A week ago, I was reading through Vitalik’s blog about prediction markets and how it can be potentially extended to a new concept called info finance.

What Vitalik was trying to say was processes like prediction markets come “with potential to create better implementations of social media, science, news, governance, and other fields”.

So I started digging into this idea, wondering if it could actually work in the real world.

And you know what?

It clicked - especially when thinking about news verification. What if we could create a system where people put their money where their mouth is when claiming something is true or false?

Look at Polymarket - it's a perfect example of how this could work. When real money is involved, people suddenly get serious. They do their homework, think twice before making claims, and actually share valuable information they might have. And the results? Their predictions have been surprisingly accurate.

Makes sense, right? Nobody wants to lose money betting on something they aren't really sure about.

This got me thinking - what if we applied the same idea to verifying news? Instead of just having fact-checkers tell us what's true or false, we could have markets where people actually bet on the truth. If you're really confident a news story is false, and you have good evidence to back it up, you could profit from that knowledge. And if you're wrong? Well, there goes your money.

I found myself getting more and more excited about this idea. It's not just another blockchain project - it is a practical way to use these technologies to solve a real problem we are all struggling with: figuring out what's true in today's flood of information.

This led me down the rabbit hole of building this project. But before diving into the implementation details, let's understand what exactly a prediction market is and why it's particularly suited for news verification.

Understanding Prediction Markets: A Primer

Prediction markets operate on a fascinating principle: they bring in the collective wisdom of crowds through financial incentives. You can imagine them as specialized betting markets where participants put their money behind their beliefs about future events or facts. For example, in a traditional prediction market, you might see questions like "Will candidate X win the election?" or "Will project Y launch before December?"

To understand how they work, let's walk through a simple example.

Suppose there's a market about whether it will rain tomorrow. The market creates two tokens: "YES" and "NO." Each token will be worth $1 if correct and $0 if wrong. You start off the market with 50% probability of each scenario being correct.

If you're confident it will rain, you might buy "YES" tokens. Let's say the current market price is $0.70 per token, suggesting the market collectively estimates a 70% chance of rain. This price isn't static – it's determined by an Automated Market Maker (AMM), which adjusts prices based on trading activity. As more people buy "YES" tokens sharing your confidence in rain, the AMM automatically increases the price, perhaps to $0.80 or higher, reflecting the strengthening collective belief in rain. Conversely, if more people doubt it will rain and buy "NO" tokens, the price of "YES" tokens would decrease.

The potential profit works like this: if you bought "YES" tokens at $0.70 and it does rain, each token becomes worth $1.00, giving you a profit of $0.30 per token ($1.00 - $0.70). However, if it doesn't rain, your tokens become worthless, and you lose your entire $0.70 stake. This significant financial risk and reward structure creates a powerful incentive for participants to thoroughly research weather patterns, analyze meteorological data, and carefully consider local conditions before committing their funds.

What makes prediction markets particularly powerful is their ability to aggregate information from many sources. When someone has insider knowledge or expert insight, they're incentivized to trade on that information, pushing prices toward the true probability of an event. This is why prediction markets often outperform individual experts and polls in forecasting outcomes.

The Issue with Centralized Fact-Checking: Where Current Systems Fall Short

Traditional fact-checking faces several major challenges in today's fast-paced digital landscape. Centralized fact-checking organizations, while staffed with skilled professionals, struggle with three major limitations:

First, there's the scale problem. The volume of potentially false information circulating online far exceeds what any centralized team can verify. By the time a thorough fact-check is published, the false narrative may have already reached millions of people. This creates an asymmetric advantage for misinformation, which can spread faster than the truth.

Second, centralized fact-checkers face a trust deficit. Even when they produce accurate assessments, their work is often dismissed as biased or politically motivated. This skepticism stems from the perception that any centralized authority might have hidden agendas or institutional biases, regardless of their actual commitment to objectivity.

Third, traditional fact-checking lacks immediate economic consequences for spreading misinformation. While reputation damage might occur eventually, there's no immediate cost to publishing unverified information. This creates a perverse incentive where being first with a story, even if unverified, can be more profitable than being right.

After all, sensationalized news, often driven by a thirst for clicks and revenue, frequently prioritizes outlandish claims over accuracy.

Prediction markets can address these limitations through a decentralized approach that aligns economic incentives with truth-seeking. When people put their own money at stake, several powerful dynamics emerge:

-

Speed of verification increases as participants are incentivized to quickly find and trade on accurate information

-

Trust is built through transparency, as market prices reflect the aggregate knowledge and confidence of many independent participants

-

Economic consequences are immediate and proportional to the confidence in one's claims

For example, if a news outlet publishes a questionable story, prediction market participants would quickly bet against any false claims, driving down the price of "YES" tokens and signaling to the wider public that the story might be unreliable. This creates a real-time, market-driven fact-checking mechanism that operates at internet speed.

