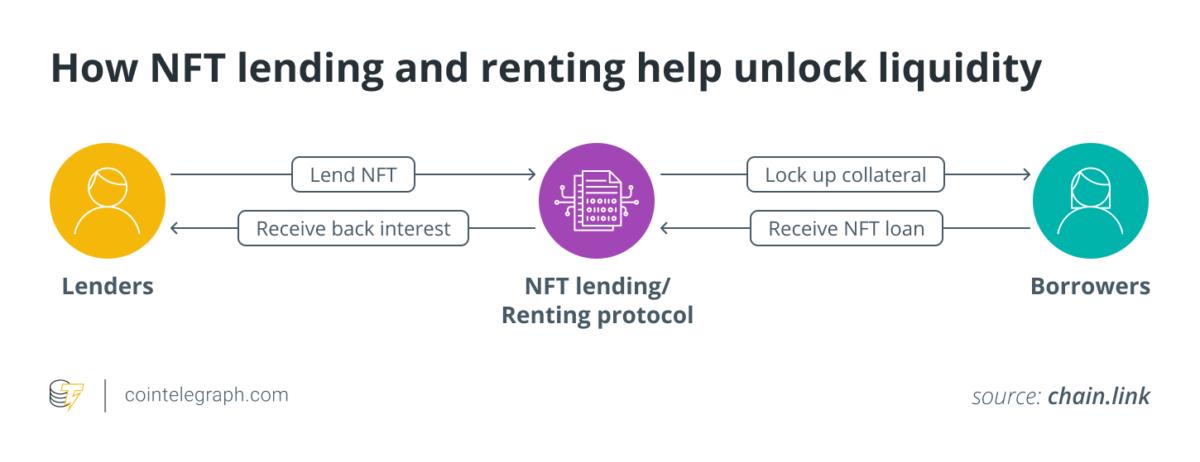

NFT Lending is a new financial service for NFT holders that allows them to leverage their existing NFTs as collateral for loans, unlocking liquidity without selling their assets.

NFTs (Non-fungible Tokens) are unique digital assets gaining traction in the cryptocurrency space. Anything from digital art and music to in-game items and even real estate can be represented by an NFT.

How Does NFT Lending Work?

There are different models for NFT Lending platforms, but the general process involves:

-

Peer-to-Peer (P2P): NFT owners list their NFTs as collateral on the platform to receive loan offers from other users.

-

Peer-to-Protocol (P2P): Borrow directly from a DeFi protocol by locking your NFT into the protocol's smart contract as collateral.

Benefits of NFT Lending for Collectors

-

Unlock NFT Liquidity: Holders can utilize their NFTs, such as borrowing funds to invest in other digital assets, without selling them.

-

Access Capital Without Credit Checks: Unlike traditional finance, NFT loans bypass credit checks, potentially appealing to those with limited or bad credit.

-

Opportunities for Collectors and Artists: Digital art creators and collectors can leverage NFT Lending to further explore the space.

Risks of NFT Lending

-

NFT Price Volatility: The fluctuating value of NFTs can impact collateral value. If the NFT value falls below the loan amount, it could lead to liquidation (where the borrower defaults and the lender claims the NFT).

-

Low Liquidity: While NFT Lending helps unlock liquidity, the overall NFT market remains illiquid. If a borrower defaults, the lender may struggle to sell the NFT to recoup funds.

-

Smart Contract Risk: Collateralized NFTs and loan terms are locked in smart contracts, vulnerable to bugs or hacks that could result in NFT or fund loss.

-

Regulation Uncertainty: The regulatory environment surrounding crypto, DeFi, and consequently NFT Lending, remains unclear. Regulatory changes could significantly impact the market and viability of NFT Lending.

NFT Lending offers a solution for the low liquidity of NFTs, allowing holders to leverage their assets. However, drawbacks exist. NFT minting can be energy-intensive, and Ethereum gas fees for validating transactions can be high.

评论 (0)