Please move on:《深度解读API3, 释放OVM的预言机赛道破圈者》

Recently, API3 recently received $4 million in strategic financing, led by DWF Labs and followed by a number of well-known VCS.

For a long time, the Oracle track is basically a three-way Oracle represented by Chainlink. 14 When I saw this news, I was also very surprised ~ why API3 was able to get financing? Could he be the ring breaker of a traditional prophecy machine? What makes him unique?

API3 as a decentralized API (dAPI) project, defined as a "first party" prophecy machine, through the groundbreaking innovation of OEV Network (based on ZK-Rollup), solves the common problems of "third party" prophecy machine intermediaries trust, low data transparency, and OEV (prophecy machine can extract value) being controlled.

1 . Can prophecy machines really predict prophets?

The term prophecy machine is somewhat mythological and can easily mislead the public. But really, he was referring to tools that provide real data off-chain for on-chain smart contracts, but what is real?

How to ensure the integrity of the prophecy machine itself? Does prophecy chance do evil? Are the multiple prognosticators colluding? How to understand OVM (Predictive machine Extractable Value)?

In 2024 Q1, after the recent BTC rally, the total value of the locked tokens also broke a new high, reaching $175 billion, compared with $103 billion in 2023 Q4, with an increase of nearly 70%, and the prediction machine has always been known as the core blood of DeFi. In the DeFi space, decentralized exchanges (DEX), lending platforms, and derivatives trading platforms all rely on accurate price data to function. In early 2023, the TellorFlex Oracle contract used by polygon's decentralized lending protocol BONQ was manipulated, and the attackers used a lower cost to modify the Oracle quote and borrow against it to gain huge profits, resulting in losses of about $88 million. Because the attack events caused by the quotation problem of the prophecy machine have been common, it can be seen that transparent and reliable off-chain data is the basic guarantee to support the operation of dApp.

