I must admit that I am not a fan of meme coin. I never buy or hold any meme coin.

Today when I was fiddling around the world of DeFi I accidently noticed the incredible high yield of being liquidity providers (LPs) of the meme coin WIF: >1% per day!

As an experienced LP, I decided to make a bold attempt: to provide liquidity for it! I never do this before. I thought it is good to record the daily process and let more people get to see it.

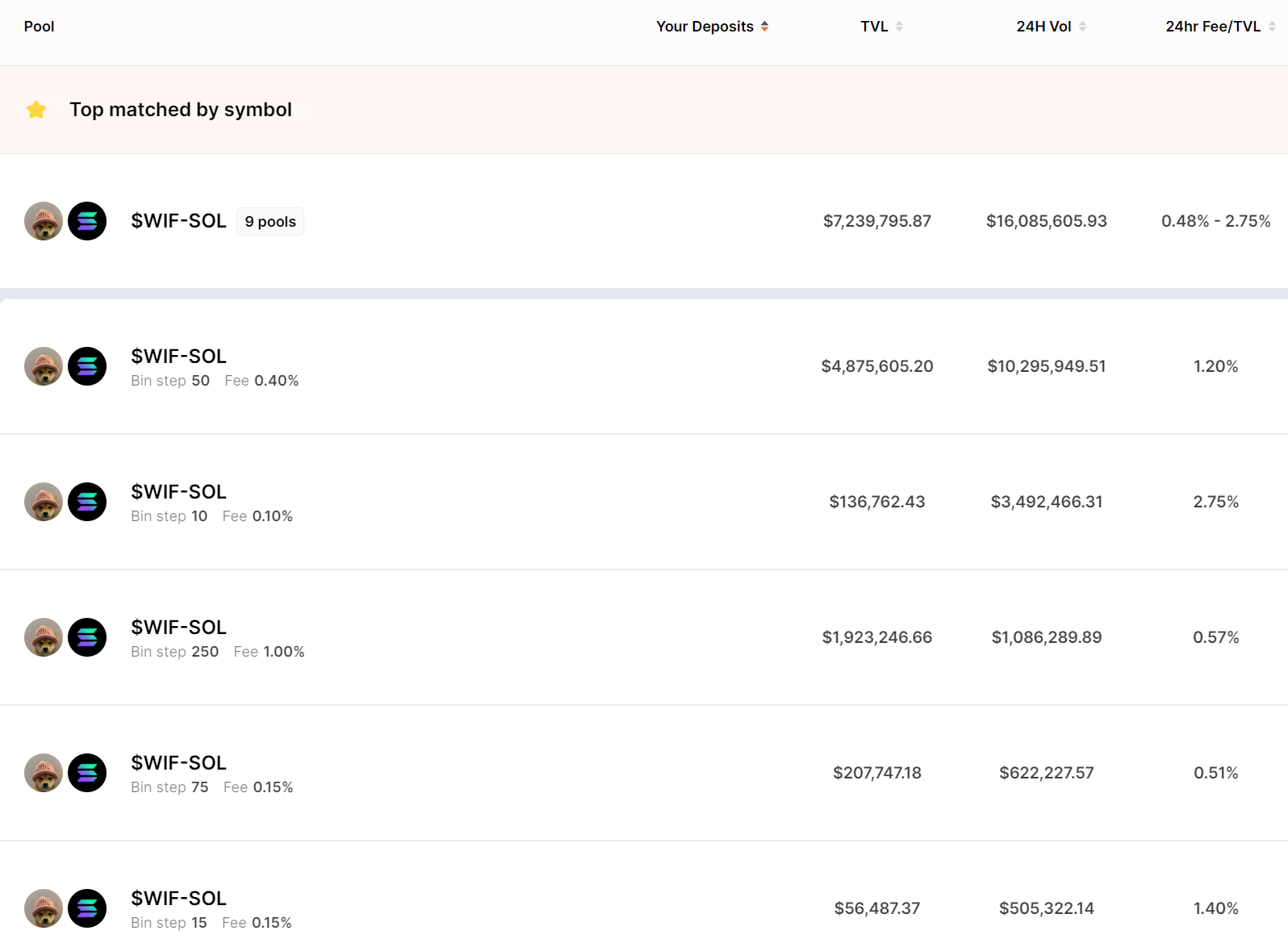

The Decentralized Exchange (DEX) I chose was Meteora, an innovative DEX on Solana. The pool I chose a DLMM pool with 0.4% Base Fee. Check the following figure for details.

