The recipients of the Season 5 grant have recently been announced and it's time to find out more about them.

A little bit about the scale of Season 5:

- 530 applications were submitted and reviewed, which is a 73.2% increase from last season.

https://x.com/OptimismGrants/status/1788334263328448955

In total, we can congratulate 87 finalists on receiving grants, but let's focus in more detail on the most interesting category for us, in which there were 15 winners - Growth and experiments grants program.

Here is the list of grant recipients:

-

Supercharge OP Mainnet (Layer 3)

Let’s talk about some of them.

Silo Finance

Silo is a risk-isolated lending market that allow users to deposit tokens to earn interest or as collateral to borrow other tokens.

What makes Silo different from other lending markets?

- Risk-Isolation

By creating individual lending markets for each base asset, each Silo market is completely separated from every other Silo market. This means lenders only take on the risk of the market they choose to deposit into i.e. the base asset.

- Markets for any Token

Silo can create markets for any token where there are willing lenders. This allows for lending markets for esoteric assets like Curve LP Tokens and Pendle PT tokens.

What advantages will users get from the fact that this project has received a grant?

The project plans to distribute 33,33% of the total grant every 30 days to exist within 3 months after receiving the grant to participants in Silo Optimism’s lending markets, both users and dApps integrating with the markets, to attract lenders and borrowers alike seeking to earn yield passively or leverage via borrowing.

Interest Protocol

Interest Protocol is a borrow-lend protocol on Ethereum and Optimism. Interest Protocol issues astablecoin called USDi, which is a liquidity provider (LP) token that represents a one-to-one claim on the protocol’s USDC.

USDi can be minted by either depositing USDC intothe protocol or borrowing USDi from the protocol. Interest Protocol generates revenuefrom interest paid by borrowers, and this revenue is distributed to all USDi holders.

What advantages will users get from the fact that this project has received a grant?

The project will distribute tokens among two categories of users:

1. Quest participants (~18.6% of grant)

Interest Protocol will create quests on Rabbithole or similar platform(s) that educate users about how to delegate OP tokens and guide them through that process using Interest Protocol's user interface.

2. Delegation Program (~81% of grant)

For users to delegate their OP through Interest Protocol. Incentives amount is denominated in OP tokens. Users will be eligible for a minimum of 5% annualized incentives and a maximum of 8%, as budget allows.

Compound Finance

Compound is an EVM compatible protocol that enables supplying of crypto assets as collateral in order to borrow the base asset. Accounts can also earn interest by supplying the base asset to the protocol.

The initial deployment of Compound III is on Ethereum and the base asset is USDC.

What advantages will users get from the fact that this project has received a grant?

Distribution will be divided into two parts:

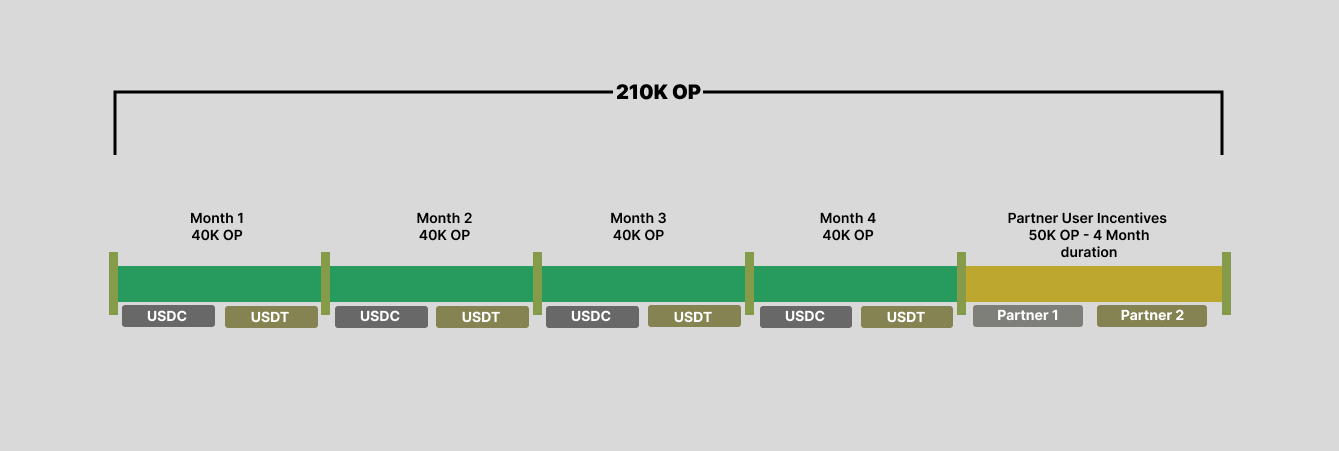

1. General Market Liquidity Incentives for USDC and USDT (160K OP)

40K OP will be used every month to incentivize user activity on the platform, this will be distributed over two markets - USDT Market and USDC Market.

2. Partner Specific Liquidity Incentives (50K OP)

It will be distribution by Defi wallets with Compound market integrations on the Optimism network. These incentives will also be divided between USDT & USDC markets.

deBridge

deBridge is a high-performance and secure interoperability layer for Web3 that enables decentralized transfers of arbitrary messages and value between blockchains.

The deBridge protocol is an infrastructure platform and a framework for:

-

decentralized transfer of arbitrary data and assets

-

cross-chain interoperability and composability of smart contracts

-

cross-chain swaps

-

interoperability and bridging of NFTs

What advantages will users get from the fact that this project has received a grant?

The deBridge protocol will distribute tokens to the following groups:

-

Makers — users who bridge liquidity through Optimism. Users bear gas costs + deBridge fees.

-

Takers — on-chain market makers and solvers who fulfill cross-chain trades/intents.

How it will be distributed?

- Every two weeks they’ll generate a snapshot of all deBridge market orders to/from the Optimism ecosystem, calculate their USD equivalents at the moment of trade, and rebate the protocol fee + gas cost to makers and spread + gas cost to takers (the total rebate for the transfer shouldn’t exceed 2% of its USD equivalent).

Contango.xyz

Contango lets you loop anything on-chain.

You can:

-

create leveraged positions just like perps with low funding

-

lever up on the yield of liquid staking and restaking assets, like stETH or eETH

-

lever up on the fixed yield of Pendle's PTs

-

create delta neutral plays to farm funding rates

-

arbitrage rates differentials on stablecoins

-

farm rewards, airdrops, points on leverage

What advantages will users get from the fact that this project has received a grant?

100% of the OP tokens will be rewarded to the end users. Contango plans to host a 12-week rewards campaign that will incentivize its 4 Optimism markets (Aave, Sonne, Granary, Exactly). Rewards will be distributed weekly (around 4,385 OP / week).

Layer3

And quite a bit at the end I will add about another recipient of the grant - the well-known quest platform Layer3.

Layer3 will use the entire grant as incentives to drive user activity across Optimism Mainnet. Layer3 will also allocate 50% of RetroPGF allocation (25,000 OP) to draw more users to OP Mainnet.

Over a 6-month period, they will deploy approximately 74 quests. So stay tuned and don’t forget about Layer3 quests.

I hope that the information in this article was useful to you.

And little reminder: Season 6 begins on June 27th and runs through December 11th. Grant applications open on July 18th and run every 3 weeks through December. You can find all dates on the public governance calendar. See Get a Grant to learn more about applying for grants.

评论 (0)