2. How is the prophecy machine connected on and off the chain?

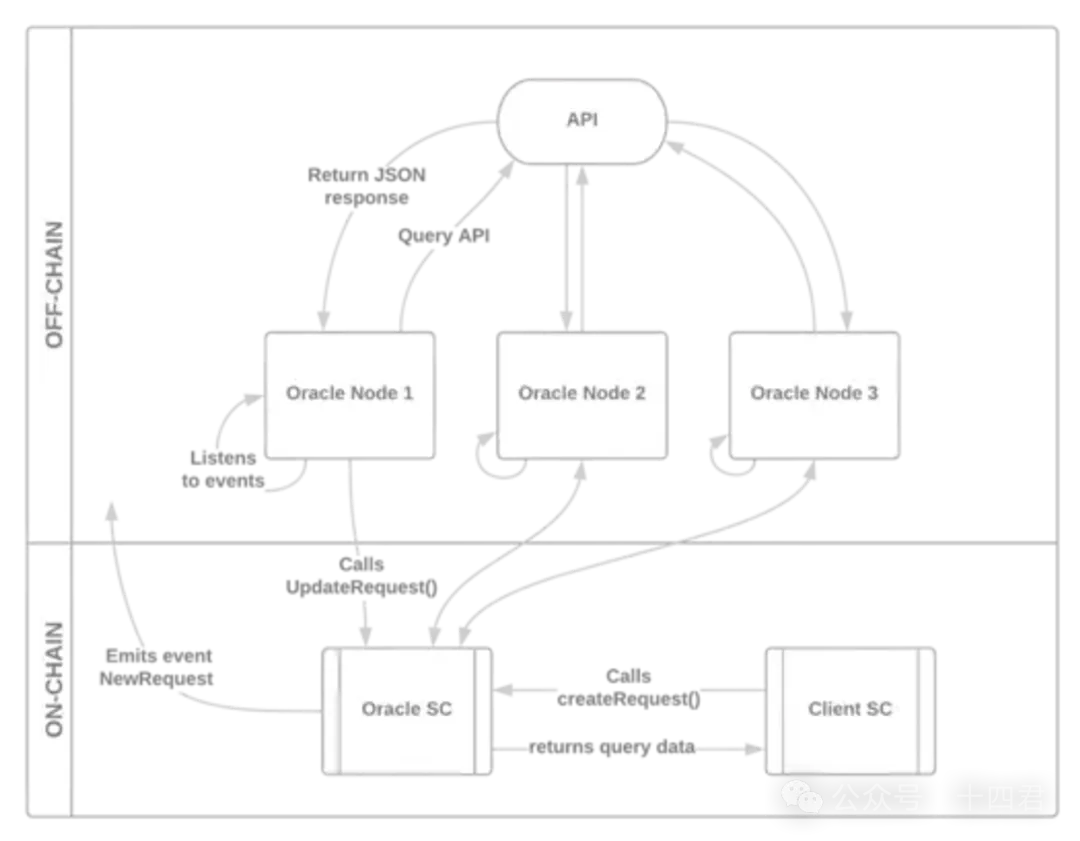

The working mode of the prophecy machine generally has three modes: timing upload, event driven, request response. We take the general process of request response as an example, which is roughly divided into the following four steps:

-

STEP 1: On the chain, the caller dApp initiates a request (essentially a transaction), and the oracle server contract triggers the on-chain event to be issued

-

STEP 2: Off-chain, the prophet nodes monitor events to obtain information, and obtain accurate off-chain information through their respective systems

-

STEP 3: Off-chain & On-chain, the oracle provides data to the oracle server contract in the form of a transaction

-

STEP 4: On the chain, the oracle server contract returns the data to the caller (dApp). There are two schemes: active push and Dapp secondary query.

For this process, the author makes an extended interpretation:

First of all, the on-chain requirements are public, because events are the common mechanism of the EVM blockchain, which means that the whole network can know that the Dapp now needs xx information.

Secondly, the off-chain push is non-atomic, the on-chain transaction is completed in real time, and the off-chain data must have a certain lag

Finally, if there is a customized demand on the chain, the oracle can become a fair role of a third party, so as to push it to the Dapp, but most similar general market data, such as the real-time price of BTC, will be the Dapp itself to retrieve the contract again. Of course, the prophecy machine itself also has a regular reporting mechanism, and the above several basic differences are not bad.

3. Luna decoupling, the windswept Prophetic machine track

But the blockchain is not only Defi, through the prophecy machine, dApp can safely and efficiently obtain off-chain data, so as to greatly expand its business scope and application scenarios, so that its business direction can be extended to finance, insurance, supply chain management, the Internet of things and more fields.

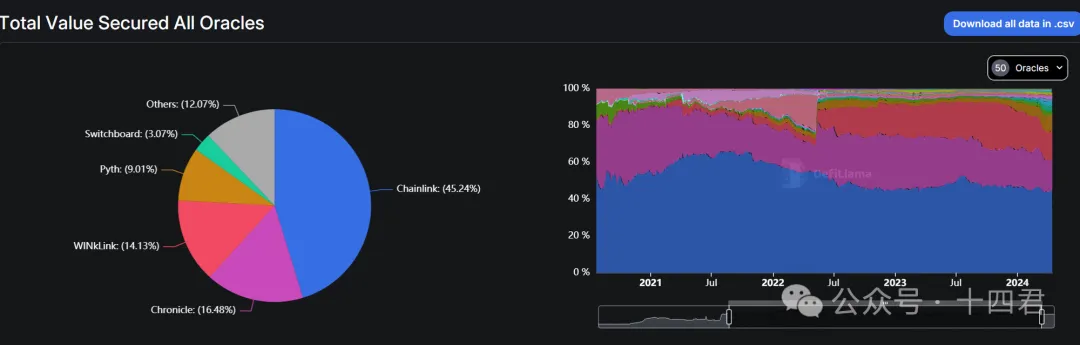

According to defillama data, Chainlink remains at the top of the market, with TVS (the total value of dollar-denominated assets deposited in markets secured by critical infrastructure such as prophecy machines) accounting for 45% of the total market.

