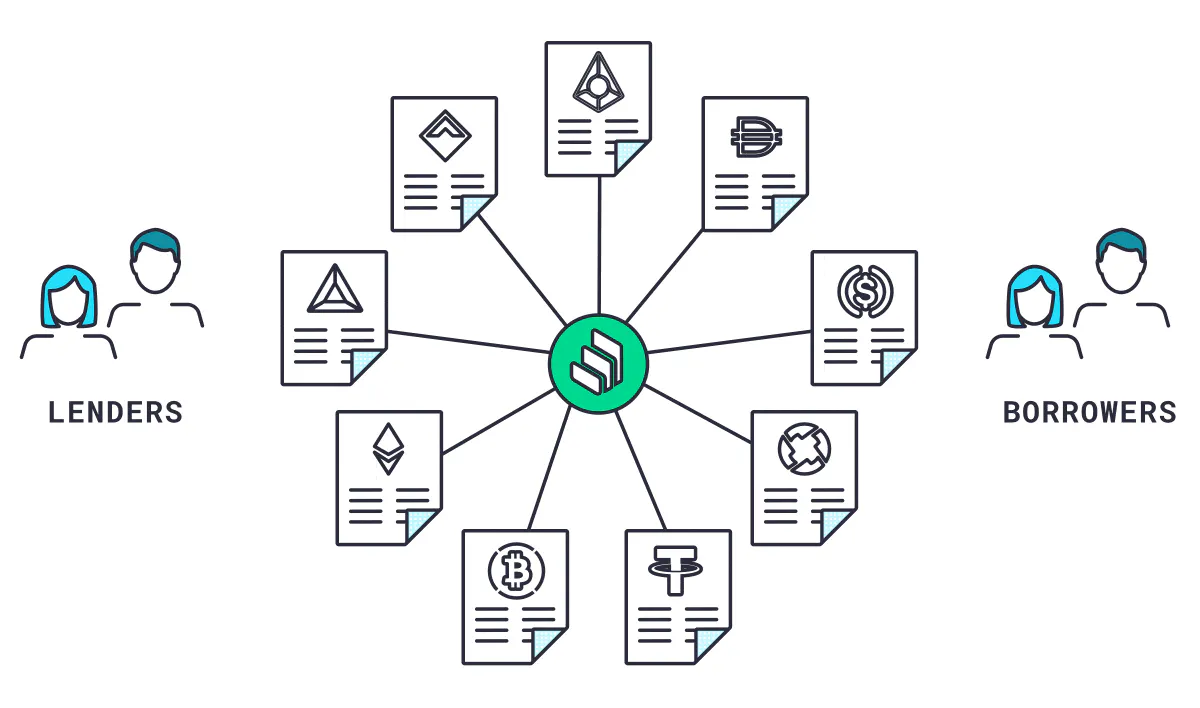

Loan services play a pivotal role in the financial sector by connecting suppliers and demanders of capital, thereby enhancing the efficiency of the financial system. Traditional financial institutions, particularly banks, predominantly offer two main types of loan services: credit loans and secured loans. Credit loans are provided based on the borrower's creditworthiness and ability to repay, whereas secured loans involve using certain assets (e.g., real estate) as collateral to execute the loan.

The blockchain-based decentralized finance (DeFi) market attempts to replicate these traditional financial system functions using cryptocurrencies but faces several challenges.

Firstly, the anonymity of blockchain makes the realization of credit-based loans difficult, as the public key encryption method allows transactions without verifying user identity, complicating credit assessment. This presents a risk of default.

Secondly, the high volatility of cryptocurrencies makes it challenging to accurately evaluate the value of collateral, imposing constraints on the implementation of loan products similar to those in the traditional financial market. Despite these challenges, there is a clear demand for cryptocurrency loans, and efforts have been made to meet this demand through centralized exchanges or P2P lending protocols.

The Emergence of Compound

The Compound protocol, considering the characteristics of blockchain and cryptocurrencies, implemented a system where users can provide cryptocurrency as collateral to borrow other cryptocurrencies. Compound uses an over-collateralization loan system, where the value of the loaned assets is set lower than that of the collateral assets, to reduce the risk of default.

Key Mechanisms in the Over-Collateralized Loan System

-

Interest Rate Determination

The interest rates for deposits and loans are determined based on the supply and demand of assets on the blockchain, distinct from traditional currency, where central institutions (banks) set the rates. Instead, in this protocol, rates are determined through algorithms and voting. -

Liquidation

Liquidation refers to the process of confiscating and auctioning off the collateral assets (e.g., real estate) when their value falls below that of the loaned assets, to forcibly repay the loan. As Compound operates a decentralized over-collateralized loan service, central institutions do not manage the collateral and loans. Thus, Compound does not directly liquidate the borrower's collateral. Instead, liquidation is conducted through a third party.

DeFi Summer Led by Compound

Compound's launch and its development trajectory hold a significant chapter in the history of decentralized finance (DeFi). When Compound was introduced to the market in September 2018, it was one of many projects aiming to innovate traditional financial services using cryptocurrency and blockchain technology. However, the subsequent Crypto Winter, characterized by a sharp decline in cryptocurrency values and a cooling market, presented growth challenges for many digital asset projects, including Compound.

A pivotal moment for Compound's leap came in 2020. In June, Compound began distributing its governance token COMP, which became tradable on exchanges and started to increase in value. The COMP token granted users the right to participate in the governance of the protocol, allowing them to directly influence future decisions of the protocol. With the introduction of this incentive mechanism, people began actively using the Compound platform to acquire more COMP tokens, heralding the onset of the DeFi boom, or the so-called DeFi Summer.

DeFi Summer significantly increased public interest and participation in cryptocurrency and blockchain-based financial services. During this period, various DeFi projects quickly emerged, offering new financial opportunities and injecting vitality into the entire cryptocurrency market. The success of platforms like Compound demonstrated the innovative potential of the DeFi sector and served as a pivotal example of how cryptocurrency and blockchain technology can transform traditional financial systems.

Reddish Capital - For DeFi Summary of Neo Ecosystem

Launched even before Ethereum in 2014, the Neo blockchain was designed to allow developers to create smart contracts using languages more familiar to them, such as C#, JavaScript, and Python, unlike Ethereum's Solidity. However, the DeFi innovation wave primarily occurred within the Ethereum ecosystem, making it challenging for platforms developed specifically for Ethereum, like Compound, to easily integrate into the Neo ecosystem.

Fortunately, the DeFi ecosystem's essential component, the DEX (Decentralized Exchange), saw rapid development and success thanks to the efforts of the Flamingo Team. Yet, the Neo ecosystem still lacked a collateralized lending protocol.

As we enter 2024 and with the resurgence of Crypto Summer, Reddish Capital aims to ignite a DeFi Summer within the Neo ecosystem by launching a collateralized lending protocol based on the Compound concept. Join Reddish Capital in this innovative venture and be part of the DeFi Summer awakening in the Neo network.

Stay tuned as we explore these possibilities and more, shaping the future of the Neo blockchain with every step we take.

Community Links

X: twitter.com/reddish_capital

Discord: discord.gg/GxD6TetR7J

评论 (0)