The lines between the crypto economy and traditional finance are increasingly blurred. Today, simply having an exchange wallet is no longer enough — proper capital management requires a reliable banking infrastructure that won’t block transfers or create unnecessary friction. This article explores why “crypto-friendly” banks are crucial for Web3 users, how to choose one, and which players deserve attention in 2025.

Why Banking Infrastructure Still Matters

Banks remain the bridge between fiat and digital assets, enabling:

-

Funding exchange accounts and withdrawing profits

-

International transfers in USDT/USDC and conversions

-

Deposits and withdrawals on P2P platforms

-

Tax reporting and holding part of your capital in “traditional” currencies

If a bank has a hostile attitude toward crypto transactions, the risk of blocked transfers, denied service, or even frozen accounts increases significantly. A crypto-friendly bank minimises such risks, enabling legal and convenient interaction with digital assets.

Why Traditional Banks Often Fail

Many “classic” banks are still wary of crypto:

-

Blocking transfers with “crypto” in the payment details

-

Charging excessive fees on international transfers

-

Causing card issues when working via P2P platforms

-

Long disputes to recover funds

These problems slow down operations and hurt profitability, forcing users to seek alternative solutions.

What Crypto-Friendly Banks Offer

Next-generation banks take Web3 realities into account:

-

Clear policies for working with exchanges and P2P services

-

Cards that can be topped up from crypto wallets

-

Integrations with exchanges, API access, and automated reporting

-

Reasonable fees and transparent terms

At the same time, they remain regulated, reducing the risks of fraud and legal trouble.

Key Criteria for Choosing a Bank

Before opening an account, make sure the bank:

-

Officially supports transfers to and from exchanges, with no hidden bans on P2P

-

Doesn’t overcharge for SWIFT/SEPA transfers or currency conversion

-

Operates in your jurisdiction and allows international transactions without undue restrictions

-

Is registered and licensed, minimising regulatory risk

-

Offers crypto-relevant products: cards, APIs, and reporting tools

Always check reviews: if users frequently complain about account freezes or excessive red tape, it’s worth looking elsewhere.

Top Banks in 2025

Several banks and fintechs have already established themselves as trusted partners for crypto investors. Here’s a brief overview:

-

Revolut (UK/EU)

A popular fintech app supporting BTC, ETH, and other assets natively. Crypto withdrawals are limited by jurisdiction, and fees vary depending on the plan. -

**SEBA Bank (Switzerland) **

A regulated bank offering custodial and brokerage services for digital assets, focused on institutional and HNWI clients. -

**Bank Frick (Liechtenstein) **

Specialises in servicing blockchain projects and custodial storage of crypto assets. Suited to professional investors. -

**DBS Bank (Singapore) **

One of Asia’s largest banks, operating its crypto exchange (DBS Digital Exchange) and focusing on corporate clients. -

**Silvergate (USA) **

A leading US bank for crypto businesses, particularly popular among institutional players.

Each offers a different balance of fees, services, and accessibility — choose according to your priorities.

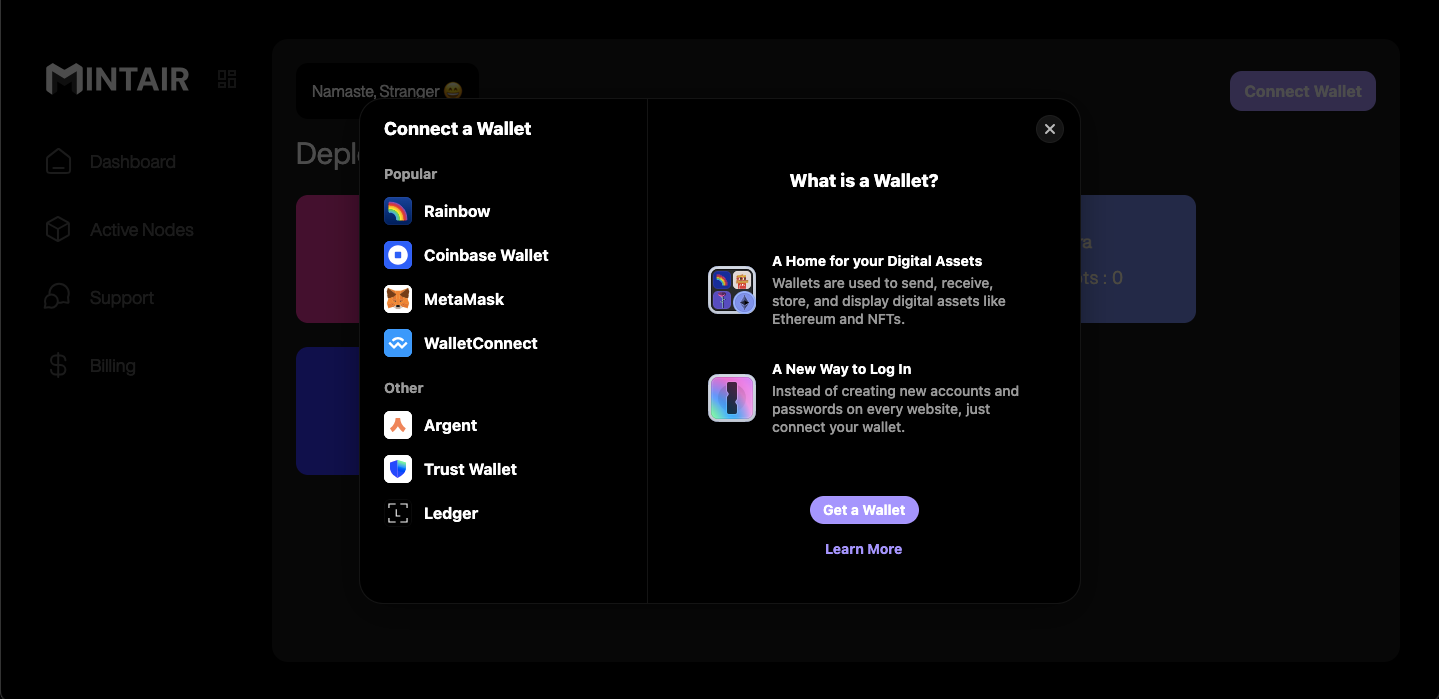

How to Get Started

A step-by-step plan for crypto investors:

-

Check the bank’s terms: make sure they support exchanges, P2P, and your client profile.

-

Open an account: submit an online application, complete KYC verification (documents, proof of address, selfie).

-

Set up transfers: ensure your bank details are compatible with your chosen exchange or service.

-

(Optional) Integrate APIs: to automate trading and reporting.

Security and Control

A few hygiene rules:

-

Work only with licensed banks

-

Enable two-factor authentication (2FA)

-

Store large sums in cold wallets

-

Double-check website addresses and never share 2FA codes

Remember: the bank is just infrastructure. You should retain full control over your assets.

Trends: Banks, Fintech, and CBDCs

In 2025, more banks are exploring blockchain potential and piloting digital asset integrations. Central Bank Digital Currencies (CBDCs) are gaining momentum, creating a new form of digital fiat. Meanwhile, fintech companies continue to roll out Web3-friendly products, offering more flexible terms than traditional banks.

Conclusion

For a crypto investor, a bank is more than just a “salary account.” It’s a key part of your capital management and risk mitigation strategy. Choosing the right partner lets you focus on investments instead of bureaucracy. Study the offerings, check reputations, and remember: the keys to your assets should always stay in your hands.

评论 (0)