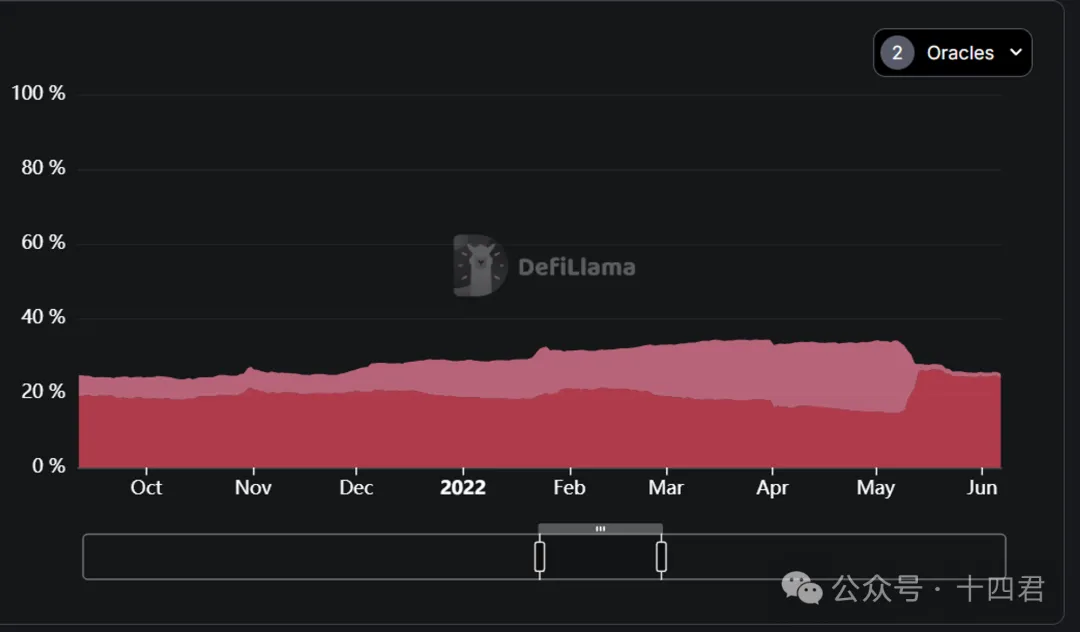

Careful readers will find that the curve on the right side of the above figure has a violent shock in May 2022, the trigger is the famous LUNA crash event in 2022, from May 7, 2022 to May 13, 2022, the algorithm stablecoin leader UST has experienced two decoupling, and finally fell into a death spiral, LUNA and UST both collapsed. At the same time, many projects that used internal prognoses had serious problems because they did not react to price fluctuations in a timely manner.

As you can clearly see from the chart below, the market share of the internal predictor (pink below) fell off a cliff in May 2022, and the Chronicle Predictor (red below) caught this wave of traffic very well, basically capturing the market lost by the internal predictor.

4.The dilemma of third-party prophecy machines

In addition to sensational industry events, it seems that the development of the prophecy machine is stuck, indeed, because the industry positioning is very clear, it is a tool for data up and down the chain, resulting in relatively single product function.

One of the most criticized is its profit model, which is currently focused on data subscription fees and hopes that the appreciation of tokens issued by the project side of the two major directions. Clearly, a single data subscription monetization model has limited benefits, taking the VRF (verifiable random sequence) billing feature provided by Chainlink as an example, see blockchain browser Etherscan, The author calculates that the total number of tokens locked in VRF V1 and V2 contracts is about 370,000 (7+30), which is about $6 million in revenue at the current LINK exchange rate ($16). The VRF V2 version has earned a total of $4.8 million since it went live at the end of February 2022, averaging about $170,000 per month (1.1W LINK). Compared to Chainlink's huge volume, these profits are really a drop in the bucket.

However, due to the characteristics of the third party, the prophecy machine itself is in a relatively neutral position, and it has begun to cost the trend of security infrastructure at the application layer. If we can break the traditional impression of middleware and carry out differentiated and systematic function expansion, we can improve the profit margin. For example, LayerZero, as a typical cross-chain bridge, places security on the ultra-light node request carried by the prophecy machine.

In short, the performance of the predictors' predicament at the market level is that they are limited by the natural disadvantages formed by the operation mode, have single functions, meager profits, and their expansion has not yet begun

However, let us expand the execution model of the so-called third-party prophecy machine, and we will find that his problem is also from the "third party" factors

API3 as a new prophesy machine, the core positioning is "first party" prophesy machine.

