Visa had issue a report “Digital Currency: Visa’s Vision for Supporting the Future of Money“ in 2021 and shared Visa’s outlook on the digital currency landscape and their approach for making digital currencies more safe, useful, and applicable for payments. This essay encapsulates Visa’s comprehensive strategy and commitment to shaping the digital currency domain, reflecting its ongoing efforts to adapt and innovate within the dynamic world of payments.

Visa’s Digital Currency Vision

In the transformative landscape of digital currency, Visa stands at the forefront, envisioning a future where money is fully electronic. The report delves into the evolution of digital currency, highlighting Visa’s strategic focus areas to integrate digital currencies into the global payment ecosystem.

The Digital Currency Landscape

Visa acknowledges the change in the community, the growing consumer interest especially among younger generations, and the burgeoning developer ecosystem that’s driving innovation in this space.

-

Early Concepts: The journey of digital currency began in 1983 with David Chaum’s idea of digital cash. The landscape evolved significantly with the introduction of Bitcoin in 2008 by Satoshi Nakamoto.

-

Growing Interest: There’s a noticeable shift in consumer behavior, especially among younger generations, towards digital currencies. The developer ecosystem is expanding, and financial institutions are increasingly engaging with digital currency.

-

Fintech Interest: Major banks and fintechs, like JP Morgan and PayPal, are increasingly adopting and offering cryptocurrency features and products.

-

Stablecoins & CBDCs: Recent years have seen the rise of stablecoins, which are pegged to fiat currencies to reduce volatility. Central banks are also exploring Central Bank Digital Currencies (CBDCs), with many conducting pilots.

Digital currencies are influencing the ‘culture of money,’ with their presence felt across social media and the internet, despite their low usage for everyday transactions. This reflects a significant cultural and technological shift in the financial landscape.

Types of Digital Currencies

Visa categorizes digital currencies into three types: cryptocurrencies, stablecoins and CBDCs.

-

Cryptocurrency: This is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Examples include Bitcoin and Ether. They are known for their high volatility and limited acceptance as a form of payment.

-

Stablecoin: These are digital currencies designed to minimize price volatility by being pegged to a stable asset, like fiat currencies or gold. They are issued by private entities and are more suitable for payments in global commerce due to their stability. Examples include USDC and Diem.

-

Central Bank Digital Currency (CBDC): This is a digital form of fiat money issued by a central bank. CBDCs can be used just like cash but in a digital form, allowing direct receipt and spending. They are gaining momentum, with many central banks exploring or conducting pilots. Examples include eCNY (China) and e-Krona (Sweden).

Visa’s Strategic Focus

Visa is actively engaging with the digital currency landscape, focusing on enhancing money movement across various platforms. Their approach includes:

-

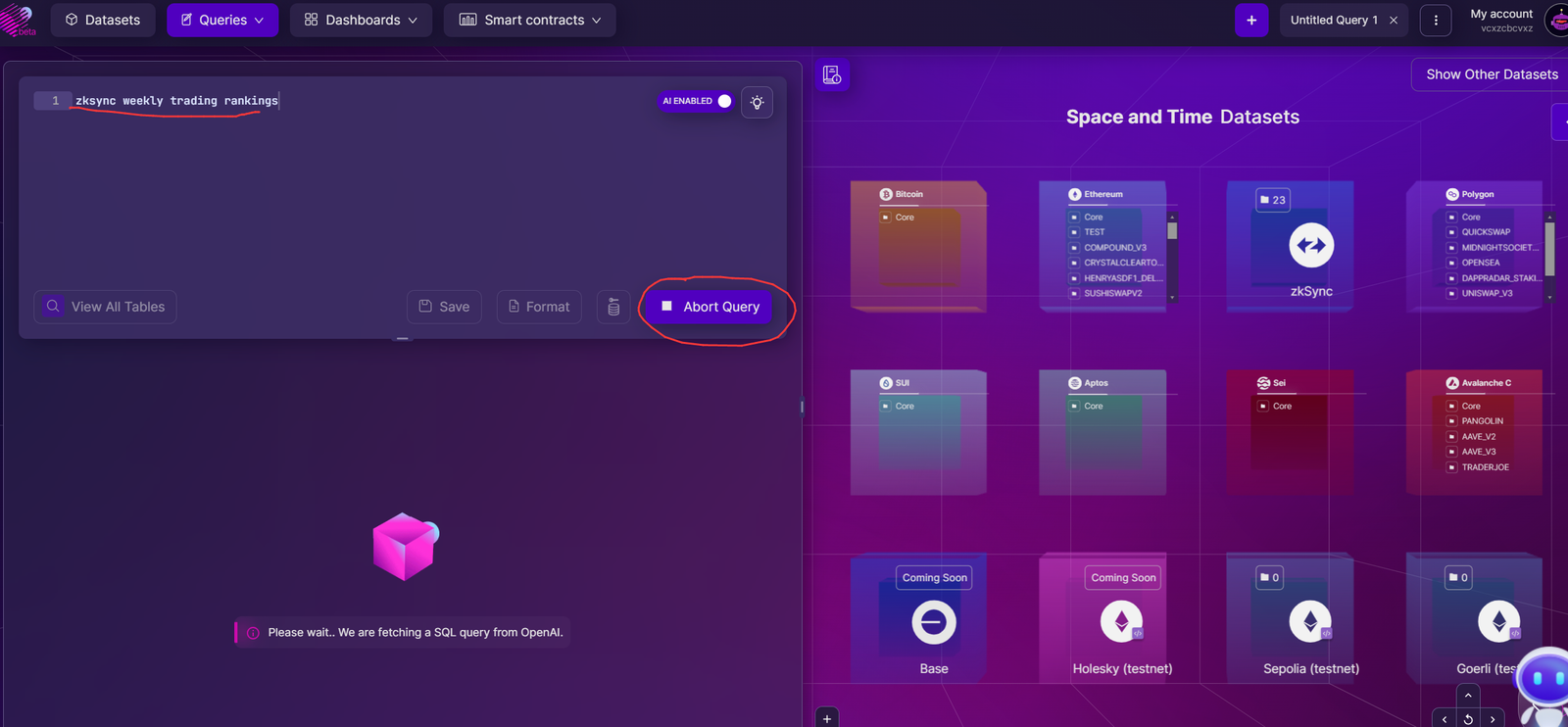

Credentials Everywhere: Collaborating with digital currency platforms to connect users’ crypto accounts to Visa, enabling easy conversion and spending at Visa-accepting merchants.

-

Digital Currency Settlement: Investing in infrastructure to allow crypto-native companies to settle transactions in stablecoins like USDC, streamlining their operations.

-

Crypto Value-Added Services: Offering Visa Crypto APIs to banks and fintechs for developing digital currency solutions, and establishing an innovation hub for collaborative development in digital currency technologies.

-

CBDC Research and Engagement: Conducting research on blockchain technology and engaging with central banks and policymakers to shape the future of CBDCs and digital currencies.

Conclusion

Visa’s paper presents a clear vision for the role of digital currencies in the future of money. By embracing innovation and collaborating with various stakeholders, Visa is poised to lead the charge in integrating digital currencies into the mainstream, ensuring secure and seamless transactions for individuals and businesses alike.

评论 (0)