Disclaimer: The information provided in this research piece does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content in this publication as such. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Billions of dollars are bridged across evm chains. We are far beyond the era of the single-chain thesis, and this shift is so apparent that even your grandmother could recognize. So many chains, so many niches, so many opportunities.

As multiple EVM chains become popular across various narratives (e.g., parallel execution, gaming, etc.), a huge chunk of liquidity will flow between them. Cross chain volumes have grown significantly from the last bull market from tens of millions in 2021 daily bridging volumes to an average of 250 million in 2023.

Bridges serve as vital infrastructure for facilitating the movement of liquidity between different chains. If you are a blockchain gambler, you probably have used bridges multiple times a week or an hour depending on how degen you are. Inherently, bridges play a significant role in facilitating the movement of funds across blockchains.

When discussing bridges, it's essential to differentiate between two main types: cross-chain token bridges and messaging protocols. Cross-chain token bridges primarily focus on the transfer of tokens between different blockchains. In contrast, messaging protocols facilitate the exchange of data, including smart contract details and block information across networks.

This research piece aims to provide an overview of the token bridge landscape, assess the current state, highlight popular protocols in the space, and delve into metrics and financial models for Across, a leading cross-chain protocol with compelling metrics.

This research is structured into three main segments:

-

Bridge Landscape Analysis

-

Data-Driven Metrics Analysis

-

Across Thesis and Model Evaluation

The landscape of cross-chain bridges encompasses hundreds of EVM bridges facilitating token transactions between different chains. These bridges can be categorized based on the underlying technology and methodology employed for cross-chain bridging.

Broadly classifying token bridges, there are three main types of token bridge designs:

-

Burn and Mint Bridges

-

Lock and Mint Bridges

-

Liquidity Network

Lock and Mint bridges were the first generation of bridges to gain popularity. These bridges relied on locking tokens on a source chain (eg BTC) and wrapping it to mint a wrapped version (eg WBTC) of it on the destination chain.

A good example of a lock and mint bridge would take us back to the early days of Ethereum DeFi. Ethereum was getting popular and users were generating yield by lending and staking assets. Bitcoin holders a slice of the pie too.

This warranted the creating of lock and mint bridge where native BTC could be locked on Bitcoin and WBTC could be generated on Ethereum. If the user wants to port back the WBTC to BTC on the bitcoin blockchain, the WBTC is burned on Ethereum and BTC is unlocked.

Apart from wrapping protocols, Lock-and-mint bridges have also become popular among native L2 evm chains where tokens are locked on Ethereum and representation are minted on the rollup. This is a method of attracting liquidity into their newly created chains. It is likely that the new and hottest shiny chain is using this method to bridge in liquidity to the chain.

Examples of Lock and Mint Bridges: Most L2 Native bridges like Arbitrum, Optimism, zksync and WBTC, Ren etc

Disadvantages of Lock and Mint Bridge

-

Fragmentation and little liquidity available in new chain when it comes to wrapped versions. As multiple chains mint their own wrapped versions, they become more and more fragmented.

-

Vulnerability from hacks on the source chain given massive amount of liquidity is locked. Hacking the liquidity causes a major depeg of the wrapped/corresponding asset on the destination chain naturally.

-

Lesser adoption among defi protocols as a precaution due to hack possibility and depeg could create an issue for defi protocols utilizing wrapped versions.

-

Long withdrawal windows as these bridges need to burn corresponding tokens and verify any fraudulent transactions. E.g., Arbitrum’s bridge withdrawal takes 7 days.

The burn and mint method is a way to transfer tokens between different blockchains. When a token is moved from its original blockchain to another, it is first "burned," meaning it is destroyed on the source blockchain, effectively removing it from circulation. Subsequently, an equivalent token is "minted" on the target blockchain, creating a new token that represents the same value as the burned one.

A number of protocols utilise this to enable quick cross chain transfers such as Hop protocol and USDC issuer Circles new CCTP.

