Introduction

Cardano is a blockchain based on Proof of Stake (POS) that began development in 2015 and was officially launched in September 2017 by Charles Hoskinson and his team. Notably, Charles Hoskinson is also one of the co-founders of Ethereum, who left Ethereum due to disagreements with Vitalik Buterin on whether to develop Ethereum into a for-profit business or a non-profit organization. Currently, Cardano is primarily supported by three organizations: the Cardano Foundation, Input Output Hong Kong (IOHK, now renamed as IOG), and Emurgo. The Cardano Foundation and IOHK are mainly responsible for developing the Cardano platform and related protocols, while Emurgo is a third-party Japanese company that focuses on developing, supporting, and incubating commercial projects on Cardano. Due to Cardano's advantages in transaction fees, scalability, and transaction speed, it is often referred to as the "Ethereum killer."

Separation of Powers

Cardano is primarily supported by IOG, Emurgo, and the Cardano Foundation:

-

IOG, co-founded by Charles Hoskinson and Jeremy Woods in 2015, is a blockchain infrastructure, research, and development company based in Hong Kong. It is a fully decentralized organization that provides evidence-based software development. For government clients, the company has created blockchain infrastructure solutions. It also collaborates with the public and commercial sectors, providing services and continuously driving the development of decentralized platforms and smart contracts.

-

EMURGO Global is the official commercial and venture capital arm of the Cardano project, registered in Tokyo since June 2017. It has two subsidiaries: EMURGO Africa and EMURGO Ventures.

-

The Cardano Foundation, based in Zug, Switzerland, is a blockchain and cryptocurrency organization. Essentially, the Cardano Foundation is an independent standards body responsible for overseeing and monitoring the ongoing development of Cardano and its ecosystem.

From the above introduction, we can see that IOG leads the technological research and development, the Cardano Foundation is responsible for promotion and marketing, and Emurgo is the financial backer and regional business developer. In theory, if each party plays its role well, 1+1+1>3. However, from a media perspective, some activities and projects involve collaboration among all parties, such as the investment in Africa, where EMURGO is expected to contribute around $100 million, with the other two also providing their technology or other resources. However, there were also some scandals in 2020, so it is currently difficult to determine whether the separation of powers brings more benefits or drawbacks. One thing is for sure: the relationship between the three supporting parties will directly affect the development of Cardano.

Project Overview

Before diving into the Cardano project, let's take a look at the number of Dapps on three other top-ten market cap blockchains that can deploy smart contracts: Ethereum, BNB Chain, and Polygon. As of February 18, 2024, according to DappRadar data (https://dappradar.com/rankings), these blockchains have 4498, 5214, and 2005 Dapps, respectively, while Cardano has only 52 recorded Dapps. The direct impact of having fewer Dapps is that there are fewer projects and play styles for participants to engage in, resulting in less on-chain activity, affecting ecosystem development, and reducing attractiveness to users. This could be one of the reasons for the fewer active accounts and project users in the Cardano ecosystem. Why is it that despite being in the top ten in market value, the number of projects is so small? Time is a factor worth considering. Although Cardano started development early, the Proof of Stake on Cardano was actually launched in 2020. It wasn't until the successful Alonzo upgrade in September 2021 that Cardano officially entered the "smart contract" era. The first DeFi service appeared at the beginning of 2022. So, considering the timeline, Cardano's ecosystem can be seen as having started from September 2021.

The year 2021 was an explosion year for public chains:

-

Solana launched its mainnet in March 2020, and the May Black Card Marathon alone brought over 300 new projects to Solana.

-

Terra (later imploded due to the Luna event) started its project in January 2018 and launched its mainnet in April 2019.

-

The Matic Network team decided to expand their project scope and rebranded to Polygon in February 2021.

-

Avalanche was co-founded in 2019 and officially launched on the mainnet on September 22, 2020.

-

Fantom was founded in January 2018 and became Ethereum Virtual Machine (EVM) compatible by the end of 2019. Developers can quickly port Ethereum-based dApps to Fantom's Opera mainnet.