Let the adventure begin

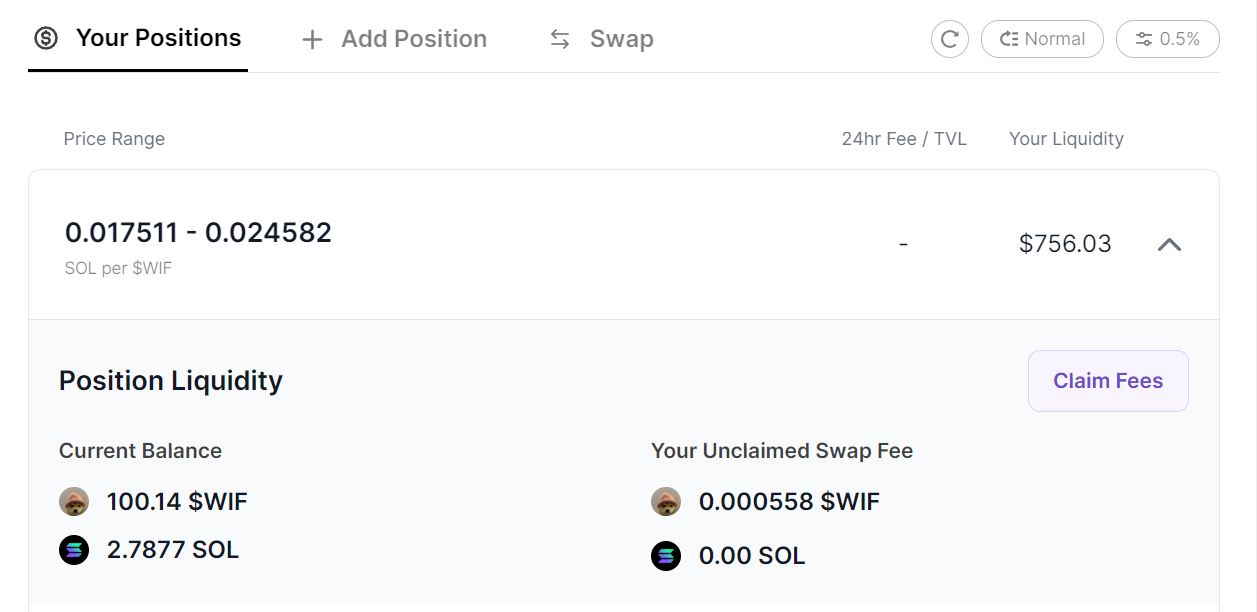

I started the adventure at the time when the price of WIF was ~0.0211 SOL.

The range I chose was 0.0175 - 0.0246. I believed this is an efficient range.

The adventure should be a SOL-based investment: The result should be calculated based on the SOL wins or losses.

I put in 100 WIF + 2.8 SOL, which was worth ~4.9 SOL.

Before entering the position, I had thought of a simple strategy to follow.

-

Claim the swap fee I receive and reinvest the same amount into the pool every day.

-

If WIF price goes up above the uppder bound, I would exit the position.

-

If WIF price goes down below the lower bound, if I am in profit I would exit the position by selling all WIF to SOL, otherwise I would sell half of the WIF at that time and enter the LP position with the range of 0.014 - 0.020 again.

A very bad (not the worst) situation is like this. I earn no swap fee before the price of WIF goes down to the lower bound. In this case, the Impermanent Loss (IL) compared to holding all SOL instead would be about 13.5%. Therefore, if I can earn 4.9 SOL * 13.5% = 0.6615 SOL, I would have the IL covered.

I will try to update the post daily to let readers see how it goes to be a LP of a meme coin. Because of the high volatility of WIF, I will calculate time in hours.

