Stablecoins account for 70% of all transaction volume ($USD) on blockchain networks. Over the past five years, stablecoins have grown over 100% year-over-year.

Stablecoins, being versatile financial instruments, serve three primary functions:

-

Medium of exchange: This necessitates wide acceptance, liquidity, and easy transferability.

-

Store of value: To function effectively as a store of value, stablecoins require collateralization by assets expected to retain or appreciate in value.

-

Unit of account: Stability is paramount for stablecoins to serve as reliable units of account.

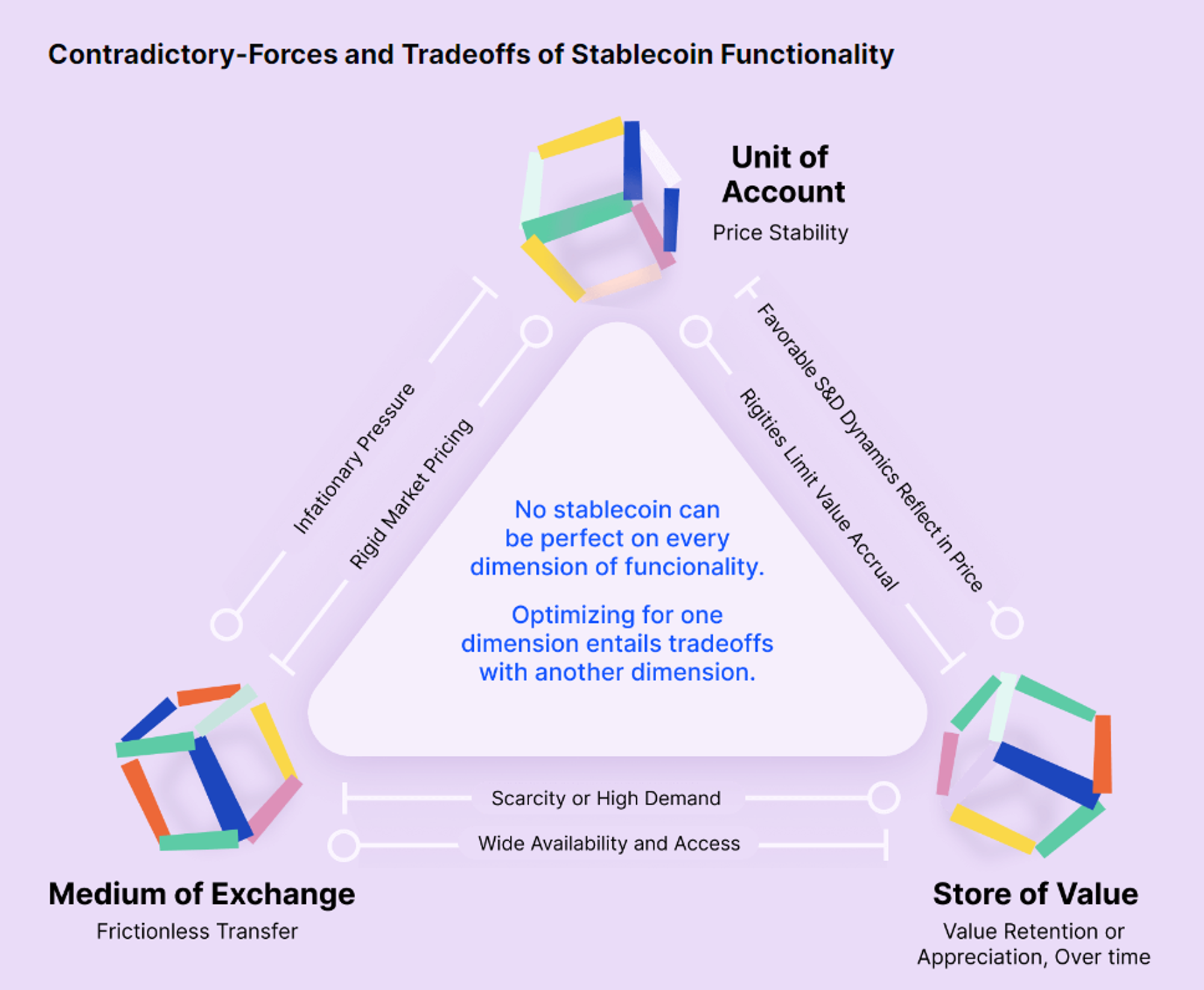

Balancing Trade-offs: While stablecoins can act as a medium of exchange, store of value, and unit of account to some extent, it's impossible for them to perfectly fulfill all three functions simultaneously. This is because the requirements for excelling in each function often contradict the others. Optimizing for one dimension inevitably necessitates trade-offs in another.