Other public chains like Near, Dfinity, Algorand, Flow, and WAX also started rapid ecosystem development in 2021. From a timing perspective, being a forerunner is an advantage, and being a latecomer could be one of the reasons for Cardano's "low-profile" ecosystem. Of course, a low-profile ecosystem does not mean a low-profile price; in September 2021, the price of ADA reached a high of $3.01, with an FDV exceeding $139 billion.

The Development of Cardano DeFi

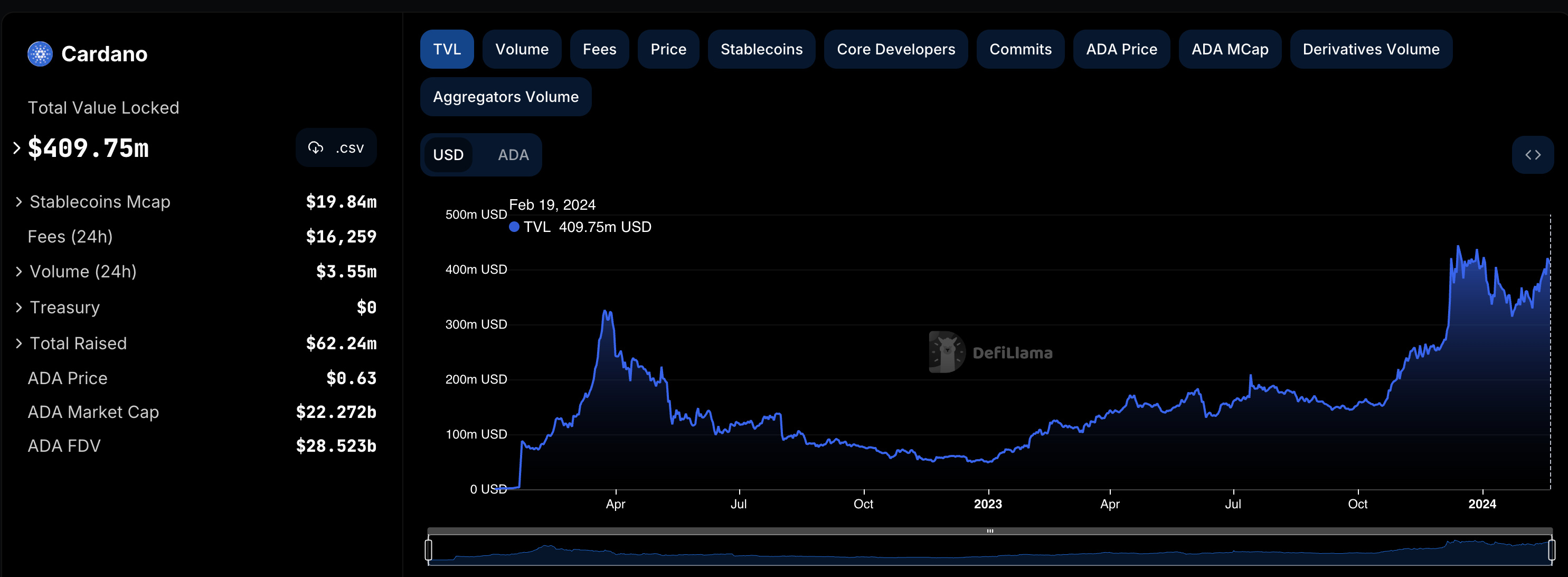

DeFi (Decentralized Finance) enhances the liquidity of a network and diversifies its assets. The first DeFi service on Cardano appeared at the beginning of 2022, with its Total Value Locked (TVL) currently at $4.0975 million, ranking 13th among public blockchain TVLs (https://defillama.com/chain/Cardano).

In terms of stablecoins, which are a key component of the DeFi ecosystem, Cardano's stablecoins were launched in the third quarter of 2023, consisting of iUSD and DJED. iUSD is an algorithmic stablecoin pegged to the value of the US dollar, while DJED is a collateral-based stablecoin, similar to DAI on Ethereum. Both of these stablecoins serve as fundamental assets for various DeFi applications on Cardano, such as lending, exchanges, and derivatives. Additionally, there is USDM, a collateral-based stablecoin launched in the first quarter of 2024 by Mehen, a DeFi protocol operating on Cardano. Supported by other cryptocurrencies (such as ADA, ETH, BTC, etc.), USDM aims to become the primary stablecoin on Cardano by providing stability and also liquidity.

