The cryptocurrency market recently witnessed what can be described as an overnight bullish surge, especially notable in Ethereum's performance. After multiple postponements by the U.S. Securities and Exchange Commission (SEC) regarding the approval of Ethereum ETFs, a critical deadline looms from May 23rd to 30th, 2024, marking the final period for several spot Ethereum ETFs awaiting the SEC’s nod.

Should the SEC decide against approval this round, the next window for reconsideration wouldn’t open until June 23rd. This would require firms like VanEck, ARK, and Hashdex to resubmit their applications for a spot Ethereum ETF.

However, developments on May 20th, 2024, suggested a significant pivot in the SEC’s approach. According to reports from CoinDesk, insiders indicated that on Monday, the SEC instructed exchanges to update their 19b-4 filings for Ethereum spot ETFs. This form is utilized to inform the SEC of rule changes that allow funds to be traded on exchanges, signaling potential approval before the critical deadline on Thursday, May 23rd. However, this does not guarantee approval of the ETFs. Prospective issuers still require approval of their S-1 applications before trading can commence, a process which the SEC can indefinitely extend as it is not bound by specific timelines.

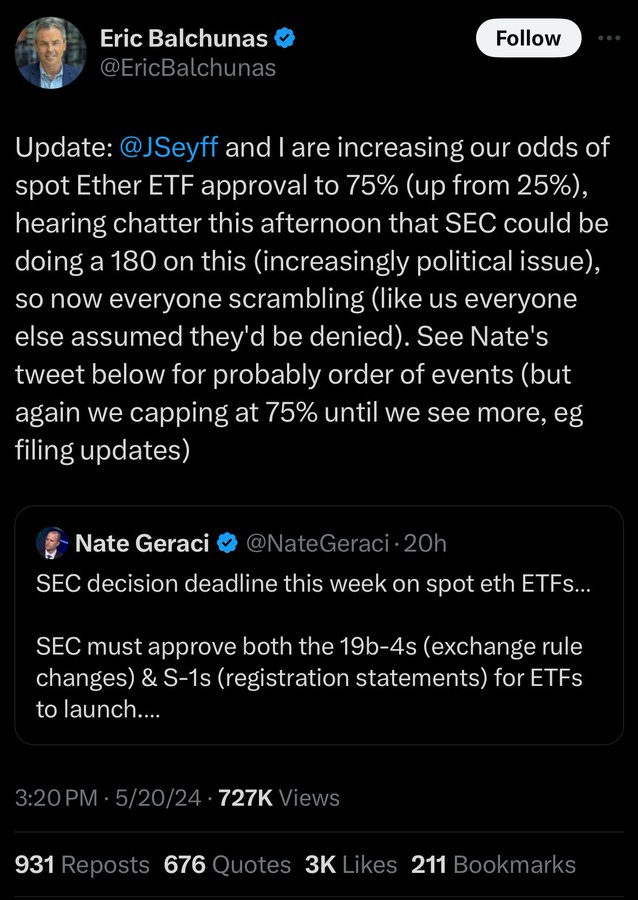

Meanwhile, Eric Balchunas, an ETF analyst at Bloomberg Intelligence, noted a significant uptick in the probability of spot Ethereum ETF approvals, increasing from 25% to 75%. He cited increased political discourse around the SEC as potentially influencing a 180-degree turn in their stance. The increasing politicization of cryptocurrency is seen as a driving factor behind this sudden shift.

An informant from a company negotiating with the SEC mentioned that while the SEC perceived itself as stalling a few weeks ago, it now feels it is on the right track to granting approvals.

Following these developments, Ethereum prices, which had been languishing for several days, suddenly soared above $3700, with a 24-hour increase exceeding 20%. The ETH/BTC rate experienced a similar rise. Previously, ETH/BTC had dropped below 0.045, leading to community speculation about Ethereum’s performance in this bull market.

Stimulated by the sharp rise in Ethereum, tokens related to the Ethereum ecosystem also saw significant gains. Interest in low-circulation/high FDV VC tokens, a popular narrative in the crypto community the previous day, quickly faded.

Before rumors of the SEC's 180-degree shift in attitude towards spot Ethereum ETFs emerged, analysts had suggested that the likelihood of the SEC approving a spot Ethereum ETF was underestimated. David Han, a Coinbase institutional research analyst, estimated in a May 15th report that there was a 30% to 40% chance of the SEC approving a spot Ethereum ETF by the end of May. Despite a general consensus that U.S. authorities were unlikely to approve in the short term, the potential for approval was still underrated.

Various crypto institutions have also weighed in on the SEC’s potential change of heart regarding spot Ethereum ETFs. Alex Thorn, head of research at Galaxy Digital, commented that if the speculation about the SEC's drastic change in stance is accurate, they might find a balance between ETH not being a security and the staking of ETH being considered a security.

Jake Chervinsky, Chief Legal Officer at Variant Fund, expressed that approval of a spot Ethereum ETF would astonish everyone closely involved in the process in Washington. He noted that such approval could signify a significant shift in U.S. cryptocurrency policy following the SAB 121 vote, potentially more impactful than the ETF approval itself.

评论 (0)