-

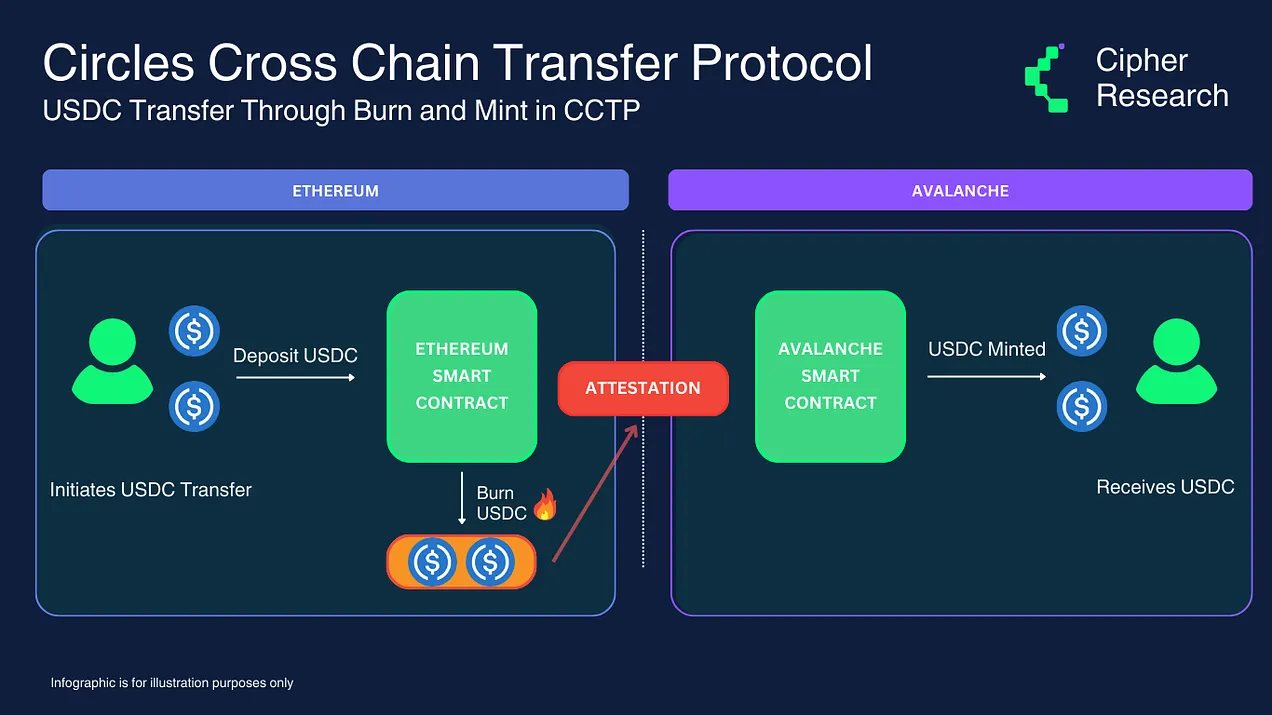

Circle CCTP

Circle, the issuer behind one of the most popularly used stablecoin USDC recently released its own proprietary cross chain transfer protocol. CCTP allows USDC flow natively cross chain in a capital efficient way across Arbitrum, Avalanche, Base, Ethereum, Noble, OP Mainnet, and Polygon PoS.

On the source chain, a user deposits USDC to the smart contract which circle burns. The attestation/proof of the burn event is generated. This action provides authorization to mint the specified amount of USDC on the destination chain. CCTP is composable and works with dApps to embed the bridge for easier bridging for users.