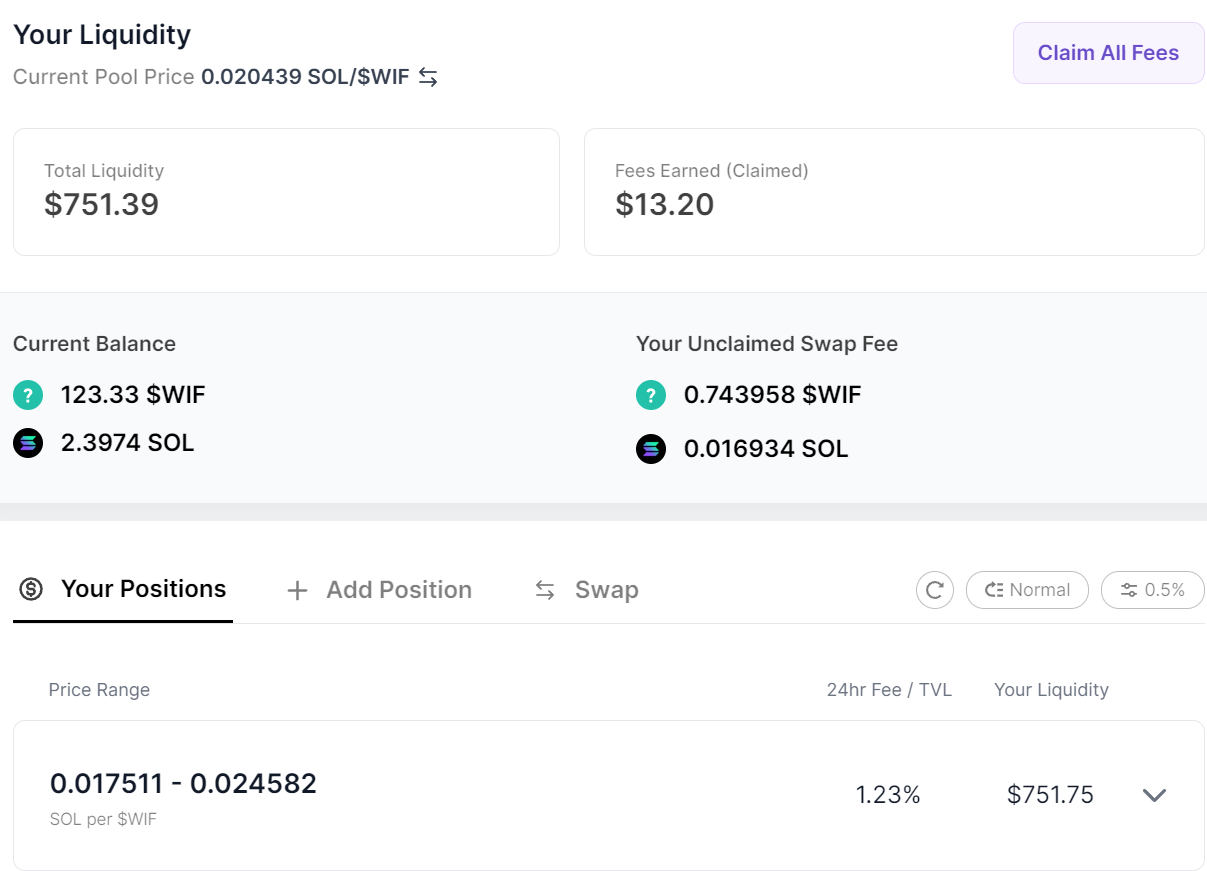

Hour 0

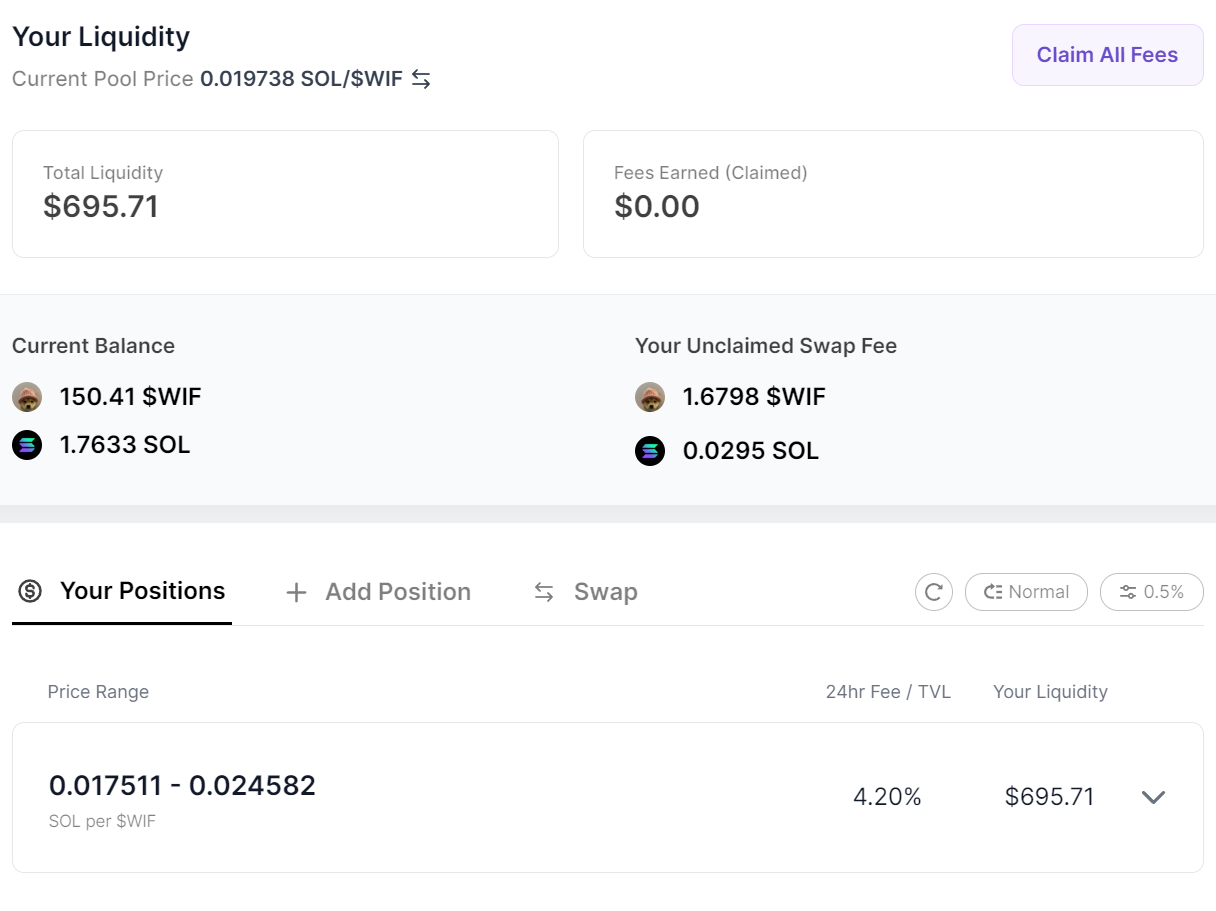

Hour 18

After 18 hours, I checked my liquidity. After a particularly volatile time period, the swap fee I received was pretty good! Let’s do some calculations.

I now have:

WIF: (154.41 + 1.6798) WIF = 156.0898 WIF = 156.0898 * 0.01974 SOL = 3.0809 SOL

SOL: (1.7633 + 0.0295) SOL = 1.7928 SOL

The total value in SOL became 4.8737 after 18 hours.

What about the swap fee I earned?

After some simple calculations, I found that the fee I earned in 18 hours was indeed ~4%!

As long as the price of WIF can stay within the range for a few days, the IL would be covered!

