Yields on blue chip protocols in DeFi are higher than they've been in quite some time. The bull market you dreamt of in 2023 is finally here. Goodbye crab market; hello double-digit yields and high volatility.

This week, we’ve seen crypto markets on the march toward new ATHs, with BTC reaching a new ATH today before dropping in price. ETH almost touched $4,000 today but was rejected. In the last week, the BTC price has climbed over 30% and ETH has seen an increase of ~15%. With that growth comes greater demand for leverage, higher funding rates, and a big jump in the base rate for onchain yields.

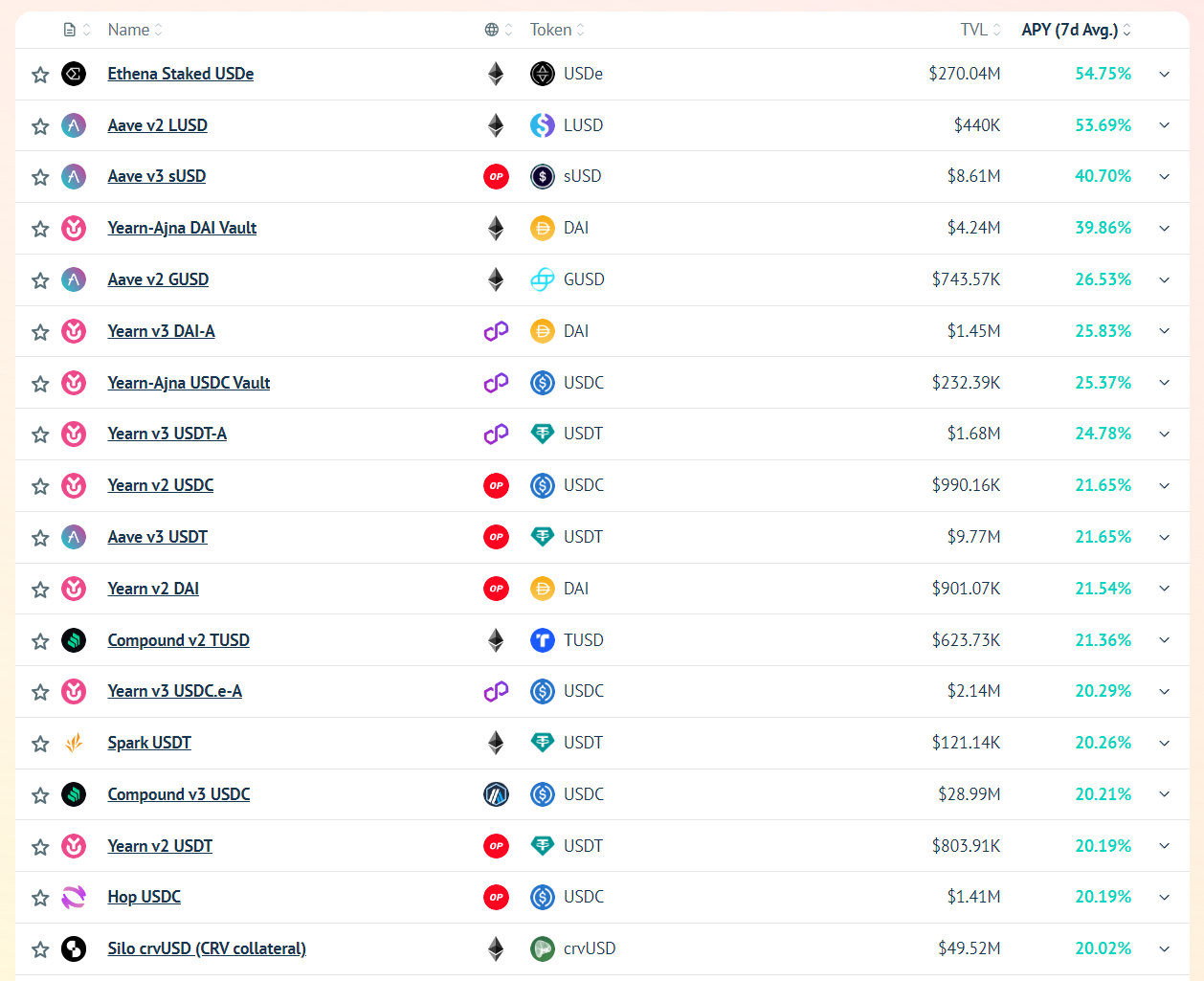

DeFi's Base Rate, Courtesy of Vaults FYI (8 March 2024)

Since I started writing this weekly review, the base rate for yield in DeFi has doubled from 10% to 20%, as shown on Vaults FYI. Utilization is high across lending protocols. In most cases, lending markets are at or above 90% utilization. Onchain APYs are massively increasing, traders are long ETH on perps markets and paying high funding rates, and yield farming protocols like Yearn are providing ever higher APYs for users.