-

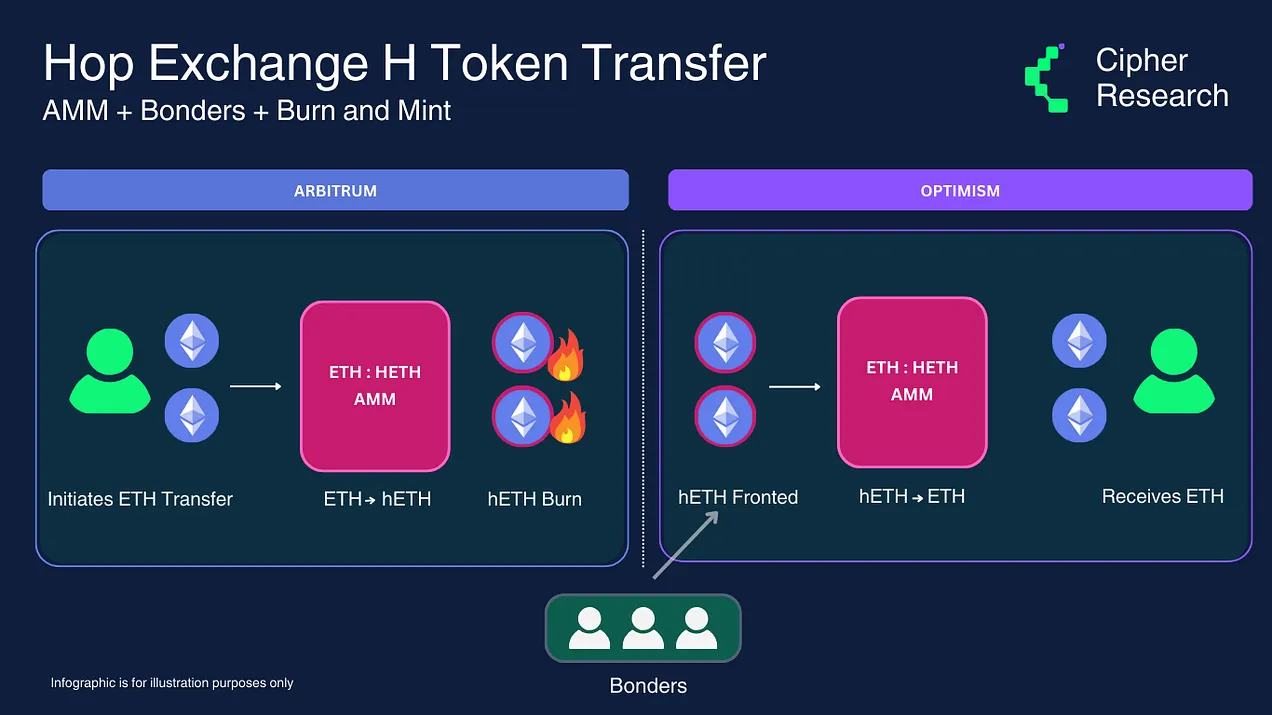

Hop Protocol

Hop is a scalable rollup-to-rollup general token bridge which uses burn and mint along with liquidity networks. It allows users to send tokens from one rollup or sidechain to another almost immediately using bonders, liquidity pools and a burn and mint mechanism.

-

Hop uses its own intermediary bridge token called the h token to bridge assets from L2s to each other and withdraw to L1. These h tokens (eg hETH, hDAI) are specialised tokens that can be transferred from rollup to rollup in batches.

As a user bridges for example ETH from Arbitrum to Optimism, the ETH is converted into hETH on Arbitrum through an AMM and the hETH is burned on Arbitrum. Meanwhile, a bonder fronts capital and mints hETH on Optimism by posting 110% of the capital collateral. This hETH is converted into ETH in Optimism and available for the users.

In the backend, Bonders receive compensation for fronting hETH minted. This compensation is derived from bridging fees and later receives the fronted capital in 24hrs. AMM pools also work through liquidity providers who earn some fees from the swaps.

Liquidity network bridges play a crucial role in enabling the transfer of assets across different blockchain networks. These bridges utilize liquidity pools available on both the source and destination chains to facilitate the movement of tokens.

Here's a simplified explanation:

When a user wishes to transfer a specific token (let's call it Token X) from one blockchain (Chain A) to another (Chain B), the liquidity network bridge facilitates this transfer by using a pool of Token X that already exists on Chain B.

This means that instead of waiting for a direct counterpart or undergoing complex processes, the token is readily released from the existing pool on Chain B to the user. This method requires the presence of external liquidity providers, who supply the pools with enough tokens on each chain to ensure there's always ample liquidity.

This setup allows for quick and efficient cross-chain transfers, making it a preferred option for users looking for speed and minimal capital slippage.

-

Celer cBridge

Celer cBridge is a versatile bridge that operates on a dual-model approach, employing both a liquidity pool-based model and a mint-and-burn model. The choice between these models depends on whether the tokens are already supported on the destination chain.

The mint-and-burn model is akin to other protocols, providing services for decentralized applications (dApps) launching on new chains, where tokens are minted on the destination chain and burned on the source chain to preserve token supply integrity.