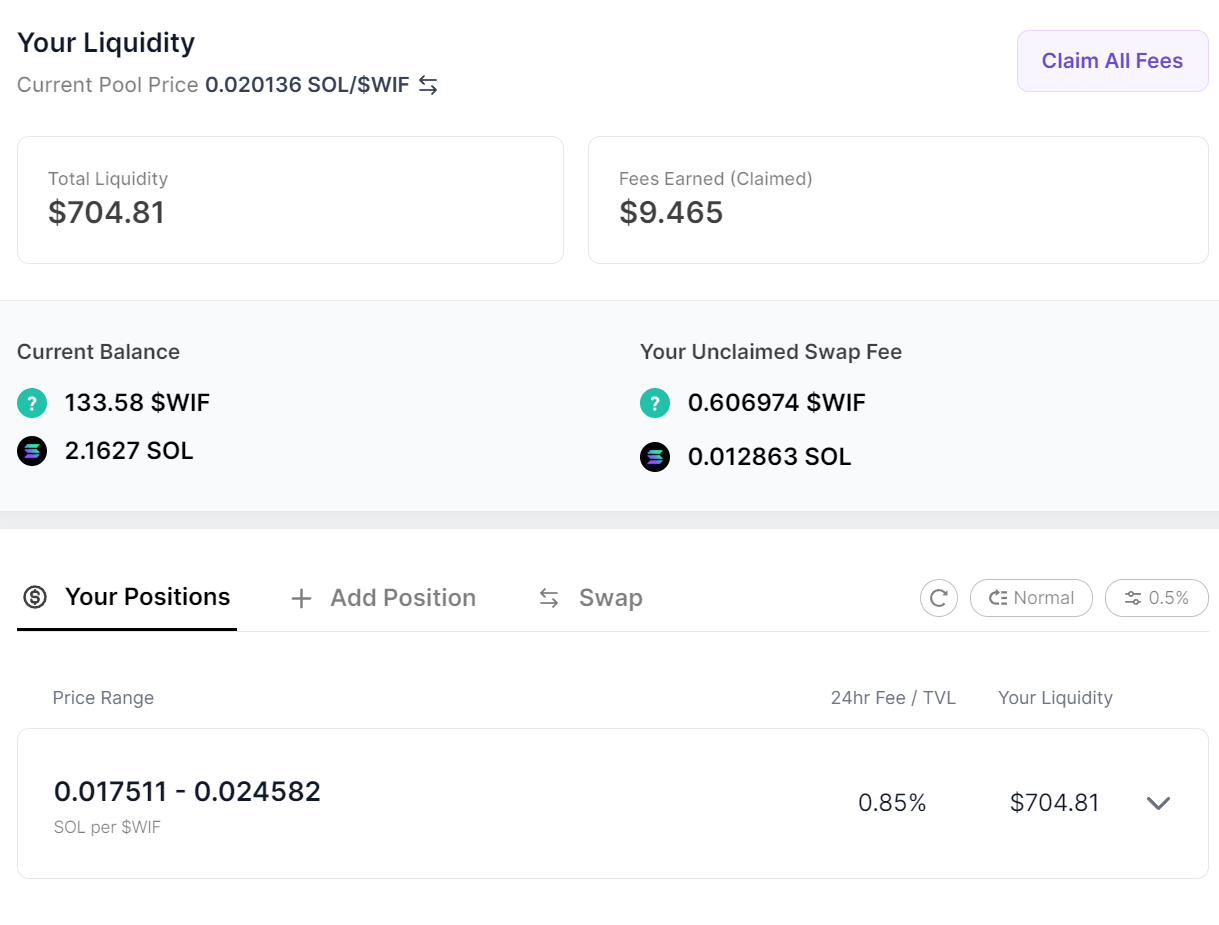

