared about what Cardano stood for —and what Charles Hoskinson was trying to build.

“A blockchain backed by science and built for real-world use cases —how could that be a scam?”

The more I spoke about Cardano, the more my friends said I was crazy. Some thought I had lost my mind in crypto.

But I didn’t care. They weren’t doing the research. I was.

I knew what I was buying — and I believed in it.

Back then, ADA wasn’t even listed on exchanges. It was in its pre-sale phase.

The price? ¥0.24 per ADA (about $0.002).I invested $1,000 and received approximately 420,000 ADA.

And that... was the beginning.

🔹 Chapter 5: ADA Goes Live — and My Portfolio Explodes

On October 1st, 2017, Cardano (ADA) was finally listed on Bittrex.

-

Initial price: around ¥2.3 to ¥3.4 ($0.02–$0.03)

-

Peak: about ¥11 ($0.10)

-

Correction: around ¥5.6 to ¥7.9 ($0.05–$0.07)

I had bought my ADA during the presale for just ¥0.24 ($0.002).Even at the initial listing price, my investment had already gone 10x.At the peak, it was up 45x —

My $1,000 could’ve turned into $45,000.

But I didn’t sell.

Why?

It wasn’t greed. It wasn’t strategy. I think… it was just a dream.

I wasn’t chasing numbers. I was chasing a vision — a future I believed in. But truthfully, I had no idea what I was doing.

I didn’t even know what a proper exit strategy was. There was no plan. No price target. No “take profit” mindset.

I was just riding the wave — wide-eyed and unprepared.

🔹 Chapter 6: Bitcoin’s Bull Run — and the Illusion of Forever

While I was still processing ADA’s explosion, something else ignited:

Bitcoin.

It started quietly. In early October, BTC was about ¥500,000 (~$4,500).

Then, like a slow-burning fuse, the price just… kept rising.

¥600,000… ¥700,000… ¥900,000…Every morning, new all-time highs.

On Twitter, people were saying:

“BTC will hit ¥1 million any minute now!” “We’re going to ¥2 million!”