Strategies with minor and moderate complexity are now offering attractive double-digit yields. Strategies for intermediate to advanced DeFi users are yielding far more (with exposure to far more risk, as well).

Let's breakdown yields between stablecoins and ETH by category.

Stablecoin Yields

Stablecoin Base Rate: 16–53%

Activity on lending markets and perpetual markets will always show what the overall sentiment is among traders—in this case, that activity points to a high degree of bullishness. The appetite for leverage has only increased since Issue 1 was published last week. The Aave and Compound governance communities both have active proposals to change their interest rate (IR) curve parameters in response to the high utilization across lending markets. On Kwenta, leverage traders are paying an annualized funding rate of 97% to open long ETH positions.

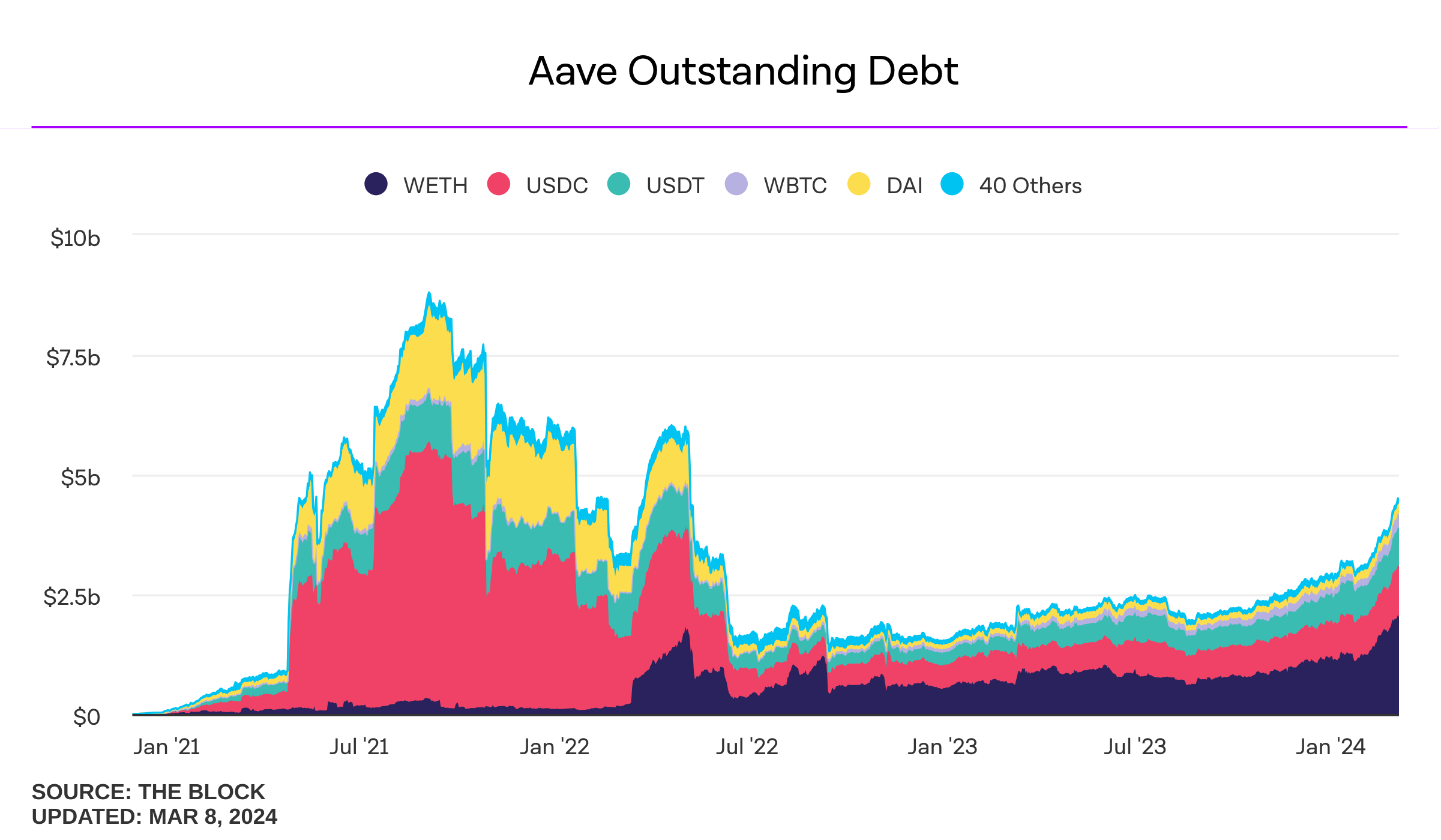

Looking at data from The Block on Aave's outstanding debt shows we're approaching levels we haven't seen since the last bull market ended. In this yield environment, lending markets–one of DeFi's core money legos–are generating double-digit rates for lenders and netting these DAOs significant revenue as people borrow against their crypto assets.

