In high school, I was an avid participant in Model UN. For those that do not know, these are conferences that aim to simulate a real UN committee where countries or organizations are represented by students. It was at one of these conferences I became enamored with Rwanda. A small but vibrant country in central Africa that had just endured one of the most brutal genocides in modern history.

What made Rwanda stand out was its growth. Often times developing countries will set ambitious growth targets but fail to meet them. Yet 30 years after heartbreak, Rwanda was the fastest growing economy in the region. Incredible!

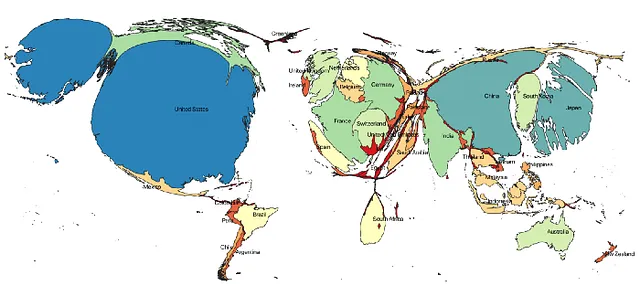

In one of our sessions, a couple of students and I figured the best way to further this growth was with targeted capital injections in key infrastructure projects. But how do you even get money in? There are fewer than 10 listings on the Rwanda Stock Exchange and almost no liquidity. See countries and businesses outside of North America and Europe suffer a severe liquidity problem. A fantastic article from Nic Carter shows the extent of this in his cartogram.

Looking here it is pretty obvious that there is an enormous imbalance. Most public equities are concentrated in the United States where the majority of global liquidity sits. But liquidity is not something that should be concentrated. It is the lifeline of every business and a healthy capital market. More importantly, it is what markets were designed to do: provide capital where it is needed so that a business can use that capital to grow.

With DeFi, there is a very real ability to create liquid markets on every asset in the world regardless of geographic location. All by leveraging automated market makers on blockchains. Instead of a few highly sophisticated market-making firms provisioning liquidity, the future financial system will allow anyone to provide liquidity and support markets. Once we get liquid markets, then all else follows: democratized access to yield and credit, frictionless global payments, and so on.

评论 (0)