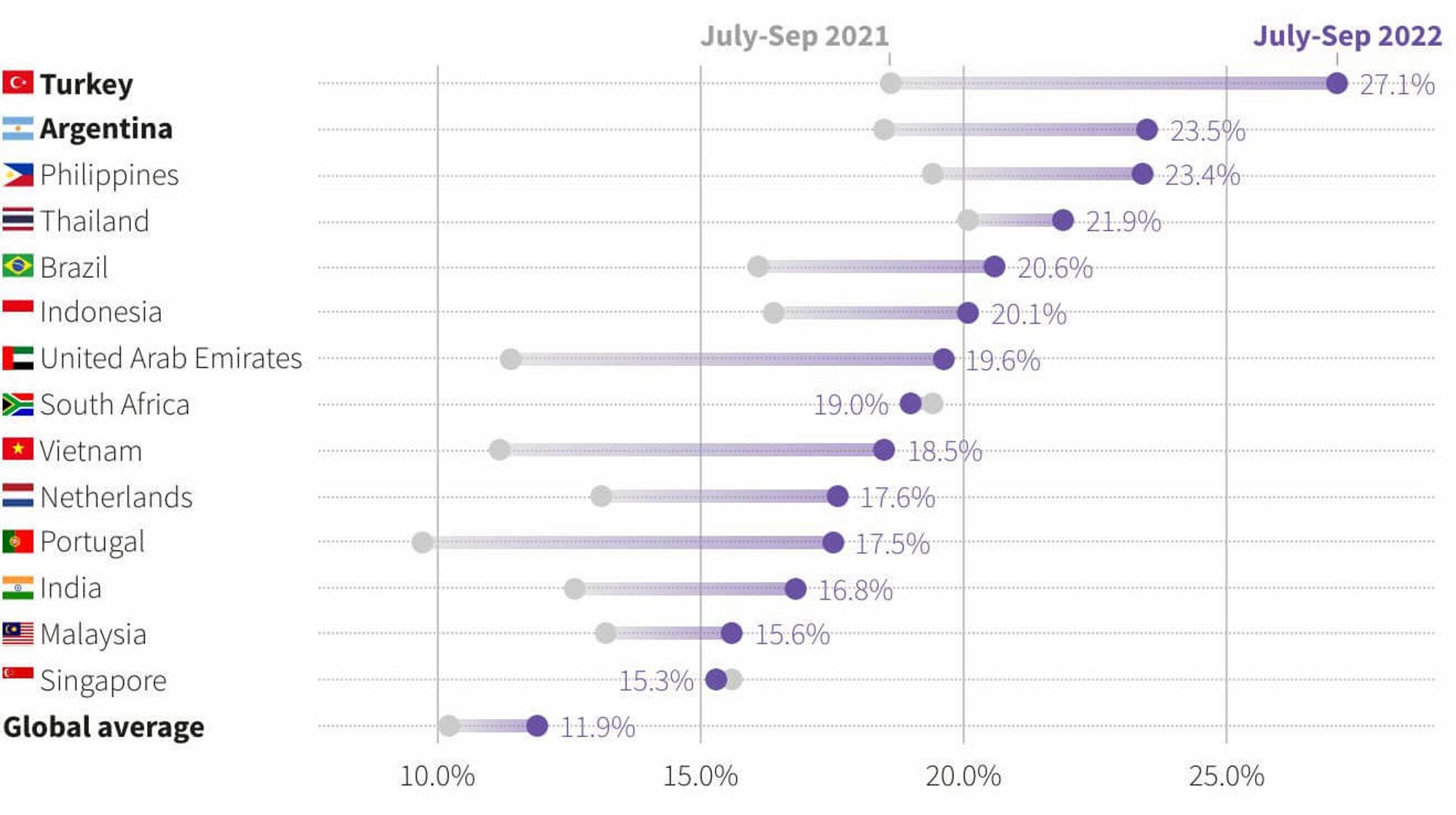

Stablecoins are showing promise in helping people manage their finances in regions with unstable economies.