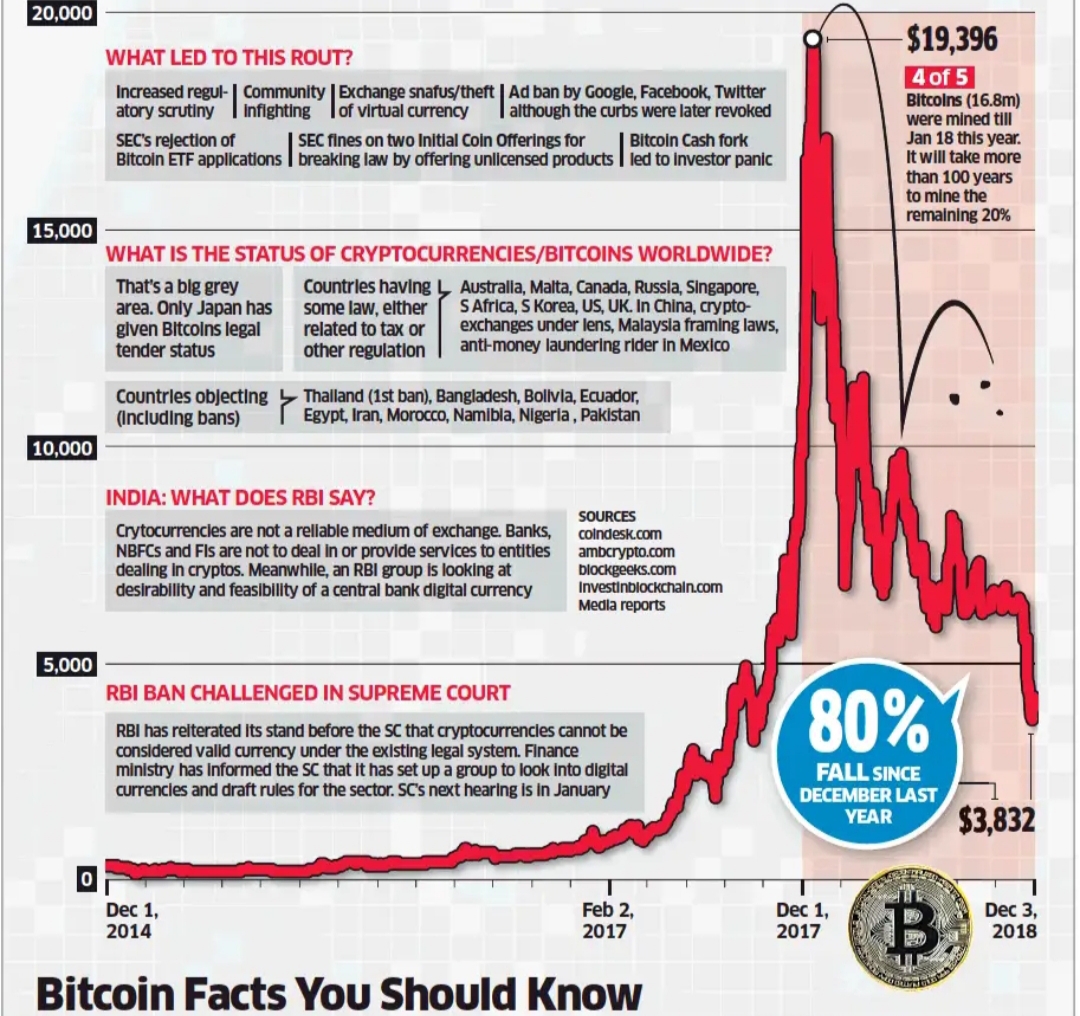

By December 2017, it happened: BTC crossed ¥2,000,000 (~$18,000). Madness.

I sat there, staring at my phone, completely frozen. All my crypto holdings combined — had crossed the one-billion-yen mark. That’s eight digits in USD.

“I’m a millionaire… It’s actually happening.”

But it didn’t feel real. It was surreal. Like a dream you’re afraid to wake up from.

Just a year before, I had invested only ¥300,000 ($2,700).At the time, that was nearly all I had. My total net worth was around ¥1 million ($9,000). Now, I was in the top 1% — on paper.

And in my head? I thought this was just the beginning.

Every day, I opened the app and saw my balance jump by ¥100,000… then ¥200,000…It felt normal. I never questioned it.

“This is nothing. It’ll keep going. I’ll buy more.”

I was in too deep. Optimism had turned into blind faith. Any correction?

“Buy the dip.”

But then the real dip came.

It didn’t crash all at once. It bled. ¥50,000 gone. Then ¥100,000. Then millions.

I watched my portfolio shrink every single day. But I couldn’t sell. Why?

Because of taxes.

In Japan, crypto gains can be taxed up to 55%. To sell would mean handing over more than half — I couldn’t accept that.

So I held. And hoped.

What was once “just a correction” turned into a full-blown crash.

“It’ll bounce back.” I told myself that. Every. Single. Day.

But it didn’t.

Only reality kept rising —The reality that it might not come back.

🔹 Chapter 7: The Crash — When Faith Was Tested

In 2018, crypto winter began. And I’ll admit it —I had no idea that markets don’t just go up forever.

In January, the dream quietly died. Bitcoin started falling… fast. And ADA? It dropped from ¥140 (~$1.20) to ¥30 (~$0.25) —then eventually below ¥10 (~$0.09).

I was scared to check my phone. But I couldn’t help it. Even though I knew it was pointless — I still checked.

“Please… just recover. When will it bounce back?”

Months passed. No recovery. A full year later — still no spring. By the second year, hope was fading.

It didn’t feel like investing anymore. It felt like religion.

On Twitter, people like me were called HODLers —we clutched onto our losses like lifeboats. Many had bought at the peak and were now buried in red. Stuck. Frozen.

Some gave up. Sold everything. I knew people who lost their entire savings.

Rumors spread that Bitcoin was dead. That it had no value. And many believed it —because they never understood why Bitcoin mattered in the first place.

But I didn’t fold.

Why?

Because I had done the homework. I knew the fundamentals. I understood what crypto truly is —and what it could become.

So even as the price plummeted, I kept holding.

To me, this wasn’t the end. This was the silence before the next surge .And that belief wasn’t just blind hope —It was backed by logic, research, and conviction.

Of course, you already know how that story played out.

At one point, my portfolio had dropped to less than 1/10th of its peak value. But even then, I still had millions of yen in profit compared to my initial investment.

That’s when I made a decision:

It’s time to leave Japan. Time to explore the world — powered by crypto.

🔹 Chapter 8: Living on Crypto — For Real

In March 2018, I began a new life overseas —powered entirely by crypto.

