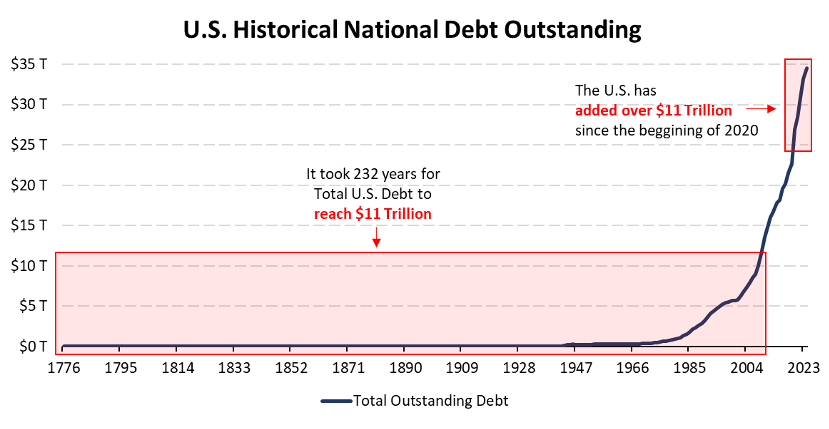

The current national debt is $35 trillion dollars. Over the past year, the U.S. has been adding $1 trillion in debt every 100 days. At this pace, the country will add $3 trillion in debt in less than one full year. For context, JPMorgan Chase, the largest bank in the world, holds roughly $3 trillion in assets, which means the U.S. government is issuing debt equivalent to the size of JPMorgan’s assets on an annual basis.