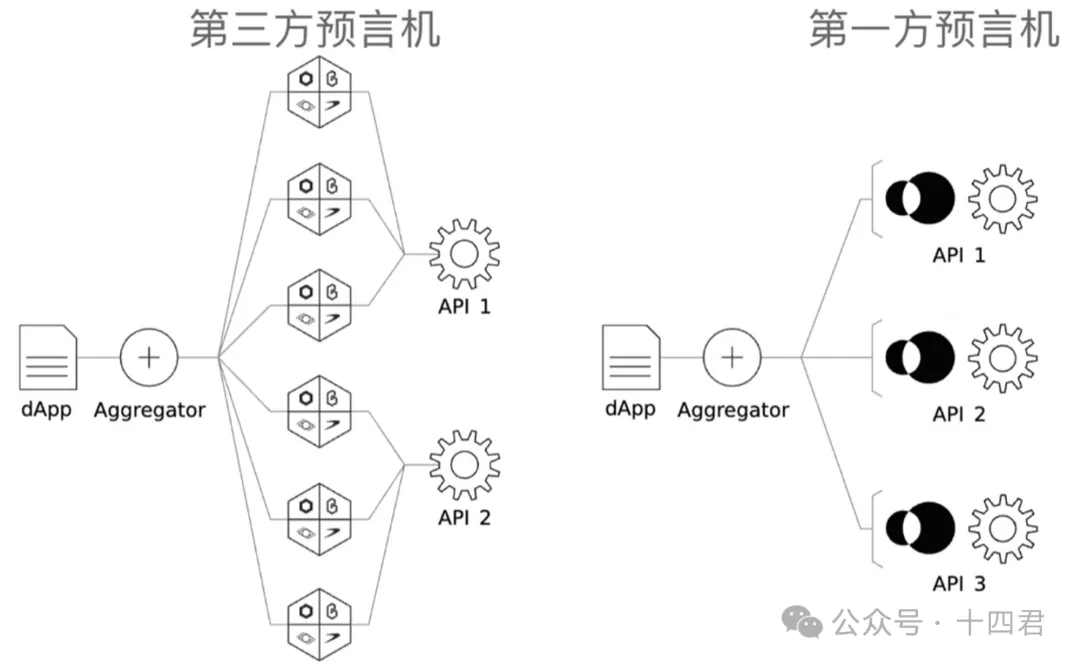

4.1 Compare third-party and first-party prophecy machines

API3 chooses to activate the integrated operation and maintenance service capabilities of API service nodes as the starting point, and uses a more web3 Native (lightweight + modular) way to build a bridge between the demand side and the supply side of the prophecy machine. API operators can quickly build their own prophet nodes based on the Airnode solution provided by API3.