A Mastercard study found that over a third of Latin American consumers have used stablecoins to pay for everyday purchases. The same study reported that over half (51.3%) of consumers in the region have made at least one cryptocurrency transaction.

This trend is likely driven by the need for stability in countries with failing monetary policies. For example, Argentina has experienced over a century of 100% annual inflation, forcing residents to seek alternative ways to preserve their wealth. In response to this problem, the new president of Argentina is even considering switching the entire economy to the US dollar.

Current Market Landscape:

-

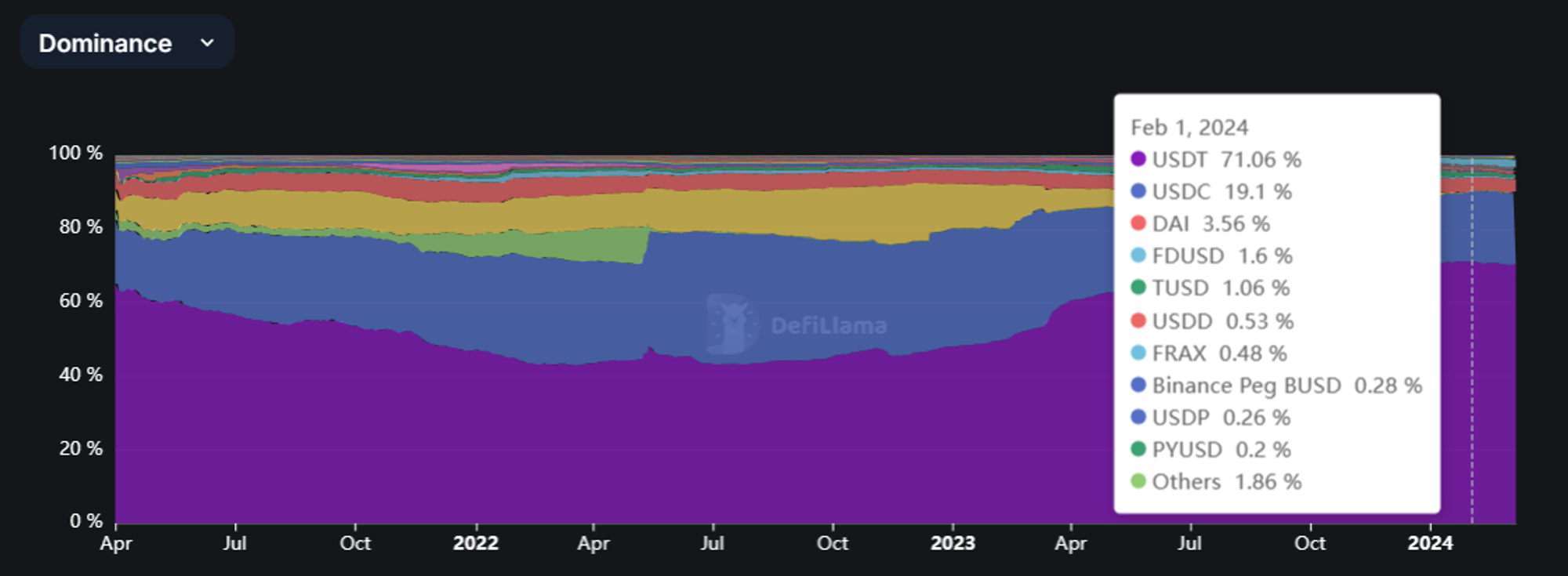

Tether (USDT) currently holds the dominant position in the stablecoin market with a 66% share, followed by USDC (20%) and DAI (4%). It's important to note:

-

USDT's market share increased significantly from 48% at the beginning of 2023 to 70% by year-end.