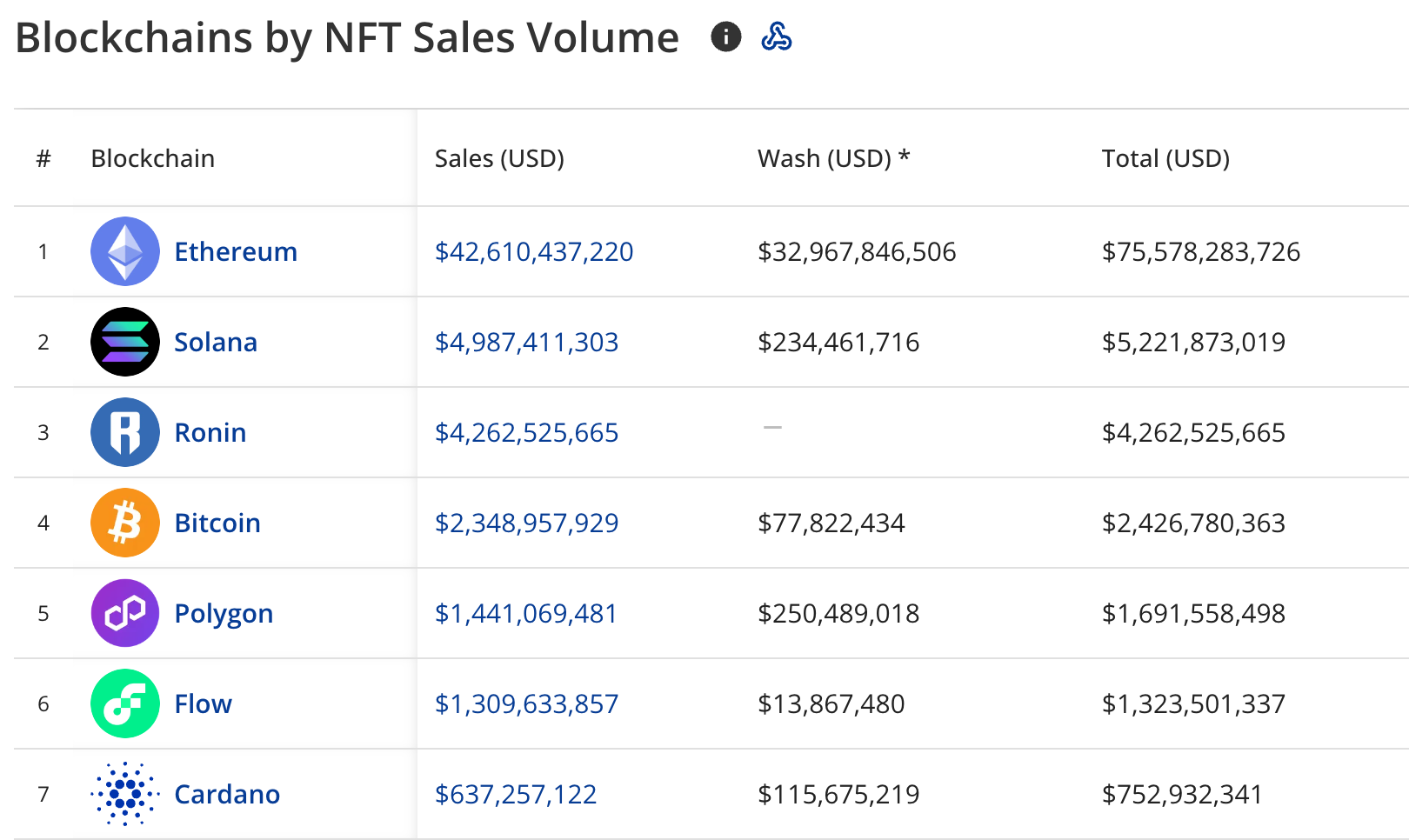

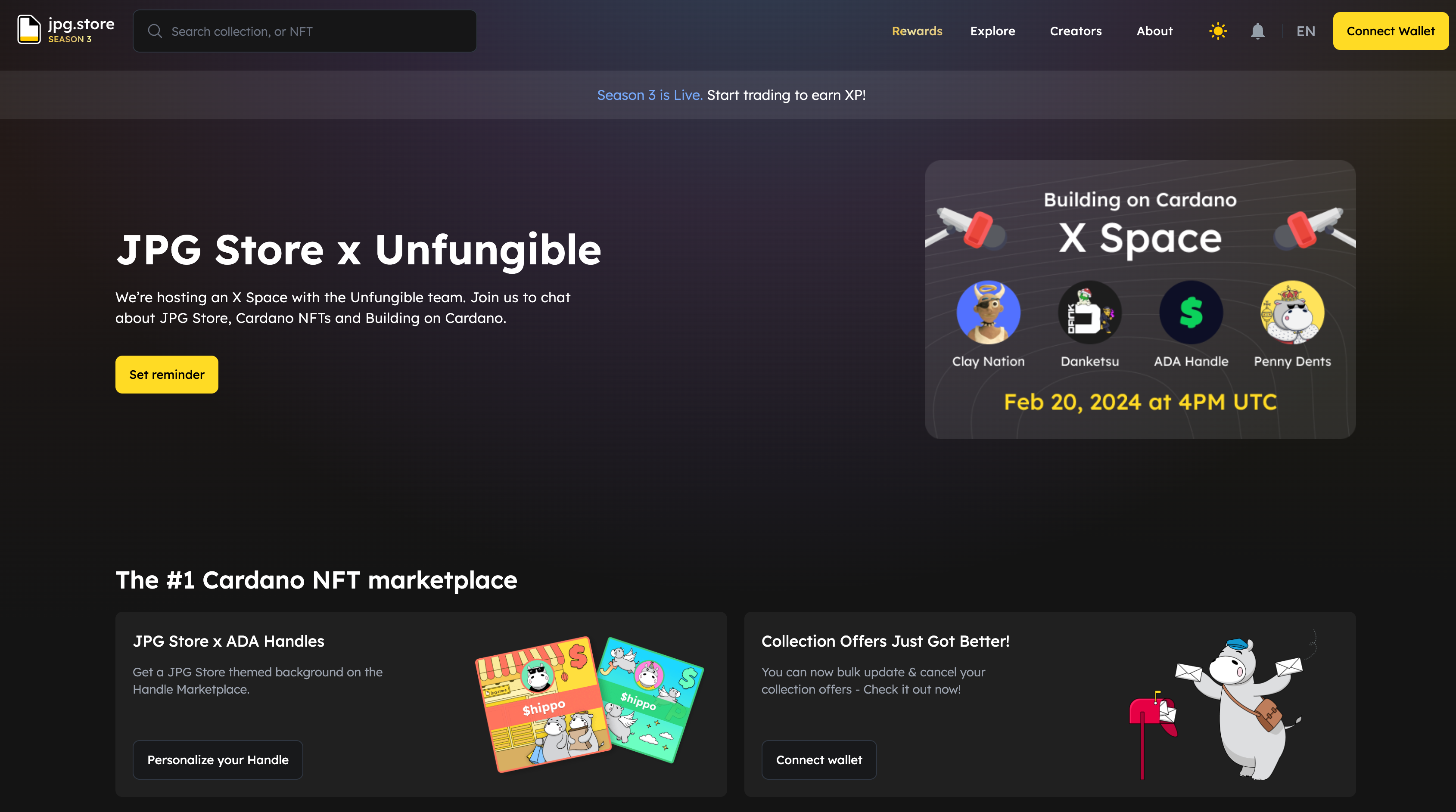

NFTs can be considered one of the more successful areas of development for Cardano. According to real-time data from Cryptoslam, the number of NFT transactions in the Cardano ecosystem ranks in the top 7. Moreover, the most popular Dapp among Cardano users is the NFT trading platform jpg.store, which has been used by 161.7K accounts. Opening jpg.store gives a similar experience to that of using OpenSea, a leading NFT marketplace on Ethereum.