No banks. No fiat. Just digital assets and a wallet I controlled.

I had a debit card that I could top up with crypto. If I needed cash, I could withdraw from local ATMs. Flights, hotels, food — all paid online with crypto.

And for the first time, I asked myself:

“Why would I ever need fiat again?”

Then one day, I needed to receive money from a friend abroad. But he didn’t use crypto.

He sent it the old-fashioned way —Cash. Paper. Banks. Delays.

It was a nightmare.

So much time. So many fees. So much friction.

And that’s when it hit me:

Crypto already solved this — for those who knew how to use it.

Here’s a fact that’s often ignored:27% of adults globally don’t have a bank account. That’s 1 in 3 people.

Not because they’re lazy. Because the system excludes them.

And without a bank account, you can’t access basic financial services —even if you have money.

Crypto changes that.

And while it’s not perfect, it’s a start. It’s a new shape of money —and it’s already here.

I know this because I lived it.

At one point, I had lost everything: My money. My home. My bank account. Even my residency in Japan.

I had no address. And without an address, you can’t open a bank account. Which means you can’t receive money. You can’t book a hostel. You can’t order cheap stuff online. You don’t exist — in the system.

But still, I had access to financial tools. Because I had crypto.

I’ll talk more about those tools in another post —and the companies building this new financial future.

🔹 Chapter 9: The Shape of Money Is Changing

Everything humans create evolves —Money is no exception.

We started with barter, moved on to stones, then shells, then metal coins, then paper, and finally bank accounts.

And now? We’re entering the era of code-based money.

Do you really believe cash and fiat are the final form of money?

Today, we have Bitcoin —money without central control.

Blockchain made that possible.

We now have DeFi, NFTs, and CBDCs —entire systems redefining what “money” even means.

Once, people laughed at the idea of a cashless world. Now?

You tap your phone at a street vendor in Thailand. You scan a QR code at a café in Tokyo. Some even pay with rings, faces, or chips in their skin.

Cash isn’t gone yet. But its days as the main player are numbered.

Cash is heavy. Hard to manage. Easy to steal, burn, or lose. And useless across borders without costly exchange.

It’s simply… inconvenient.

So ask yourself:

Do you really think we’ll still be using it 10 years from now?

In 2018, when Bitcoin crashed, everyone said:

“Crypto is dead.”“Too late to get in.”

And yet…Here we are, in 2025 —with Bitcoin alive and growing stronger.

So If you still think it’s too late —That’s your biggest mistake.

What you really need to do now is learn.

Crypto isn’t just about making money and living easy. It’s about learning to live freely.

And yes, the profits matter —But they’re just a checkpoint.

Not the destination.

🔹 Chapter 10: What Crypto & Blockchain Are Really About

The spread of cryptocurrency and blockchain isn’t just about faster payments or making money.

It’s about undoing decades of control —by governments, banks, and mega-corporations —over our money, data, and trust.

This shift means we move from being controlled, to being empowered.

It changes not only how society works —but also how we live.

Imagine a world where:

-

Endless paperwork disappears

-

Lies and cover-ups are exposed

-

Trust isn’t needed — because truth is verifiable

That’s what blockchain enables.

It’s not just about technology. It shapes human behavior.

When people know,

“Everything is recorded. Everything can be seen.”

They act differently.

They cheat less. They think twice.

Because transparency changes incentives.

No one steals in a room with cameras.

That’s the power of blockchain.

You don’t need permission to create value. You can hold your own assets. You are responsible — but not alone.

If you break the rules, you’re not punished by some distant authority —you’re held accountable by the network.

It’s futuristic. But also deeply human.

That’s the real essence of crypto. That’s the revolution behind the blockchain.

Of course, it’s still early. There are scams. There’s ignorance. There’s hype.

But that’s exactly why we need to learn to see clearly.

Discernment is the skill that matters most now —and yes, there’s a method to it. (I’ll cover that in another article.)

The spread of this technology means we’re heading toward a future that’s:

-

More equal

-

More free

-

More accountable

Those who plant seeds early will harvest the biggest rewards.

Because investing isn’t about timing the market —it’s about seeing what others don’t.

🔹 Chapter 11: What Changes If Blockchain Wins?

Let’s imagine something simple.

What if every tax dollar your government collects —was recorded on the blockchain?

You could see:

-

How much was collected

-

Where it was sent

-

What it was used for

In real time. With no way to edit. No way to delete.