Conversely, the liquidity pool-based model involves liquidity pools located both on the source chain and a mediating Proof-of-Stake (PoS) chain known as the State Guardian Network (SGN). This network plays a crucial role in enabling cross-chain transfers, where nodes within the SGN provide essential transaction details such as fees, liquidity availability, and other parameters. Liquidity Providers (LPs) contribute to pools across various chains, facilitating the transfer process.

A typical cross chain transaction:

-

Initiation: A user wishing to perform a cross-chain transaction from Arbitrum to Ethereum first queries the SGN for information on transaction fees and liquidity. After reviewing the transfer parameters, the user initiates the transaction.

-

Locking of Funds: The user locks up funds in a Hashed Timelock Contract (HTLC) on Arbitrum, setting specific conditions for the release of these funds. The SGN monitors this HTLC and assigns a node to manage the transaction.

-

Verification and Release: The assigned node verifies the release conditions of the HTLC. Once verified, it facilitates the release of equivalent funds on Ethereum from the liquidity pool, completing the cross-chain transaction.

-

-

Connext

Connext serves as a robust platform aimed at developers, designed to facilitate the construction of cross-chain applications. It provides a dual-faceted solution: a developer-oriented API for integrating cross-chain functionality into decentralized applications (dApps), and a user-friendly bridging interface that leverages liquidity providers and routers. These routers, essential intermediaries in the Connext ecosystem, offer liquidity and front capital to ensure seamless cross-chain transactions.

The process begins when a user submits a transaction intended to cross from one blockchain to another. Routers within the Connext network evaluate this transaction and, upon deciding to support it, issue a bid.

Should their bid be successful, these routers then provide the necessary funds at the transaction's destination chain, effectively bridging the user's assets across chains. This upfront funding by routers accelerates the cross-chain transfer, offering users immediate access to their funds on the destination chain.

The repayment to routers is facilitated through the utilization of native, secure bridges of the involved chains. Although this repayment process can be time-consuming, it ensures that the funds are returned safely to the router, thereby maintaining the integrity of the liquidity pool.

