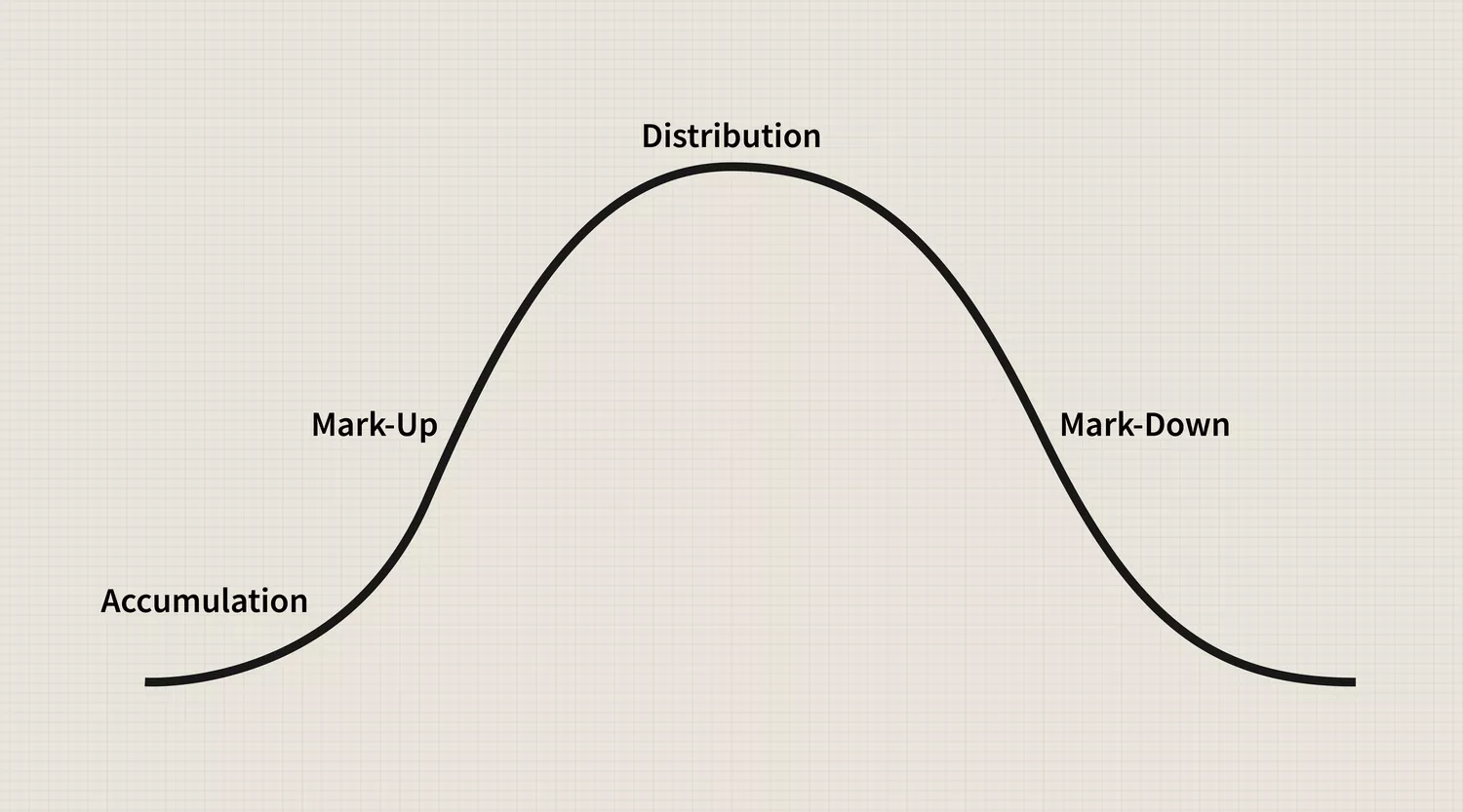

Cycles are prevalent in all aspects of life; they range from the very short-term, like the life cycle of a June bug, which lives only a few days, to the life cycle of a planet, which takes billions of years. No matter what market you are referring to, all go through the same phases and are cyclical. They rise, peak, dip, and then bottom out. When one market cycle is finished, the next one begins. The problem is that most investors and traders either fail to recognize that markets are cyclical or forget to expect the end of the current market phase. Another significant challenge is that even when you accept the existence of cycles, it is nearly impossible to pick the top or bottom of one. But an understanding of cycles is essential if you want to maximize investment or trading returns. Here are the four major components of a market cycle and how you can recognize them.