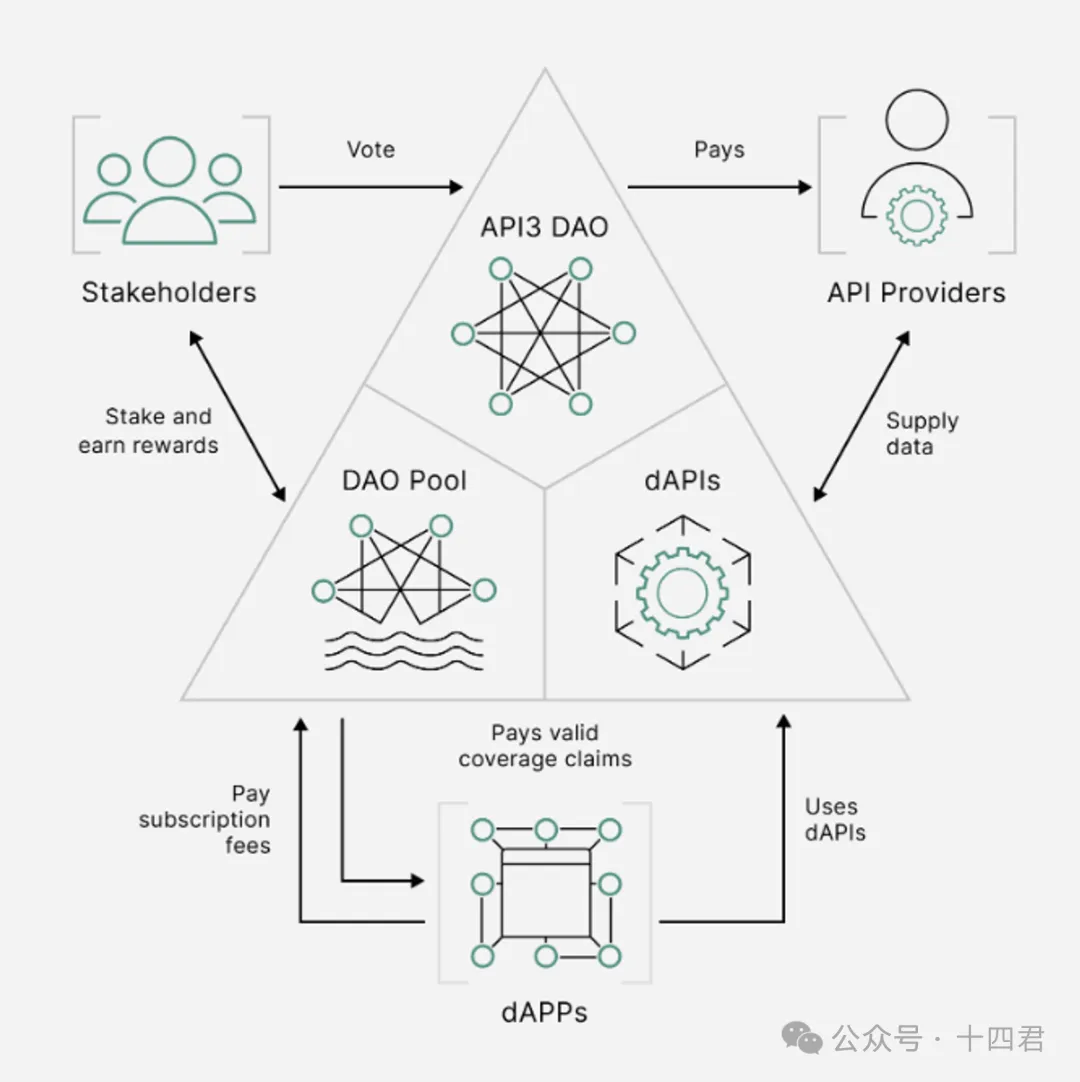

As a first-party prophesy machine project, compared with the traditional third-party prophesy machine API supplier → prophesy machine →Dapp business process, the transformation of API3 (API supplier + prophesy machine) →Dapp makes the API supplier the master, no longer just acting as the role of third-party prophesy machine Worker, and has more say.

As shown in the figure above, the data link is reduced without the intervention of a third party. When the API provider is integrated into the role of the oracle, there is no question of where the data comes from, because the API provider's reputation is carried along with the data on the chain.

Due to the API vendor's reputation and strong binding policy of providing data, traceability is simple, it is technically not allowed to do evil (without detection), and there is a margin mechanism as a backstop. Even if the API provider provides false data for personal gain, the damaged user can still appeal for compensation. For entangled incidents (such as malicious complaints by users for insurance fraud), it will enter the on-chain court system for arbitration. With the insurance mechanism provided by the fully decentralized API3 DAO, API3 is able to punish API vendors to the maximum extent possible and provide compensation to damaged users.

5.Dive into the token economy model of API3 DAO

API3 DAO, based on its pledge mechanism, enables API3's token economic model to operate stably through positive and negative feedback.

5.1 Pledge governance mechanism

Pledge mechanism is the routine operation of DAO governance pledge profit, pledge governance, but also the starting point of circular economy. API3 is also optimized:

What if the pledgee runs away after receiving the proceeds of the pledge? The inflated revenue generated by user pledges (newly minted tokens) will be delayed and will flow to the pledge pool by default.

What else can tokens in a pledge pool do? Can be used to compensate users for losses.

How is the price of the pledge pool stable? API3 controls inflation through Burn and Token locking mechanisms: In exchange for access to dAPI services, users need to burn their tokens or lock their tokens.