-

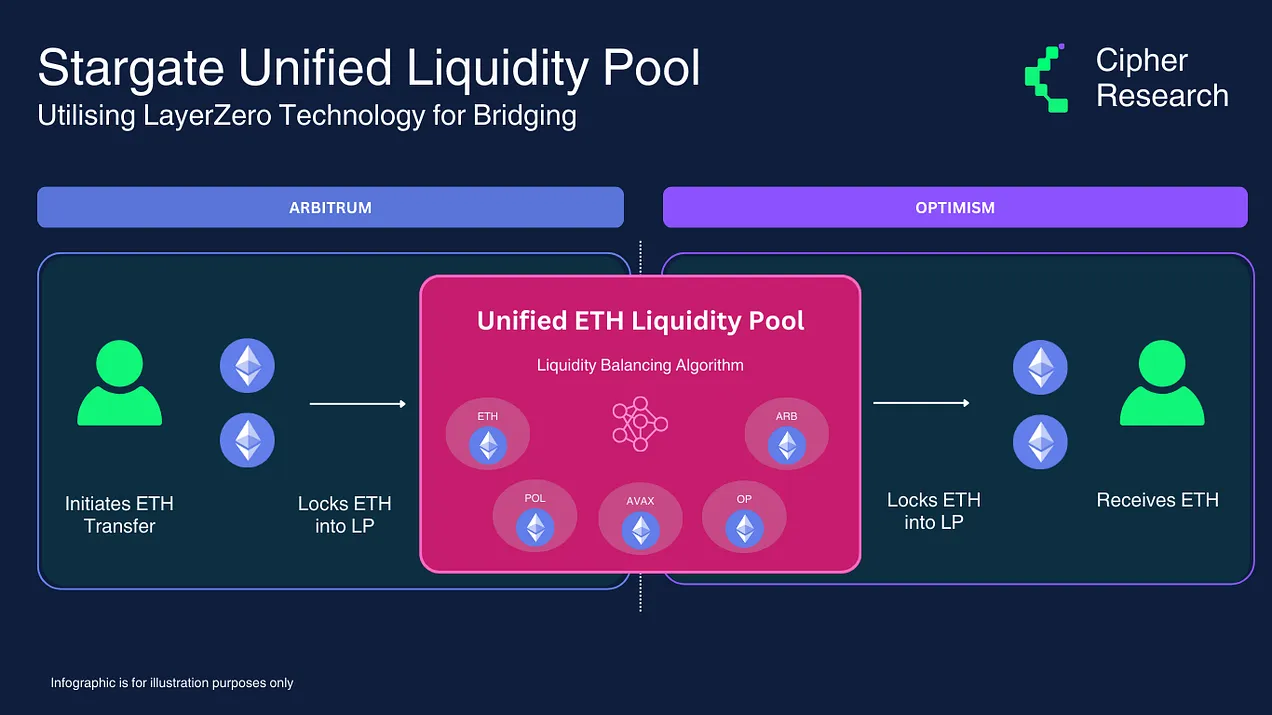

Stargate Finance

As many are aware, Stargate is a unified liquidity network bridge that utilizes layer zero technology. Unlike using fractured liquidity like other bridges, which is liquidity maintained across all the assets supported by the bridge among the chains, it uses a unified liquidity pool mechanism. This means that if chain A has a USDC liquidity pool, other chains can borrow and return USDC liquidity from chain A.

Stargate employs a "resource balancing algorithm" to ensure liquidity is effectively distributed among different chains sharing the unified pool. This algorithm divides the pool into intervals, each managed separately for different chains.

-

When a cross-chain request occurs, the algorithm checks liquidity in each interval and allocates user assets to those with insufficient liquidity, preventing transaction failures. It also allows borrowing and returning of liquidity between chains to balance volumes and assigns weights based on transaction frequency, directing excess liquidity to chains with higher demand, enhancing efficiency and reliability.