Project Guide

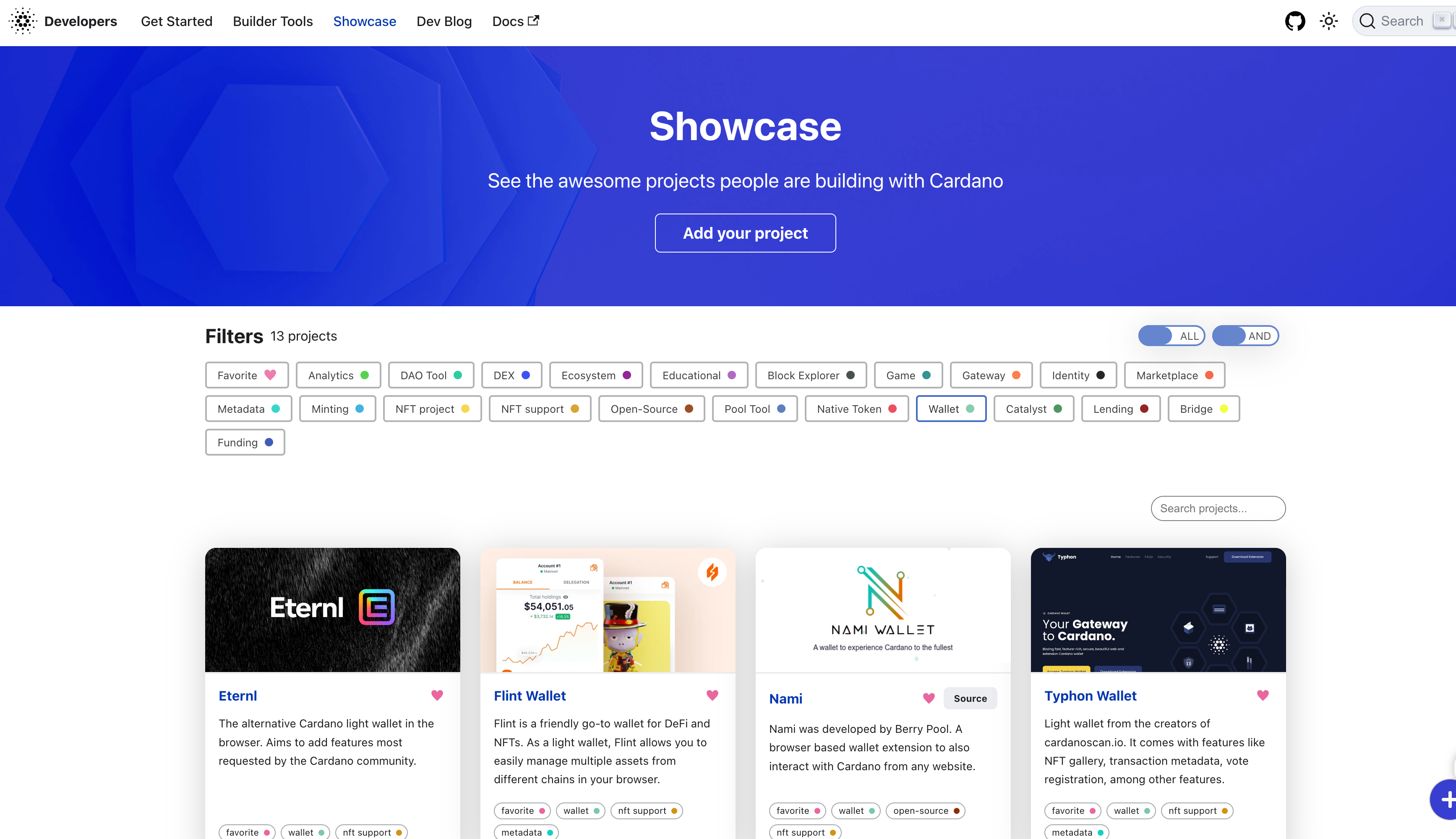

1.Wallets (https://developers.cardano.org/showcase/?tags=wallet)

Similar to other common public blockchains, Cardano requires a dedicated network wallet for use. After trying out several wallets, the experience and services seem quite similar.