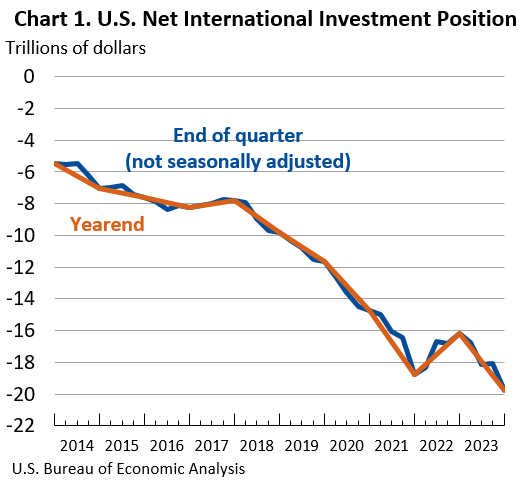

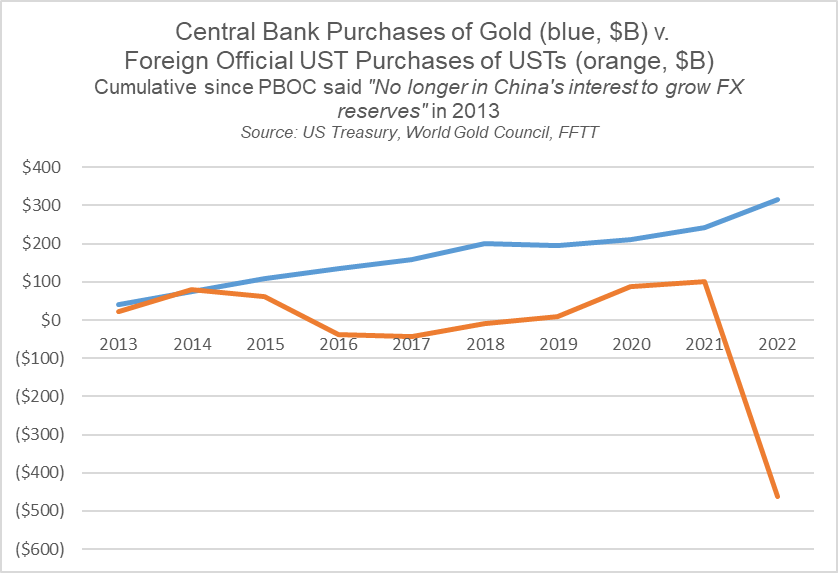

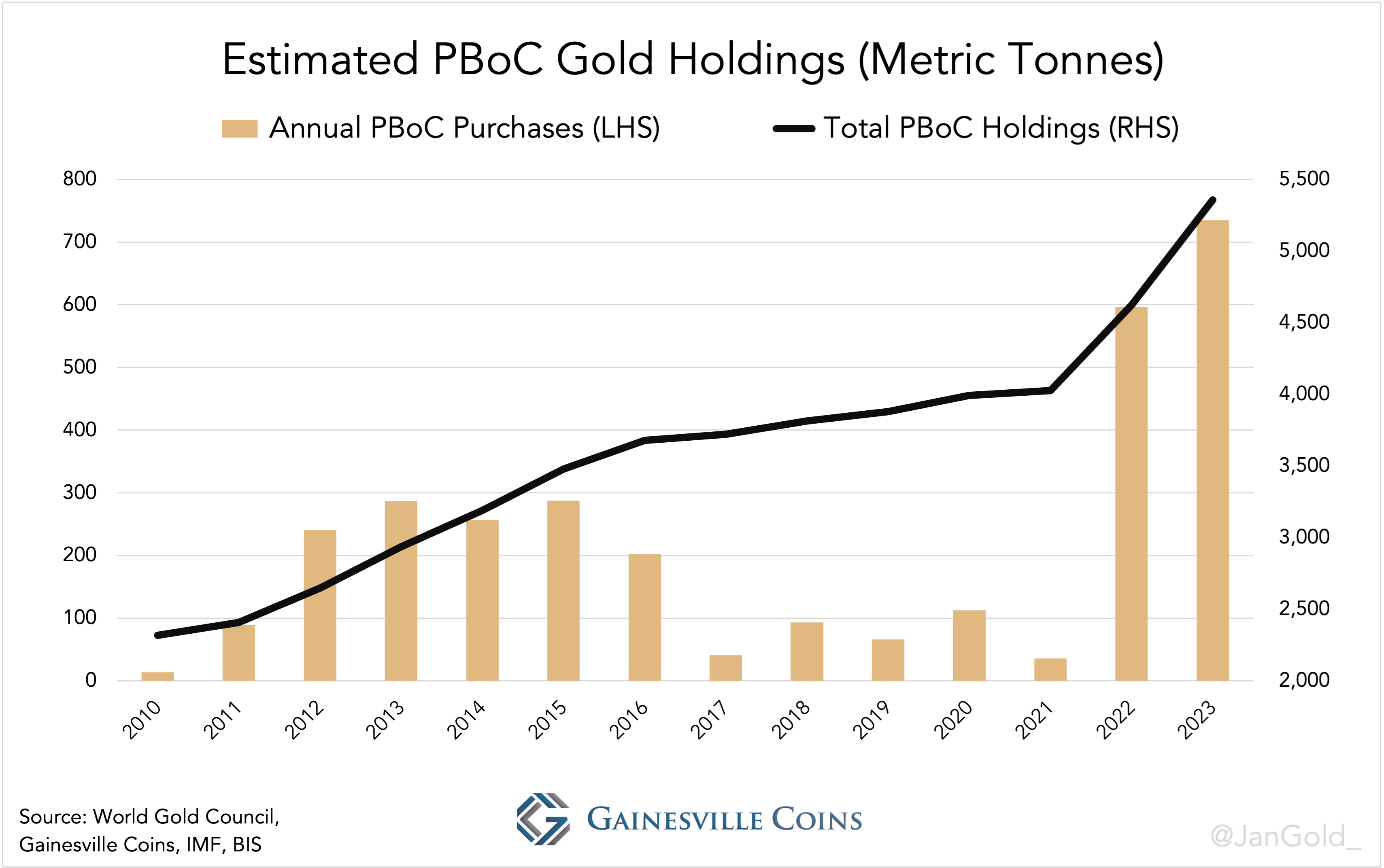

Much of this increase has come in recent years via stimulus packages and structural deficits without the necessary level of foreign investment (Net International Investment Position, or NIIP) from countries such as China, who have been choosing to buy gold over US treasuries (see charts below).

