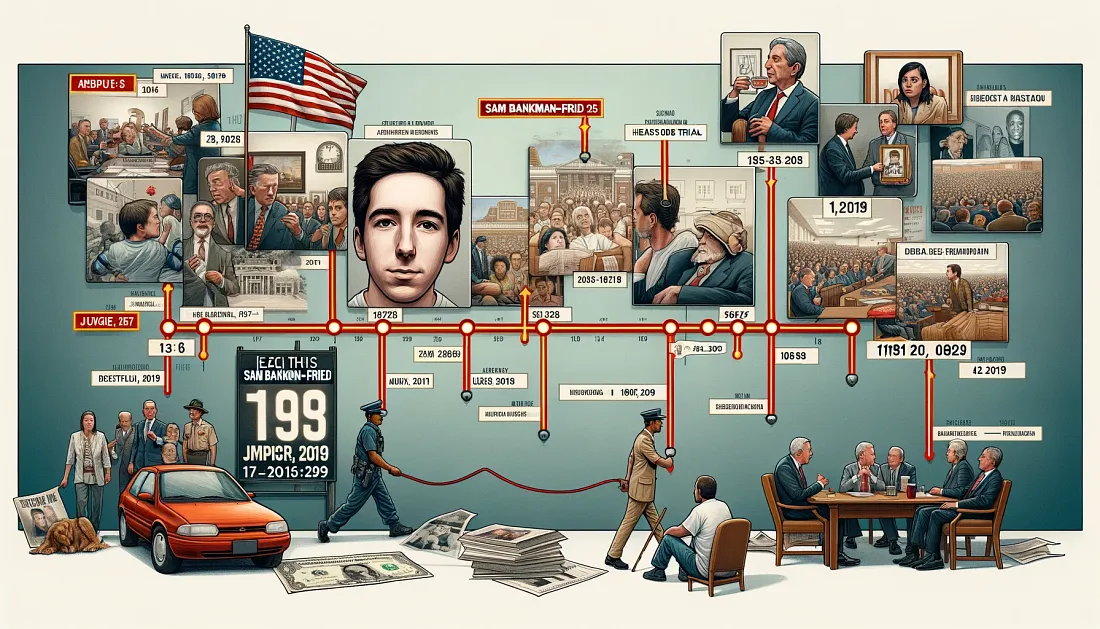

Sam Bankman-Fried, once the celebrated CEO of FTX, has been sentenced to 25 years in prison.

Seems like a sliver of justice actually manifested.

This ruling follows his conviction on seven counts of fraud and money laundering.

FTX’s collapse led to a $10 billion loss in customer deposits.

Prosecutors had sought 40 to 50 years, while his lawyers argued for six.

Judge Lewis Kaplan emphasized Bankman-Fried’s perjury and lack of remorse.

Is 25 years fair for SBF?

Should the judge have given him more or less?

Elizabeth Holmes received 11 years for the Theranos scandal, whereas Bernie Madoff got 150 years for his Ponzi scheme.

The public perception of SBF and Holmes varies.

Holmes, once hailed as a visionary, faced backlash for endangering patients with faulty technology.

The same media that lionized her, went ape-shit to destroy her rep thereafter.

SBF, on the other hand, operated in the volatile world of crypto, where risks and rewards are understood differently.

He was also painted as a prodigal demigod and then flamed badly by the media.

But were the trials and treatment fair?

Bankman-Fried’s trial moved swiftly compared to other high-profile cases.

It was uncanny.

Holmes’ legal battles spanned years before her final sentencing.

The rapid prosecution of SBF might reflect the urgency to address crypto-related frauds and restore investor confidence.

But really, why the rush?

And what about the victims of FTX?

Bankruptcy proceedings are ongoing, and they might get their money back after all.

FTX’s legal team is working to trace and return lost assets.

Bankman-Fried plans to appeal, which could prolong the resolution process.

Regulatory scrutiny is bound to increase, aiming to prevent future scams.

Yet, the inherent risks of crypto investments persist.

Despite SBF’s downfall, the allure of quick riches in the crypto space continues to attract both legitimate entrepreneurs and unscrupulous actors.

Justice might have been served swiftly in SBF’s case, but it’s a reminder of the volatility and risks inherent in the crypto market.

All this chaos, mess and resources spent on cleaning up.

Will this deter future frauds?

Hardly.

You watch, it will be a few short years, people will forget, memories fade and the next SBF will rise again.

-

Will there be another SBF?

-

#Crypto #SamBankmanFried #FTX #Fraud #Justice #CryptoRegulation #ElizabethHolmes #BernieMadoff #FinancialScandal #Investors #DigitalCurrency #LegalBattle #PrisonSentence #CryptoCommunity #FinancialIntegrity

评论 (0)