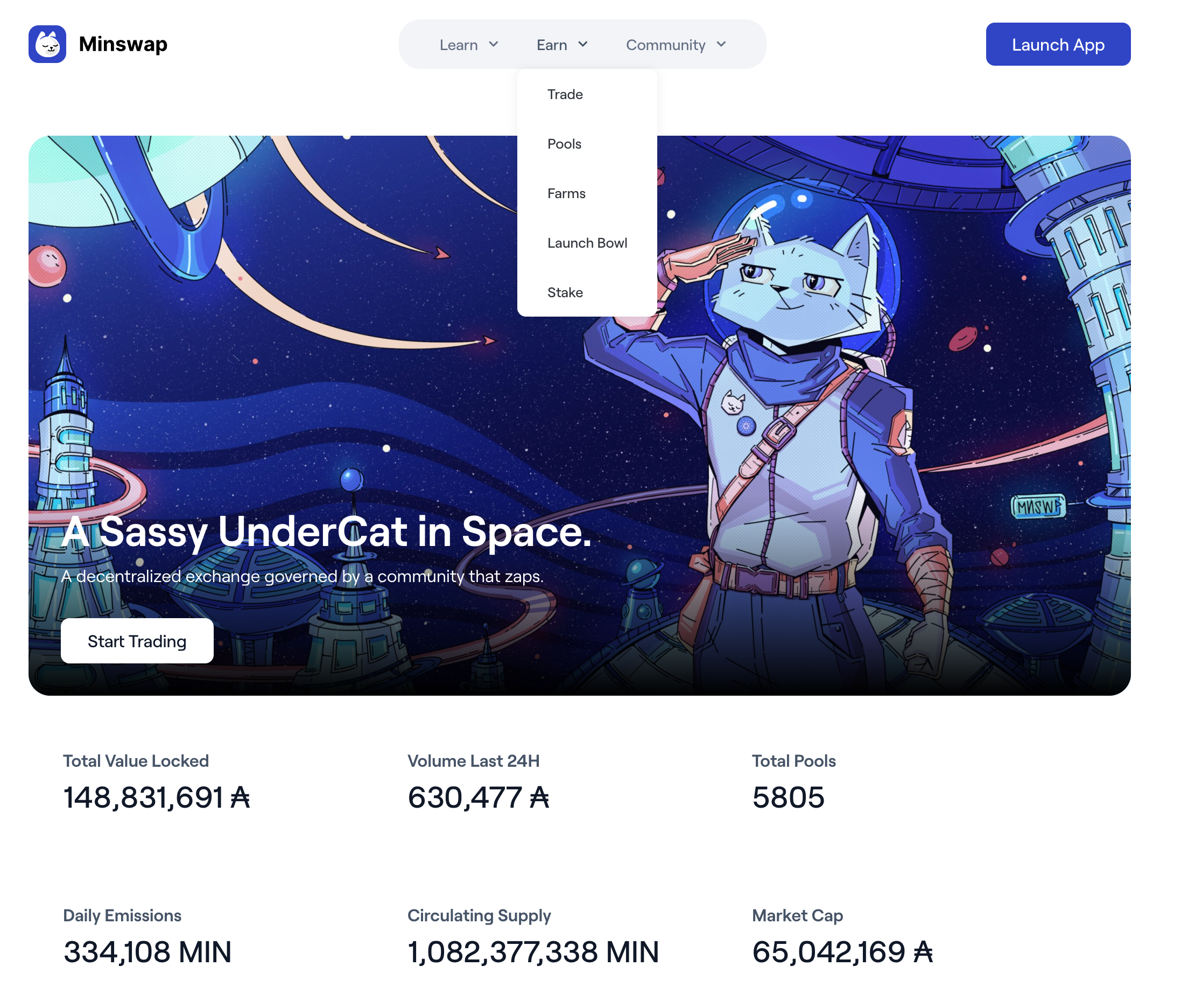

2.DeFi (https://minswap.org/)

Minswap is recommended as it is currently the DeFi product with the highest TVL on Cardano. Its features include Stake, Swap, Pool, Farm, and Launchpad, which can give you a better understanding of the tokens of other projects in the Cardano ecosystem, and it has a user-friendly interface.

3.NFT (https://www.jpg.store/)

One of the hottest NFT trading platforms, Jpg.store, is introduced here. Its overall user interface is similar to OpenSea, so those with NFT trading experience can start using it right away. Its features include trading, browsing NFTs, creating NFT portfolios, and launchpad. The new feature JPG Studio allows users to “Generate and customize your entire NFT project without a developer and mint exclusively on JPG Store”. Their Season 3 also launched on February 5, 2024.