5.2 Positive and negative feedback loop

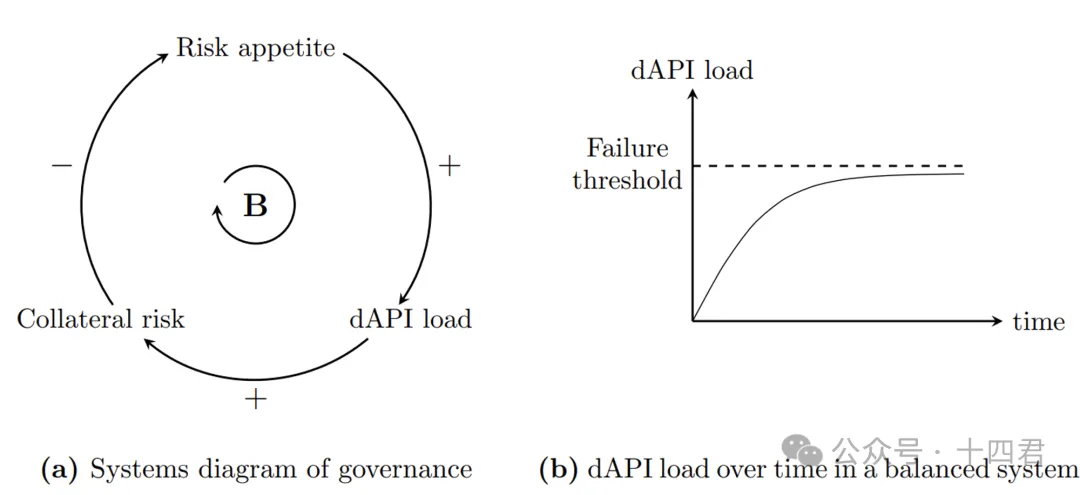

So, what will be the trend of the number of tokens in the pledge pool? Will there be a disorderly expansion or a collapse that falls short of the payouts? Let's analyze:

-

As the number of dAPI users increases, the system risk increases (the operating cost of the system increases with the number of users) and the number of events that need to be paid increases. At this point, the tokens in the pledge pool will be reduced (to compensate the damaged users), and the pledgee (and the manager) will suffer from their own interests due to poor management. But equally, a decrease in the number of tokens in the pledge pool also means an increase in the number of tokens flowing to the market. Since the tokens held by users are affected by inflation, a large part of the flow of tokens is still the pledge pool for their own interests.

-

When dAPI users decrease, the risk of the system decreases, the number of tokens in the pledge pool will gradually increase, and the number of tokens flowing to the market will become scarce. But this does not mean that the number of tokens in the pledge pool will always increase, and the API3 DAO will fit it to a target health value by dynamically controlling the pledge yield (and inflation rate).

The above two cases can be very good to form the positive and negative cycle on the left (a) of the figure below. When either situation reaches the threshold, the system will self-adjust, and dAPI users will tend to be stable as shown on the left (b) in the figure below, finally making the system run in a healthy state.

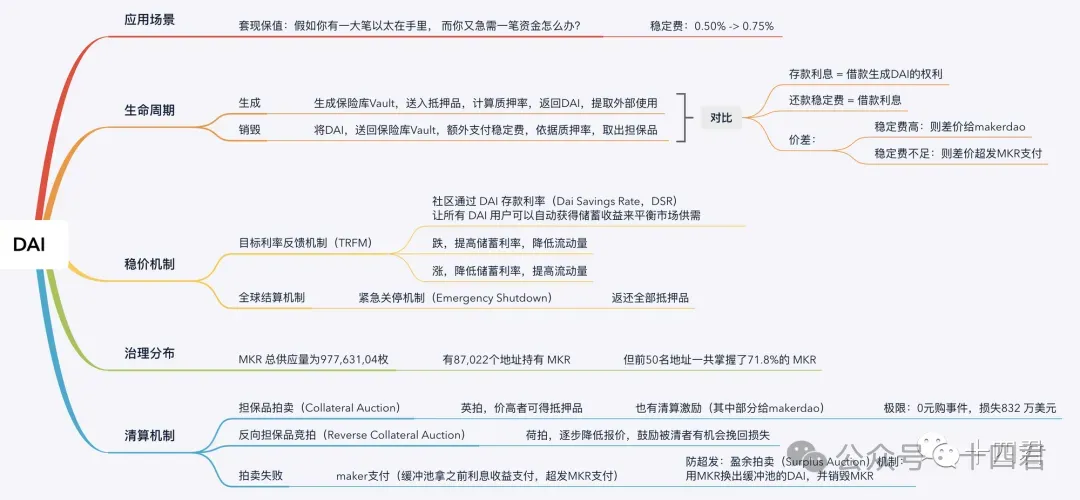

In fact, this kind of DAO-style governance token has long been popular in various DeFi governance, such as the DAI of MakerDao, the detailed implementation benchmark of decentralized stablecoins analyzed by the author before, and MKR as a pioneer:

Especially beautiful is his 4-way auction mechanism: Scalable reading: "A clear -DeFI King AAVE's latest stablecoin GHO proposal" Which "insolvency, four auctions" column.