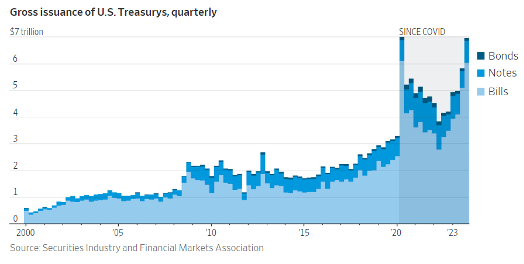

Following the COVID-19 outbreak, trillions have been injected to bolster the healthcare system, support struggling businesses, and provide financial assistance to individuals grappling with job losses and economic uncertainty.

Since the beginning of 2020, the country has added more than $11 trillion in debt, something that previously took the country 232 years to accomplish (see image below).

The level of debt issuance seen above has caused a number of issues such as significant inflation, which also led to the Federal Reserve increasing interest rates to historic levels. This create significant losses in the bond market and ignited multiple bank runs in March of 2023. The volatility in bond prices and the impact on bank balance sheets forced banks to reduce their treasury purchases, and combined with other factors, created upward pressure on bond yields in Q4 2023 resulting in significant unrealized losses for banks who were previously encouraged by the FED to add more treasury holdings via reduced reserve requirements during COVID-19.

As a result, Treasury Secretary Janet Yellen combat the pressure on bond yields by changing the mixture of the Treasury’s debt issuance, reducing the volume of medium and longer-term bonds and replacing them with shorter term bills and notes:

-

Treasury Bill - a short-dated government security, yielding no interest but issued at a discount on its redemption price. The maturities of T-bills are one year or less.

-

Treasury Notes - a marketable U.S. government debt security with a fixed interest rate and a maturity between 2-10 years.

-

Treasury Bond - a marketable security with a fixed interest rate and a maturity between 20-30 years.

Below is a graph that shows the total gross issuance mix of U.S. treasuries by quarter dating back to the beginning of 2000, as well as definitions of Treasury Bills, Notes, and Bonds.

The issuance mix is very important because ultimately Treasury debt prices are driven by the supply of debt being issued and the demand to purchase that debt.

Demand for notes and bonds was limited as foreign buyers began reducing their U.S. debt holdings (e.g. China buying gold instead of USTs); however, there remains significant demand for short-term bills and notes as a result of (1) investors that are worried about inflation and don’t want to lock-up capital and lose value on their bond** and (2) the consistent demand from money market funds as the primary buyers of short-term bills.

**the value of a bond is inversely related with the interest rate. If the interest rate goes down, more people borrow money, stimulating the economy and raising the price of assets, so the devaluation of your bond is essentially the opportunity risk of not holding that bond rather than participating in risk-on assets. However, the FED and Treasury have gotten very tricky with all the levers at their disposal to stimulate the economy w/o suppressing interest rates, screwing over investors who think they are making the smart decision being in bonds but don’t see the forest for the trees.

The lack of demand for long-term notes and bonds will not only impact government borrowing costs, but impact bond prices, yields, broader borrowing costs, and overall economic sentiment

The US Treasury has made adjustments over the years to accommodate ongoing debt issuance volumes including the elevated issuance of Treasury bills instead of longer duration notes. Issuance of bills/notes have led to ongoing deficits as investors need to be paid the premium/interest on these short duration bills/notes (which also effectively increases stimulation/inflation in the short term) as well as run the risk of demand for these short duration bonds slowing down as they mature, potentially triggering a debt crisis.

The ongoing fiscal deficits, large volume of overall debt and government intervention in both issuance and bond markets is perpetuating the unsustainable government fiscal situation, elevating the risk of a fiscal debt crisis in the United States, while creating a very large burden for future generations.

Much of what has been described above can be defined as ‘Fiscal Dominance,’ a phenomenon I will write about in a separate post. It is increasingly obvious that the United States will have to inflate this debt away via USD weakness (good for risk-on assets) or risk the bursting of a global sovereign debt bubble.

评论 (0)