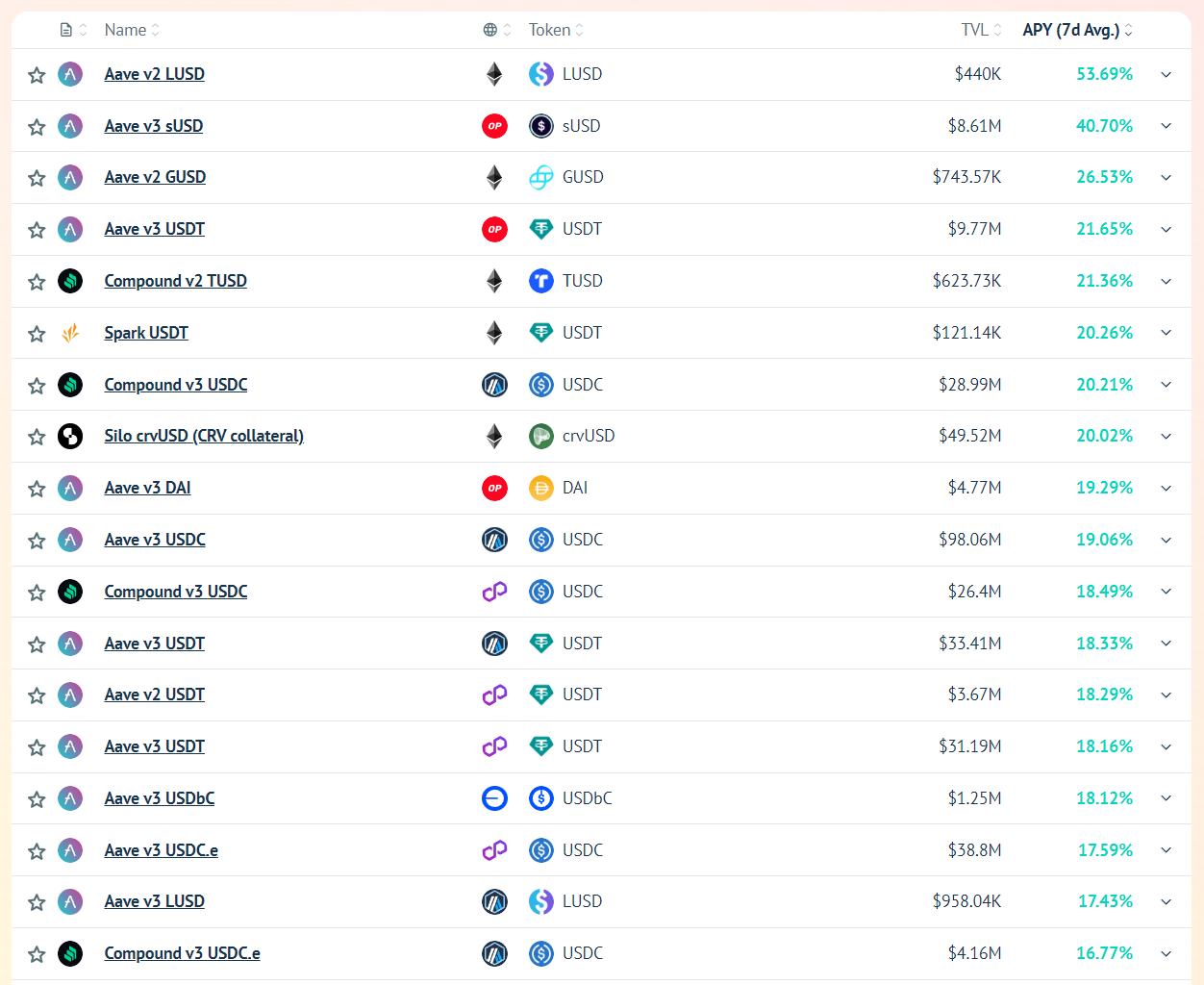

Aave v3 and Compound v3 Markets

Lenders have earned the highest APYs in Aave v2/v3 markets on Ethereum and Optimism, where Synthetix's sUSD is in high demand. In the Aave v2 Ethereum market, sUSD's supply APY is 66.15%, with borrow utilization at 94.21% at the time of writing. In the Aave v3 Optimism market, sUSD's supply APY is 47.02% and borrow utilization is 90.97%.