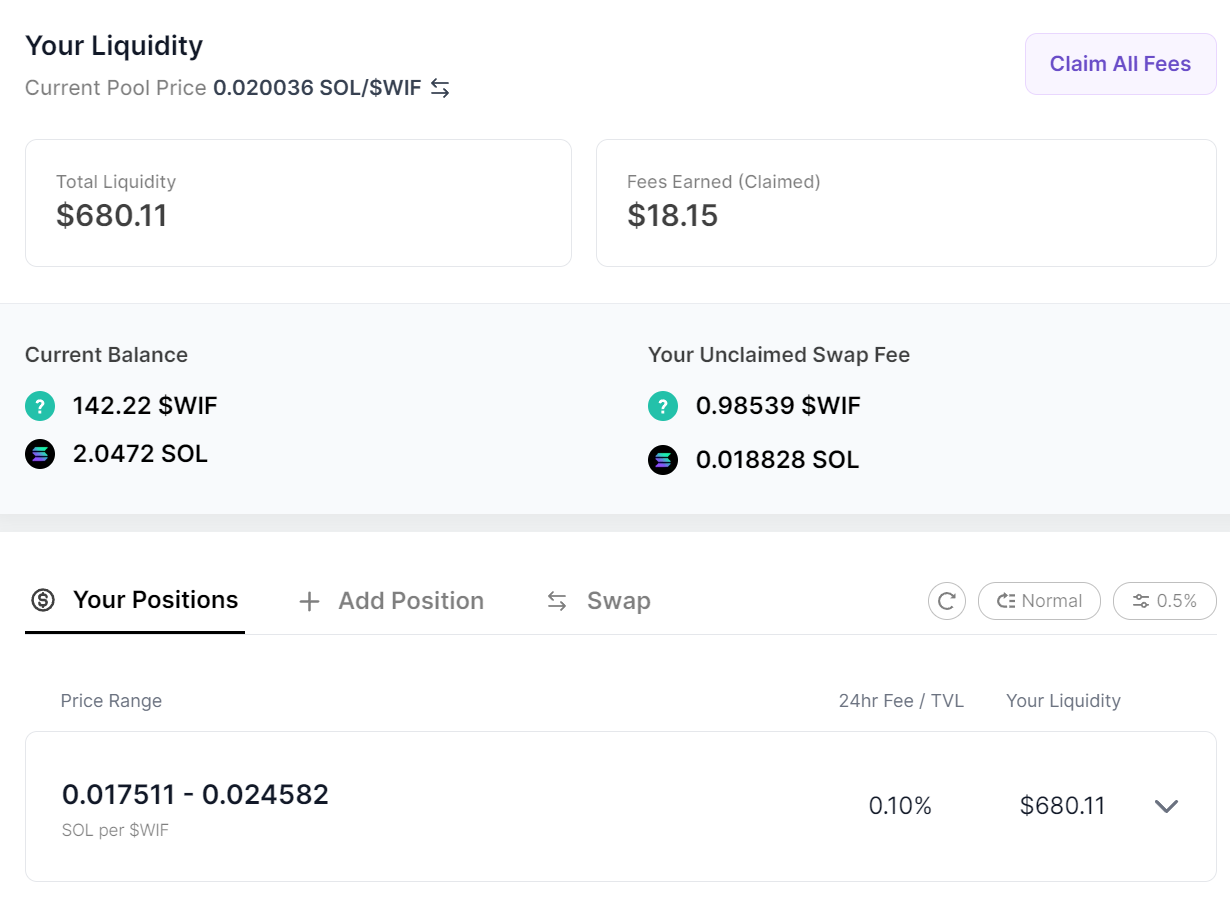

Hour 40

Hour 60

It looks good!