-

Conversely, USDC's share decreased from 32% to 18% during the same period.

-

BUSD's share experienced a drastic drop from 12% to 0.5% in 2023.

-

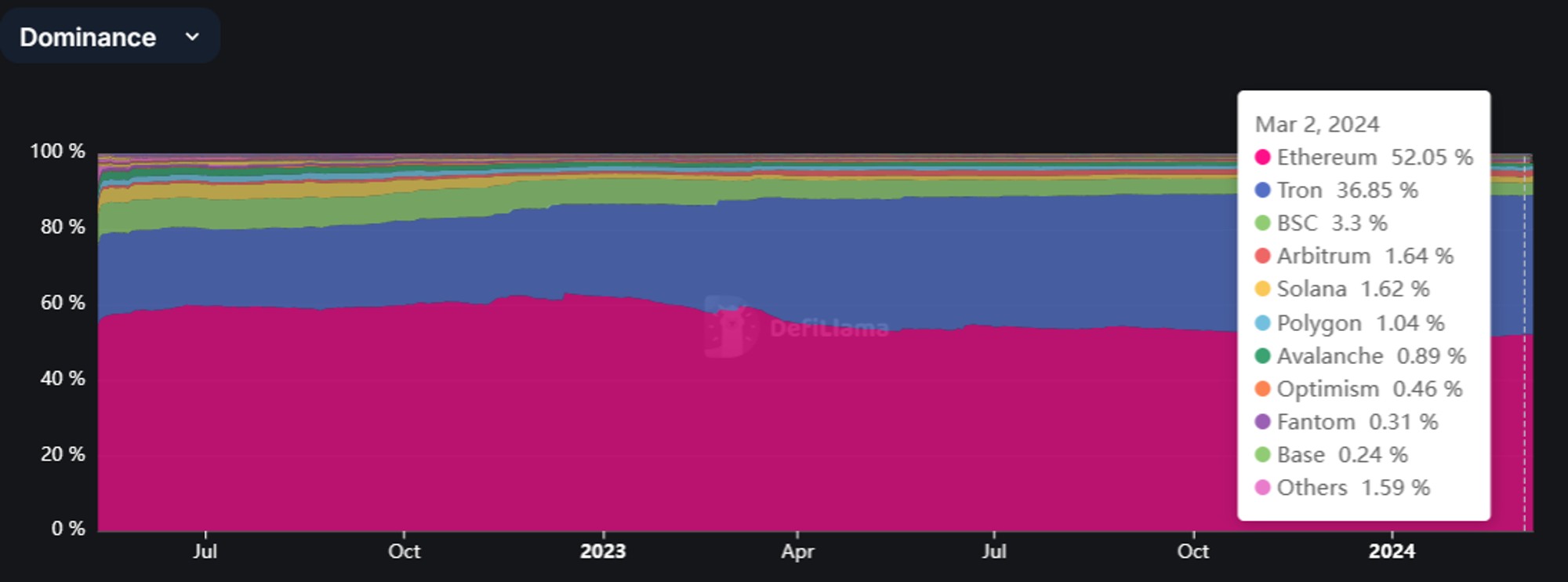

Chain Distribution:

-

Ethereum remains the leading blockchain for stablecoin market cap, although its dominance has decreased from 62% to 52% in 2023.

-

Tron's share has significantly increased, rising from 24% to 37% over the same period.

-

Interestingly, USDT holds a staggering 96% share of the Tron chain's stablecoin market cap.