Rates for centralized stablecoins have also been high in both Aave v3 and Compound v3 markets. On Optimism, lenders can earn 25.66% vAPY on USDC.e (Aave v3); 16.43% vAPY on Native USDC (Aave v3); 17.29% vAPY on DAI (Aave v3); and 13.31% on USDT (Aave v3). On Arbitrum, lenders can earn 52.08% vAPY on DAI (Aave v3); 30.55% vAPY on USDT (Aave v3); 16.48% on Native USDC (Aave v3); 13.63% vAPY on USDC.e (Aave v3); 15.67% vAPR on USDC.e (Compound v3); and 19.54% vAPR on Native USDC (Compound v3).

According to Vaults FYI, the seven (7) day average APY on stablecoins across these markets ranges from 17–54%. Depositing into Aave or Compound can outperform many rates in TradFi, but, again, this comes with smart contract and economic risk that you should familiarize yourself with. As I shared last week, you can buy Protocol Cover from OpenCover on L2s or Nexus Mutual on Ethereum to protect against major onchain risks in both Aave v2, Aave v3, and Compound v3.

Because demand for leverage is so high across major lending markets in DeFi, these markets are seeing utilization rates well above 90%, which provides for great returns for lenders but less liquidity for people looking to withdraw than is ideal. This week, there have been governance proposals that address this problem popping up on forums across DeFi.

Looking Toward Future Lending Market Yields

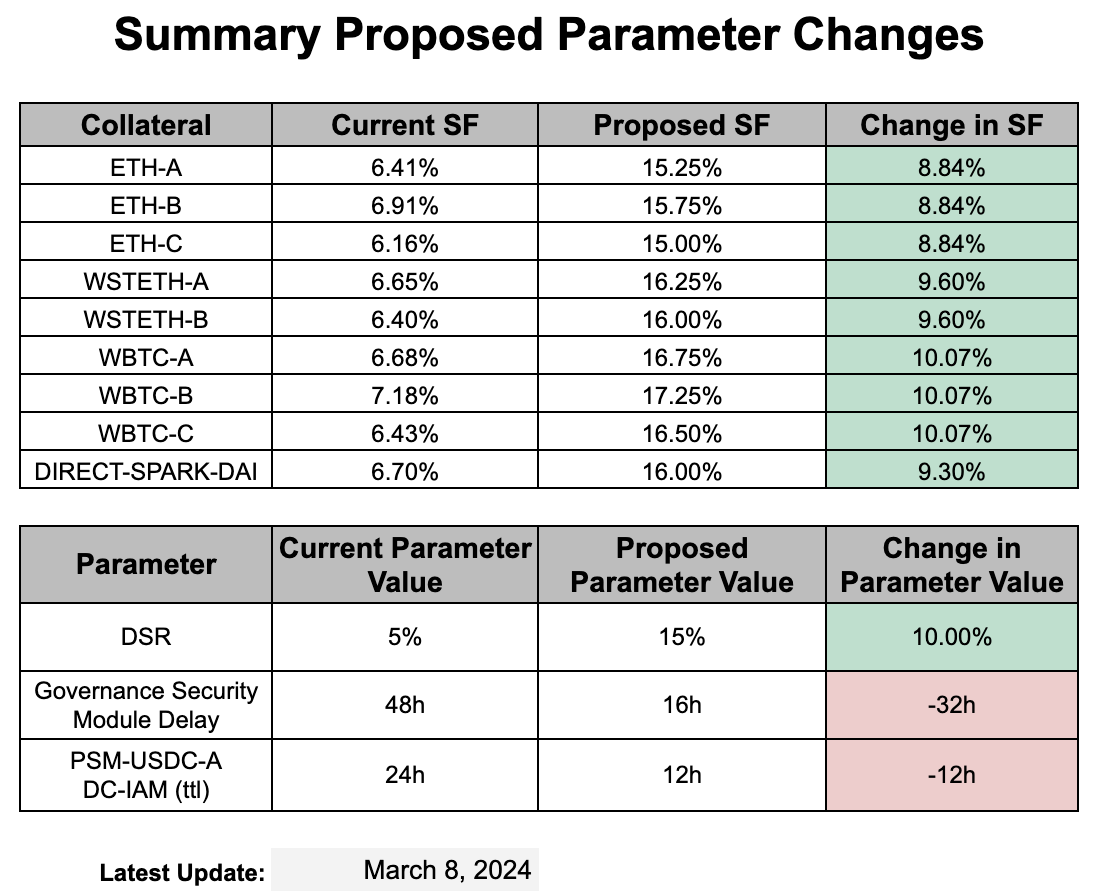

Demand has been so high, Chaos Labs has proposed adjusting the Aave v2/v3 interest rate curve across markets to stabilize borrow demand. The ARFC would increase interest rates to keep utilization rates closer to the 90% optimal threshold. If AAVE holders vote to pass this ARFC, you can expect higher rates on Aave v3 and slightly lower utilization rates, which will ensure there is sufficient liquidity for lenders looking to withdraw from these markets.