Therefore, DAO-style governance is the mainstream operation mode of economic stability, but the innovation point of API3 is not the second.

6、Unique Advantage - Pioneering OEV Network (based on ZK-Rollup)

6.1 Birth of OEV

Similar to MEV (miner extractable Value), OEV (predictor extractable Value) refers to the fact that a predictor uses its position to capture value that would otherwise go to third parties. MEV captures value through transaction sequencing, and OEV is the use of on-chain and off-chain price differentials to extract value, such as in key market data or scenarios that trigger significant on-chain events, such as liquidation.

To understand how OEV is generated, we need to know the current problems of the prophecy machine: due to the cost of data linking, the current prophecy machine basically adopts a mechanism of periodic data upload, and the time interval is set in a relatively small range. At the same time, in order to avoid huge price fluctuations affecting the market in the short term, the predictor generally sets a threshold, and when the price fluctuation range reaches the threshold in a short period of time, it will actively trigger an update.

While this remedy can alleviate some of the problems, the data upload latency problem is not fundamentally solved. While the DeFi market is usually highly volatile, asset prices can change significantly in a short period of time, and the uncertainty brought by the price feeding function of the prophecy machine to the DeFi market cannot be underestimated.

In this case, the third party profit seeker is like opening the perspective of God, by taking advantage of the delay of data update, it can capture huge profits, and OEV is generated.

For DApps that rely on predictors, any updates or omissions in data feeds could create opportunities for OEVs, such as pre-emptive trading, arbitrage, and clearing. Because the ownership of the exploitable value caused by the data feed delay is actually difficult to judge, the data link itself is a certain volatility, so if the data link delay is some, and the problem of the prophecy machine can not be located, then the exploitable value generated by this part of the delay can not be said to be malicious generated by the prophecy machine.

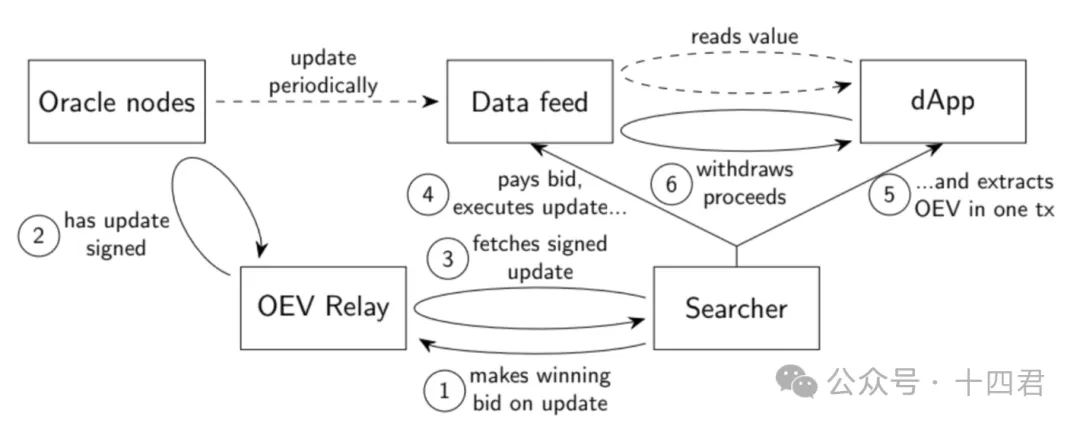

6.2 OEV Network - multi-game auction stage

Due to the existence of OEV, the user and dApp as two sides of the interaction, but the third party collects value from it, which is obviously a situation that the two do not want to see. API3 discovered that the oracle had the right of first refusal to capture the value of all such leaks (the pricing power of on-chain data), and the OEV NetWork was proposed.