What if elections ran on blockchain? Every vote — transparently recorded. No rigging. No manipulation.

Everyone could verify the results.

What would change?

You’d see where every yen, dollar, or baht goes. Which ministry spent it. What it was spent on.

That kind of transparency would be revolutionary.

No more missing subsidies. No more vanishing funds. No more “we don’t know where the money went.”

Everything… would be visible to us.

And what happens when people can see that?

Politics changes.

Why?

Because the people are watching.

When we can see clearly, we start to care. People who never voted before start to ask questions. Start to connect the dots. Just like checking your bank account —you’d check how your taxes were used.

And with that awareness… comes participation.

Change begins. We need to change if we want to get better life.

🔹 Chapter 12: Imagine This

What if the people got angry enough to act?

What if we stopped trusting the same corrupt leaders —and started building something better?

History shows: When ordinary people wake up, everything changes.

The truth is —your government is not broken by accident. It’s been designed to confuse you, control you, and hide things from you.

But now, for the first time, we have something they can’t control:

Blockchain.

It’s not just “tech.” It’s a tool that can flip the system upside down.

When everything is recorded and nothing can be hidden, corruption has nowhere to run.

Bribes. Backdoor deals. Fake numbers. All of it becomes visible.

That’s the world we can build — if we understand this technology.

This isn’t a dream. It’s already happening.

Countries are already using blockchain to track government spending, secure elections, protect land rights, and cut out middlemen.

We’re not waiting for the future. We are already in it.

So the question is:

Will you learn about this —or keep pretending it doesn’t matter?

Because if we do nothing, nothing will change.

And if nothing changes, things will only get worse.

But here’s the hope:

The fact that you’re reading this, that you’re curious, that you’re starting to see —that alone means something is already shifting.

🔹 Chapter 13. What You Can Do Right Now

So, what exactly should you do to help create this future?

Start with crypto. Buy some. Learn it. Get used to using it.

That’s it.

You don’t need to go all in. Just buy a little Bitcoin—maybe $10, maybe $100.Get your hands dirty. Let your curiosity lead. Balance your knowledge, question everything, and don’t fall for the hype.

Eventually, without realizing it, you’ll start using it like your own hands and feet.

I first discovered crypto back in 2016.That moment completely changed the course of my life.

But the real opportunity? It’s in your hands right now.

Anyone can be part of this new era. Not just the rich, not just the privileged—anyone.

With the right knowledge, a clear mind, and the courage to take action, even $200 or $300 could become millions. Yes, it’s possible. I’m living proof of that.

There are still countless hidden gems in the crypto world today—projects that might become the next Cardano, the next Ethereum, the next Amazon or Google.

But along with them, there are fakes. Scams. Traps. It’s hard to tell what’s real.

That’s the true challenge: How do you tell the difference?

We’re living in an age of overwhelming information. Anyone can get tricked. That’s why real knowledge, and a calm, critical eye, are your best assets.

I’m not here to sell you anything. No secret course. No subscription. I’ll give away everything I’ve learned—for free. Because I know: the more real users we have, the stronger this system becomes—for all of us.

Many people have reached out to me over the years—young, broke, confused, curious—and now they’ve built wealth, freedom, and new lives through crypto.

I believe the future should be like that for everyone.

Just like today, almost every person on Earth uses fiat money to survive—I dream of a world where everyone uses crypto to thrive.

And now, there’s something I feel just as passionate about — something I truly want to share with people all over the world.

It’s a project called WeFi — and to me, it represents the next great leap in the blockchain revolution.

Just like how crypto changed my life back in 2016, WeFi has the potential to change how the entire world thinks about money, banking, and financial freedom.

This isn’t just another DeFi platform. It’s a reimagining of how financial services should work — without borders, without banks, and without the old systems holding people back.

A new kind of infrastructure is being built. One that could bring real financial power to people everywhere.

In my next article, I’ll tell you exactly what WeFi is — and why I believe it might be the most important thing I’ve seen since Bitcoin.

So if you’re interested, even just a little—**don’t ignore that feeling. Honor it. Follow it. That’s your beginning.**💬 Want to make your life better? I’ll show you exactly how. Reach out like you’re texting a friend.

Follow and Message me. I read everything.

-

Everyday Life → @bonsai_Traveler

-

Crypto Thoughts → @Bonsai_CryptoX

-

🌐All links → linktr.ee/bonsai8

评论 (0)