In Compound governance, Gauntlet recently proposed reducing COMP rewards across Comet (V3) markets and adjusting the borrow kink (i.e., optimal utilization rate) from 85% to 90%. In December 2023, Gauntlet proposed adjusting the borrow kink from 80% to 85% for their L2 markets. COMP holders voted to approve these changes, and they were enacted in late December.

If Gauntlet's proposal is approved, this would make Compound v3 more attractive for people looking to borrow USDC. With higher utilization, you can still expect attractive interest rates, but the reduction of COMP may impact the APY you can earn as a borrower. If these changes result in greater growth in Comet markets, the COMP incentives may not be missed, as rates could be sustained at current levels without incentives, which would help cut COMP emissions.

The MakerDAO community is also evaluating an increase in borrow rates within Maker Vaults and an increase to the DAI Savings Rate (DSR). The proposed changes would help Maker stay competitive and grow the DAI supply, which has seen a 14% drop in just the last week. The BA Labs team, who authored this proposal, has said this is a temporary measure to make DAI a competitive asset to hold while the wider market sees a period of high rates and high volatility. A boost in the DSR to 15% will anchor the base rate to that value and likely lead to higher rates across DeFi in yield aggregators and lending markets for DAI holders.

I highly doubt we'll see interest rates on DeFi lending markets decrease much, if at all, over the next several months. These governance proposals will help balance supply and demand, attract more capital, and offer borrowers more liquidity. If utilization says around 90% in these markets, high APYs are here to stay.

Stablecoin LP Yields

Last week, I highlighted Aerodrome and Velodrome for attractive APYs on stablecoins. With the uptick in APYs on lending markets, there's more competition for stablecoin capital. While there are high yield opportunities for stablecoin LPs on Velodrome and Aerodrome, there's been a noticeable shift in APYs for crvUSD LPs on Curve. If you plan on LPing in any of these markets, Beefy provides a noticeable boost, which is worth checking out if you're a fan of auto-compounding positions.

The Beefy crvUSD/USDT Vault on Optimism offers 32.84% vAPY, which is 2x the current stablecoin base rate. This is also a "zappable" vault, meaning you enter the position with one asset—Beefy will present you with a zap route, where your single asset is converted to crvUSD and USDT, deposited into the Curve LP, and staked in the Beefy vault.

The other Beefy vaults offer APYs ranging from 22.02–25.29%. You can check out the following vaults if you're interested in other Beefy stablecoin LPs with APYs above the base rate.

-

Beefy crvUSD/USDC Vault (Optimism) | 25.29% vAPY | Underlying Strategy: Curve

-

Beefy crvUSD/USDC.e Vault (Optimism) | 24.83% vAPY | Underlying Strategy: Curve

-

Beefy DAI-USDCe sLP V2 Vault (Optimism) | 24.31% vAPY | Underlying Strategy: Velodrome

-

Beefy USDC-USDC.e sLP V2 Vault (Optimism) | 22.02% vAPY | Underlying Strategy: Velodrome