-

Accumulation Phase

This phase occurs after the market has bottomed and the innovators (corporate insiders and a few value investors) and early adopters (smart money managers and experienced traders) begin to buy, figuring the worst is over. At this phase, valuations are very attractive, and general market sentiment is still bearish. Articles in the media preach doom and gloom, and those who were long through the worst of the bear market have recently given up and sold the rest of their holdings in disgust. However, in the accumulation phase, prices have flattened and for every seller throwing in the towel, someone is there to pick it up at a healthy discount. Overall market sentiment begins to switch from negative to neutral.

-

Mark-Up Phase

At this stage, the market has been stable for a while and is beginning to move higher. The early majority are getting on the bandwagon. This group includes technicians who, seeing the market is putting in higher lows and higher highs, recognize market direction and sentiment have changed. Media stories begin to discuss the possibility that the worst is over, but unemployment continues to rise, as do reports of layoffs in many sectors. As this phase matures, more investors jump on the bandwagon as fear of being in the market is supplanted by greed and the fear of being left out. As this phase begins to come to an end, the late majority jump in and market volumes begin to increase substantially. At this point, the greater fool theory prevails. Valuations climb well beyond historic norms, and logic and reason take a back seat to greed. While the late majority are getting in, the smart money and insiders are unloading. But as prices begin to level off, or as the rise slows down, those laggards who have been sitting on the sidelines see this as a buying opportunity and jump in en masse. Prices make one last parabolic move, known in technical analysis as a selling climax when the largest gains in the shortest periods often happen. But the cycle is nearing the top. Sentiment moves from neutral to bullish to downright euphoric during this phase.

-

Distribution Phase

In the third phase of the market cycle, sellers begin to dominate. This part of the cycle is identified by a period in which the bullish sentiment of the previous phase turns into a mixed sentiment. Prices can often stay locked in a trading range that can last a few weeks or even months. For example, when the Dow Jones Industrial Average (DJIA) peaked in Feb. 2020, it traded down to the vicinity of its prior peak and stayed there over a period of several months. But the distribution phase can come and go quickly. For the Nasdaq Composite, the distribution phase was less than a month long, as it peaked in Feb. 2020 and moved higher shortly thereafter. When this phase is over, the market reverses direction. Classic patterns like double and triple tops, as well as head and shoulders patterns, are examples of movements that occur during the distribution phase. The distribution phase is a very emotional time for the markets, as investors are gripped by periods of complete fear interspersed with hope and even greed as the market may at times appear to be taking off again. Valuations are extreme in many issues and value investors have long been sitting on the sidelines. Usually, sentiment slowly but surely begins to change, but this transition can happen quickly if accelerated by a strongly negative geopolitical event or extremely bad economic news. Those who are unable to sell for a profit settle for a breakeven price or a small loss.

-

Mark-Down Phase

The fourth and final phase in the cycle is the most painful for those who still hold positions. Many hang on because their investment has fallen below what they paid for it, behaving like the pirate who falls overboard clutching a bar of gold, refusing to let go in the vain hope of being rescued. It is only when the market has plunged 50% or more than the laggards, many of whom bought during the distribution or early markdown phase, give up or capitulate. Unfortunately, this is a buy signal for early innovators and a sign that a bottom is imminent. But alas, it is new investors who will buy the depreciated investment during the next accumulation phase and enjoy the next mark-up.