-

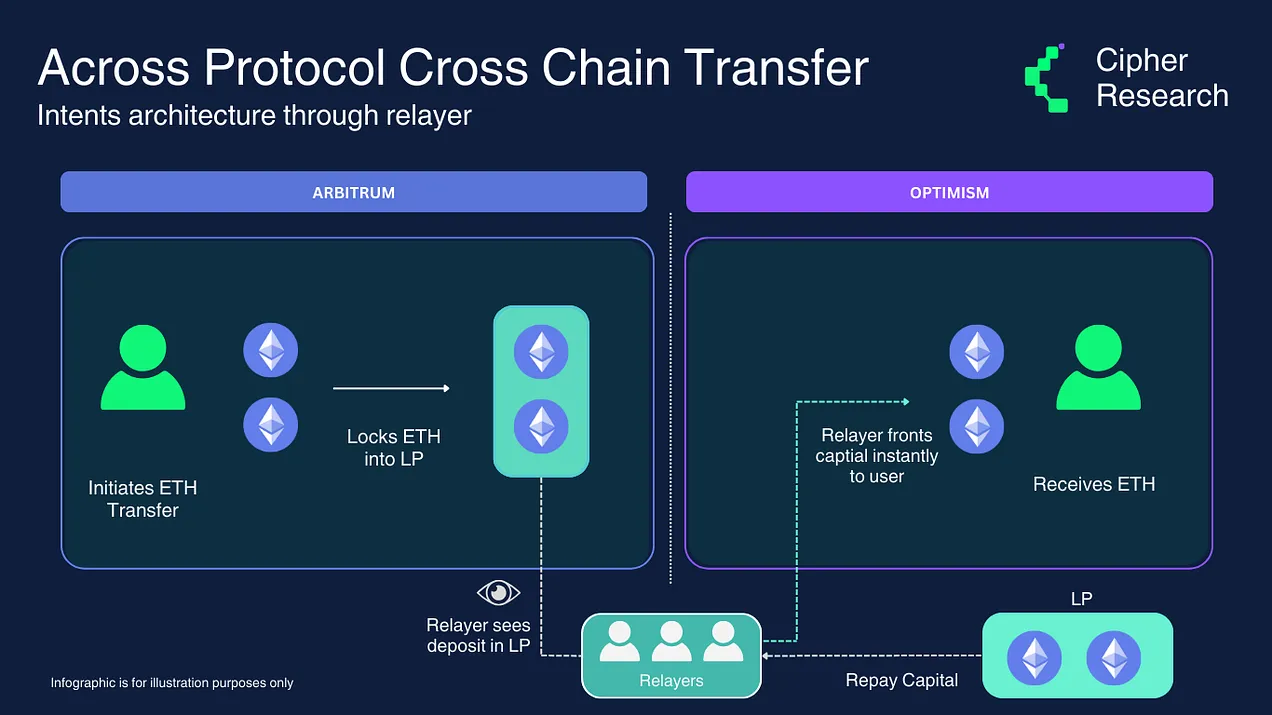

Across Protocol

The Across bridge is a unique bridge that utilises both liqudity networks and intents architecture. Intents are user specific objectives or request that they aim to achieve while solvers take care of the rest. Through this combination, across has become one of the fastest and cheapest ways to conduct cross chain swaps across chains.

As user puts up an intent to send tokens from L2s to L1s. The users deposits the amount and instantly get their funds on the destination chain in less than 2 mins or faster. That’s the end of the user side of the transaction. Simple, quick and cheap.

-

On the background, relayers look at the deposit on the source chain and use their capital to front capital on the destination chain. After executing a transaction, they submit evidence of their action and the original deposit's validity to an optimistic oracle for verification. This verification process ensures the transaction's integrity and triggers the reimbursement to the relayer.

The reimbursement comes from a centralized liquidity pool. This mechanism ensures relayers are compensated for their fronted capital, maintaining the system's efficiency and security.

-

Synapse Protocol

Synapse protocol is one of the earliest cross chain solutions in the market. The protocol has its own communication network called the Synapse Interchain Network, along with the synapse bridge. The bridge is a hybrid type that supports canonical token bridging, liquidity-based bridging, and RFQ (Request for Quotation) bridging.

Most of the bridge currently runs on the liquidity network with its unique stablecoin nUSD or nexus USD. The cross chain stablecoin is backed by DAI, USDC and USDT on ethereum through a pool, enabling a stable peg. Pools on destination chains also have nUSD pools which earn fees and SYN emissions.

When stablecoins are bridged between Synapse-enabled chains, they're automatically converted to nUSD and locked in the contract on the source chain. New nUSD is minted on the destination chain and swapped for the native stablecoins of the destination chain using the local nUSD pool.

Given the amount of interest in the cross chain transactions, we can expect enormous amounts of tokens interchanging between L1s and L2s. This provides a key catalyst to invest in tokens that have the potential to bridge the most volumes.

-

Monthly bridge volumes grew 112% YoY

-

Notably, native bridges have emerged as significant contributors to this volume, accounting for an average of 56% of monthly volumes

-

Key players such as Arbitrum, Optimism, and Polygon POS bridges have sustained their volumes, likely due to incentivization strategies, coupled with third-party bridges leveraging them for mainnet to rollup transfers

-

The pursuit of airdrops has spurred increased bridge volumes, exemplified by platforms like zksync

Analysis of Third Party Bridges - A growing segment

Growth of Bridge Volumes

-

The landscape of third-party bridges has undergone notable expansion

-

The number of bridges reporting monthly volumes exceeding $50 million doubling over the last year.

-

This growth signifies a heightened competitive environment, with more protocols vying for a share of the cross-chain transaction market

Dominance across Bridges

-

Stargate has the highest volume share across third party bridges largely driven by the speculation surrounding the Layerzero airdrop. However, its volumes have sharply declined over the past six months, relinquishing dominance by over 50%.

-

Across protocol has seen massive growth in volumes with quadrupled volumes in 6 months. Presently, the protocol accounts for 20% of daily volumes among third-party bridges.

