Given the current tightness in Liquid and financial constraints, I've curated a cost-effective strategy leveraging Pendle, borrowing, and lending to amplify our funds' impact. Let's dive into the details!

Strategy 1 – Mantle Network – $200

Mantle x INIT Protocol x Ethena x Eigen

Merchant Moe: https://merchantmoe.com/

- Buy $200 MNT/WETH/METH

INIT Protocol: https://app.init.capital/points?ref=63276F

-

Deposit MNT/WETH/METH as collateral

-

Borrow $100 USDT against deposit

Merchant Moe: Swap USDT for USDe

Pendle: https://app.pendle.finance/points

- Deposit $100 in YT Pool for leverage of $600

You will also earn eigen points for every shard you accumulate.

Strategy 2 - Ethereum or Arbitrum Network - $400

https://app.pendle.finance/points

Now, let’s explore exposure to LRT on Pendle. I recommend Pendle’s YT pools for the SMOL fish to get SIZE at low cost.

Here we are farming Kelp x Renzo x Zircuit x EtherFi x Eigen – Ethereum Network

-

Deposit $200 into 2 YT pools on Pendle. Play around with figures to reach your target amount.

-

At the time of writing, just $200 USDT gives you 0.8E worth of exposure.

Reminder: You can sell these tokens at any time. Rotate out before June 27 (maturity) to avoid losses.

Arbitrum Network - Honourable mention to the farm on Arbitrum there is currently a YT pool which expires in 10 days which is offering an insane amount of leverage. You can’t Lego the YT pools like you can on Ethereum but you will save a lot in fees so the pools are worth looking at.

Strategy 3 – Linea Network – $300

This strategy combines Linea Early Adopter status, Renzo, and ZeroLend.

To qualify as an Early Adopter, deposit 0.1E into any protocol on LINEA.

Renzo: https://app.renzoprotocol.com/?ref=0x2c2eddb62ddf2905b89a3698e5ef4f7647e4e6a0

Deposit 0.1 ETH into Renzo to receive ezETH.

ZeroLend: Step one

Deposit ezETH into the ezETH pool for rewards.

DISCLAIMER: If you are feeling like a degenerate you can borrow against your ezETH and LOOP it back through RENZO. BUT I ONLY RECCOMEND THIS IF YOU KNOW HOW TO UNWIND AND MANAGE YOUR LTV RATIO IF YOU DON’T YOU WILL GET LIQUIDATED!

Added Note on ZeroLend: ZeroLend will charge 0 fees from all users for lending/borrowing on the Linea, Blast, Manta & Ethereum markets until Chapter 1 is completed. That is till TGE on April 29th.

Points Programme and Quests:https://airdrop.zerolend.xyz/#/?invite=DocnsISJU9Zn

Strategy 4 – Scroll Network – Scroll x Ambient Finance x Kelp - $100

Ambient Finance – Provide liquidity in the RSeth – ETH liquidity pair: https://ambient.finance/trade/market/chain=0x82750&tokenA=0x0000000000000000000000000000000000000000&tokenB=0xa25b25548b4c98b0c7d3d27dca5d5ca743d68b7f.

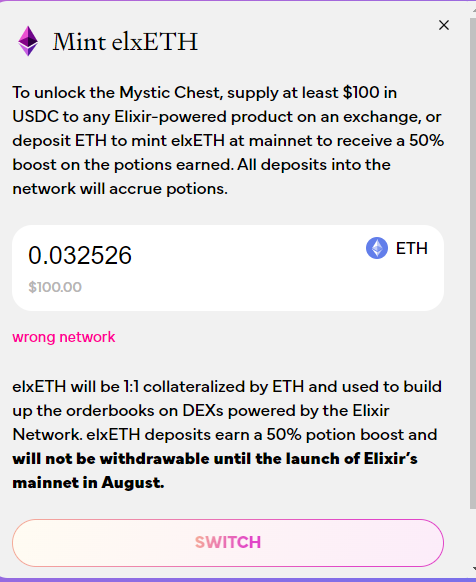

Strategy 5 – Elixir – Ethereum Mainnet - $100

No legos here, just a niche project.

Step 1: - https://www.elixir.xyz/refer/feeney4775

: Deposit $100 USDC and mint elxETH. It will be 1:1 collateralized by ETH and used to build up orderbooks on DEXs powered by the Elixir Network.

ElxETH deposits earn a 50% potion boost and will not be withdrawable until the launch of Elixir’s mainnet in August.

That concludes it. Remember these are just rough figues and you can use how much how little you want. only got 500$ just half the amounts!

评论 (0)