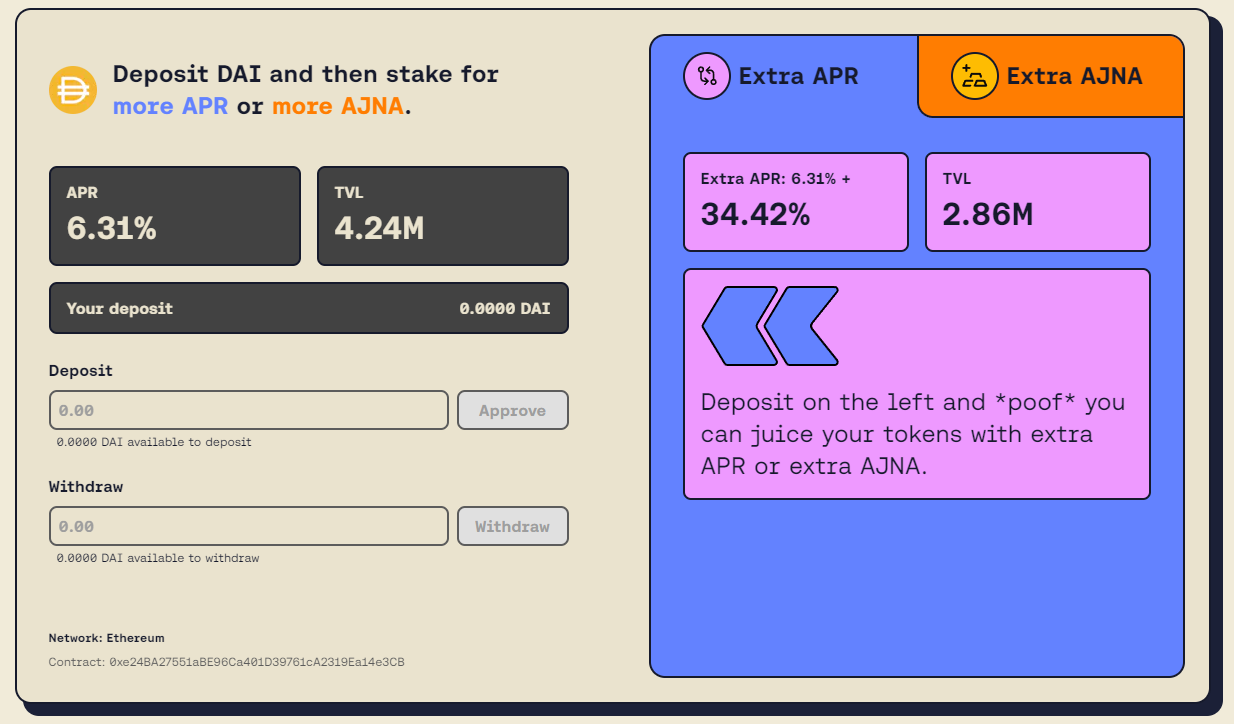

Yield Optimisers

Yearn was building during the bear market and they launched just in time for the bull. They've been dominating the yield field with their Yearn Juiced Vaults, which use Ajna Finance as an underlying yield source. The Juiced DAI Vault on Yearn currently offers a base 6.31% APR with an added *juiced* APR of 34.42% for a total of 40.73% APR on your DAI. The Juiced USDC Vault on Yearn isn't as high but still appealing, with a base 0.87% APR and an added *juiced* APR of 25.32% for a total of 26.19% APR.

The Yearn folks have been using Ajna's permissionless lending market as a major building block and we'll continue to see high double-digit yields in Yearn's Juiced Vaults.

Keep an eye out for a new cover product from Nexus Mutual, which will launch in the near future, that offers full-stack protection for Yearn's Juiced Vaults for those who want to deposit but need protection against smart contract risk.

ETH Yields

ETH Base Rate: 3–4.3%

As I shared last week, the base rate for ETH is tied to staking yields, and that rate hasn't changed since last week. Liquid restaking tokens (LSTs) continue to dominate the yield landscape, though there are efforts to raise WETH utilization in DeFi lending markets, as evidenced by the ACI's Merit Program proposal. We're still seeing yield opportunities above the base rate in Liquid Restaking, Yield Optimizer, and LP protocols.

Let's see where users like you can beat the base rate.

Lending Markets

Currently, ETH lenders can earn 1.66% vAPY in the Aave v3 Ethereum market; 2.52% vAPY in the Compound v3 Ethereum market; 5.77% vAPY in Block Analytica's MetaMorpho market on Ethereum; and 17.52% vAPY in Re7's MetaMorpho market on Ethereum. While Aave v3 and Compound v3 are still below the base rate for ETH if you're just looking to lend and earn, the MetaMorpho markets are offering high APYs with added incentives and strong demand for leverage strategies that are primarily focused on LRTs.

The weETH/WETH market managed by Re7 offers a 54.62% vAPY for WETH lenders. Because demand to farm points is so high in DeFi, the weETH → WETH recursive loop strategy is generating substantial borrow demand. The MetaMorpho markets just launched at the beginning of the year, so there's still a fair degree of risk but the yield is far higher here than in other lending markets.

For those of you who weren't here during DeFi summer or the last bull market, a recursive loop strategy is one where you deposit one asset as collateral, use it to borrow another asset, and then deposit the borrowed asset as collateral to borrow more. These strategies are effective when there's some kind of liquidity mining incentives for both lenders and borrowers. In this case, people running this strategy are earning ETH staking yields, Etherfi loyalty points, and EigenLayer points. It comes at a cost, though, and is still largely driven by airdrop speculation. As always, be careful when using leverage. Don't get blown out at the start of this bull market.

Looking Toward Future Lending Market Yields

Lending markets will be adjusting parameters and change interest rate curves in response to such significant demand. As MetaMorpho markets grow, onboard more capital, and mature, the rates likely won't be so high. Aave still dominates the lending sector and has the most TVL of any lending protocol in DeFi.