As a Network based on Polygon zk rollup, it is a single order stream (any participant's intention to change the state of the blockchain is an order) auction platform, auctioning the right to update dAPI data.

API3 developed its own auction platform, eliminating the dependence on external services, allowing stakeholders to share OEVs among themselves without sharing profits to the auction platform, and internalizing OEVs in all blockchains with integrated data feeds.

Auction winners can get the right to update dAPI data, update the price data, and most of the auction profits will be returned to dApp, with a small part going to API3 to cover operating costs. Obviously, the auction will only be conducted when the auctioneer (the third party) believes that the cost of the auction is less than the revenue brought by the updated price, so the third party will also be profitable. As users of the dApp platform, it seems that they do not participate in the distribution of benefits and generate actual benefits. In fact, thanks to the high-quality data sources provided by dAPI for dApp, they can better conduct transactions and risk management and gain potential benefits.

The life cycle of the auction is shown in the figure below, when the searcher finds the OEV, it initiates an auction bid. After winning the auction, the searcher will get the right to update the dAPI data of the predictor node. After paying the auction fee, the searcher can exercise the right to update the dAPI data of the predictor node. The auction fee paid is the captured OEV, which flows to the dApp.

The natural tendency of auctions is for third parties (searchers) to raise the bidding price further in order to make a possible profit. The higher the auction price, the smaller the difference between the actual OEV and the captured OEV.

As for the size of this cake, we may wish to wait and see, and wait for the test network to run for a period of time, and then judge.

The result of the auction is almost a win-win situation for the four roles of dApp, API3 prophecy node, third party and dAPP user. The wool collected by the third party in the dAPP connected to the API3 data source is minimized, and most of the OEV value can also be captured. Because the final form of market competition must be the competition between the third party and the third party, in order to seek profit space, the profits of the third party will be gradually compressed, and the final beneficiary must be the dApp. For API3, a small part of the OEV value can be used to maintain the operation of the OEV's business path. For third parties, there's a cut. For dApp users, by incentivizing highly specialized third-party actors to provide a more insightful approach to determining when to update data points on the chain, granularity can be improved, ultimately radiating benefits to dAPP users.

At this point, the OEV auction scheme based on API3 has solved the benefit distribution problem of the multi-party game to the greatest extent, and the original "wrong profit" of the third party is fed back to the relevant stakeholders. This is an elegant solution.

"UniswapX Research Report (Part 1) : Summarizing the V1-3 development Link and interpreting the Principle Innovation and Challenges of the next Generation DEX" Understand the auction mechanism of UniswapX.

7、Summary

API3 builds a self-driving ecosystem based on its own token economics, and makes the operation of the system more stable through positive and negative feedback adjustment.

At the same time, the OEV Network proposed by API3 has cleverly solved the problem of the flow direction of OEV by introducing the auction mechanism of dAPI pricing update right, and subtly transferred the contradiction between the prophecy machine and dApp due to OEV to a third party.

With the popularity and development of decentralized applications, the demand for reliable and secure oracle services will continue to grow, and the prototype of the next generation of oracle machines seems to be emerging.

However, API3 also faces some challenges.

The economic model is not defined and designed well at the beginning, and it can run stably for a long time, and the subsequent continuous process often falls into excessive governance or governance neglect.

In addition, API auction, the core of which is the measurement of reputation and income, is essentially an optimistic model rather than a pessimistic model (ZK). Although LayerZero, which also adopts this reputation structure, has been in continuous operation, even the combination of prediction machine + cross-chain bridge two-way high risk has not had any market problems, and its safety can be guaranteed. But there are still risks. Continuing to gamble on reputation means that the market returns of participants must be high enough, which is closely related to the market development of API3.

Finally, the market of the prophecy machine is not good to compete, the root cause is that the Dapp is not only the ability to provide data, but the positioning of the third party of the prophecy machine itself, and now API3 breaks this point, but Dapp itself can participate in the auction, inevitably let users worry about whether they will collude, although it also means gambling on their own Dapp reputation. In addition, the old chainlink is not unable to follow up, they can also release more OEV to continue to control the market.

Can background message author, discuss web3 industry issues

Like attention, fourteen with technical perspective to bring you value

Weekly more bloggers, recommend adding stars to reduce the omission of the latest original views!

评论 (0)