Project Vision: A Decentralized News Verification System

The rise in the spread of misinformation has created an urgent need for reliable fact-checking mechanisms. Traditional centralized approaches have limitations, but blockchain technology and prediction markets offer a novel solution: a decentralized system where market forces drive truth discovery.

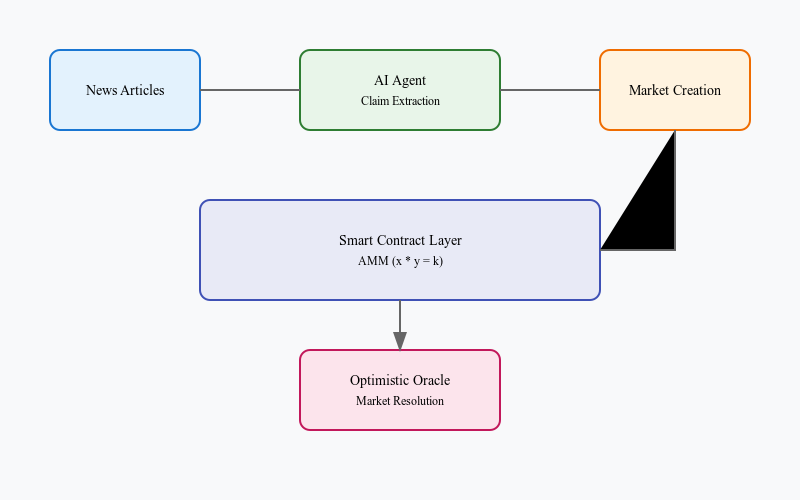

System Architecture Overview

Let me break down the system into its core components and explain how they interact:

-

News Input and Claim Extraction

The process will begin with news articles entering the system. An AI agent, powered by natural language processing, will analyze these articles and extracts specific, verifiable claims.For instance, with the Daily Mail article about FBI's statements on Android-iPhone texting security, the AI might extract claims like "FBI officially stated cross-platform texting is unsecure" or "FBI issued a public warning about messaging security."

-

Market Creation and Smart Contract Layer

For each extracted claim, the system will create a prediction market through smart contracts. These markets use a Product Constant AMM (x * y = k) to maintain liquidity and price discovery. This formula will ensure that as more people trade on one side of the market, the price will adjust automatically to reflect the changing probability assessment. -

Market Operation

Each market runs for a predetermined period, allowing participants to trade YES/NO tokens based on their research and confidence in the claim's validity. The AMM continuously adjusts prices based on trading activity, effectively converting individual trades into a collective probability assessment of the claim's truth. -

Resolution Mechanism

Markets resolve through one of two mechanisms:-

UMA's Optimistic Oracle: A sophisticated system where proposed outcomes can be challenged, requiring disputants to stake tokens

-

Simple Bond System: Similar to Polkamarket's approach, where resolution proposals must be backed by a significant bond to prevent manipulation

-

Lets take a look at how this would be implemented with FBI story example.

-

AI identifies claim: "FBI warned about Android-iPhone texting security" -

Market created with initial 50/50 probability -

Participants research and trade:-

Find official FBI statements -

Check technical documentation -

Consult security experts

-

-

Market price moves based on evidence -

Resolution process begins after time period -

Outcome verified and rewards distributed

Technical Implementation Challenges

Several key challenges need careful consideration:

AI Agent Development:

The AI must reliably extract clear, verifiable claims while avoiding subjective or ambiguous statements. This requires sophisticated natural language processing and possibly human oversight in the early stages.

Smart Contract Architecture:

The contracts need to handle:

-

Market creation and token minting

-

AMM logic and price calculations

-

Secure fund management

-

Resolution and reward distribution

Oracle Integration:

The UMA Optimistic Oracle integration requires careful design to ensure:

-

Proper dispute resolution mechanisms

-

Adequate time delays for challenges

-

Appropriate bond sizes for proposals

Front-end Interface:

Users need a clean, intuitive interface to:

-

View active markets and their probabilities

-

Access underlying news sources

-

Trade tokens easily

-

Track their positions and rewards

I had a quick discussion with a friend who’s already invested in the industry and he said this looks like a promising idea that’s worth building. This was the final validation that was required for me to try and build this project.

Let’s see how it goes.

评论 (0)