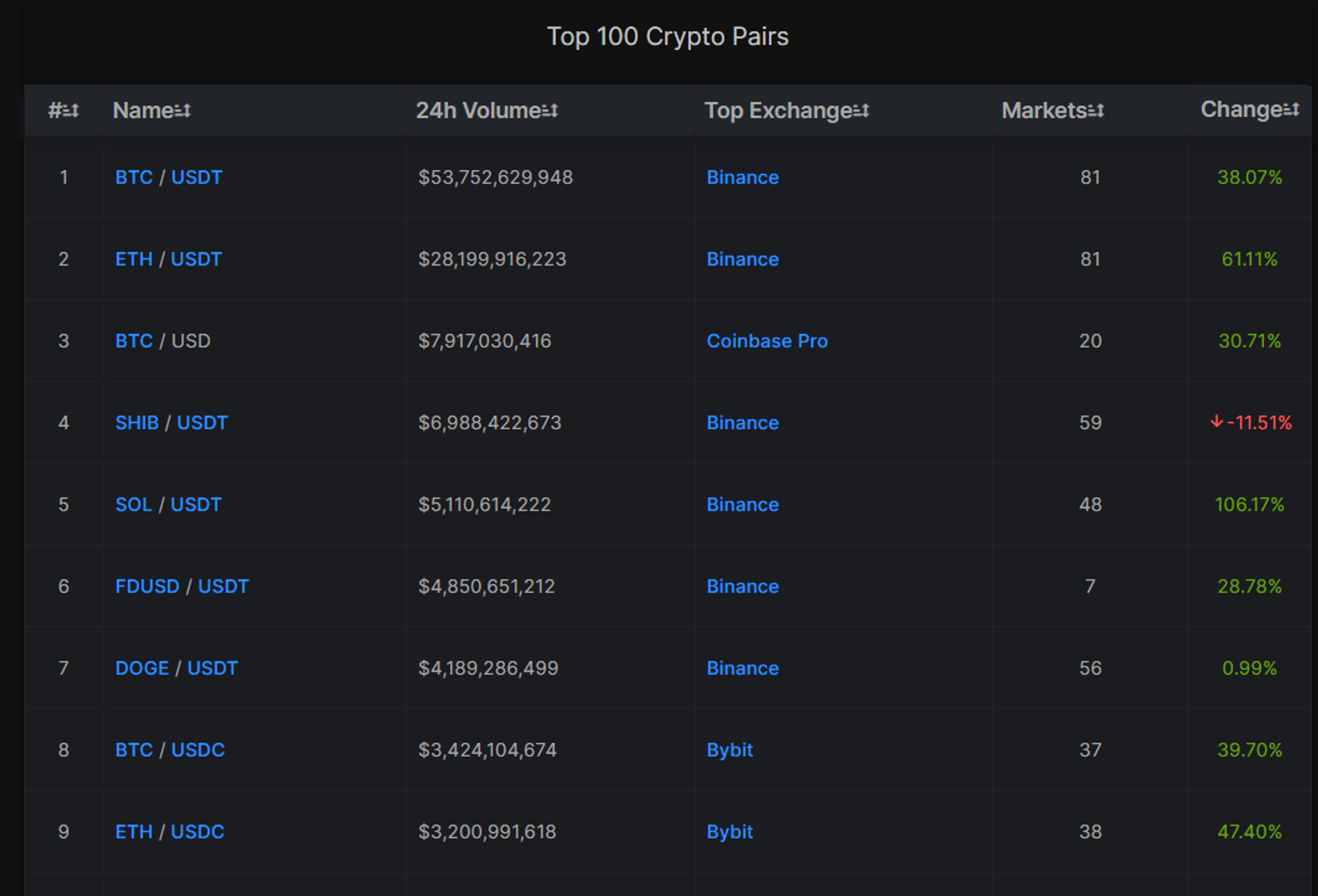

Network Effects:

- USDT dominates DEX (Decentralized Exchange) usage top pairs.