-

Synapse ranks third in terms of volumes and has witnessed an upward trajectory recently. However, it's crucial to note that a significant portion of recent volumes have been routed through Synapse CCTP, a native integration with Circles CCTP

*

-

While Synapse exhibits impressive stats in 30-day volumes, it's essential to consider that the bulk of volumes are channeled through CCTP and not its native bridge, necessitating a cautious assessment of its capital efficiency

-

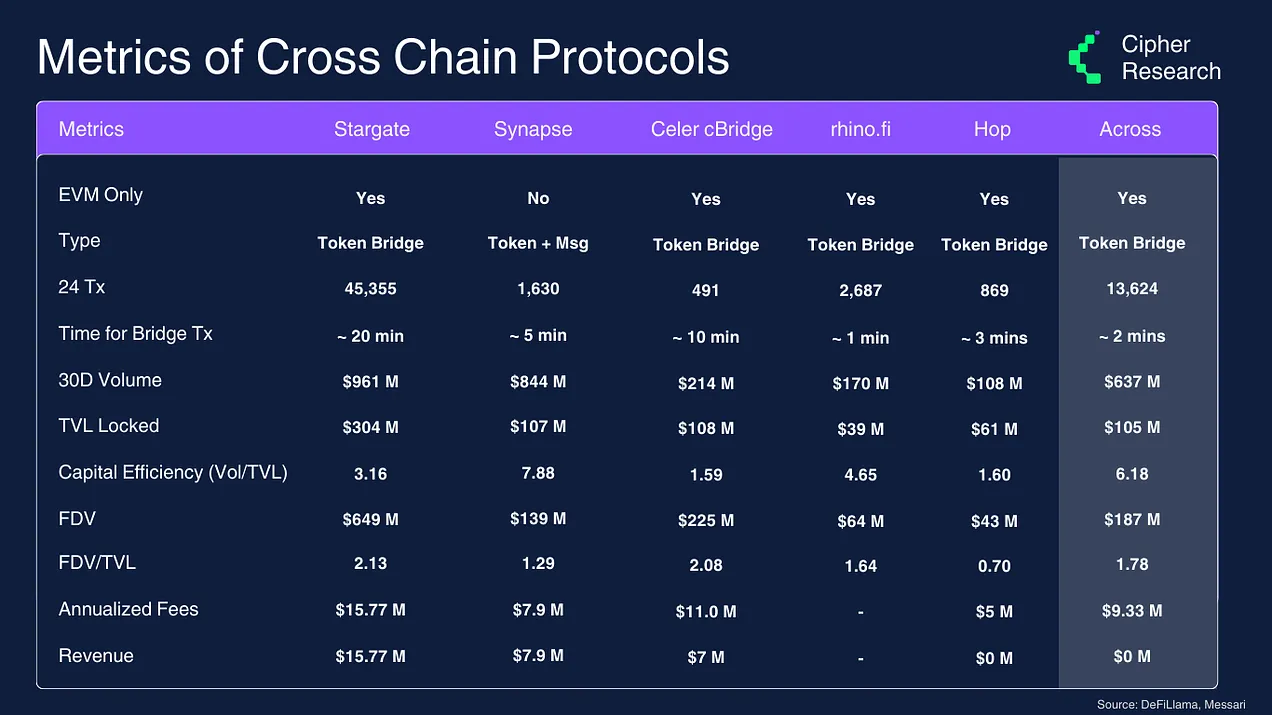

Across emerges as the fastest and most capital-efficient means to transfer funds across chains. Given the paramount importance of capital efficiency for liquidity network bridges, the protocol emerges as a frontrunner in the evm bridge race

Upon delving into the latest data charts, it becomes evident that Across protocol stands at the forefront of the EVM bridging landscape.

Core Thesis on Across Protocol

The core thesis on Across protocol is founded on several key factors:

-

Speed and Cost Efficiency: Across stands out as one of the fastest and most cost-effective methods to transfer funds across Layer 2 networks.

-

Capital Efficiency: It is recognized as the most capital-efficient liquidity network bridge currently available in the market.

-

Security: Relayers front capital, mitigating risk for users engaged in bridging activities, ensuring a secure transaction environment.

-

Transaction Volume: Across processes the second-highest number of transactions, trailing only behind Stargate, which is heavily utilized by airdrop farmers.

-

Recent Growth: Volumes and dominance have seen a notable uptick, particularly within the past year.

-

Intent Architecture: Across employs an intent architecture narrative with relayers, enhancing the efficiency and effectiveness of cross-chain transactions.

-

Bridging Aggregators: Bridging aggregators route a significant majority of transactions through Across, leveraging its speed, low fees, and security features.