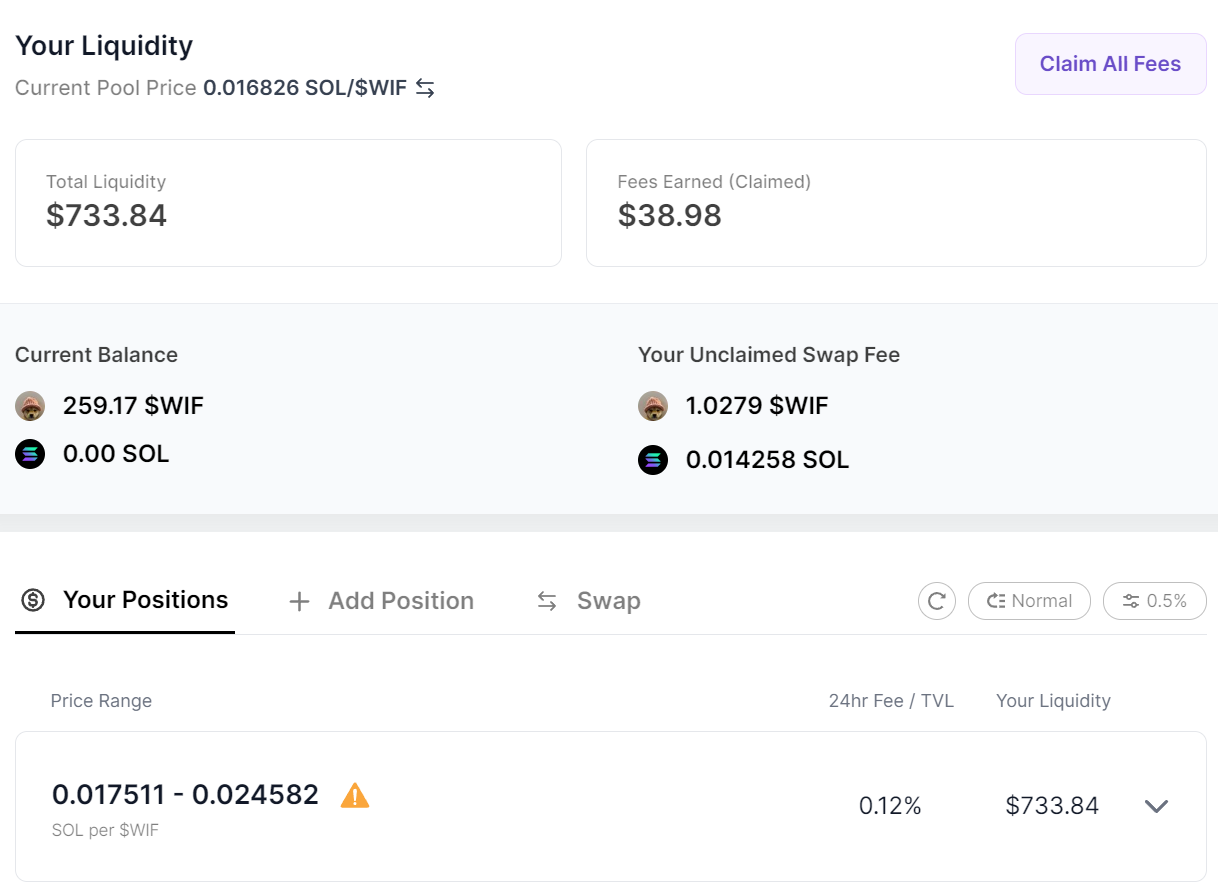

Hour 132

Hour N: WIF price fell below the lower bound

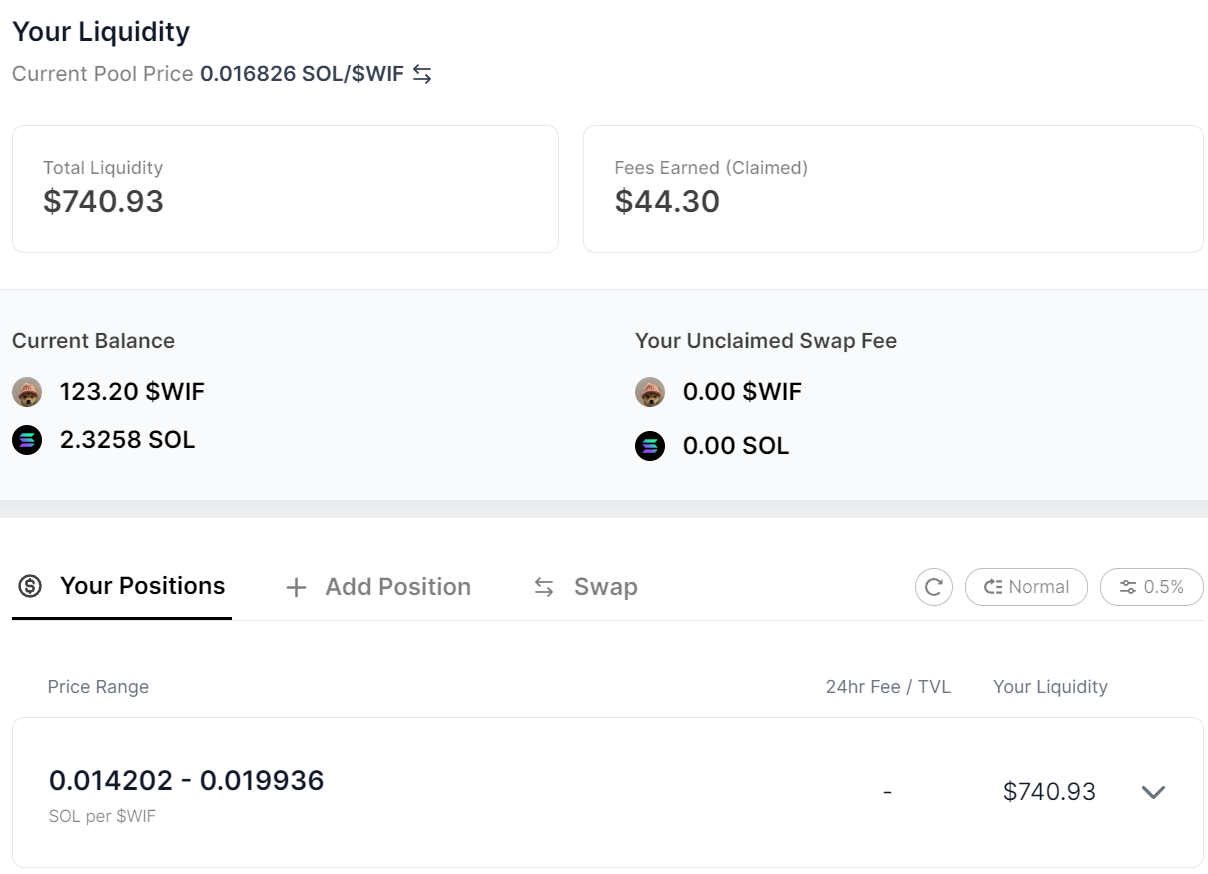

WIF price fell below the lower bound. I withdrew, rebalanced, and added position again.

Here’s the new position.

评论 (0)