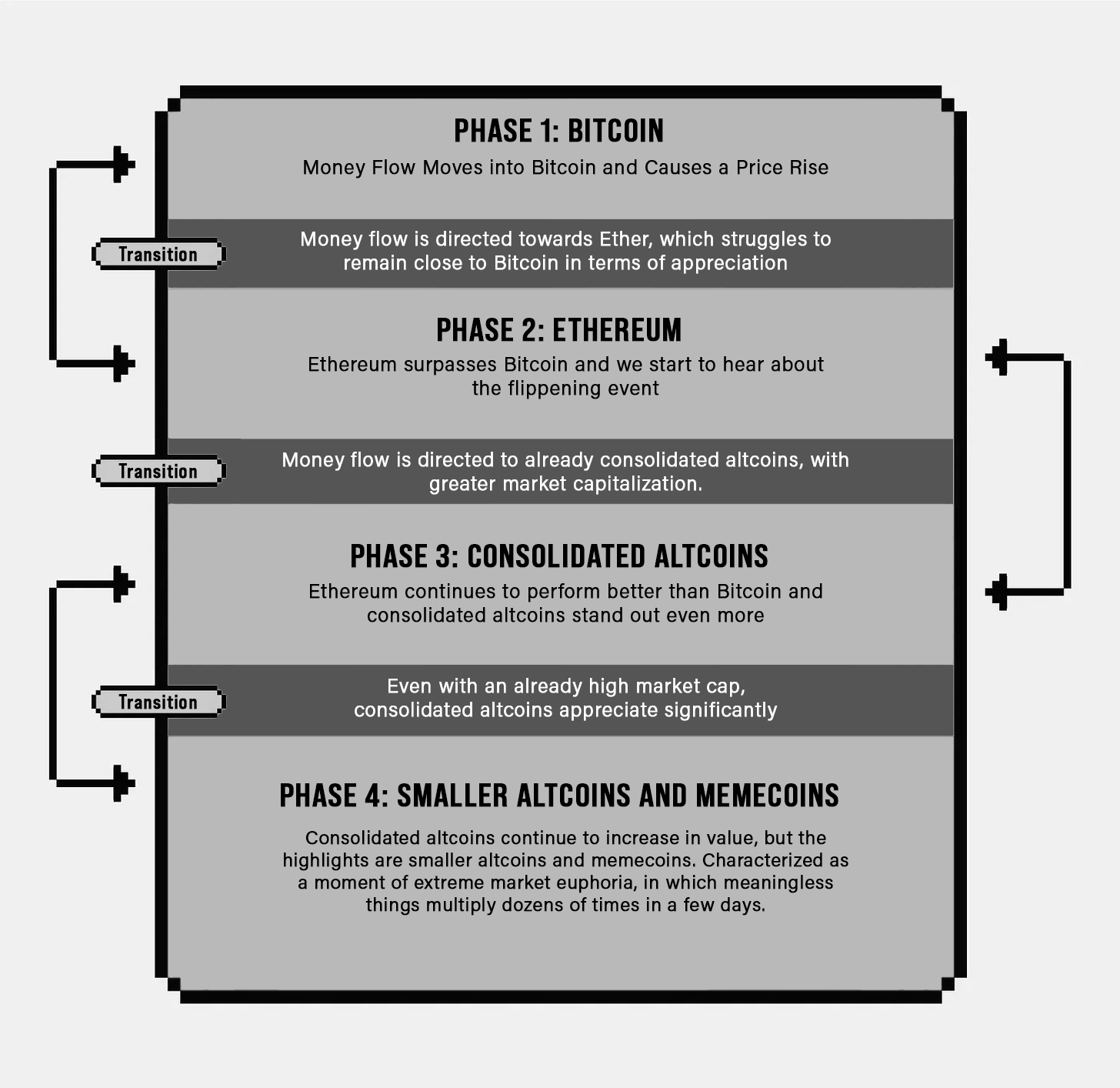

Crypto Money Flow Simplified

Crypto market cycles can also be viewed in a more simplified way, as shown in the graph below, which shows how the flow of money operates within the phases of the bullish cycle.

This movement has been noticeable in past cycles and this moment of attention rotation, which should occur during 2024, has proven to be a great time to take more risk in altcoins to the detriment of positions in BTC.

Hope you all like it.

P.W.P.

评论 (0)