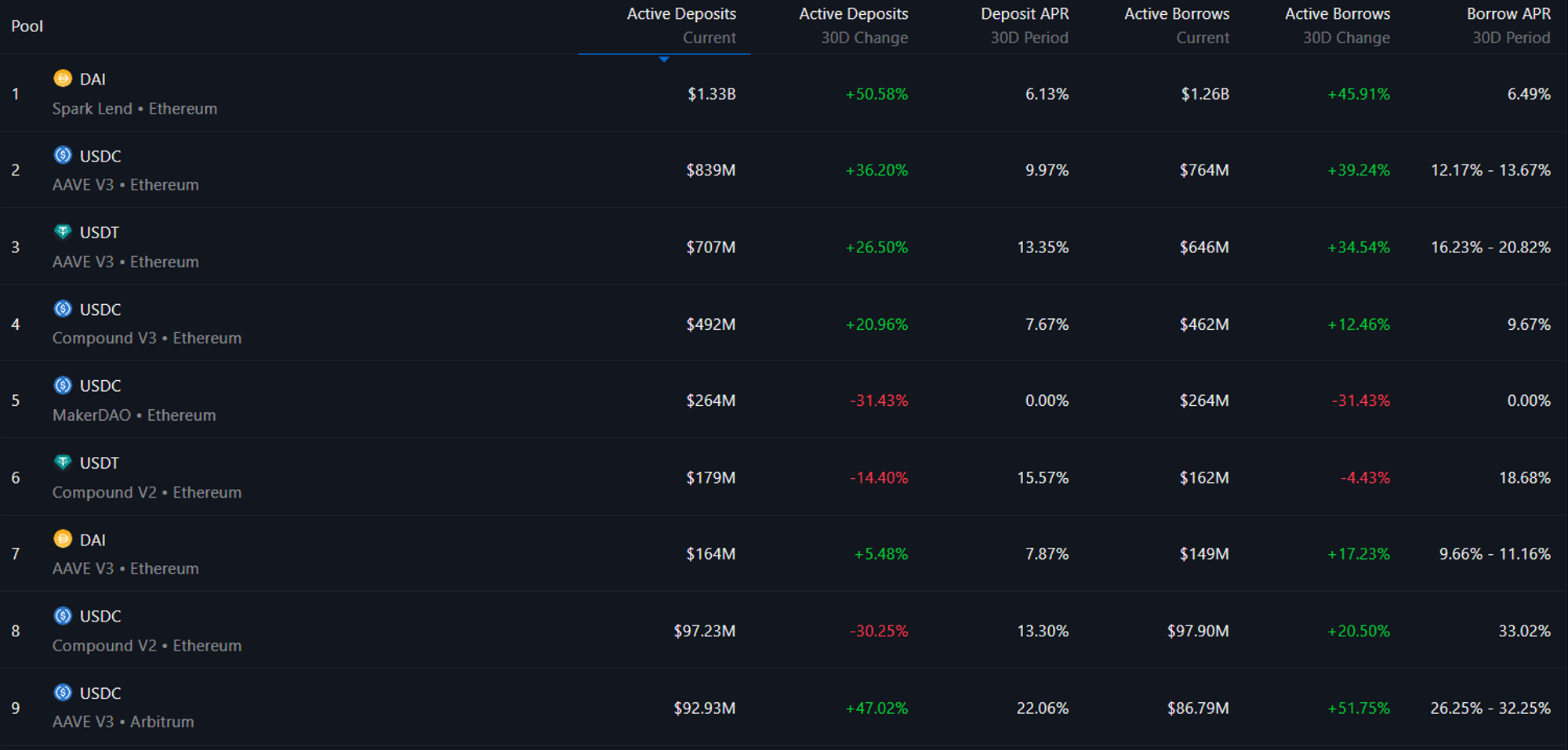

However, USDC takes the lead in lending protocol and bridge transactions, accounting for a remarkable 98.62% of tokens bridged out of Ethereum.

Transactional Differences:

-

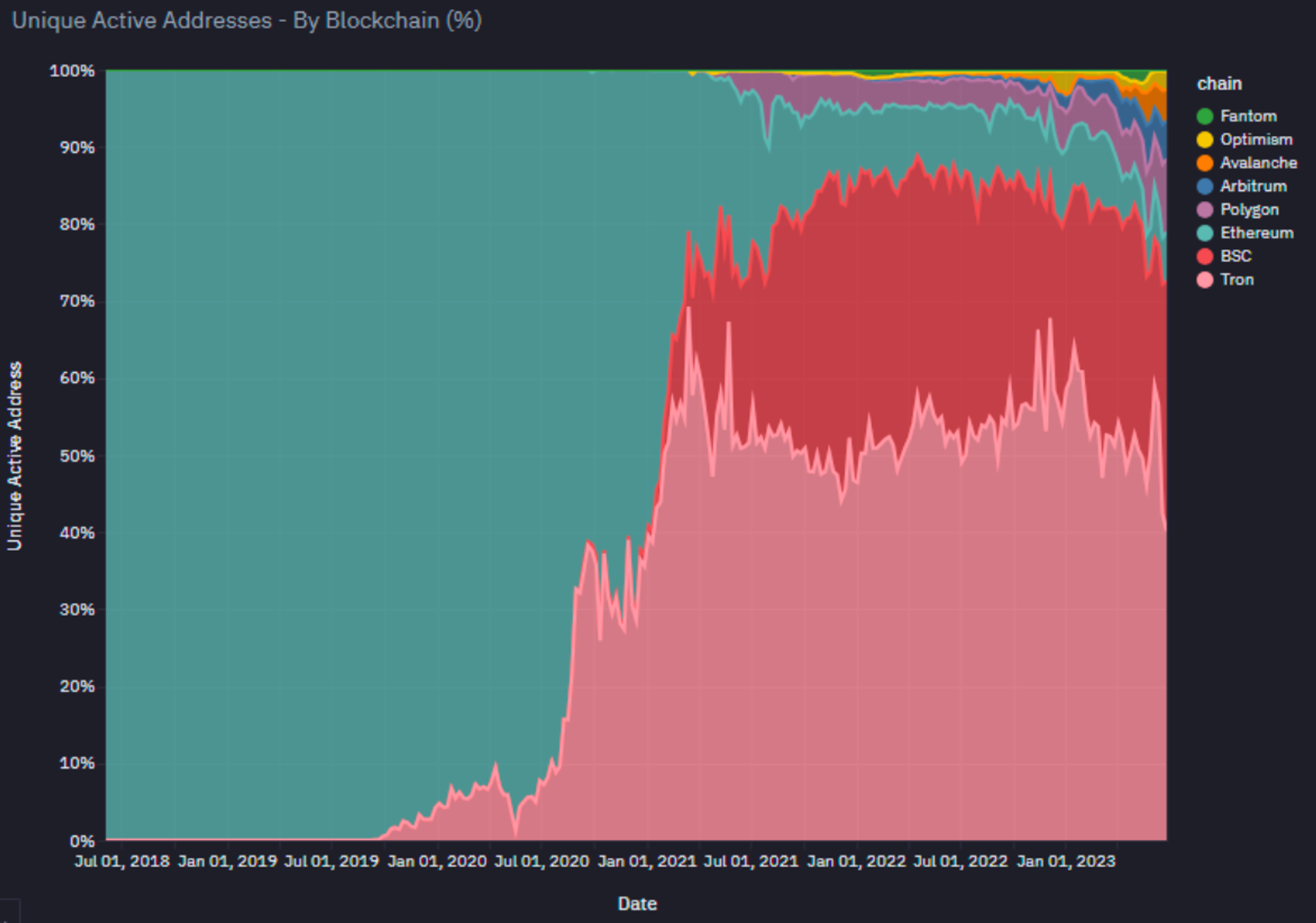

Consumer stablecoin transactions primarily utilize USDT on the Tron network, likely due to its lower transaction fees.

-

Ethereum, on the other hand, sees USDT used for larger-value holdings and transactions, potentially due to its perceived security benefits.

Stablecoin issuers are increasingly exploring the creation of interest-bearing products. These products are typically backed by tokenized traditional financial instruments or real-world assets (RWAs) held off-chain. A notable example is MakerDAO's $DAI, which at its peak, was backed by $3 billion worth of U.S. Treasury bills.

Regulatory scrutiny: “Tether is mostly at risk given its lack of regulatory compliance and transparency, while direct legal actions against offshore entities and decentralized firms are complex, indirect measures and international cooperation could potentially hinder the usage of tether,” analysts led by Nikolaos Panigirtzoglou wrote.

Final Thoughts:

USDT currently holds the clear lead regarding market cap and DEX activity. This dominance is likely to be further strengthened by network effects, potentially solidifying its position throughout 2024. However, regulatory uncertainties and the evolving landscape necessitate close monitoring of this dynamic market.

Resources:

评论 (0)