Of note is the Merit Program, as proposed and designed by the Aave Chan Initiative (ACI). The Merit program would offer $2.1M in WETH and $2.9M in GHO incentives for Aave users who borrow WETH and GHO on Aave v3's Ethereum market. If this proposal moves to an AIP and is adopted by AAVE holders, this should increase WETH interest rates for lenders.

Keep an eye on Aave governance to keep up with the Merit Program's transition through the governance process.

Liquid Restaking

Last week, I highlighted the incredible momentum of EigenLayer and the points economy they've created, which has continued across other protocols building on top of EigenLayer.

The points economy is going strong, with Pendle benefiting more than anyone at this point. Pendle allows users to separate their principal from their yield. Because there's such an incredible appetite to farm points, people are paying LRT holders for their points over a defined maturity.

Currently, LRT holders willing to sell their points can earn high ETH yields on Pendle:

-

ezETH holders on Ethereum can earn a fixed APY of 41.01% for the next 47 days

-

eETH holders on Arbitrum can earn a fixed APY of 33.37% for the next 47 days

-

rsETH holders on Arbitrum can earn a fixed APY of 33.20% for the next 47 days

-

rsETH holders on Ethereum can earn a fixed APY of 24.21% for the next 110 days

It's been incredible to see the market speculate on EigenLayer and other LRT project's points. There are even elaborate Dune dashboards where people provide estimates on the potential value of EigenLayer points—the Dune dashboard linked here is courtesy of hahahash.

While EigenLayer hasn't launched yet and the yield here is purely based on speculation, there is a remarkable opportunity to earn on ETH by selling points. There are those who are so bullish, they can't get enough points. Gearbox v3 has answered the prayers of every leverage points farmer in DeFi with their one-click strategies. If you're an experienced DeFi farmer, you can earn 18x the Etherfi or Renzo points and 9x the EigenLayer points using one of Gearbox v3's leverage strategies.

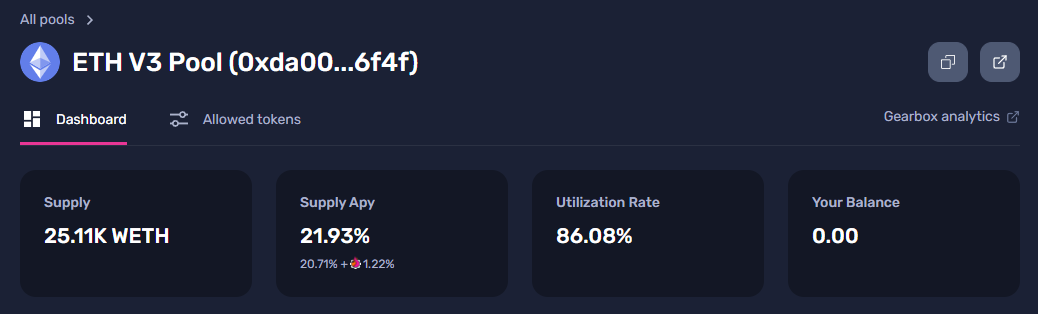

The insane demand for leverage has raised interest rates in the Gearbox v3 passive earn market, where lenders can earn 21.93% APY on their ETH when they deposit and offer liquidity for leverage traders.

All of these strategies come with added risk, and I'd recommend checking out OpenCover and Nexus Mutual for Protocol Cover on Pendle and Gearbox v3. In the coming weeks, there may be full-stack protection coming for one of the EigenLayer + Pendle strategies, so keep an eye out for that announcement.