Technical Features & Roadmap

1.Academic Atmosphere

Cardano has a distinct academic flavor. Scientists propose innovative ideas through rigorous scientific research and then implement them carefully. Precisely, Cardano uses the Haskell functional programming language to avoid "bugs" in its code. Haskell provides a theoretical framework for describing and evaluating functions, where each function is a mathematical function, ensuring high security. Cardano is the first in the industry to propose code peer-review, meaning all of Cardano's code undergoes specialized peer review to ensure the feasibility of the technology before it is officially launched. This is one of the reasons why smart contracts were launched later, as the process is time-consuming but rigorous.

2.Network Architecture

Cardano's technical architecture makes it a third-generation blockchain platform. It uses an extended Unspent Transaction Output (UTXO) model that combines Bitcoin's transaction-based design with Ethereum's accounting model, providing a more universal framework. The Cardano blockchain consists of four complete layers, each contributing to its robustness and efficiency:

-

Settlement Layer: This foundational layer supports the blockchain's physical and governance structure, serving as the basis for all other components.

-

Consensus Layer: Utilizing the Ouroboros series of Proof of Stake (PoS) consensus protocols, this layer enhances security similar to Proof of Work systems but significantly reduces energy costs.

-

Network Layer: A complex peer-to-peer network stack provides the necessary infrastructure for protocol support, including features such as pipelining, multiplexing, and protections against malicious actors.

-

Scripting Layer (Plutus): This layer introduces smart contract functionality to the network through its scripting language.

3.Programming Languages

The Cardano blockchain is built on the functional programming language "Haskell." "Plutus," the smart contract programming language for Cardano, is built on Haskell, as is "Marlowe," Cardano's domain-specific language for financial smart contracts. Haskell was developed in the 1990s, and it is not particularly beginner-friendly. Only a small number of developers in the market are proficient in this language.

Road Map

The development of Cardano is divided into five phases, and although each phase of Cardano will be delivered in sequence, the work of each phase can be carried out in parallel. Research, prototyping, and development can often be conducted simultaneously in different development streams. What is most admirable is that Cardano organizes the development methods, prototyping, technical specifications, etc., of each phase in some academic form for everyone to view.

-

BYRON: After two years, tens of thousands of GitHub commits, and hundreds of hours of research, the first version of Cardano was released in September 2017, marking the beginning of the Byron era.

-

SHELLEY: Unlike the Byron era, which began at a single point in time with the launch of the mainnet, the transition to Shelley aims to achieve a smooth, low-risk transition without causing service interruptions. As the Shelley era progresses, more and more nodes will switch to being operated by the Cardano community.

-

GOGUEN: Goguen will add the ability to build decentralized applications (DApps) on the solid foundation of peer-reviewed research and high-assurance development of Cardano.

-

BASHO: The Basho era is an optimization period aimed at improving the scalability and interoperability of the network. Previous development phases focused on decentralization and new features, while Basho is dedicated to improving the underlying performance of the Cardano network to better support the growth and adoption of high-transaction-volume applications.

-

VOLTAIRE: With the introduction of voting and financial systems, network participants will be able to use their stakes and voting rights to influence the future development of the network.

Tokenomics

ADA is the native token of the Cardano blockchain, with a total supply cap of 45 billion tokens, which will be gradually released through a process called minting. This hard cap ensures that ADA has deflationary characteristics over time, although the ecosystem is expected to exhibit inflationary trends before a significant portion of the reserve is circulated (expected to begin around 2030).

ADA is an integral part of the Cardano operational framework. It facilitates governance, stimulates network participation, and enhances security by increasing user engagement. A key feature of ADA is staking, which benefits long-term holders. By staking ADA, users can contribute to network security, and this staking process not only protects the network but also allows ADA holders to earn rewards, incentivizing participation and investment in the ecosystem.

Users also have the opportunity to earn ADA by delegating their holdings to staking pools. This process is non-custodial and fully liquid, allowing users to verify and confirm transactions in real-time. Importantly, pool operators neither control nor have access to the delegated tokens, and rewards are automatically distributed by the Ouroboros protocol every five days, ensuring the security and transparency of the staking process.

Author: Simon Wen

Editor: Sam Wang

评论 (0)