-

Tokenomics: Across boasts a low float with a substantial treasury, with over 50% of the token supply locked up. Additionally, investor tokens are subject to vesting until June 25th.

-

Team Background: The core team behind Across is Risk Labs, renowned for their work on the UMA oracle and Oval projects.

-

Upcoming V3: Across V3 is in development, which will utilize intents as its foundation, further enhancing its capabilities.

-

Future Fee Switch: A significant catalyst anticipated for Across is the implementation of a future fee switch for the protocol. This switch would enable token holders to direct a portion of bridge fees towards $ACX holders, potentially resulting in increased revenue and token value.

One of the bigger catalysts I’m looking for in across has been a future fee switch for the protocol. The resulting scenario will bring in large amounts of revenue to the protocol and price go up. This is an option that token holders have to direct a portion of bridge fees towards $ACX holders.

Modelling ACX

Based on a hypothetical scenarios of Across turning on its fee switch, the following is a hypothetical business of the protocol. It is important to note that Across distributes 100% of the protocol fees to LPs with a future ambition to distribute to token holders.

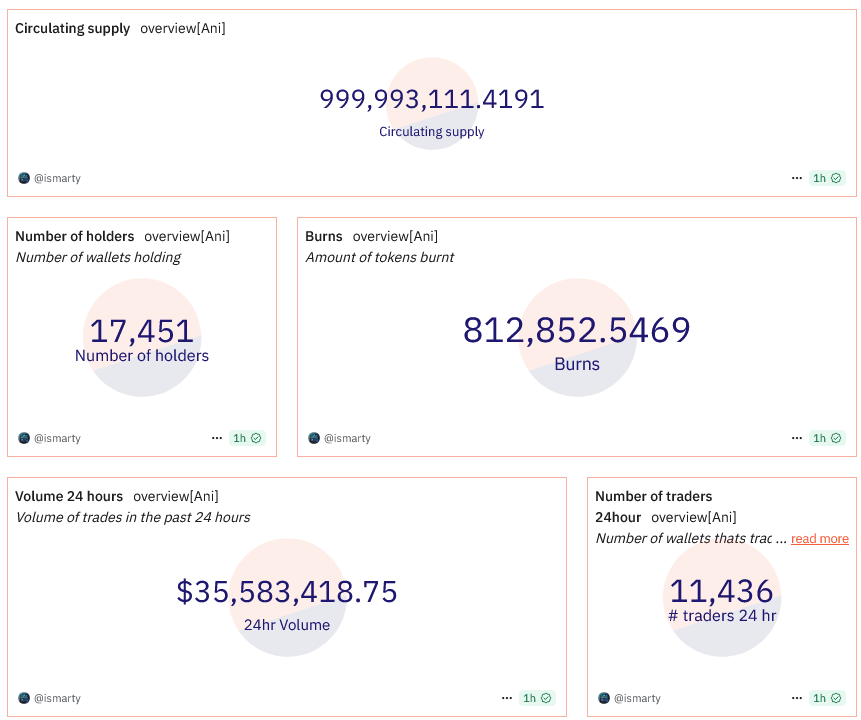

Total EVM Bridging Volume: The current annualized EVM bridge volumes, including native and third-party bridges, amount to $79 billion.

Across Market Share: Across currently commands over 20% of the third-party bridge market and 9% of the total bridge market, including native bridges.

Base Case and Bullish Case: In the base case scenario, with an expected 345% growth in volumes to $350 billion, and a 20% revenue take rate, Across could see a 112% upside potential. In the bullish case, where volumes reach $475 billion and a 50% revenue take rate, the potential upside for Across stands at 1,245%.

These values are purely speculative and represent hypothetical forecasts for when Across activates its fee switch.

Sources

https://blog.catalyst.exchange/catalyst-and-cross-chain-routers/

https://www.hiro.so/blog/understanding-blockchain-bridges-a-key-to-interoperability-in-web3

https://docs.optimism.io/builders/dapp-developers/bridging/standard-bridge

https://medium.com/amber-group/bridges-designs-trade-offs-and-opportunities-2196b8754e70 c

https://docs.google.com/spreadsheets/d/1BTnTUsE0_U_MLHLid0xV1nXNcvIOYcHCwt4_x5_e6lI

评论 (0)