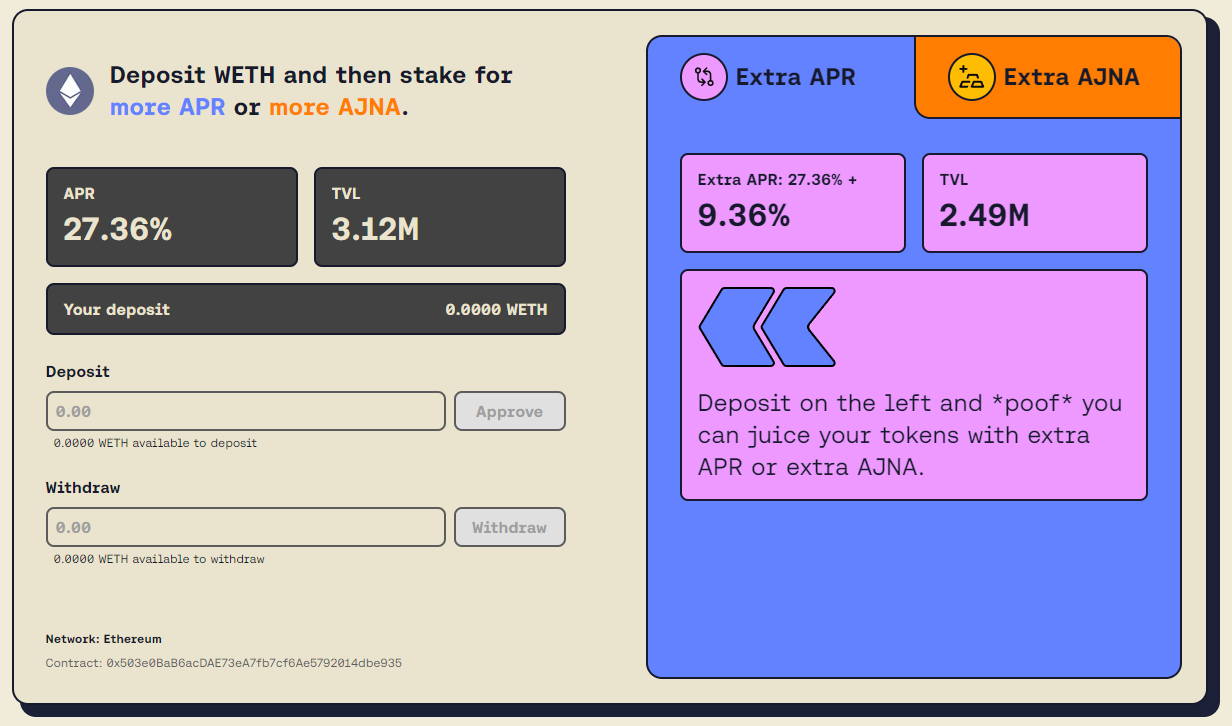

Yield Optimisers

Once again, the chads at Yearn have been offering incredible yield on ETH in the Juiced Vault, where you can earn a base APR of 27.36% with a *juiced* APR of 9.36% for a total of 36.72% on your ETH. I've yet to see any other yield optimizers compete with Yearn at this rate. The only one that compares is Pendle.

LP Yields

If you're looking to take a more hands-off approach to earning yield, you can find a correlated ETH LP strategy. LRTs still offer the highest yields, even for LPs.

The rsETH/ETHx Balancer v2 LP can be staked in Aura Finance for 37.78% vAPR, where you'll primarily earn yield in BAL and AURA rewards plus the trading fees you earn. Beefy's weETH-rETH Vault offers 13.86% vAPY, as well.

While there are opportunities to earn high yields as an LP, the yield can vary as incentives change week-to-week. Currently, these yields are attractive if you're looking to earn passively, but Yearn's Juiced Vaults offer a similar experience with a competitive yield.

Pendle outperforms both but because the fixed APY is for set maturities, it won't be yield available for long durations. All of the opportunities offer yields that will likely change on a longer time frame, so keep that in mind, as well.

Takeaways for this Week's DeFi Yields Report

The market is still moving and there's plenty of speculation about the ETH ETF driving volume. Stablecoin yields are through the roof as people take long positions on ETH and try to find the best yield across L2s. The EigenLayer effect has created a blackhole of demand for ETH that is driving current ETH rates across DeFi protocols. This yield environment will start to attract money from TradFi. If an ETH ETF is approved in May, we'll see more ETH held on Coinbase, but it's likely more money flows onchain to farm these high yields.

With the proposed changes coming to lending markets, it will be more expensive to take a leverage position. Who knows if that will taper demand or if degens will pay for their leverage. Either way, it will lead to higher rates on stablecoins if utilization stays as high as it's been over the last month.

As crypto prices climb, yields increase, and the market continues this bullish trend, it's highly likely we'll see some large exploits in DeFi. IntoTheBlock published "Decoding DeFi Risks: Exploring the Data Behind $50B+ in DeFi Losses" in early February on The Defiant, where they highlight the different technical and economic risks DeFi users are exposed to.

Don't dismiss these risks. I'm a firm believer in Nexus Mutual's Protocol Cover, which protects against the major risks in DeFi: smart contract hacks/exploits; oracle manipulation/failure; liquidation failure; and governance takeovers. Protecting your productive crypto only costs a portion of your yield. Don't let a hack wipe you out in this bull run.

You can buy Protocol Cover from OpenCover on L2s or Nexus Mutual on Ethereum mainnet. The majority of the protocols I highlighted in this report are available on both OpenCover and Nexus Mutual. Below, I've included links to those listings.

There's yield out there for everyone. You can farm safely, manage your risk, and grow your portfolio. I'll be back next week with an updated look at the state of DeFi yields.

Until next time, stay safe out there.

评论 (0)